Bitcoin Falls Below the 100,000 Mark: Turning Point Between Bull and Bear Markets?

Liquidity is the key factor influencing the current performance of the crypto market.

Liquidity is the key factor influencing the current performance of the crypto market.

Written by: 1912212.eth, Foresight News

The sentiment in the crypto market is extremely pessimistic and fearful, with the current fear index at 20, hitting a new six-month low. On the night of November 4th at 11 p.m., bitcoin fell from $104,000, and by around 5 a.m. on November 5th, it had dropped below the $100,000 mark, reaching as low as $98,944. It is currently rebounding and fluctuating near $101,000. ETH dropped from $3,500 to as low as $3,057, a nearly 10% drop in 24 hours, and is now fluctuating near $3,300. SOL fell to $145. Affected by the overall market, altcoins also experienced widespread declines.

In terms of open interest data, according to coinglass, in the past 24 hours, total liquidations reached $2.095 billions, with long positions liquidated for $1.682 billions. The largest single liquidation occurred on HTX - BTC-USDT, valued at $47.8728 millions.

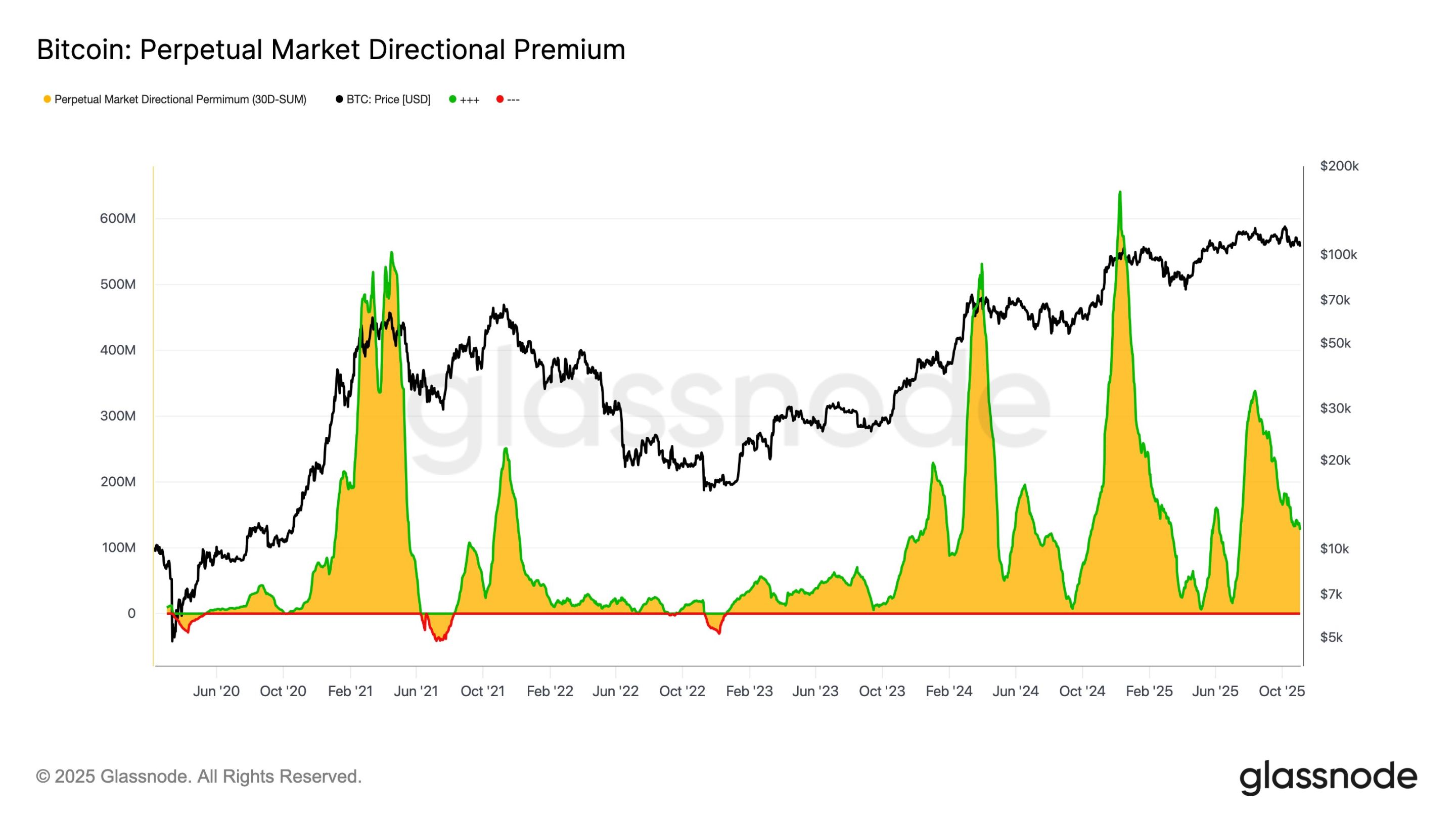

For bitcoin perpetual contracts, the funding rate paid by longs per month has dropped by about 62%, from $338 millions per month in mid-August to the current $127 millions per month. Market speculation has dropped significantly.

After four months, BTC has once again lost the critical $100,000 level. Is this the start of a bear market?

U.S. Stocks Plunge

On Tuesday, U.S. stocks closed with the Dow Jones down 0.53%, the S&P 500 down 1.17%, and the Nasdaq down 2%. Tesla (TSLA.O) fell 5%, Nvidia (NVDA.O) dropped nearly 4%, and Strategy (MSTR.O) fell over 6%. U.S. and European stock index futures also continued to decline. For U.S. stock investors, yesterday was undoubtedly a "Black Tuesday." Spot gold fell below $4,000, with a daily drop of 1.76%.

Specifically, two major events directly triggered the sell-off of popular retail stocks. First, Palantir's earnings report raised concerns about its growth prospects. Although Palantir's earnings showed strong performance in Q3, the market questioned the sustainability of its high valuation. This retail "darling," which soared over 150% this year, suffered a sharp decline yesterday, closing down nearly 8% and remaining weak after hours. Second, legendary investor Michael Burry's regulatory filing became the last straw.

According to a 13F regulatory filing, Michael Burry, the hedge fund manager made famous by the movie "The Big Short," established short positions on Palantir and chip giant Nvidia in the previous quarter.

Just a few days ago, Burry had issued a warning to retail investors about market exuberance. The disclosure of his short positions undoubtedly confirmed his bearish stance and quickly intensified market panic.

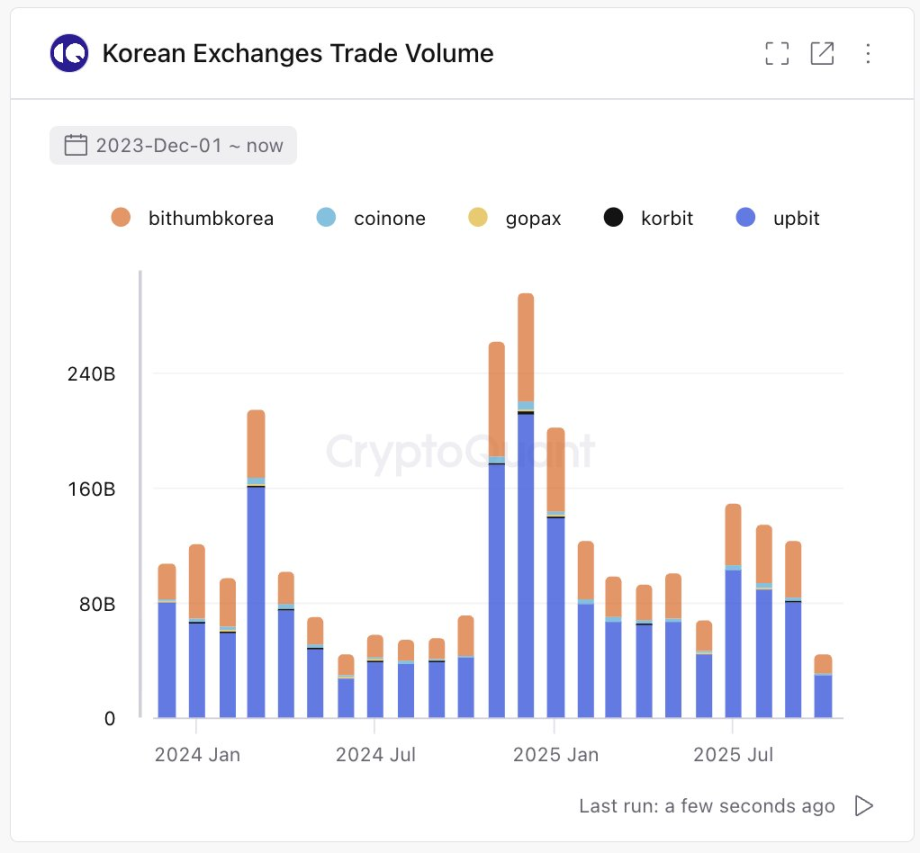

In Asian markets, South Korea's KOSPI index even fell by 3.3%, prompting the Korea Exchange to trigger a circuit breaker. Just yesterday, the KOSPI hit a record high, while crypto exchange trading volumes hit a yearly low.

The U.S. government shutdown remains unresolved. Under the negative impact of the macro market, cryptocurrencies have once again been affected.

Large Net Outflows from Bitcoin and Ethereum Spot ETFs

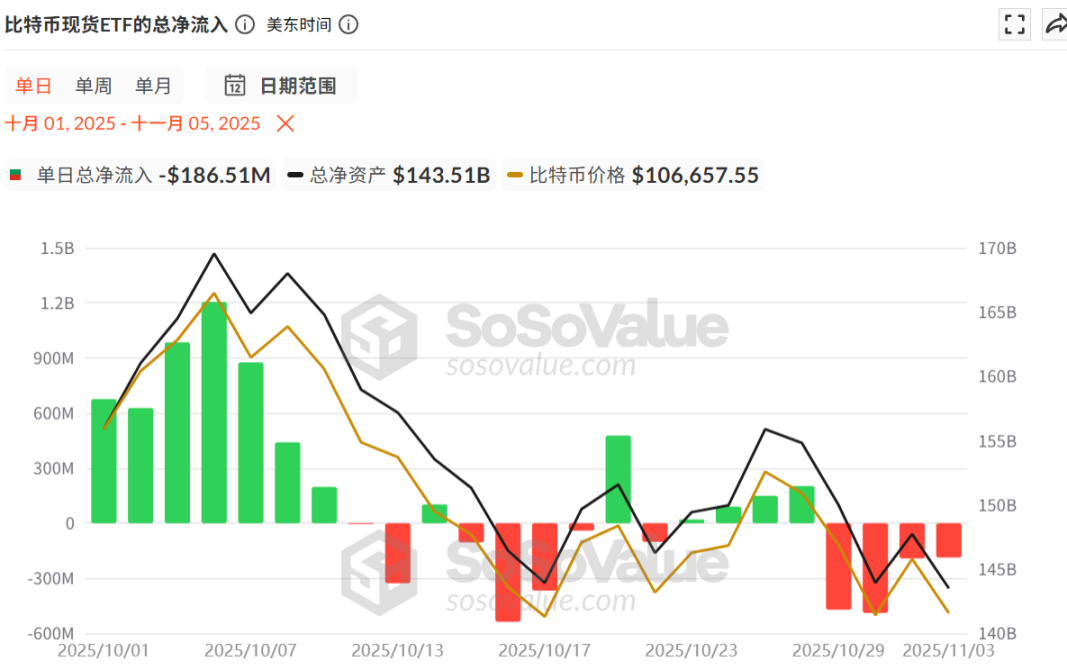

Since mid-October this year, bitcoin spot ETFs have seen large outflows. Although there were several small net inflows at the end of October, there were still significant net outflows at the end of October and early November.

On October 29, the single-day net outflow reached $470 millions, and the next day, the net outflow was $488 millions. From October 31 to January 3, the single-day net outflows ranged from $180 millions to $190 millions.

Bloomberg ETF analyst Eric Balchunas stated that the growth of bitcoin ETFs will experience a "two steps forward, one step back" process, and we are currently in the retreat phase.

Ethereum spot ETF data is also showing signs of weakness.

Since the large net outflows in mid-October, the overall trend has been that the number and amount of net outflows far exceed net inflows, with even four consecutive days of net outflows. From October 29 to November 3, the single-day net outflows ranged from $80 millions to $180 millions.

Market Outlook

Crypto market maker Wintermute stated that despite a supportive macro environment—including interest rate cuts, the end of quantitative tightening, and stock markets near highs—cryptocurrencies continue to lag behind other asset classes. The article points out that global liquidity is expanding, but funds are not flowing into the crypto market. Of the three main inflow engines that drove performance in the first half of this year, only the supply of stablecoins continues to grow (up 50% this year, an increase of $100 billions), while ETF inflows have stalled since summer, with BTC ETF assets under management hovering around $150 billions, and digital asset trading (DAT) activity has dried up. Wintermute believes that the four-year cycle concept no longer applies to mature markets, and liquidity is the key factor driving current performance. They will closely monitor ETF inflows and DAT activity, as these will be important signals for liquidity returning to the crypto market.

Yi Lihua, founder of Liquid Capital (formerly LD Capital), stated: "Continue to buy gradually; before the U.S. government reopens, it is a huge opportunity. Don't worry about ETH spot, ETH fundamentals have not changed, stablecoin supply continues to grow, U.S. stock market risks are not significant in the short term, and I am optimistic about the market after late November."

Chinese crypto analyst Ban Muxia stated, "Regarding bitcoin, many people still underestimate the complexity of the upcoming market. I believe it is highly likely that this small bear market will end near $84,000. This does not mean it will smoothly fall to $84,000; this time it is likely to be a complex sideways adjustment. At present, it may drop slightly to around $94,500, then is likely to enter an extremely complex consolidation, with rebounds possibly reaching above $116,000, and then slowly falling to the $84,000 and below 6-8% range."

Bitwise Chief Investment Officer Matt Hougan stated that although bitcoin has fallen below $100,000, hitting a new low since June and sparking concerns about a "crypto winter," he believes the current market is closer to a bottom rather than the start of a new long-term bear market. Matt Hougan said that retail investors are currently in an "extremely desperate" phase, with frequent leveraged liquidations and market sentiment at new lows; however, institutional investors and financial advisors remain bullish, continuing to allocate to bitcoin and other crypto assets through ETFs. He pointed out that institutions are becoming the main driving force in the market. Matt Hougan stated that retail crypto investors' selling is nearing "exhaustion," and he believes the bitcoin price bottom is about to appear, and it will come sooner than expected. He believes bitcoin still has a chance to reach new highs this year, with the price possibly rising to the $125,000 to $130,000 range, and if the trend is ideal, it could even reach $150,000. Hougan believes that as institutional buying continues to grow, the next phase of the crypto market will be driven by more rational capital.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Arthur Hayes: An In-depth Analysis of U.S. Debt, Money Printing, and the Future Trend of Bitcoin

Price predictions 11/5: BTC, ETH, BNB, XRP, SOL, DOGE, ADA, HYPE, LINK, BCH

Bitcoin supply held at loss rises to 2024 level: Can BTC recover before 2025 ends?

ETH price drop to $3K sets stage for $7B short squeeze if crypto market recovery holds