المقالة الحالية لا تدعم اللغة التي اخترتها، تمت التوصية تلقائيًا باللغة العربية نيابة عنك

Bitget Futures—Position Tier System Explained

[Estimated reading time: 5 mins]

In Bitget's futures trading, the position tier system is a key risk management mechanism. As a user's position value increases, the platform adjusts the supported leverage and margin requirements based on tier levels. This helps maintain market stability and protect user funds. Below is a breakdown of how Bitget's position tier system works, including examples and calculations to support your understanding.

What are position tiers

Position tiers categorize positions into different risk levels based on the position value. The higher the position value, the lower the maximum supported leverage, and the higher the initial and maintenance margin requirements. Bitget sets four position tiers for each trading pair (e.g., BTCUSDT).

-

Standard tier: Base position size

-

Special Level 1: 1.5x standard tier size

-

Special Level 2: 2x standard tier size

-

Special Level 3: 3x standard tier size

If the standard tier limit for BTCUSDT is 150,000 USDT, then:

-

Special Level 1: 225,000 USDT

-

Special Level 2: 300,000 USDT

-

Special Level 3: 450,000 USDT

This tiered structure helps control the risk of large, high-leverage positions—especially during volatile markets—to prevent cascading liquidations.

BTCUSDT position tier (example)

The table below outlines the leverage and maintenance margin rate (MMR) for each BTCUSDT tier:

|

Tier

|

Standard tier (USDT)

|

Special Level 1 (USDT)

|

Special Level 2 (USDT)

|

Special Level 3 (USDT)

|

Leverage

|

Maintenance margin rate

|

|

1

|

0 - 150,000

|

0 - 225,000

|

0 - 300,000

|

0 - 450,000

|

125

|

0.40%

|

|

2

|

150,000 - 900,000

|

225,000 - 1,350,000

|

300,000 - 1,800,000

|

450,000 - 2,700,000

|

100

|

0.50%

|

|

3

|

900,000 - 3,000,000

|

1,350,000 - 4,500,000

|

1,800,000 - 6,000,000

|

2,700,000 - 9,000,000

|

50

|

1%

|

|

4

|

3,000,000 - 6,000,000

|

4,500,000 - 9,000,000

|

6,000,000 - 12,000,000

|

9,000,000 - 18,000,000

|

40

|

1.50%

|

|

5

|

6,000,000 - 9,000,000

|

9,000,000 - 13,500,000

|

12,000,000 - 18,000,000

|

18,000,000 - 27,000,000

|

20

|

2%

|

As position value increases, the maximum supported leverage is reduced and the required maintenance margin rate increases, limiting the platform's exposure to risk from large trades.

How to calculate margin requirements (example)

Scenario: You hold a BTCUSDT position worth 1,000,000 USDT under Special Level 2. Your required maintenance margin is calculated as follows:

Steps:

1. From the table, 1,000,000 USDT falls under Tier 2 for Special Level 2 (300,000 USDT – 1,800,000 USDT).

2. The maintenance margin rate for this tier is 0.50%.

3. Maintenance margin = position value × MMR = 1,000,000 × 0.50% = 5000 USDT.

Conclusion: You must maintain at least 5000 USDT in your account to avoid liquidation. This example is for illustration only and may not reflect real-time market conditions. Always monitor your positions carefully.

How to view position tiers

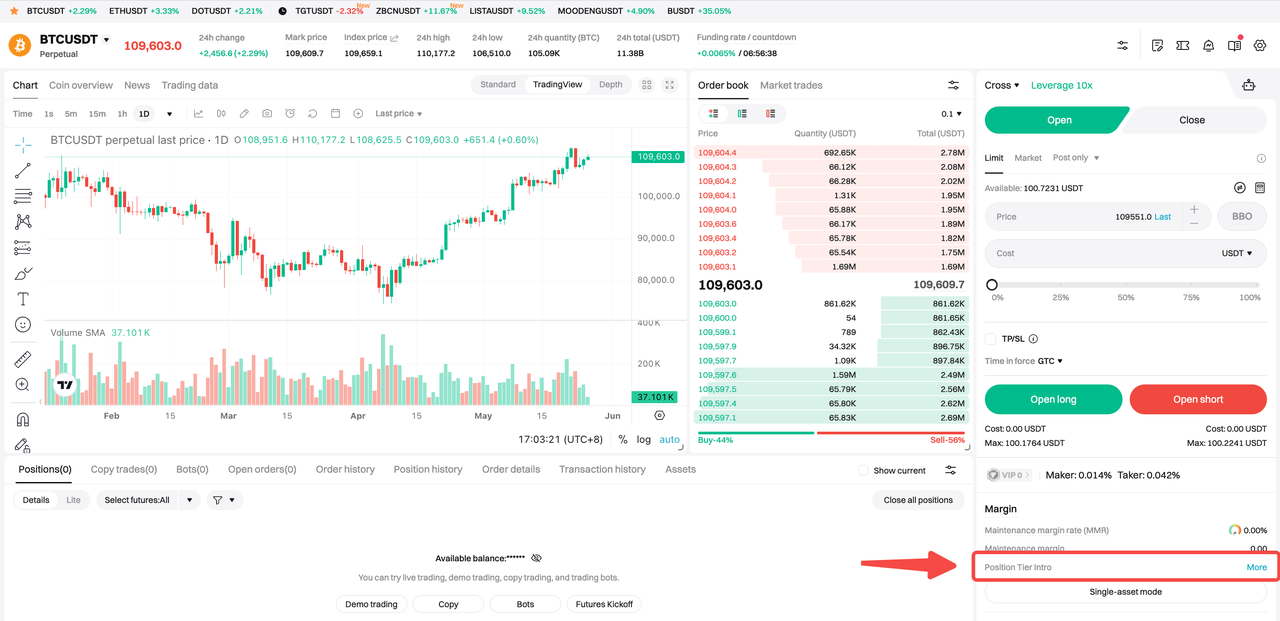

On the Website:

To view position tier information for all trading pairs: Navigate to the futures trading page. Go to Margin > Position Tier Intro > More, or visit this page.

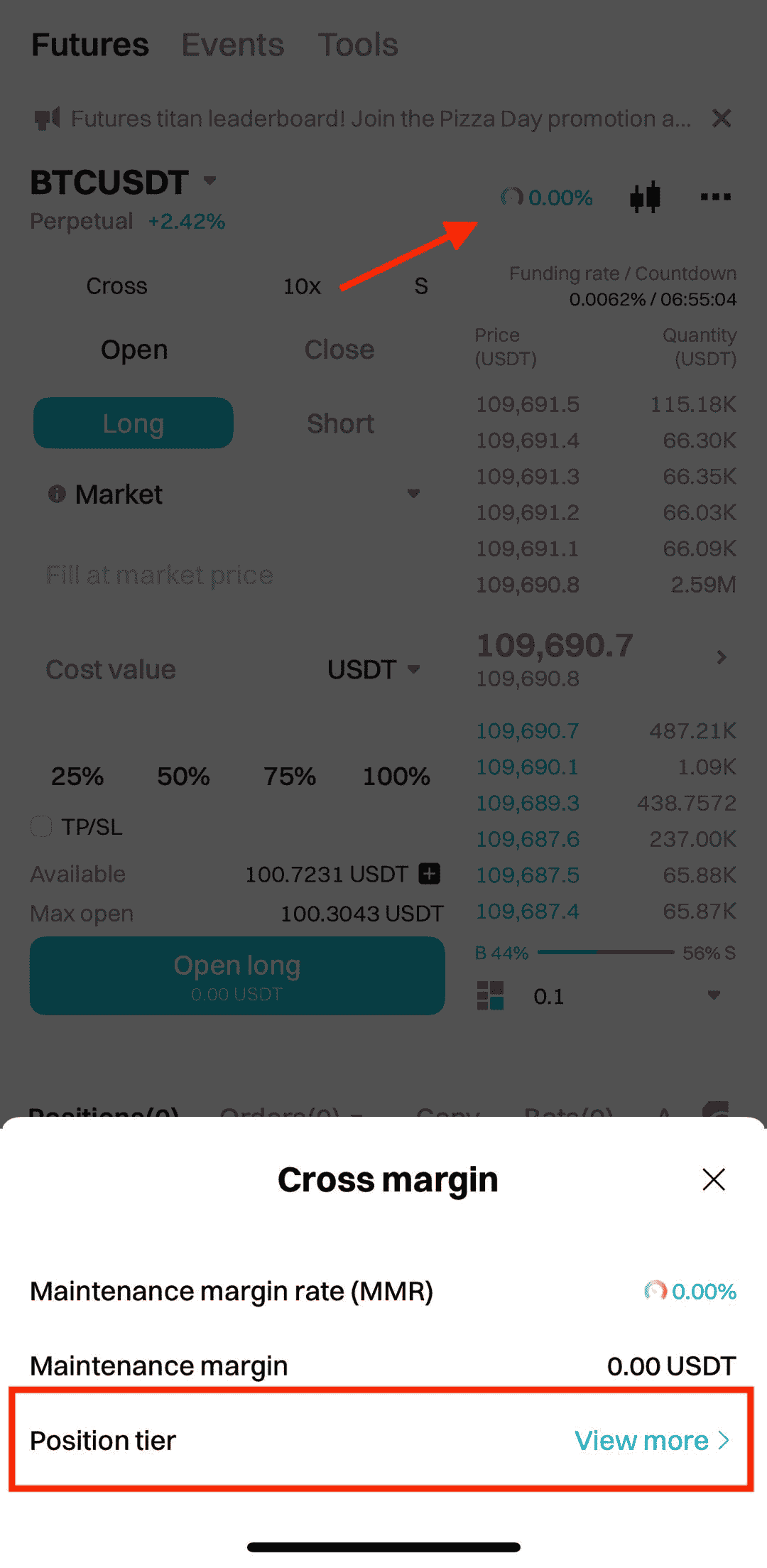

On the App:

To view position tier information for all trading pairs, navigate to Futures. Then, tap the "..." icon next to the candlestick chart icon and select Position Tiers, or visit this page.

Why are position tiers necessary

The position tier system is designed to protect both individual users and the overall market stability. In highly volatile markets, high-leverage trading can significantly amplify losses. By reducing the maximum supported leverage and raising margin requirements for larger positions, Bitget helps prevent cascading liquidations during sharp market swings. Understanding and properly using the position tier system helps you better manage risk and optimize your strategies in Bitget futures trading.

FAQs

1. What are position tiers in Bitget futures?

Position tiers categorize positions into different risk levels based on position value. Higher position values have lower maximum supported leverage and higher initial and maintenance margin requirements.

2. How many position tiers does Bitget set for each trading pair?

Bitget sets four position tiers for each trading pair: Standard tier, Special Level 1, Special Level 2, and Special Level 3.

3. Why are position tiers necessary?

Position tiers protect both individual users and overall market stability. They reduce maximum leverage and raise margin requirements for larger positions to help prevent cascading liquidations during volatile market conditions.

4. What's the difference between initial and maintenance margin rate?

Initial margin rate is the minimum margin rate required to open a position. Maintenance margin rate is the minimum margin rate required to keep a position open and avoid liquidation. Both rates increase with the position tier level.

5. How to choose the right leverage?

Choose your leverage based on your risk tolerance and market volatility. Bitget offers leverage up to 125x, but high leverage should be used with caution.

Disclaimer and Risk Warning

All trading tutorials provided by Bitget are for educational purposes only and should not be considered financial advice. The strategies and examples shared are for illustrative purposes and may not reflect actual market conditions. Cryptocurrency trading involves significant risks, including the potential loss of your funds. Past performance does not guarantee future results. Always conduct thorough research, understand the risks involved. Bitget is not responsible for any trading decisions made by users.

Join Bitget, the World's Leading Crypto Exchange and Web3 Company

مشاركة