Prediction markets are sending a blunt message: Bitcoin might not hit $100,000 before the year closes. That does not mean Bitcoin is dead. It means the crowd is pricing in a tighter finish to 2025, which changes how some investors think about risk.

In the same cautious environment, Digitap ($TAP) is attracting attention for its model tied to real-world utility rather than daily chart volatility, according to recent market coverage.

Prediction Markets Are Pricing BTC Under $100K

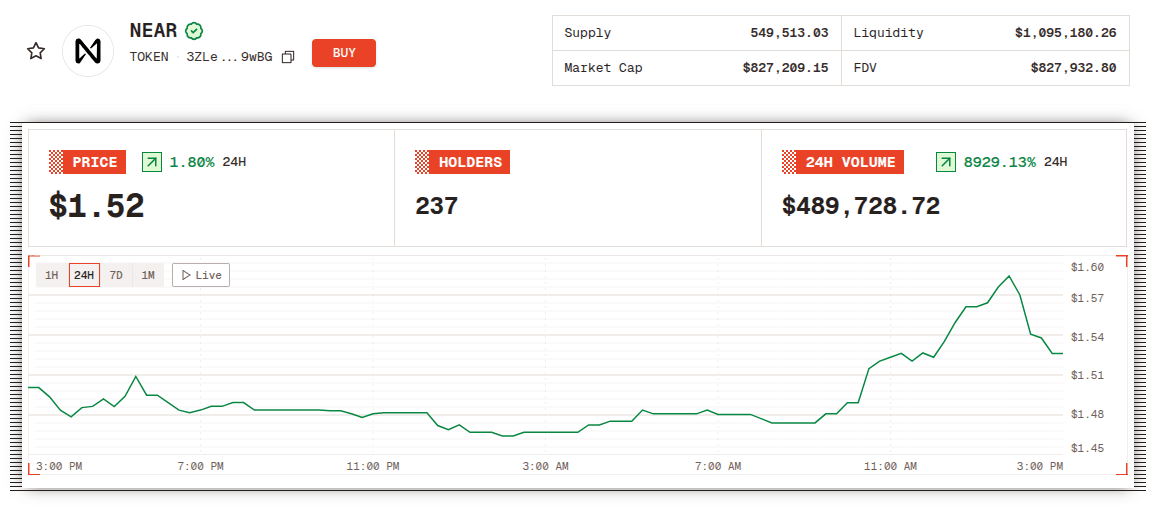

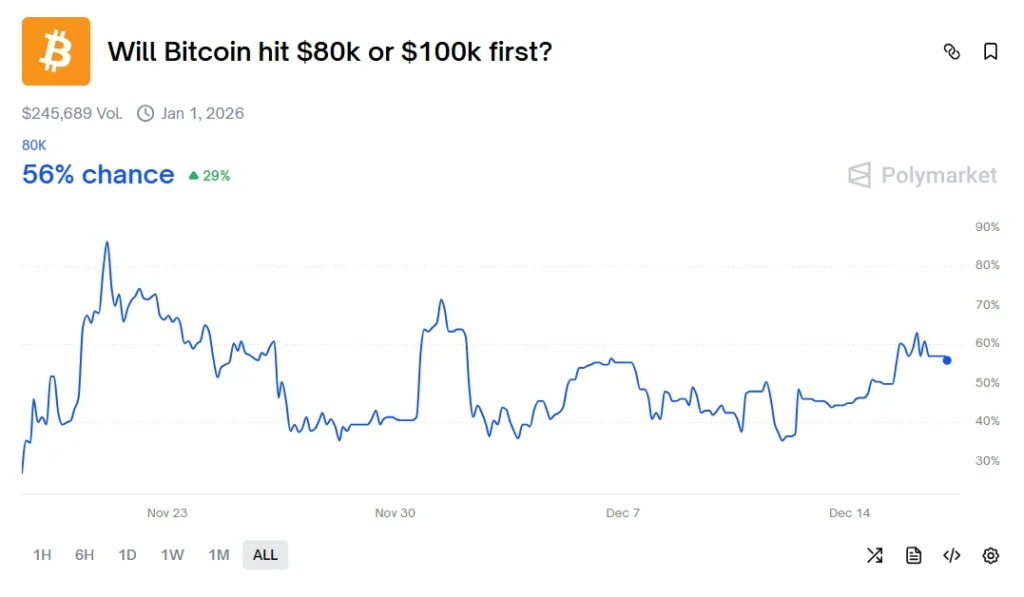

As of mid-December, traders on Polymarket were signaling hesitation around Bitcoin’s next move. In one of the platform’s most active markets, bettors assigned roughly 56% odds that Bitcoin hits $80,000 before it reaches $100,000, compared to 44% odds that $100K comes first, based on a contract resolving on Jan. 1, 2026.

Prediction markets are leaning cautiously: Traders assign higher odds to Bitcoin revisiting $80K before making another run at $100K. Source: Polymarket.com

That matters because prediction markets are not just “social media vibes.” They aggregate money-backed positioning into probability-like signals. They can still be wrong, but they are useful as a live read on sentiment.

The same market framing highlights how stubborn the $100,000 level has been lately. Bitcoin’s December high hovered around $94,600, and the last time it traded above $100,000 was in mid-November.

What This Signal Means for Regular Crypto Buyers

When Bitcoin is trending hard, people chase it because the upside feels obvious. When it stalls, the thinking changes.

A range-bound Bitcoin can compress the risk-reward for late buyers. They still get volatility, but they might not get the kind of move that makes that stress “worth it.” Reuters reported a recent dip below $90,000 tied to broader risk sentiment and noted that even one of Bitcoin’s biggest bullish forecasters at Standard Chartered cut its end-2025 call to about $100,000.

For beginners, the practical takeaway is simple:

- If the market is treating $100K as a hard target in the short term, some money looks for asymmetric setups elsewhere, especially when people are searching for the best crypto to buy now without relying on a single breakout.

- In bear-leaning conditions, people often prefer trades where entry pricing is structured, and the story is less dependent on a single breakout candle.

That is where utility-first projects come in, particularly crypto projects with real utility that are less dependent on day-to-day chart momentum. They are not safer in an absolute sense. Crypto is still crypto. But they can remove one specific headache: the price is not changing every second because of macro headlines.

Why Digitap ($TAP) Fits the Bear-Market “Rational Hedge” Narrative

Digitap’s pitch is pretty straightforward: it presents itself as a crypto-and-fiat banking platform designed to bring wallets, cards, and payments into one system during a volatile market.

In the current market regime, the key idea is not “get rich fast.” It is about protecting capital and avoiding getting chopped up while waiting for the next cycle. Digitap is being framed as that kind of defensive play in partner coverage, largely because:

- The product narrative centers on usable payments and banking rails, not just token speculation.

- The token story leans on deflation and value capture concepts often described as buyback and burn, funded by platform activity in third-party write-ups.

That last point matters a lot for beginners. Many first-time buyers do not lose money because they chose the wrong coin. They lose money because they panic-buy pumps and panic-sell dips. A structured entry removes some of that impulse pressure and gives beginners a clearer framework for how to buy crypto before exchange listing without chasing volatility.

Digitap also leans on stable settlement features, which allow users to convert incoming crypto into cash rather than ride every market dip. In a choppy environment, that kind of control matters.

Digitap Snapshot Heading Into 2026

Multiple recent crypto outlets describe Digitap as being in a later phase with a $0.0371 token price and a next step to $0.0383, while referencing a planned listing price of $0.14. They also claim that the token sale has raised about $2.5 million and sold roughly 143 million tokens, with the current round nearing completion despite bearish conditions.

When users strip away the marketing gloss, the logic is simple: when Bitcoin’s near-term upside looks capped, people hunt for smaller setups where upside comes from a different driver, often framed as the best cheap crypto to buy now due to structured pricing.

$TAP has also been pushing a holiday-themed engagement layer, positioned like a digital advent calendar with two reward drops per day (reported as timed around 7:00 UTC and 19:00 UTC). In a slow, cautious market, that kind of recurring activity is usually trying to do one thing: keep attention and participation consistent, instead of relying on a single hype spike.

Digitap is live, staged, and positioned as a structured entry alternative to chasing Bitcoin’s year-end breakout.

Is $TAP the Best Banking Altcoin to Buy Before 2026?

Prediction markets do not decide price. They just reveal what the crowd thinks is likely. Right now, that crowd is not confident that Bitcoin clears $100K before the calendar flips.

Anyone who is a beginner needs to remember that the smarter response is not to spiral. It is to zoom out. Bitcoin can still perform well over the long term, even if it chops into year-end. When upside confidence compresses, it is normal for capital to explore utility-led alternatives.

Crypto projects can appeal in these windows because they reduce chart stress and, for some investors, act as hidden crypto gems when approached with caution and basic risk management. In Digitap’s case, powered by strong fundamentals, it can grow and scale even while BTC looks ugly.