News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

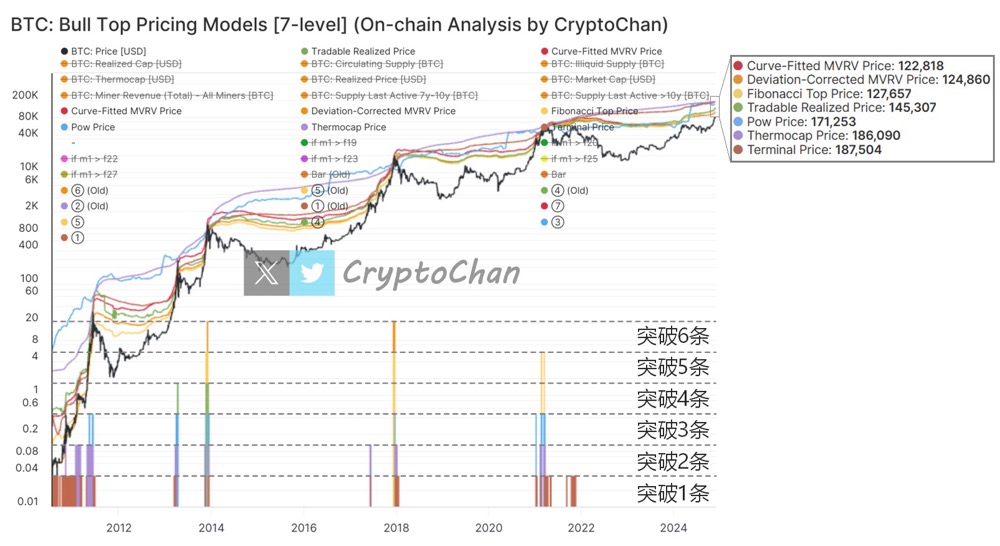

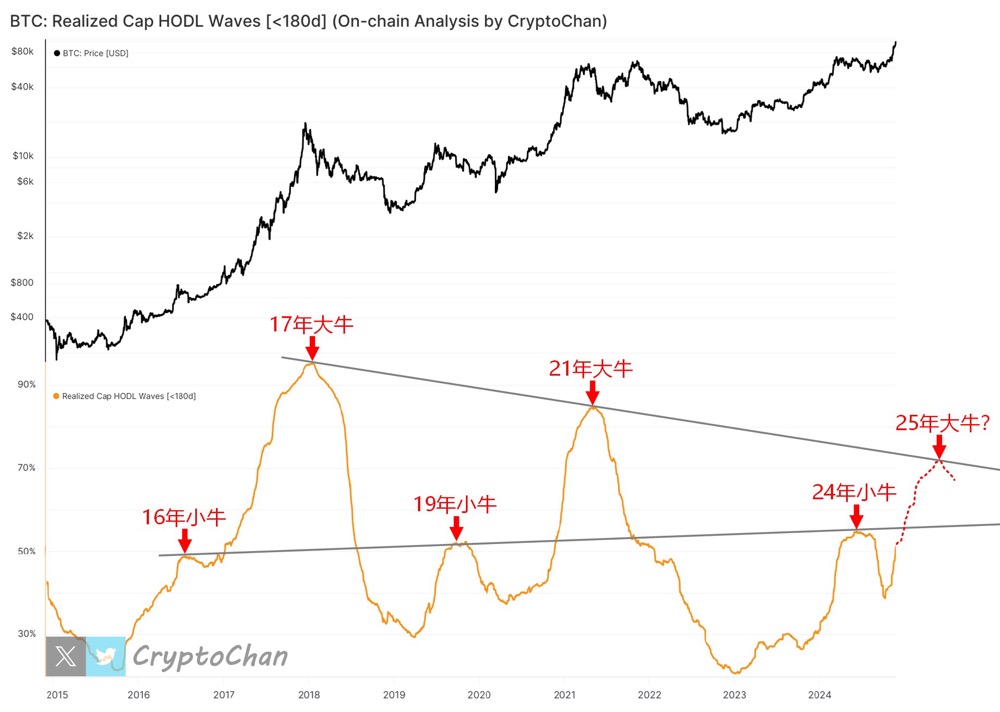

BTC price nears crucial resistance as various model target prices indicate potential for a bull market

CryptoChan·2024/11/28 08:20

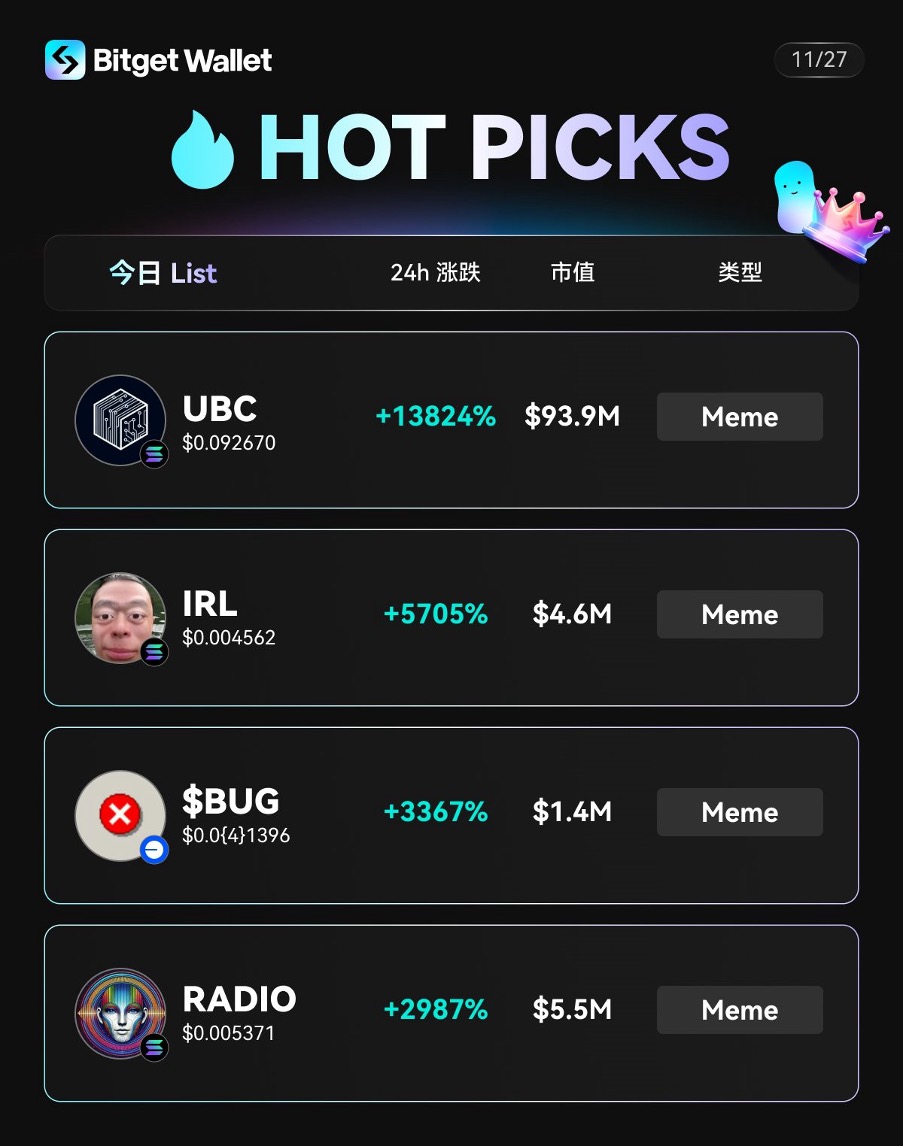

Today's Popular MEME Stocks

币币皆然 ·2024/11/27 10:33

An Overview of Anti and Pro Mechanisms: The Value Gap of DeSci Infrastructure

Timo·2024/11/27 08:54

Bitget Daily Digest | BTC faces short-term decline, XRP ETF filed by WisdomTree

远山洞见·2024/11/26 11:46

Today's Popular MEME Inventory

币币皆然·2024/11/26 10:56

On-chain signal reappears? Bitcoin's 25-year bull market may be on the horizon

CryptoChan·2024/11/26 06:14

Today's popular MEME list

币币皆然·2024/11/25 10:44

Flash

- 09:41Data: In October, the net inflow of US Bitcoin spot ETFs was $3.4249 billionsAccording to ChainCatcher, citing data from Farside Investors, the net inflow of US spot bitcoin ETFs in October was $3.4249 billions. IBIT (BlackRock): net inflow of $3.9312 billions; FBTC (Fidelity): net inflow of $163.8 millions; HODL (VanEck): net inflow of $66.7 millions; BTC (Grayscale Mini): net inflow of $64.1 millions; EZBC (Franklin): net inflow of $10.1 millions; BTCO (Invesco): net inflow of $7.2 millions; BTCW (WisdomTree): net inflow of $6 millions; BRRR (Valkyrie): net outflow of $10.2 millions; BITB (Bitwise): net outflow of $30.3 millions; ARKB (Ark Invest): net outflow of $237.2 millions; GBTC (Grayscale): net outflow of $546.5 millions.

- 08:59This week, US spot Bitcoin ETFs saw a net outflow of $799 million.According to ChainCatcher, citing monitoring by Farside Investors, the net outflow from US spot bitcoin ETFs this week reached $799 million. IBIT (BlackRock): net outflow of $403.4 million; FBTC (Fidelity): net outflow of $155.9 million; BITB (Bitwise): net outflow of $79 million; ARKB (ARK): net outflow of $76.5 million; GBTC (Grayscale): net outflow of $68.1 million; BTCO (Invesco): net outflow of $8 million; BTC (Grayscale mini): net outflow of $4.3 million; HODL (VanEek): net outflow of $3.8 million.

- 08:47Analyst: Bitcoin enters an institution-dominated era as retail trading share drops sharplyChainCatcher News, CryptoQuant analyst Axel Adler Jr stated in an article that the share of bitcoin retail trades (in the $0–$1,000 range) has dropped from 1.8% in 2021 to the current 0.48%, indicating that large participants are increasingly dominating overall trading volume. As of October 2025, the daily average activity of retail trades remains stable at $108 million, but this is significantly lower than the historical peak of $132 million to $150 million, which may suggest a change in market structure and a decline in speculative activity among smaller participants. The number of daily trades in the $0–$1,000 range is about 700,000, close to the historical average, but the average trade size has decreased compared to previous cycles, further confirming the more conservative behavior of retail participants. The bitcoin market is showing clear signs of institutionalization: over the past four years, the proportion of retail trading has dropped sharply, indicating that market control is shifting to large institutions, and the influence of small speculators on overall trends is weakening. The current retail activity is stable at a daily level of $108 million, representing a new benchmark in a mature, institutionalized market—here, the speculative frenzy of small retail investors gives way to more robust accumulation strategies.