Cryptocurrency analyst Ali Martinez recently observed that technical indicators in key altcoins are signaling potential bottoms and hinting at possible recovery movements. In his personal posts, Martinez drew attention to the re-testing of critical support levels in altcoins such as SEI, PEPE, VeChain (VET), Algorand (ALGO), and Avalanche ( AVAX ).

Formation Patterns Drive SEI and PEPE Prices

According to Martinez, the SEI coin has generated a purchase signal near the bottom of its price channel, around the $0.15 region. This response suggests a potential rise in price in the short term to the range between $0.23 and $0.36. The formation in the charts indicates that the price is consolidating within the current trend channel, and an upward breakout could gain momentum.

Altcoin SEI

Altcoin SEI

On the other hand, the analyst pointed out a head and shoulders formation in the PEPE chart. Martinez noted that the current breakdown is bearish, with a target level of $0.00000185. This level stands out as a short-term technical target and a psychological support for PEPE investors. The analyst expects the price to consolidate briefly at this level before continuing its decline.

Altcoin PEPE

Altcoin PEPE

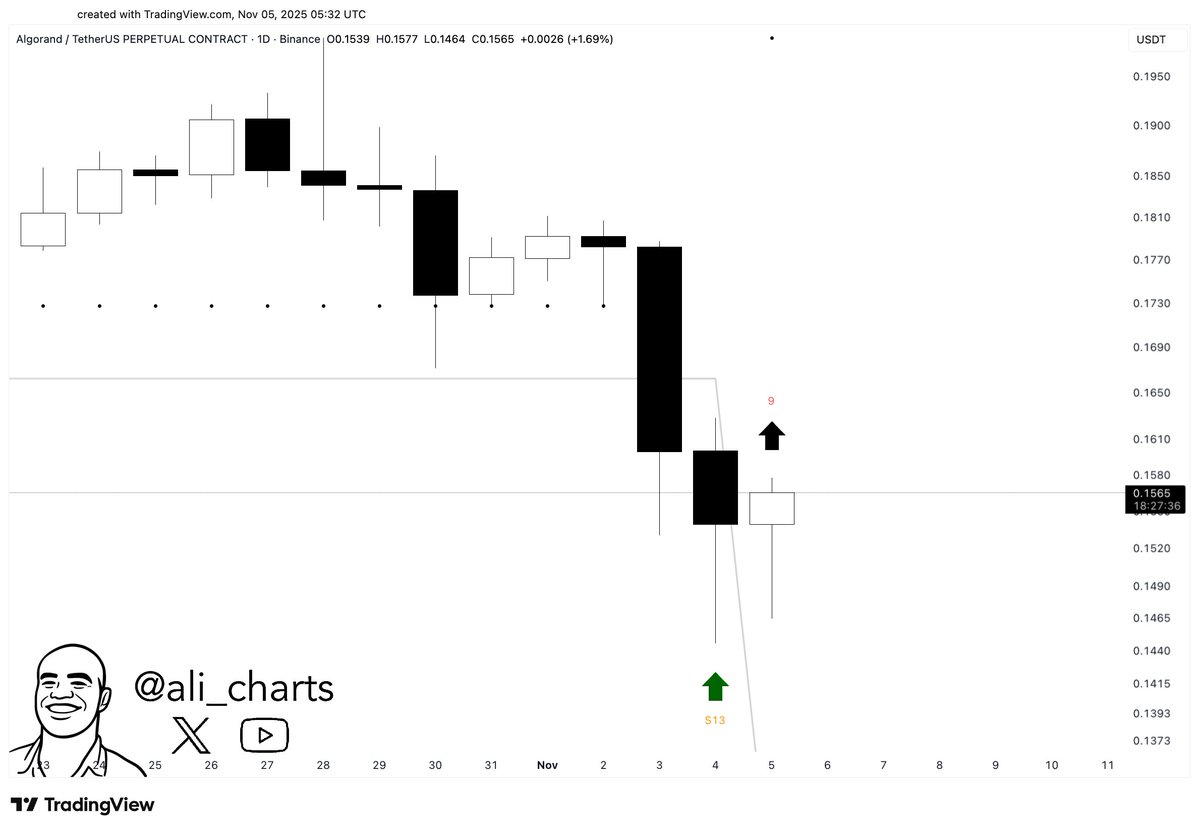

Martinez’s Insights on VET, ALGO, and AVAX

Martinez’s analysis revealed that VET and ALGO received a dual bottom buy signal from the TD Sequential indicator on the daily chart. In VET’s case, aggressive 13 and red 9 signals suggest a possible shift in direction is setting the stage. Similarly, signals seen in ALGO’s chart show that the selling pressure has weakened, while the technical potential for a rebound has strengthened. Such signals are of great importance, particularly as they are often considered precursors to trend reversals.

ALGO Coin

ALGO Coin

For AVAX coin, the analyst emphasized that the $16 level has been maintained as significant support since March. According to Martinez, the price re-testing this level confirms that buyers have aggressively taken positions in this area for Avalanche. The reaction of AVAX from this region may determine the medium-term direction of the trend.