Ethereum Crash Deepens: Can the $3K Line Hold or Will It Break Next?

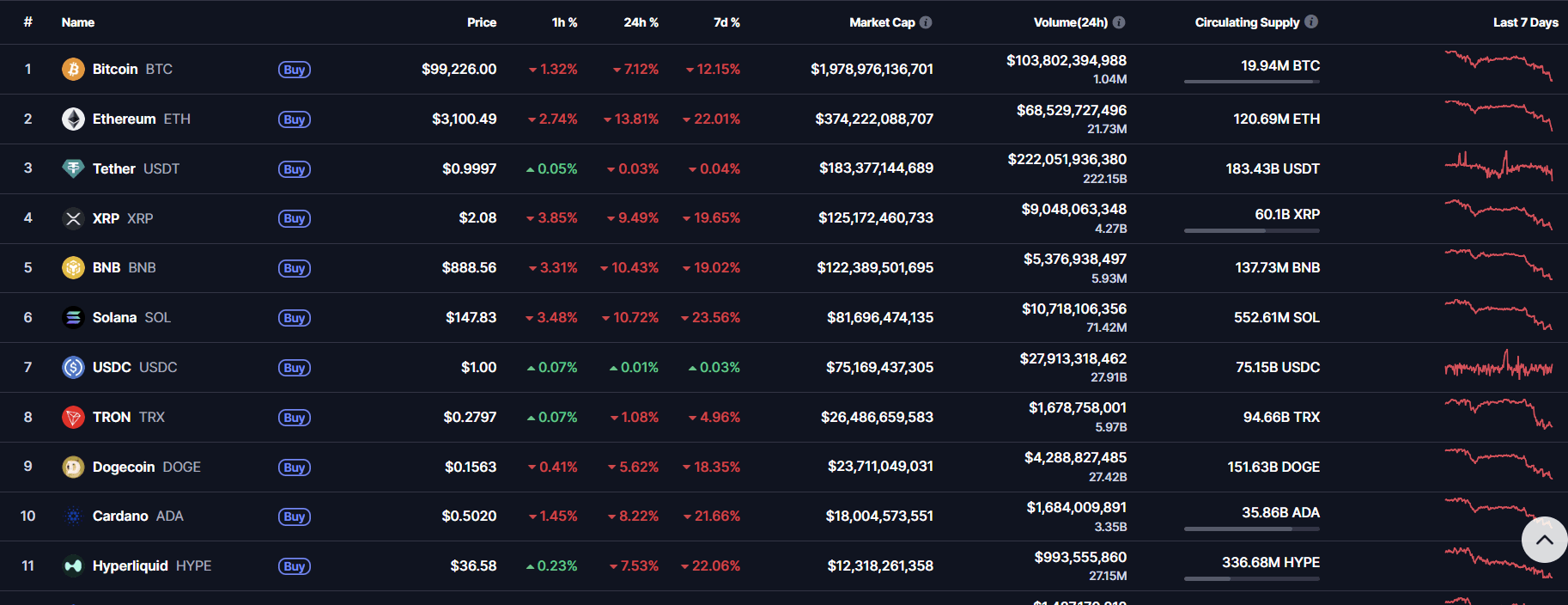

The crypto market is in freefall , and Ethereum is one of the hardest hit.

Following Bitcoin’s sharp decline under $100K, $ETH plunged over 13% in a single day, wiping out weeks of gains and reigniting fears of a deeper bear trend.

Ethereum Price Crash Toward $3,000

$Ethereum crashed from around $3,600 to nearly $3,100, breaking several key support zones. The 200-day SMA at $3,370 has been breached, confirming a bearish trend continuation.

ETH/USD 1-day chart - TradingView

RSI has dropped to 43, indicating rising selling pressure but not yet fully oversold.

MACD remains in negative territory, with widening divergence — a clear sign that momentum is still heavily bearish.

Bitcoin Crash Triggered the Avalanche

Bitcoin’s breakdown below $100K acted like a domino effect across all markets.

Ethereum, BNB, Solana, Cardano, and Dogecoin all saw steep declines as liquidations exceeded $100 billion in 24h trading volume across top exchanges.

Solana dropped 23%, Cardano lost 21%, and BNB tumbled nearly 10%.

The entire crypto market capitalization has now fallen below $3.6 trillion.

Ethereum Price Prediction: Key Levels to Watch for ETH

If Ethereum fails to hold above the $3,000 mark, the next strong supports lie at $2,730 and $2,400.

A rebound may occur if BTC finds stability near $100K, potentially sending ETH back toward $3,500.

However, sentiment remains extremely bearish — and any short-term rally could face resistance near the $3,370–$3,800 range.

Will Ethereum Price Recover?

Both $Bitcoin and $Ethereum have entered dangerous territory.

While the RSI readings suggest short-term exhaustion among sellers, macro factors — including liquidations, investor fear, and risk-off sentiment — continue to weigh on the market.

Until $BTC reclaims $106K or $ETH climbs above $3,500, the crypto correction is far from over.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Aave News Today: Connecting DeFi and Traditional Finance: Aave and Chainlink Propel Institutional Integration

- Bitcoin hit $104,000 in Nov 2025 amid institutional interest and dollar weakness, signaling crypto market maturity. - Aave integrated Chainlink's ACE compliance tool to verify institutional transactions, bridging DeFi and TradFi with $35B TVL. - Chainlink expanded to TON blockchain via CCIP, enabling Toncoin cross-chain transfers and real-time data access for 900M Telegram users. - Telegram's Cocoon AI network added GPU rentals to TON, diversifying use cases while prioritizing infrastructure over hype. -

Regulatory challenges and market fluctuations prompt Dupay's departure as the crypto sector shifts direction

- Dupay, a crypto payment card firm, shuts down due to regulatory pressures and market volatility, reflecting broader industry challenges. - Canada's $10M stablecoin regulation mandates reserves and transparency, raising compliance costs for smaller crypto firms. - JELLYJELLY token's 224% surge triggered $13M liquidations, exposing risks of high-leverage trading in volatile crypto markets. - U.S. government shutdown disrupts social safety nets, potentially reducing demand for crypto-linked payment solution

AAVE Rises 4.85% Following $50M Buyback and $35B TVL: Will Chainlink ACE Prevent Further Decline?

- Aave's AAVE token rose 4.85% in 24 hours amid a $50M annual buyback program and $35B TVL, despite 13.66% monthly declines. - The protocol generated $98. 3M in fees and $12.6M revenue last month, supporting its position as a stable DeFi platform with strong liquidity. - Technical analysis identifies $150–$160 as a potential floor, with bullish targets at $240–$538 by year-end if key trendlines hold. - A backtesting strategy using historical data aims to validate the buyback's price-stabilizing impact amid

MSX Connects Conventional and Blockchain Financial Systems through Incentives Prioritizing Liquidity

- MSX launches S1 Points Season with M Bean incentive mechanism to boost user engagement and liquidity via blockchain-based rewards. - Non-lockup model allows users to earn rewards through trading, staking, and governance, mirroring MEXC's high-yield airdrop strategies. - Platform integrates on-chain data partnerships (e.g., Tradeweb-Chainlink) to provide institutional-grade transparency in tokenized finance. - Analysts highlight need for sustained utility and adaptive tokenomics to maintain value, leverag