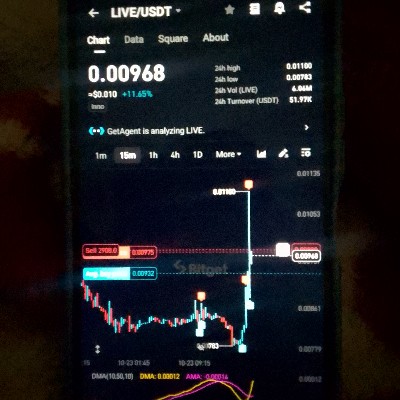

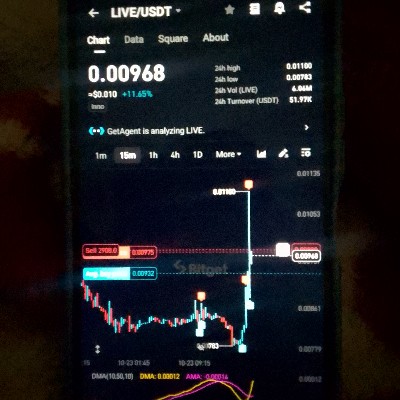

ART Coin priceART

ART Coin market Info

Live ART Coin price today in USD

The cryptocurrency market is abuzz on October 28, 2025, with significant regulatory shifts, notable price movements in major assets, and key industry events unfolding. The overarching sentiment points to a blend of cautious optimism and strategic development, as the sector continues to mature amid evolving global frameworks and technological advancements.

Regulatory Landscape Takes Center Stage

Regulatory clarity remains a dominant theme in the crypto space. The Financial Stability Board (FSB) and the International Organisation of Securities Commissions (IOSCO) recently published two reports on October 16, 2025, assessing the implementation of their recommendations for crypto-asset and stablecoin activities. The reports highlighted that while some progress has been made, implementation remains slow and fragmented globally, emphasizing the need for more consistent and effective regulatory responses to prevent arbitrage and ensure market integrity. [1]

In the United Kingdom, new draft legislation, the Financial Services and Markets Act 2000 (Cryptoassets) Order 2025, published on April 29, 2025, is set to bring cryptoassets formally within the UK's regulatory scope. This legislation introduces new regulated activities, including the operation of crypto trading platforms and stablecoin issuance, and establishes standards for transparency and consumer protection. [2] The Financial Conduct Authority (FCA) has also released consultation papers and a 'Crypto Roadmap,' with significant changes expected to take effect in 2026. Notably, the FCA has lifted its ban on certain Bitcoin-based Exchange-Traded Products (ETPs), paving the way for products like BlackRock’s ETP launch. [2]

Across the Atlantic, US Senate members convened a private roundtable with leading cryptocurrency executives on October 22, 2025, to discuss comprehensive market regulation. Key policy areas addressed included clearer jurisdictional boundaries between regulatory bodies, a federal framework for stablecoins, enhanced anti-money laundering measures, and robust investor protections. [4] Meanwhile, the Swiss Bitcoin-only application, Relai, achieved a significant milestone by obtaining a MiCA license from the French Financial Markets Authority (AMF) today, October 28, 2025. This authorization allows Relai to expand its regulated Bitcoin services across the European Union, enhancing accessibility and transparency for users. [20]

Bitcoin and Ethereum Show Resilience and Bullish Signals

Today, Bitcoin (BTC) is demonstrating bullish momentum, pushing towards the $115,000 region. This surge follows recent outflows and is attributed to easing selling pressure, growing bullish sentiment, and increased accumulation by investors. Over 7 million Bitcoin returned to profitability in the last 24 hours, underscoring renewed investor confidence. [8, 31] Analysts are optimistic, with some projecting Bitcoin could reach $120,000 and potentially surpass its all-time high of $126,000-$130,000 by year-end, possibly extending to $150,000 as 2025 approaches. [9, 26, 31]

Ethereum (ETH) is also exhibiting strong performance, outperforming Bitcoin with a 6% increase and trading above $4,200. [22, 23, 31] Market observers note a 'bull flag' pattern, suggesting potential for ETH to reach $5,000. [22] Institutional demand and continued ETF inflows are contributing factors, with 'whales and sharks' reportedly accumulating ETH, indicating improving confidence among larger accounts. [13, 22] The upcoming Federal Reserve meeting on October 28-29, with an anticipated 25 basis points rate cut, is widely expected to act as a significant catalyst, boosting risk assets across the board, including cryptocurrencies. [9, 21, 22, 27, 31]

Altcoin Market Dynamics

Amidst the broader market movements, several altcoins are drawing attention. Digitap ($TAP), an omnibank offering a Visa card for both crypto and fiat, has successfully raised over $1 million in its presale, with some analysts forecasting significant growth. Hyperliquid (HYPE) recorded a 26% price surge, supported by its treasury firm's plan to raise $1 billion. Cardano (ADA) is also under the spotlight, with investors anticipating a potential ETF approval. [3]

Chainlink (LINK) is showing signs of a potential breakout, driven by increased on-chain activity and accumulation by large holders, solidifying its role as crucial infrastructure in decentralized finance. [16, 17] In a notable development, Vultisig's native token, $VULT, is making its debut today, October 28, 2025, with a listing on the Kraken exchange. [14, 34] Furthermore, Nasdaq-listed EtherZilla (ETHZilla), a corporate investor in Ethereum, executed a $40 million ETH sale to fund a share buyback program, aiming to enhance shareholder value. [29]

Key Industry Events and NFT Market Evolution

The cryptocurrency calendar highlights the Blockchain Life 2025 forum, commencing today, October 28-29, in Dubai. This significant event is set to host over 15,000 attendees, bringing together industry pioneers and leaders to discuss the future of Web3, cryptocurrencies, and mining. [7, 19, 24] Also, a crucial technical milestone for Ethereum is set for today, October 28, as its Fusaka hard fork upgrade undergoes its final dry run on the Hoodi testnet, with mainnet deployment projected for early December. [13, 21, 22]

The NFT market, after experiencing a volatile period in early October that saw a dip in market capitalization due to geopolitical tensions, has demonstrated a resilient rebound. The market's recovery signals a growing focus on utility and long-term value over speculative gains, with OpenSea evolving into a comprehensive crypto trading aggregator. [30] The market is shifting towards projects with clear roadmaps and demonstrable real-world applications, with projections estimating the NFT sector's market capitalization to reach $49 billion in 2025. [30]

In conclusion, October 28, 2025, marks a dynamic period for the crypto market, characterized by advancing regulatory discussions, bullish price movements for leading assets, and continued innovation across the altcoin and NFT sectors. The confluence of these factors underscores a market that is actively building foundational elements for sustained growth and broader adoption.

Now that you know the price of ART Coin today, here's what else you can explore:

How to buy crypto?How to sell crypto?What is ART Coin (ART)What are the prices of similar cryptocurrencies today?Want to get cryptocurrencies instantly?

Buy cryptocurrencies directly with a credit card.Trade various cryptocurrencies on the spot platform for arbitrage.ART Coin price prediction

What will the price of ART be in 2026?

In 2026, based on a +5% annual growth rate forecast, the price of ART Coin(ART) is expected to reach $0.00; based on the predicted price for this year, the cumulative return on investment of investing and holding ART Coin until the end of 2026 will reach +5%. For more details, check out the ART Coin price predictions for 2025, 2026, 2030-2050.What will the price of ART be in 2030?

About ART Coin (ART)

The Historical Significance and Key Features of Cryptocurrencies

Cryptocurrencies, digital or virtual currencies that use cryptography for security, have become an integral part of the financial and investment industries. Ever since Bitcoin was launched by an anonymous person or group of people known as Satoshi Nakamoto in 2009, the world of finance hasn't been the same. This new approach marked a paradigm shift in the domain of currency, introducing a world of decentralized digital cash in the form of cryptocurrencies.

Historical Significance

The historic relevance of cryptocurrencies lies in their inception, as Bitcoin was the first form of digital currency introduced to the world. This novel concept of decentralized control was a counter model to the then traditional centralized banking system. The paper titled 'Bitcoin: A Peer-to-Peer Electronic Cash System' published by Satoshi Nakamoto explained the operative structure of blockchain">blockchain technology that underlines all cryptocurrencies even today. Nakamoto's invention inspired many other developers and gave birth to thousands of cryptocurrencies, heralding a new era in the global financial space.

Historically speaking, cryptocurrencies have gone beyond their primary function as a medium of exchange. They have changed investment patterns and perceived values of conventional monetary systems. This historical development is seen as a technological revolution in finance, influencing payments, investments, and even politics around the world.

Key Features of Cryptocurrency

Decentralization

Unlike traditional forms of money, cryptocurrencies are not regulated or controlled by any government or centralized financial authority. Each cryptocurrency operates on a technology called blockchain, which is decentralized in nature. This feature not only provides freedom from central authority but also makes transactions transparent, secure, and immutable.

Security

Security is one of the primary features that distinguish cryptocurrency from other forms of payment. By using cryptographic techniques, transactions and coin ownership can be secured. It protects the system from fraud and hacks, making the digital currency a preferred choice for many.

Anonymity and Privacy

Cryptocurrencies allow users to maintain anonymity in their transactions, a feature that attracts many individuals to this digital form of payment. While the transaction trail can be traced in the public ledger of a blockchain, the identities of people involved in transactions are encrypted and difficult to track back, promoting user privacy.

Accessibility and Inclusivity

One of the key advantages of cryptocurrencies is the accessibility it provides. Individuals with an internet connection can make transactions from anywhere around the world, circumventing the need for traditional banking systems. This attribute make cryptocurrencies especially advantageous for those in developing countries without access to standard banking systems.

The Future of Cryptocurrency

While the revolutionary spirit of cryptocurrencies signifies a departure from the traditional banking system, the sustainability and longevity of these digital currencies are still subjects of ongoing debate. The inherent volatility and regulatory complexities often challenge the growth trajectory of cryptocurrencies. However, the environment is rapidly changing, and digital currencies are becoming increasingly mainstream and integrated into traditional financial systems.

In conclusion, the historical significance of cryptocurrency lies in its revolutionary decentralization and its potential to challenge and change traditional financial systems. The unique features of anonymity, security, and inclusivity have made cryptocurrencies an appealing alternative to standard monetary systems. Regardless of the controversies and challenges that cryptocurrencies face, their impact on the global financial landscape is undeniable.

Bitget Insights

What can you do with cryptos like ART Coin (ART)?

Deposit easily and withdraw quicklyBuy to grow, sell to profitTrade spot for arbitrageTrade futures for high risk and high returnEarn passive income with stable interest ratesTransfer assets with your Web3 walletWhat is ART Coin and how does ART Coin work?

Buy more

FAQ

What is the current price of ART Coin?

What is the 24 hour trading volume of ART Coin?

What is the all-time high of ART Coin?

Can I buy ART Coin on Bitget?

Can I get a steady income from investing in ART Coin?

Where can I buy ART Coin with the lowest fee?

Related cryptocurrency prices

Prices of newly listed coins on Bitget

Hot promotions

Where can I buy ART Coin (ART)?

Video section — quick verification, quick trading