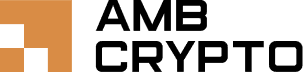

Bitcoin Cash [BCH] has been trading within a range since July 2024. This range extended from $272 to $624. Since the 15th of November, Bitcoin Cash has rallied by $22.2%, while Bitcoin [BTC] fell by 7.4% during the same period.

Despite the gains over the past seven weeks, Bitcoin Cash bulls could not make a decisive breakout from the range yet.

The good news for long-term investors was the rising buy volume despite the range-bound price action. Since November 2024, Bitcoin Cash has been unable to break the $624 long-term resistance, but the OBV has made higher lows since then.

This indicated that buyers were stronger, on average, over a long period of time. This meant that a range breakout was only a matter of time.

Should you buy BCH now?

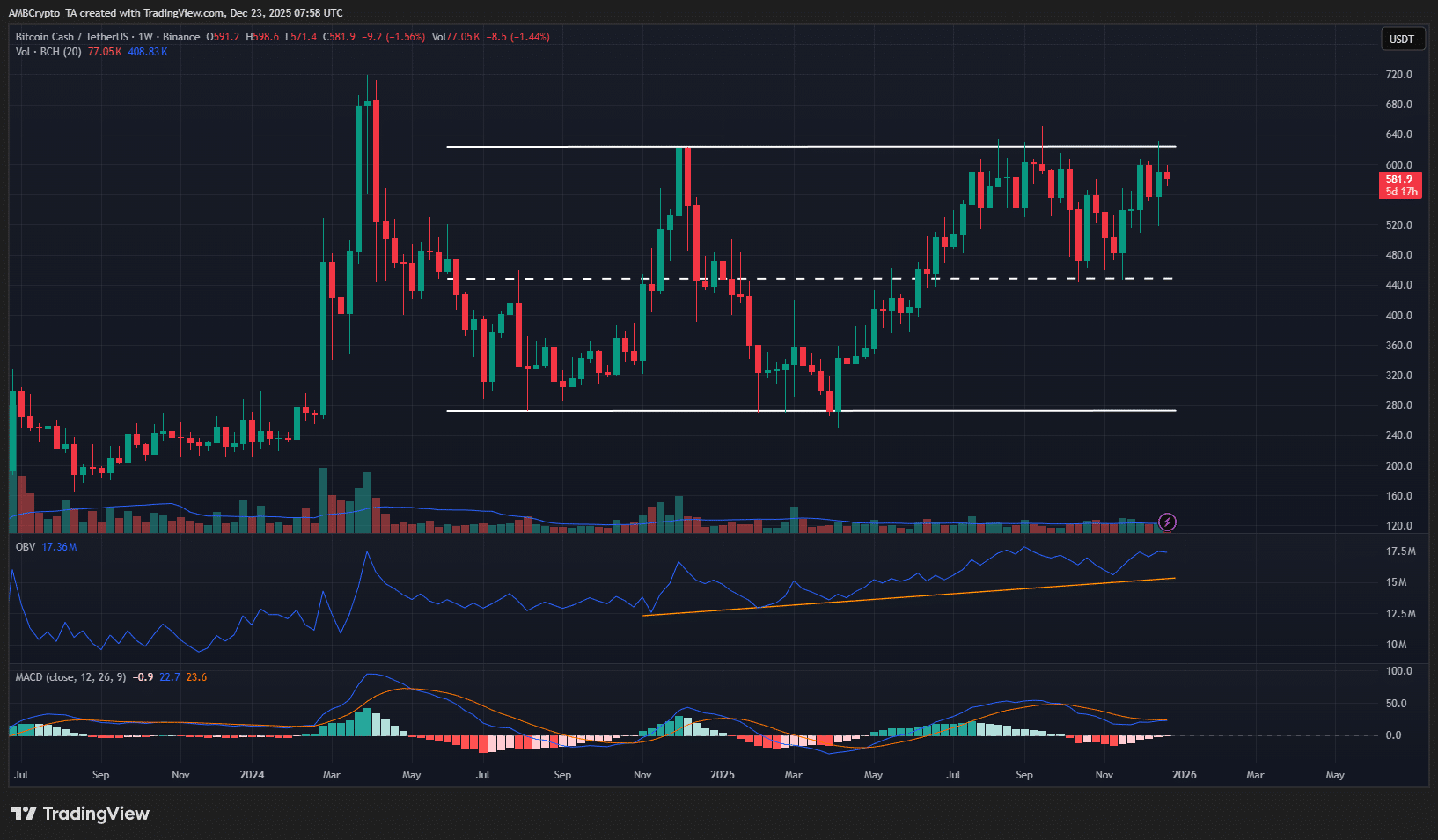

In general, it is not a great idea to buy at the range highs. Yes, a breakout is possible. A Bitcoin move above $94.5k, the local resistance, could shift the market sentiment bullishly, for example.

At the time of writing, the evidence at hand does not support such an outcome in the coming days or even weeks. Until we get a breakout above $624 and a retest as support, investors need not buy BCH above $600.

Is it time to go short?

Source: Coinalyze

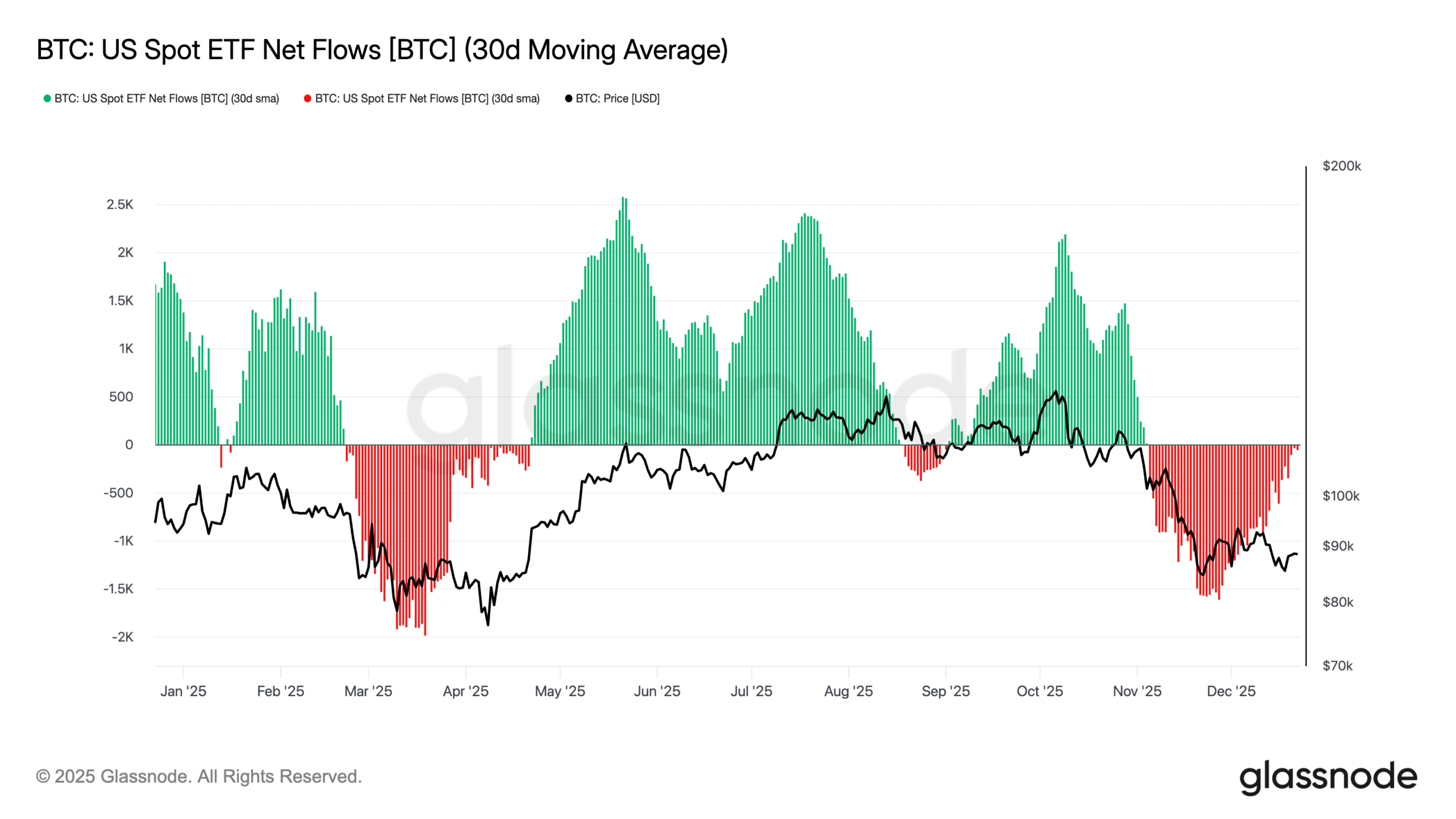

Coinalyze data showed that the spot CVD has been in decline over the past three days, showing spot selling activity. The Open Interest was down almost 20% following the rejection of the range highs, a sign of waning speculative confidence.

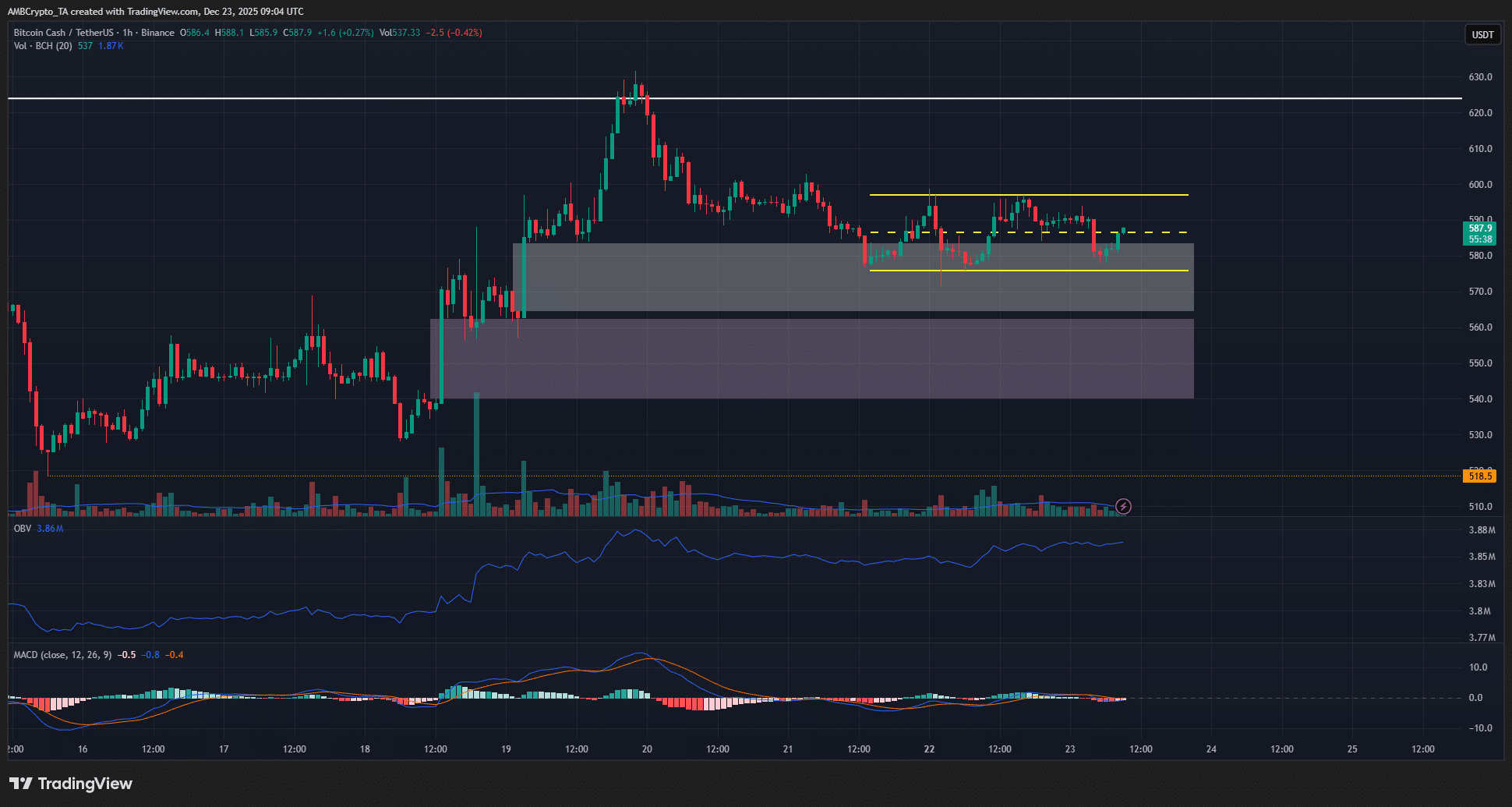

Source: BCH/USDT on TradingView

The 1-hour chart showed another short-term range (yellow) from $575 to $597. The psychological $600 would likely be a good opportunity to go short for lower timeframe traders.

The presence of the imbalances on the hourly timeframe from $540 to $580 (white and pink boxes) represented demand zones that could see a price bounce. Hence, short-sellers should expect BCH to tarry in these regions before falling lower.

A move above $605 would invalidate the short-term bearish idea.

Final Thoughts

- Though Bitcoin Cash saw respectable gains since mid-November, it was not a good idea to buy the altcoin near its long-term range highs.

- The short-term range below the $600 level could offer profitable trade setups, but it is not a swing trade, and might only be held for a day or two at most.