2025 TGE Annual Report: Over 80% of 118 Projects Fell Below Issue Price, Higher FDV Suffered Greater Declines

History always repeats itself in astonishing ways: In 2025, most TGE projects are concentrated in the infrastructure and AI sectors, which happen to be the hardest-hit areas for losses.

Written by: Memento Research

Translated by: Saoirse, Foresight News

Data as of December 20, 2025. Metrics: Percentage change from TGE opening to present, calculated by fully diluted valuation (FDV) + market capitalization (MC)

Summary

We tracked 118 token launches in 2025, and the data is dismal:

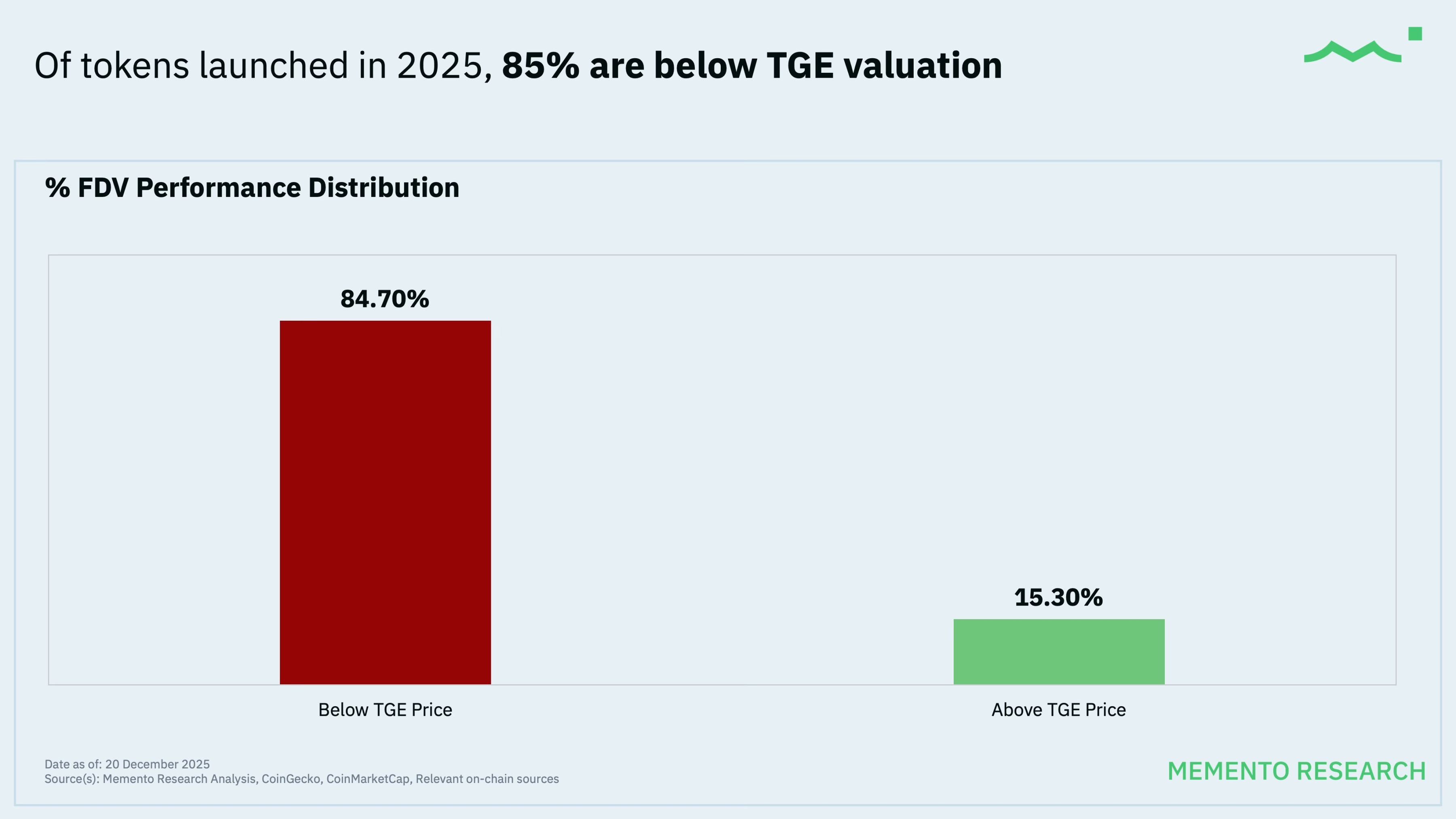

- 84.7% (100 out of 118 projects) have token prices below their initial TGE valuation, meaning about four-fifths of launched projects are in a loss position;

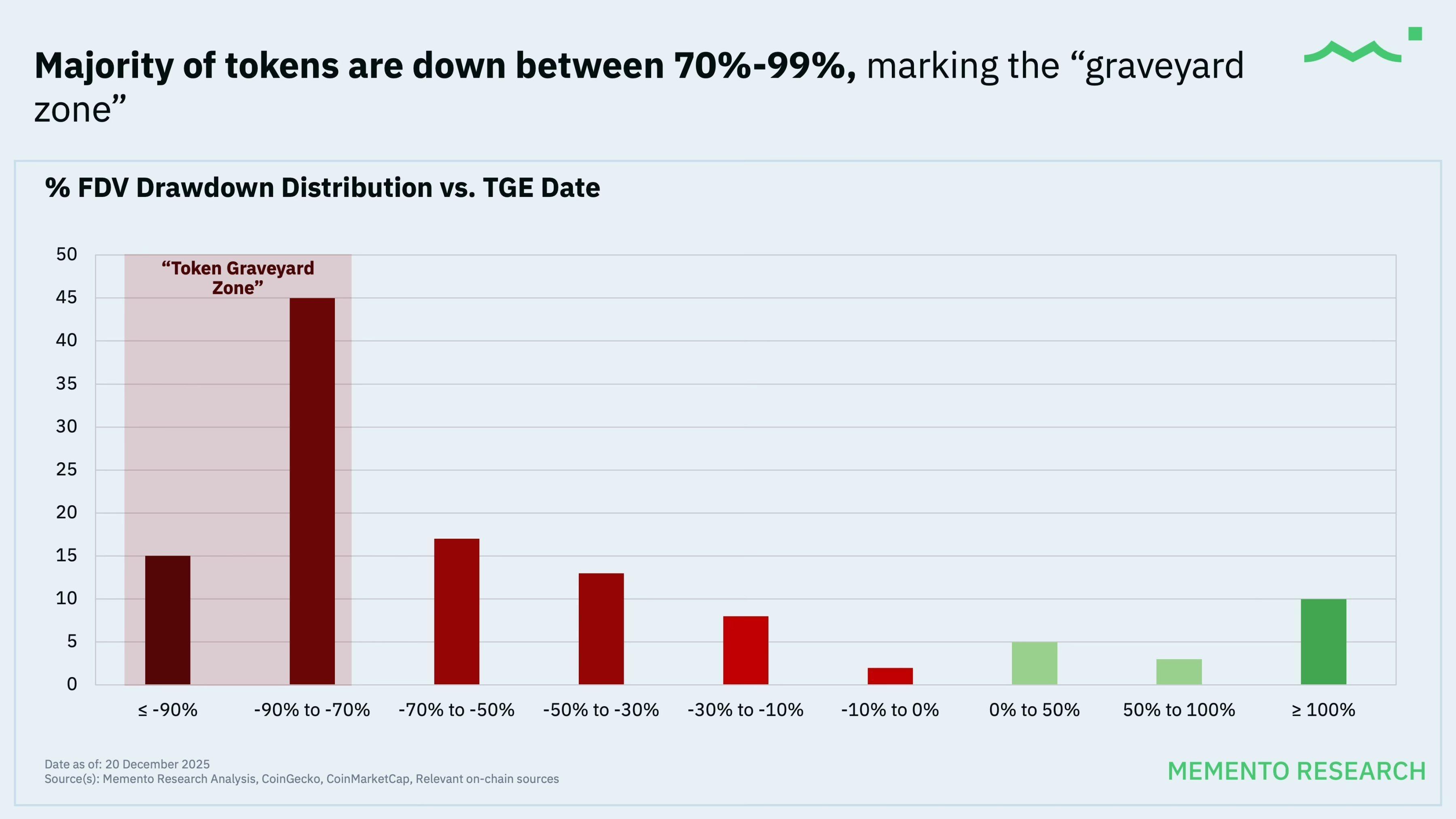

- Median performance: since launch, fully diluted valuation (FDV) has dropped by 71.1%, and market capitalization (MC) has dropped by 66.8%;

- The "average" masks the brutal reality: although the equal-weighted portfolio (by FDV) fell by about 33.3%, the FDV-weighted portfolio dropped as much as 61.5%, which is even worse (this means that larger, more hyped projects performed even worse);

- Only 18 out of 118 projects (15.3%) saw price increases ("green"): the median increase for rising tokens was 109.7% (about 2.1x), while the remaining 100 projects fell ("red"), with a median decline of 76.8% for falling tokens.

Distribution of Fully Diluted Valuation (FDV) Declines

Summary of the current situation:

- Only 15% of token prices remain above their initial TGE valuation;

- As many as 65% of token launches have prices that have dropped more than 50% from their TGE price, with 51% of projects falling by more than 70%.

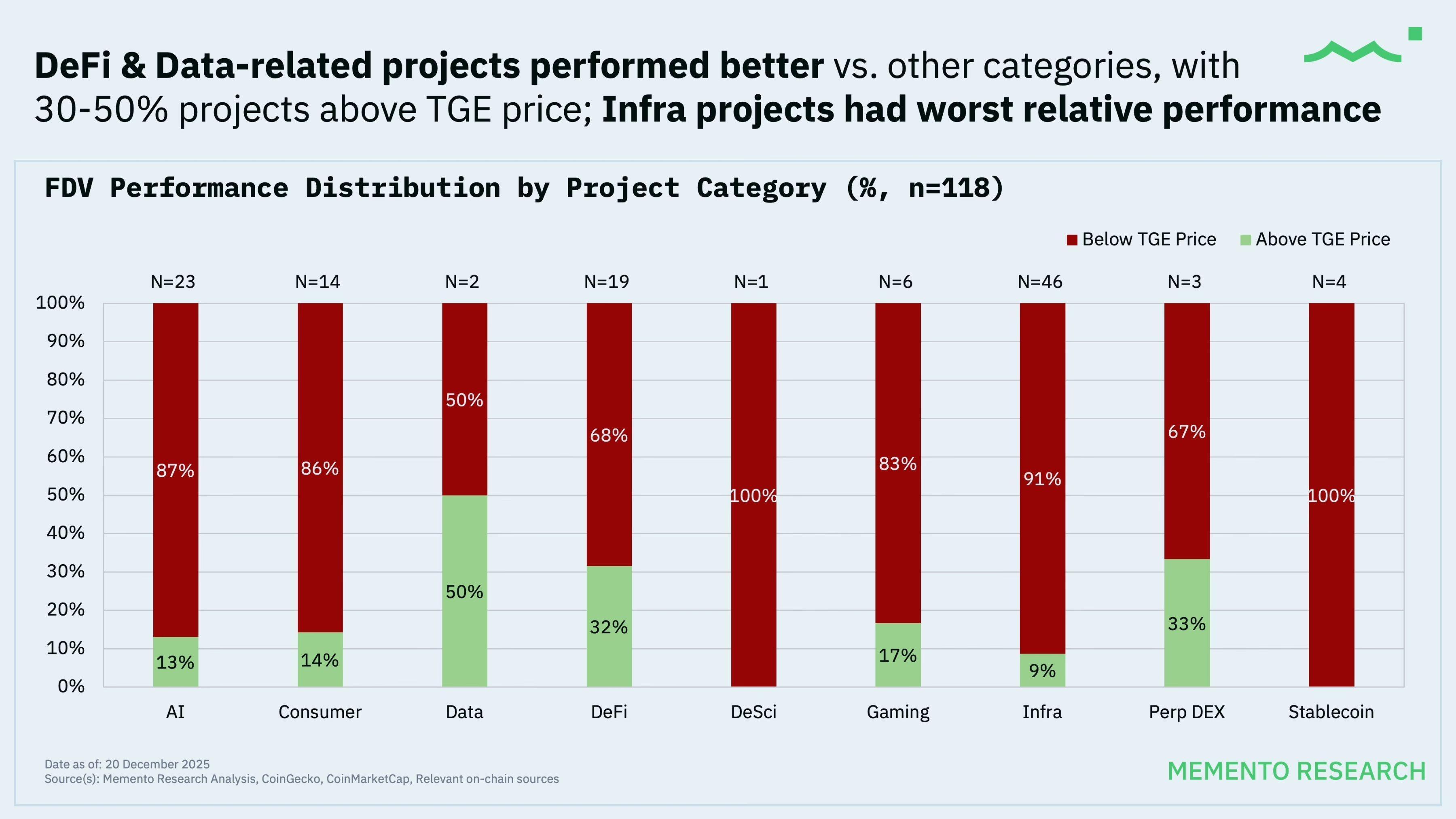

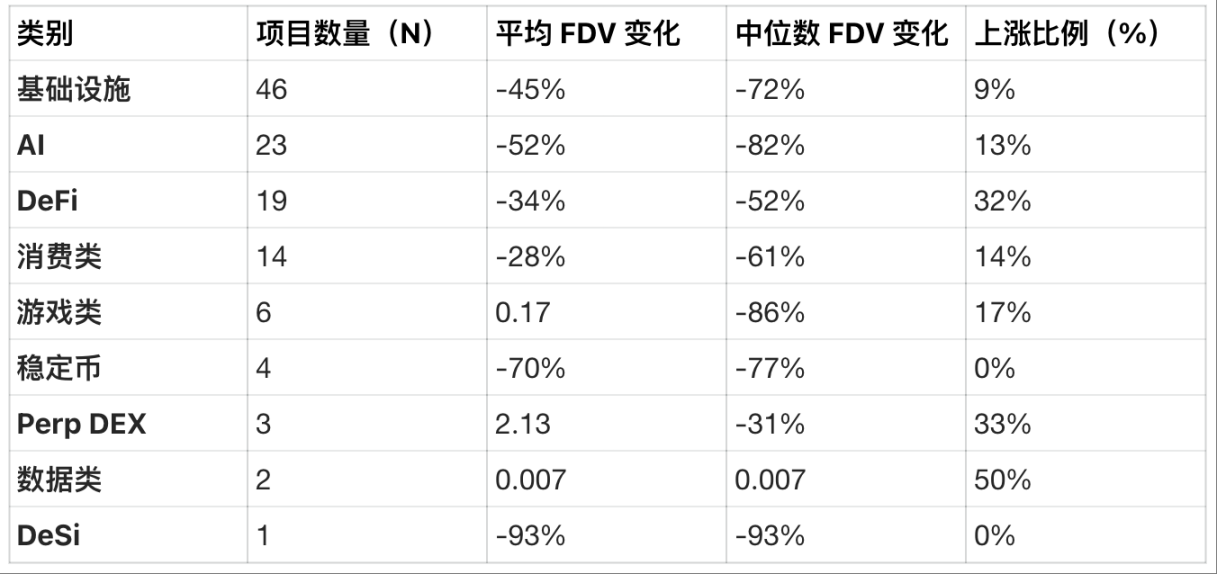

2025 Projects by Category and Relative Performance

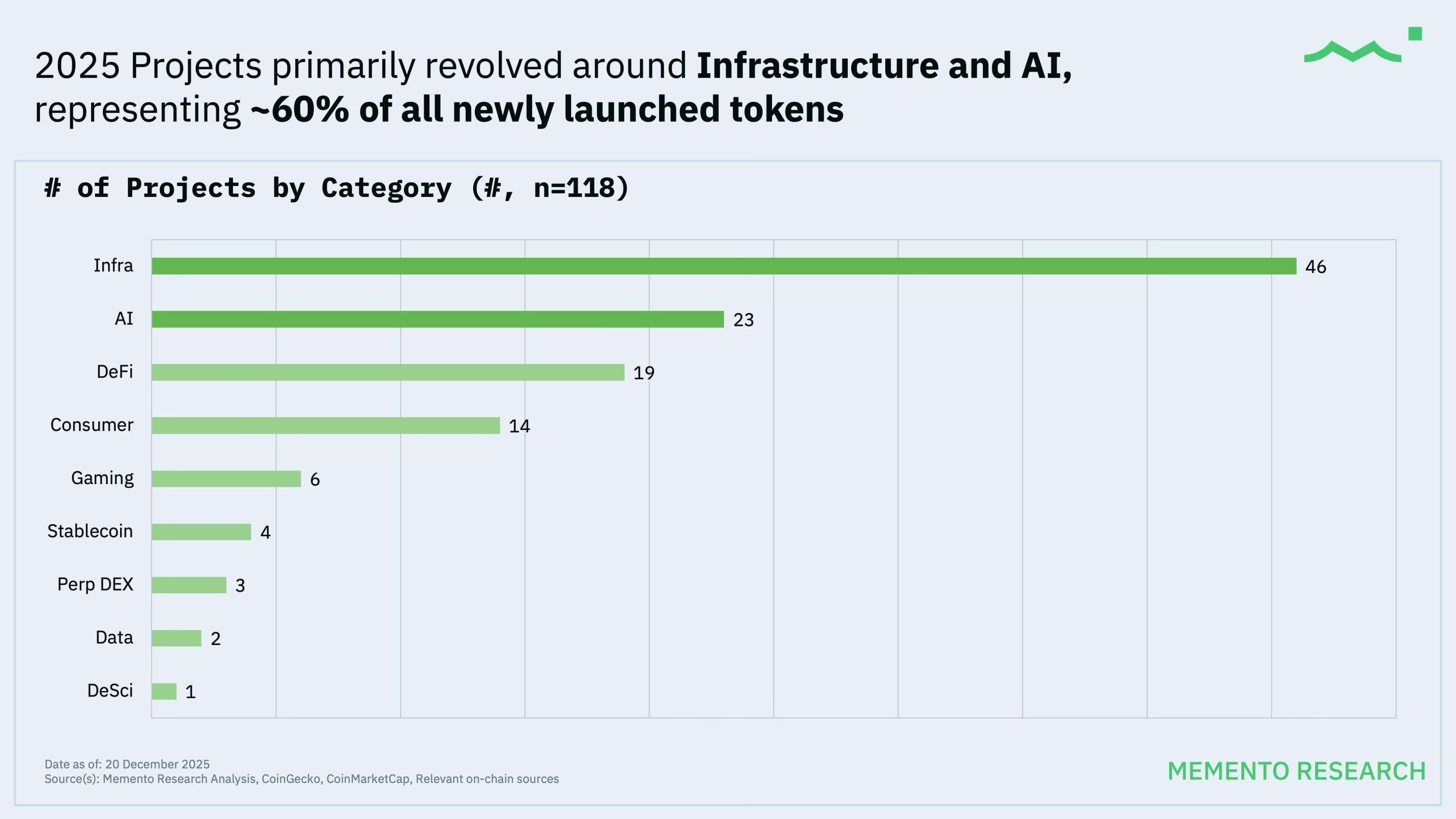

Token launches in 2025 are mainly concentrated in two major sectors—Infrastructure (Infra) and Artificial Intelligence (AI), which together account for 60% of all new tokens. However, there is a significant difference between the average and median returns for each category, which is worth noting.

Data interpretation:

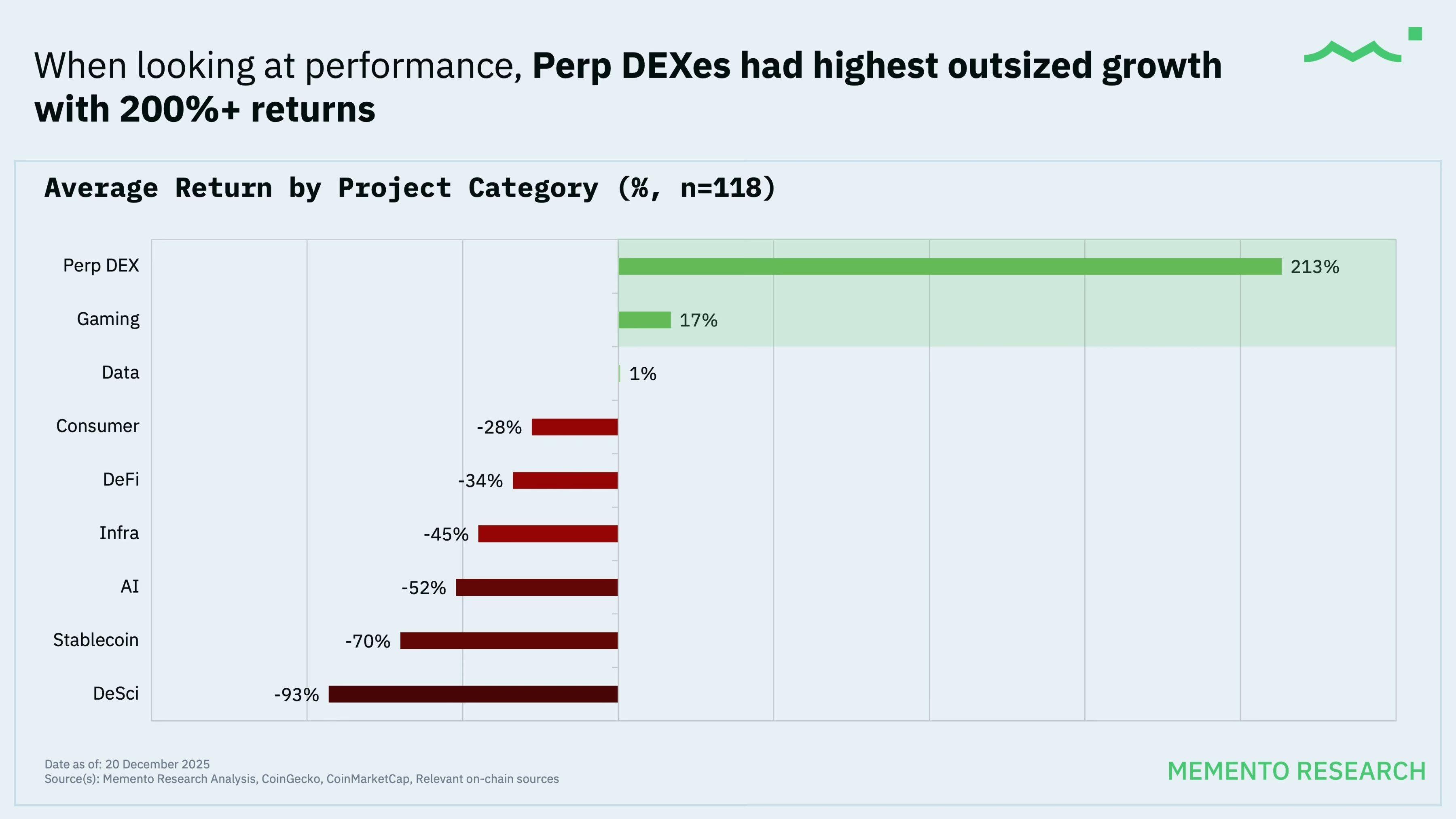

- The main theme of 2025 is the rise of perpetual contract decentralized exchanges (Perp DEX), represented by Hyperliquid, with Aster also successfully launching in Q4. Although the sample size for this category is small and the median is still negative, Perp DEXs (average increase of 213%) are the "standalone winners";

- The sample size for gaming projects is too small to draw meaningful conclusions and is heavily influenced by individual outliers—this results in a positive average increase but a median decline as high as 86%;

- Decentralized finance (DeFi) is the sector with the highest "hit rate" (32% of projects increased), with more "survivors" than "blockbuster projects";

- Infrastructure (Infra) and AI projects are crowded and highly competitive, with poor performance—median declines of 72% and 82%, respectively.

Correlation Between Initial Fully Diluted Valuation (FDV) and Project Performance

The clearest conclusion from the data:

- There were 28 token launches with an initial FDV ≥ $1 billion;

- Currently, all of these projects have declined in price (0% have increased), with a median drop of about 81%;

- This also explains why the FDV-weighted index (down 61.5%) performed much worse than the equal-weighted index (down 33.3%)—the poor performance of large initial projects dragged down the entire market for the year.

Key takeaway:

When a project's initial valuation is set too high, far above its fair value, it leads to poor long-term performance and even greater declines.

2025 Review and Outlook

The following conclusions can be drawn from the above data:

- For most tokens, the token generation event (TGE) is often a "worse entry point," with the median price performance being "down about 70%";

- The TGE is no longer an "early entry window"—for projects that are overhyped but fundamentally weak, the TGE even represents the price "top";

- Projects launched with high initial FDVs have not "grown to match their valuations"; on the contrary, their pricing has been significantly marked down;

- History always repeats itself in astonishing ways: most TGE projects are concentrated in the infrastructure sector (and, due to the current AI bubble, there are also many AI projects), but these sectors are precisely the hardest-hit areas for losses;

- If you plan to participate in TGE investments, you are essentially "betting that you can find rare outlier projects," because from a basic probability perspective, most projects perform very poorly.

If we divide the 2025 market by the quartiles of initial FDV, the pattern is very clear: token launches with the lowest initial FDV and cheapest pricing are the only category with a considerable survival rate (40% of projects increased), and their median decline is relatively mild (about -26%); all projects with initial FDV above the median have basically been repriced to the bottom, with median declines between -70% and -83%, and almost no projects have increased in price.

Therefore, a core lesson can be drawn from this dataset: the 2025 token generation event (TGE) is a "valuation reset period"—most token prices continue to fall, with only a very few outlier projects rising; and the higher the FDV at the project's initial launch, the greater the eventual decline.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

PUMP Whale Exits at $12M Loss: Is a Bounce Finally Coming?

Why CRV Is Surging Today: Key Factors Behind the Price Jump

Bitcoin Sentiment Index Drops to 40% as Market Turns Risk-Off

Bitget Updates its VIP Program with New Interface and Fee Structure