Prediction markets meet Tinder: Can you place bets on Warden's new product by simply swiping left or right?

No need for chart analysis, macro research, or even inputting the amount of funds.

No chart analysis required, no need for macro research, not even an input of capital is necessary.

Written by: 1912212.eth, Foresight News

The AI wave has swept the globe in recent years, with AI agents bringing convenience and efficiency to human life and work. Amid this AI revolution, its integration with cryptocurrency has naturally drawn significant attention from industry entrepreneurs and investors.

Warden is quietly but efficiently attracting attention. As a platform focused on AI-driven on-chain agents, Warden officially disclosed that its Beta version has been live for less than four months, with daily active users stabilizing at 350,000, and over 9 million agent transactions in total. Its annual revenue has already reached $1.7 million, sourced from transaction fees, cross-chain operation fees, AI feature subscription fees, and developer incentives.

Although these numbers are not staggering, they reflect a solid foundation within a niche developer community. However, to maintain an edge in the fiercely competitive crypto market, continuous expansion of boundaries is still required.

The Prediction Market Surge

Recently, one of the biggest narratives in the crypto space has been prediction markets. On October 23, Bloomberg cited sources revealing that Polymarket is seeking funding at a valuation of $12 to $15 billions, just a month after receiving a $2 billions investment from Intercontinental Exchange. Also this month, another US-compliant prediction market, kalshi, completed a $300 million financing round at a $5 billions valuation, with a star-studded venture capital lineup including Sequoia Capital, a16z, Paradigm, CapitalG, and Coinbase Ventures. In addition, kalshi will begin allowing customers from over 140 countries to place bets on its website.

Data shows that the total transaction volume of mainstream prediction market platforms is soaring.

Limitless’s founder ignited controversy marketing on Twitter and secured another tens of millions in financing. He Yi personally advocated for prediction market entrepreneurship on BNB Chain, and the recently invested Opinion has already opened invitation code testing.

The crypto community is abuzz, and even outsiders are getting involved. Robinhood is exploring offshore prediction markets outside the US, and even Trump Media Group has partnered with Crypto.com to enter the prediction market business.

Recently, Warden officially entered the prediction market track through its self-developed product BetFlix. Warden’s entry is not just following the trend, but an attempt to fill the gap in real-time, entertainment-focused prediction, avoiding the complexity of traditional platforms.

Prediction Markets + Trading

The booming prediction market provides an excellent entry point for Warden’s BetFlix. The success of Polymarket and Kalshi stems from the 2024-2025 election cycle and sports betting, with trading volumes surging. Behind the high valuations is investors’ bet on the monetization of “collective intelligence”—these platforms allow users to predict everything from politics to economics through event contracts, often achieving higher accuracy than traditional polls.

The problems are also obvious: high user thresholds, requiring reading lengthy event descriptions, choosing Yes/No, investing funds, and waiting days for settlement. This deters many retail investors, especially in the highly volatile crypto environment.

Warden’s BetFlix is designed to address this pain point, simplifying prediction trading to the extreme, blending real-time and entertainment elements, and aiming to capture mobile users.

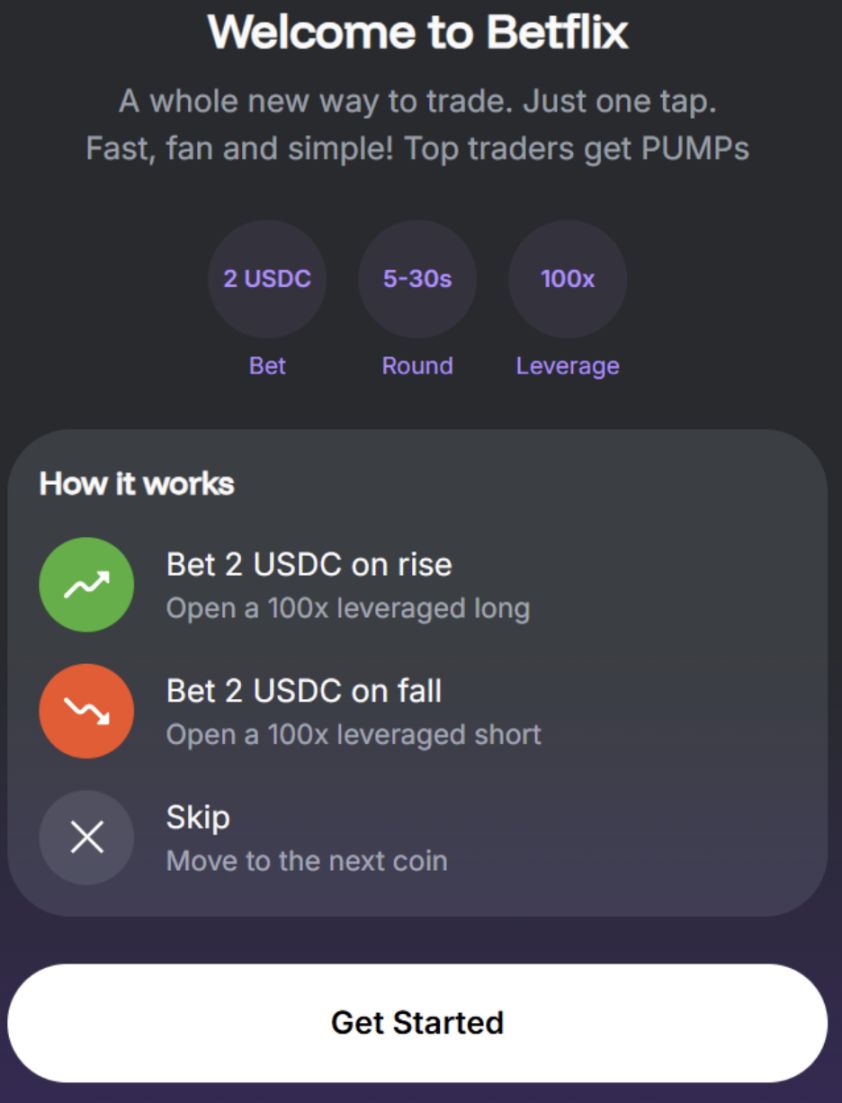

The core of BetFlix is a swipe operation mechanism, similar to Tinder’s matching interface. Users can predict the direction of token prices simply by swiping left or right—swipe left for bearish, swipe right for bullish.

This design abandons the complexity of traditional platforms: no chart analysis, no macro research, not even an input of capital is necessary. Trading focuses on short-term fluctuations, with settlement cycles as short as 10 seconds. The minimum participation is only $2, yet it offers up to 100x leverage.

This means users can see results within seconds, and the instant feedback mechanism increases stickiness.

Compared to Polymarket, where users must delve into event details, or Kalshi’s compliance-oriented approach, BetFlix is more like a gaming app: settlement cycles are only 5-15 seconds, users can continuously swipe to participate in multiple rounds, enjoying entertainment while earning small profits.

Team

Warden’s team configuration is the foundation of its confidence in prediction markets. Co-founder David Pinger serves as CEO. He previously led R&D at Qredo Labs, driving Web3 innovations such as stateless chains, WebAssembly, and zero-knowledge proofs. He also served as head of product and operations at Binance.

Another key figure is Luis, former Binance regional director responsible for developing the Latin American market. His experience has helped Warden quickly establish an agent network in emerging regions.

Josh Goodbody, as executive chairman, is a star member of the team—he was formerly head of Binance’s European market, driving compliance and user growth in Europe. He previously worked at HTX, State Street Bank, and Open Custody Protocol, and graduated from University College London.

Other team members come from Uber, Tendermint, Google, NASA, and W3C, with deep expertise in bilateral network expansion, blockchain protocols, and AI systems.

Warden’s previous strategic moves have also paved the way for BetFlix’s launch. Since 2023, Warden has focused on AI agent networks, with early products such as agent building tools helping developers create on-chain bots for automated trading and data aggregation. In 2024, it partnered with the Cosmos ecosystem to expand into a multi-chain environment, ensuring secure agent execution. This provides the technical foundation for BetFlix—AI agents monitor price fluctuations in real time, generate swipe options, and prevent human manipulation.

Overall, Warden’s entry into the prediction market through BetFlix is an attempt to transition from AI infrastructure to the application layer. Stimulated by the high valuations of giants like Polymarket, this layout carries certain risks, but if BetFlix’s user growth explodes as expected, Warden’s valuation may soar accordingly.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

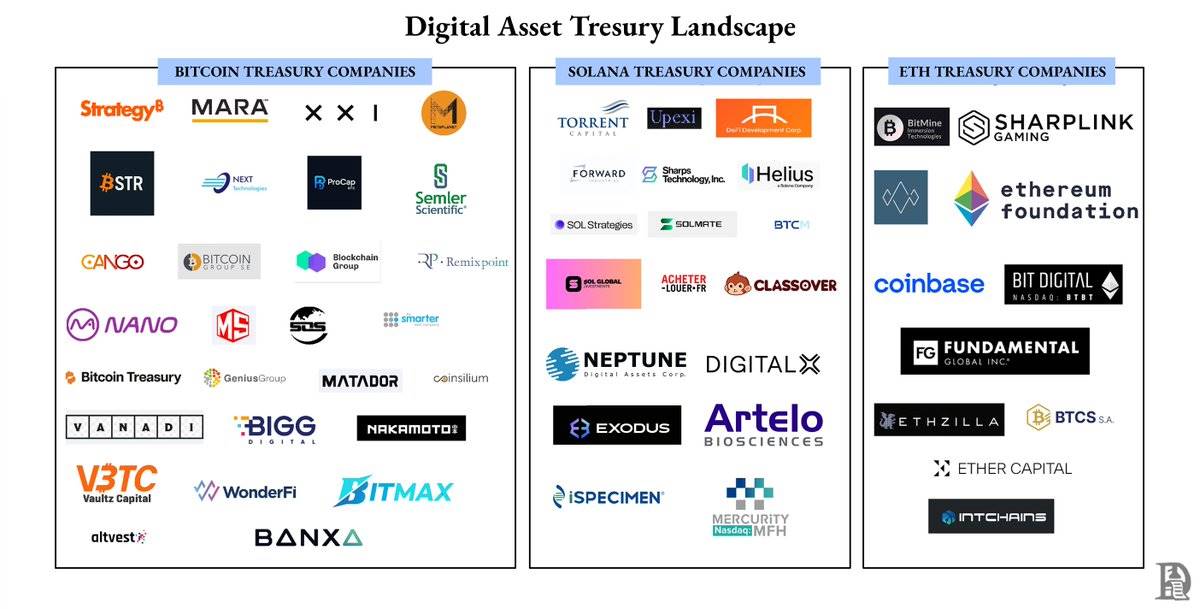

A bucket of cold water: Most Bitcoin treasury companies are facing doomsday

They imitated the asset and liability structure of Strategy, but did not replicate its capital structure.

Dive into Altcoin Strategies that Shape the Market

In Brief Arthur Hayes shares insights on the genuine emergence of an altcoin season. Investors now focus on income-generating and share-distributing projects. This shift reflects the evolving maturity of the crypto market.

Ripple and Mastercard Propel XRP to New Heights

In Brief XRP's price surged by 4.9%, reaching $2.35, driven by institutional trading. The XRP Ledger pilot by Ripple and Mastercard boosts XRP's market demand. Dogecoin maintains its trend with institutional support around $0.1620-$0.1670.

Cryptocurrency Analyst Highlights Recovery Hints in Key Altcoins

In Brief Analyst Ali Martinez identifies potential recovery signs in key altcoins. Martinez highlights critical support re-tests in SEI, PEPE, VET, ALGO, and AVAX. Technical indicators suggest possible trend shifts in these altcoins.