Canada establishes robust stablecoin regulations set to take effect in 2026, aiming to enhance trust and security.

This week, the Bank of Canada detailed the operational standards for stablecoins under regulatory rules set to take effect in 2026. Governor Tiff Macklem said that stablecoins should operate like trusted money. He told the Montreal Chamber of Commerce that these digital assets must be pegged 1:1 to central bank-issued currencies, such as the Canadian dollar or other major fiat currencies. These pegged values must be backed by high-quality liquid assets, such as treasury bills and government bonds.

Macklem emphasized that stablecoins must always be redeemable at face value. To ensure this, issuers will be required to fully disclose redemption terms, including redemption timelines and any related fees. The Bank of Canada stated that these conditions will help Canada establish stablecoins that are safe for both individuals and businesses.

Officials view the new framework as part of the modernization of Canada’s financial system. Alongside stablecoin regulation, Canada plans to launch a real-time rail system to enable instant settlement between consumers and businesses. Officials are also continuing to advance open banking to increase competition and flexibility in the financial services sector.

Regulatory Cooperation and Consumer Protection

The Bank of Canada said it will coordinate with the Ministry of Finance to assist in drafting upcoming legislation. The proposed rules will align with the Retail Payment Activities Act, expanding the regulatory scope to include stablecoin payment services and requiring issuers to demonstrate sufficient operational resilience.

Macklem defined this initiative as ensuring that stablecoins become what regulators call “good money.” He compared stablecoins to paper money and deposits, which Canadians trust to preserve value and facilitate transactions. This perspective reflects the central bank’s broader responsibility to maintain monetary stability and safeguard the payments system.

The federal government announced in November last year that it would introduce stablecoin legislation next year. The 2025 budget proposal noted that stablecoin issuers not currently subject to prudential regulation must comply with strict reserve and risk management standards as part of the new legal framework.

Global Context and Innovation Goals

Canada’s move follows similar initiatives by other countries to regulate digital assets without stifling innovation. Stablecoin blockchain technology has gradually become a bridge between traditional finance and blockchain services, but reserve transparency and redemption risks remain key concerns for policymakers.

By clarifying expectations, Canada aims to balance the benefits of digital currencies with consumer and investor protection. Regulators say this approach will foster safe innovation while reducing the risk of financial instability caused by digital assets lacking robust backing.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Pundit: Bitcoin Was the Test Run. XRP Is the Upgrade

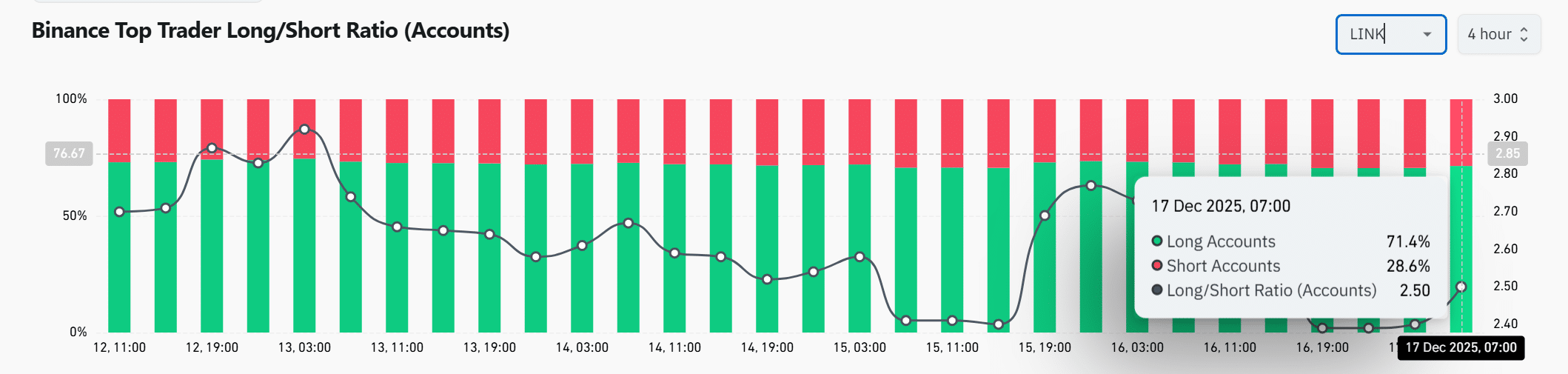

Chainlink price tests $12 support: Will whale accumulation trigger a move?

Which Is the Best Presale Crypto Right Now? A Closer Look at Four Leading Contenders