Genius Sports Sees Revenue Growth Despite Lower Profits; Analysts Maintain $15 Price Target

- Genius Sports (GENI) reports Q3 2025 earnings with $156.27M revenue but -$0.18 EPS, showing revenue growth vs. worsening losses. - Analysts maintain "Outperform" rating (avg. $15 target, 33% upside) despite GF Value model suggesting $10.45 fair value. - Stock faces pressure from profitability challenges, with June 2025 post-earnings drop highlighting revenue-profitability disconnect.

Analysts See Potential

Genius Sports Ltd (NYSE:GENI), known for its sports data and integrity offerings, is scheduled to announce its Q3 2025 results on November 4, 2025, according to a

The company’s financial path has been uneven. Over the past 90 days, revenue projections for 2025 have climbed by $24.29 million, indicating rising interest in its sports data products. On the other hand, profit forecasts have worsened, with 2025 estimates dropping by 170 basis points to $-0.18 per share, which analysts link to persistent cost and operational issues.

Even with a negative earnings outlook, analysts remain cautiously upbeat. The consensus 12-month price target is $15.00, suggesting a 33.21% increase from the current $11.26 share price. This positive sentiment is supported by a collective "Outperform" rating from 19 brokerages, averaging a recommendation score of 1.8 on a 1–5 scale, according to the preview. However, the GF Value model offers a more reserved perspective, estimating fair value at $10.45, which would be a 7.19% decrease from the current price, the preview notes.

The share price’s fluctuations reflect the ongoing struggle between revenue expansion and profitability worries. In the June 2025 quarter, Genius Sports’ stock dropped 4.50% after earnings, despite exceeding revenue projections. Analysts point out that while revenue growth is strong, turning that into steady profits remains a significant challenge.

Looking forward, the upcoming Q3 results will be crucial. Should the company manage to reduce its losses or show improvements in controlling costs, investor interest could be reignited. On the flip side, continued losses may weigh on the stock, especially since the GF Value model indicates the shares may be overvalued compared to analyst targets.

Brokerage opinions are divided between short-term optimism and longer-term caution. Although 19 firms maintain an average "Outperform" rating for Genius Sports, the gap between price targets and intrinsic value highlights the importance of careful risk evaluation.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum News Update: Ethereum ETFs See $210M Outflows While Altcoins Gain $200M from Institutional Investors

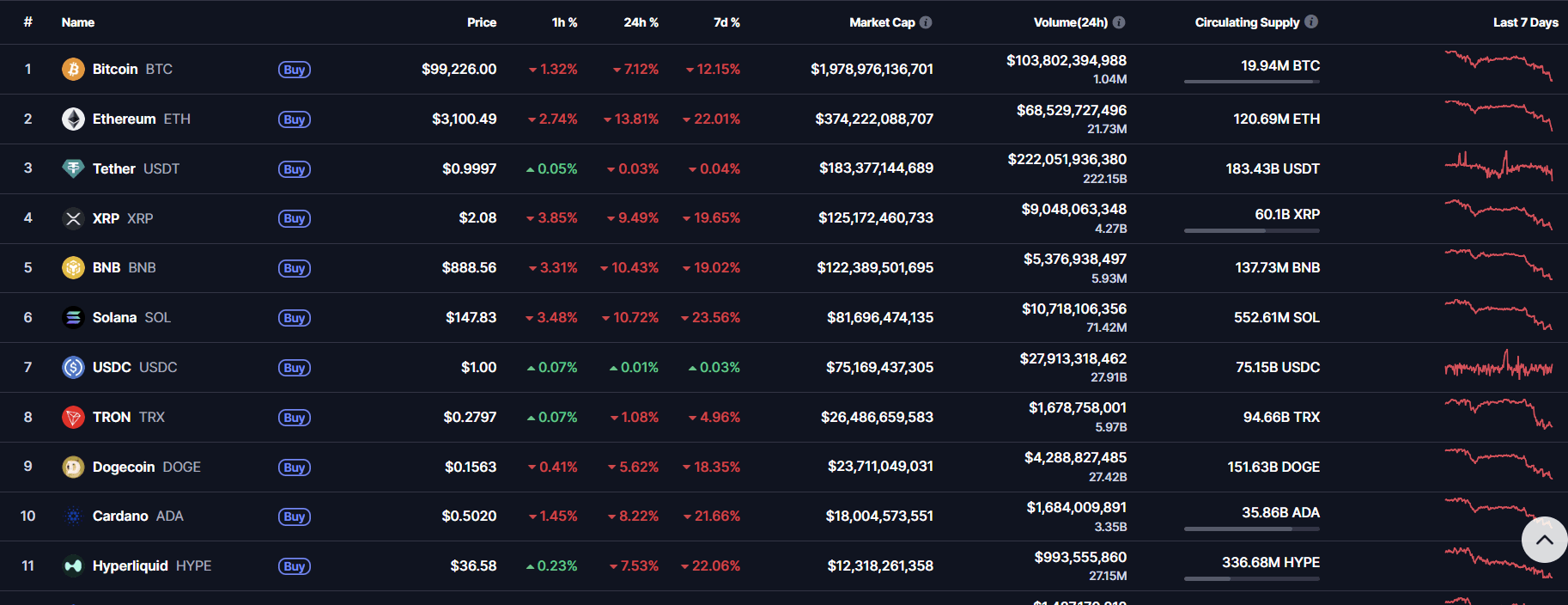

- US Ethereum ETFs saw $210M in 5-day outflows, with BlackRock's ETHA leading $81.7M daily redemptions amid regulatory uncertainty and market shifts. - Bitcoin ETFs lost $543.59M over 3 days, while Solana's BSOL ETF attracted $197M in inflows, reflecting institutional appetite for high-performance altcoins. - Ethereum's price fell below $3,500 as ETF redemptions worsened bearish pressure, contrasting with new Solana/Hedera ETFs drawing $199M in four days. - Market analysts highlight maturing crypto dynamic

Political Stalemate on Healthcare Funding Triggers Nationwide Emergency

- U.S. government shutdown hits 36 days, nearing 1995-96 record, as Congress deadlocks over healthcare funding and political concessions. - Economic impact grows: CBO warns of 1-2% GDP loss, $7B-$14B in irrecoverable costs, and 0.4% unemployment rise from prolonged closure. - Political tensions escalate: Senate Democrats block GOP funding bills, while Trump threatens to withhold SNAP benefits until government reopens. - Human crisis deepens: Food banks report surging demand, military families face food ins

Ethereum Crash Deepens: Can the $3K Line Hold or Will It Break Next?

Bitcoin Updates: Swiss Crypto Lending Offers 14% Returns Alongside Bank-Backed Insurance

- Swiss crypto lender Fulcrum offers 14% APR on stablecoins with Lloyd's insurance and FINMA regulation. - Platform uses 50% LTV over-collateralization and institutional-grade security to mitigate market risks. - Targets inflation-hedging investors by bridging traditional finance gaps with insured crypto yields. - Competes with alternatives like Bitget's zero-interest loans but emphasizes regulatory compliance and capital preservation.