Bitcoin falls below the key $100,000 support level—where is the market bottom?

Author: Rhythm Junior Worker

Original Title: Wall Street Continues to Sell Off, How Much Further Will Bitcoin Fall

The first week of November saw very poor sentiment in the crypto space.

Bitcoin has already dropped to a new low below the "10.11" crash, failing to hold the $100,000 mark and even falling below $99,000, marking a new six-month low. Ethereum touched as low as $3,000.

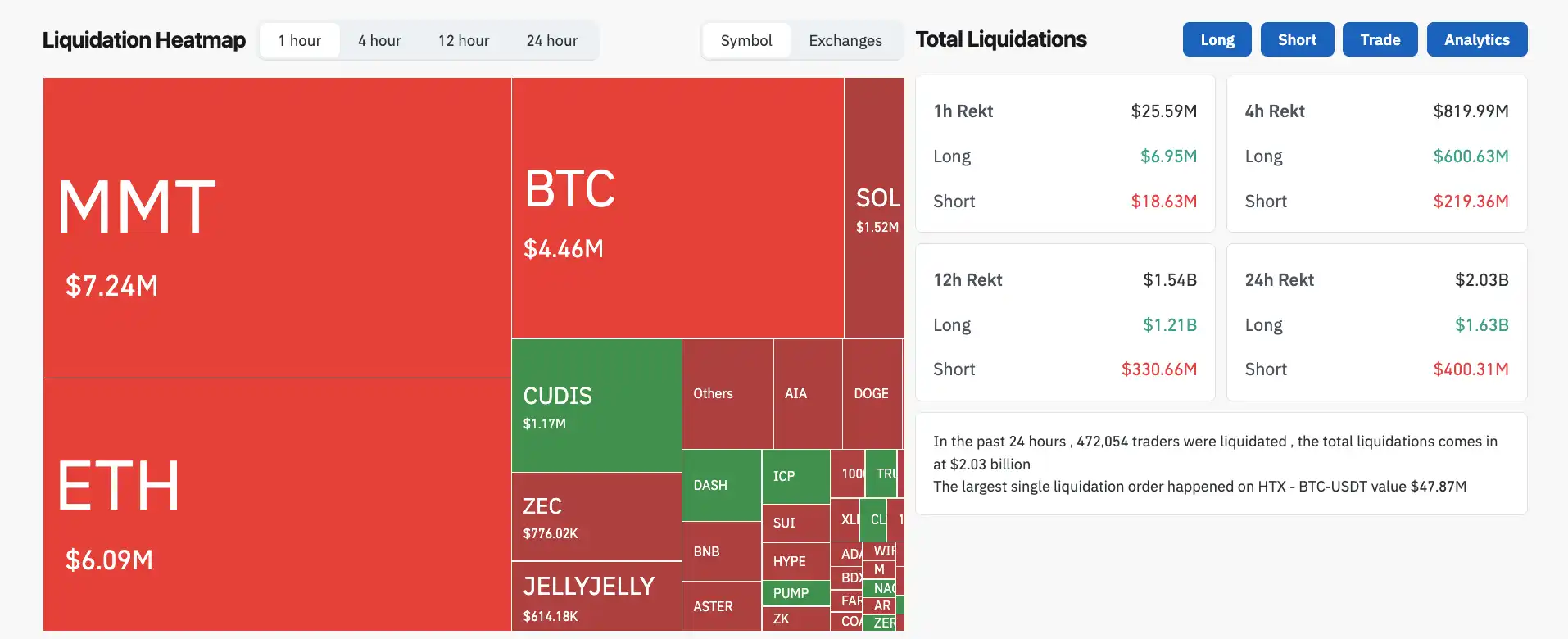

The total amount of liquidations across the network in 24 hours exceeded $2 billion, with long positions losing $1.63 billion and short positions losing $400 million.

Data source: CoinGlass

The worst was a BTC-USDT long position on the HTX exchange, which was liquidated for $47.87 million in a single trade, topping the network-wide liquidation leaderboard.

There are always some reasons behind the decline, which we can analyze in hindsight.

Within the Industry

For two consecutive days, projects encountered problems. On November 3, the long-established and well-known DeFi project Balancer was hacked for $116 million due to a code issue. Balancer is part of DeFi infrastructure and even older than Uniswap. Such code problems have a significant impact on the industry.

On November 4, a financial management platform called Stream Finance exploded, with the official statement claiming a loss of $93 million. The problem is that it’s unclear how the loss occurred, and the official team did not explain. The community speculates it happened during the "10.11" crash.

There’s only so much money in the crypto space, and another $200 million has disappeared in the past two days.

From a Macro Perspective

Looking at global capital markets, November 4 saw declines worldwide, with record-high Japanese and Korean stocks also falling, and U.S. stocks dropping in pre-market trading.

First, regarding interest rate cuts: last Wednesday, the Federal Reserve spoke, and the certainty of a rate cut in December seemed to decrease, suggesting there is no rush to cut rates.

Then, ETFs also saw net outflows. Last week, U.S. Bitcoin ETFs had a net outflow of $802 million, and on Monday, November 3, another $180 million flowed out.

Another event on November 5 is that the U.S. Supreme Court will hold oral arguments for the "tariff trial," reviewing the legality of Trump’s global tariffs. The uncertainty lies in that if the final ruling opposes Trump, tariffs may be canceled, leading to new policy adjustments.

The U.S. federal government "shutdown" has entered its 35th day, tying the record for the longest shutdown in U.S. history. The government closure has led institutions to hedge high-risk assets, triggering sell-offs. This may be one of the core reasons for the recent sharp decline.

According to a previous article by Wallstreetcn, analysis shows that the shutdown forced the U.S. Treasury to increase its general account (TGA) balance at the Federal Reserve from about $30 billion to over $100 billion in the past three months, a five-year high. This process effectively drained over $70 billion in cash from the market.

This large-scale liquidity withdrawal has a tightening effect comparable to several rate hikes. Key financing rate indicators are all under pressure. According to Bloomberg, the Secured Overnight Financing Rate (SOFR) surged 22 basis points on October 31, far above the Fed’s target range, indicating that actual market financing costs have not fallen with Fed rate cuts. Meanwhile, usage of the Fed’s Standing Repo Facility (SRF) is also approaching historical highs.

Spot ETFs Continue to Bleed

The outflow from ETFs is actually more severe than imagined.

From October 29 to November 3, IBIT, the world’s largest Bitcoin spot ETF under BlackRock, which holds a 45% market share, saw a cumulative net outflow of $715 million over four trading days, accounting for more than half of the $1.34 billion total outflow from all U.S. Bitcoin ETFs.

Looking at the whole week from October 28 to November 3, IBIT had a net outflow of $403 million, accounting for 50.4% of the market’s $799 million outflow. On October 31 alone, there was a single-day outflow of $149 million, setting an industry record for the highest single-day outflow.

On November 4, BlackRock’s Coinbase Prime custody address also made on-chain adjustments of 2,043 BTC and 22,681 ETH, leading the market to speculate that ETF holders are still continuously selling off crypto assets.

Although IBIT’s current asset size remains between $95 billion and $100 billion, holding about 800,000 Bitcoin (3.8% of the circulating supply), the four-day outflow corresponds to about 5,800 BTC, accounting for 0.7% of its holdings.

Although the proportion is not large, as the industry leader, the demonstration effect is obvious.

Looking at other major Bitcoin spot ETFs, the top five are BlackRock’s IBIT, Fidelity’s FBTC, Grayscale’s GBTC, Bitwise’s BITB, and ARK’s ARKB in partnership with 21Shares.

Fidelity’s FBTC had a net outflow of $180 million during the same period, accounting for 0.7% of its size, which is relatively moderate; Grayscale’s GBTC saw redemptions slow after a fee reduction, with a $97 million outflow this week; the smaller BITB and ARKB had weekly changes around $50 million each.

This wave of redemptions is essentially due to a sharp decline in investor risk appetite, in sync with macro high-interest rate expectations and Bitcoin’s technical breakdown.

Long-term On-chain Holders Are Also Cashing Out Aggressively

Even more intense than ETFs are the old players on-chain.

In the past 30 days (October 5 to November 4), wallet addresses holding coins for more than 155 days, commonly known as "long-term holders" (LTH), have cumulatively sold about 405,000 BTC, accounting for 2% of the circulating supply. At an average price of $105,000 during the period, they cashed out over $42 billion.

This group still holds about 14.4 to 14.6 million BTC, accounting for 74% of the circulating supply, and remains the largest supplier in the market. The problem is that their selling pace has matched the price trend exactly: after Bitcoin hit a historical high of $126,000 on October 6, profit-taking accelerated significantly; on the day of the "10.11" flash crash, 52,000 BTC flowed out in a single day; from late October to early November, combined with four consecutive ETF net outflows, daily sales exceeded 18,000 BTC.

On-chain data shows that the main sellers are "mid-generation" wallets holding 10 to 1,000 BTC, i.e., those who bought 6 months to 1 year ago and are now sitting on about 150% profit. Whales holding more than 1,000 BTC are actually slightly increasing their holdings, indicating that top players are not bearish, but medium-sized profit-takers are cashing out.

Historically, in March 2024, LTHs sold 5.05% in a single month, and Bitcoin fell 16%; last December, they sold 5.2%, and Bitcoin dropped 21%. This time, October’s sell-off was 2.2%, with only a 4% decline, which is actually moderate.

But with both ETFs and on-chain holders bleeding at the same time, the combined forces are too much for the market to bear.

Judging the Bottom of the Decline

glassnode published a market view stating that the market continues to struggle above the short-term holder cost basis (around $113,000), which is a key battleground for bulls and bears. If it fails to regain this level, it may further fall to the actual price of active investors (around $88,000).

CryptoQuant CEO Ki Young Ju posted a series of on-chain data last night, stating that the average cost for Bitcoin wallets is $55,900, meaning holders are on average up about 93%. On-chain capital inflows remain strong. The price cannot rise due to weak demand.

10x Research CEO Markus Thielen stated after the market decline that Bitcoin is approaching the support line since the October 10 crash. If it falls below $107,000, it may test $100,000.

Chinese crypto KOL Banmuxia publicly stated today, "The traditional four-year bull cycle has ended. Bitcoin will gradually fall to $84,000, then experience several months of complex fluctuations, and by the end of next year or early the following year, it will surge to $240,000 following the U.S. stock market bubble."

At present, the only good news seems to be that, historically, Bitcoin has averaged gains in November.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

As treasury companies start selling coins, has the DAT boom reached a turning point?

From getting rich by holding coins to selling coins to repair watches, the capital market is no longer unconditionally rewarding the narrative of simply holding tokens.

Bitcoin Falls Below the 100,000 Mark: Turning Point Between Bull and Bear Markets?

Liquidity is the key factor influencing the current performance of the crypto market.

The "mini nonfarm payrolls" rebound beyond expectations, is the US job market recovering?

US ADP employment in October saw the largest increase since July, with previous figures also revised upward. However, experts caution that the absence of nonfarm payroll data means this figure should be interpreted cautiously.

Microsoft Strikes $9.7B Deal With IREN as AI Demand Surges