News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Nov 12)|Solana financial firm Upexi posts record quarterly results; Nick Timiraos: “Fed increasingly divided over December rate cut”; Injective launches native EVM mainnet, advancing MultiVM roadmap2Zero flow to Bitcoin ETFs: The market sulks despite a favorable context3Chainlink Price Prediction 2025: Is LINK Positioned to Gain Most from Tokenization Growth?

Stripe and SUI Coin Launch a Next-Generation Stablecoin

In Brief SUI partners with Stripe to launch the USDsui stablecoin. Stablecoins could achieve a $3 trillion market by 2030, according to Bessent. USDsui enhances Sui's network liquidity, promoting institutional collaboration.

Cointurk·2025/11/12 21:09

SoFi Becomes First U.S. National Bank to Offer Crypto Trading Amid Regulatory Shift

DeFi Planet·2025/11/12 20:57

JPMorgan Pilots JPMD Deposit Token on Base, Accelerating Institutional On-Chain Finance

DeFi Planet·2025/11/12 20:57

Ethereum Price At Crossroads: $3,532 Support Or $3,326 Slide?

Coinpedia·2025/11/12 20:48

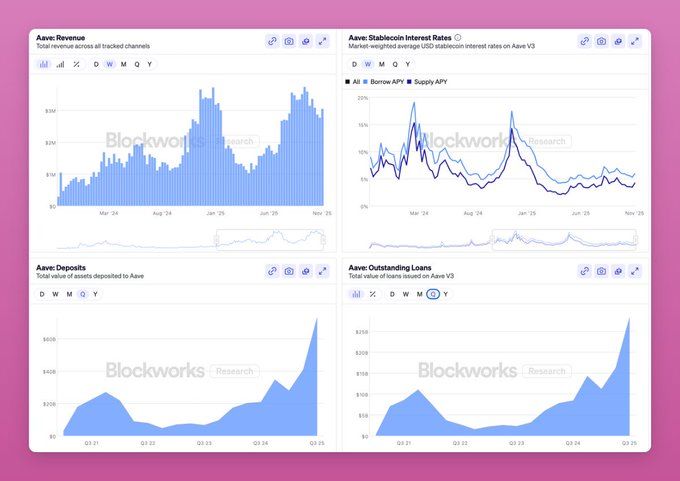

AAVE Price Prediction 2025: AAVE Eyes 2x Rally With Record On-Chain Growth

Coinpedia·2025/11/12 20:48

Circle’s Q3 Revenue Jumps 66%, USDC Circulation Surges To $73.7B

Coinpedia·2025/11/12 20:48

XRP Price Prediction For November 13

Coinpedia·2025/11/12 20:48

Hashgraph Association Unveils Global Membership Program for Web3 and Hedera Growth

CryptoNewsFlash·2025/11/12 20:45

Shiba Inu (SHIB) Addresses Market Concerns Amid Utility Expansion With Unity Nodes

CryptoNewsFlash·2025/11/12 20:45

Flash

- 21:59The US Dollar Index rose by 0.05% on the 12th.Jinse Finance reported that the US Dollar Index rose by 0.05% on the 12th, closing at 99.495 in the foreign exchange market.

- 21:47The US Dollar Index rises to 99.495, major currency exchange rate fluctuations detailedAccording to ChainCatcher, citing Golden Ten Data, the US Dollar Index, which measures the dollar against six major currencies, rose by 0.05% on November 13, closing at 99.495 in the late foreign exchange market. 1 euro exchanged for 1.1586 US dollars, down from 1.159 US dollars in the previous trading day; 1 pound exchanged for 1.313 US dollars, down from 1.3172 US dollars in the previous trading day; 1 US dollar exchanged for 154.72 yen, up from 154.09 yen in the previous trading day; 1 US dollar exchanged for 0.7978 Swiss francs, down from 0.8001 Swiss francs in the previous trading day; 1 US dollar exchanged for 1.3998 Canadian dollars, down from 1.4009 Canadian dollars in the previous trading day; 1 US dollar exchanged for 9.4493 Swedish kronor, down from 9.4514 Swedish kronor in the previous trading day.

- 21:38Federal Reserve's Collins: Keeping interest rates unchanged for a period of time may be appropriateJinse Finance reported that this year's FOMC voting member, Boston Fed President Collins, stated on Wednesday that she believes the threshold for further rate cuts in the short term is "relatively high" due to concerns about persistently high inflation. Collins voted in favor of a rate cut last month. "Unless there are clear signs of significant deterioration in the labor market, I will remain cautious about further policy easing, especially given the limited inflation data available to us in the event of a government shutdown... In the current highly uncertain environment, maintaining policy rates at their current level for some time may be an appropriate approach to balance inflation and employment risks." Her remarks highlight the deep divisions within the Federal Reserve. Since the last rate cut, several Fed officials, including Collins—both voting and some non-voting members—have signaled increasing caution regarding further rate cuts. Collins believes that short-term borrowing costs are currently in a "mildly restrictive" range, while overall financial conditions still provide a tailwind for economic growth. The labor market has indeed shown signs of slowing, but downside risks have not intensified since the summer.