Bitcoin Price Prediction: BTC Sell-Off Continues, Approaching December Lows

Bitcoin (BTC) price continues to pull back, and as of press time on Tuesday, the trading price has fallen below $86,000, marking the fifth consecutive trading day of decline. Institutional investor sentiment is divided, with spot Bitcoin exchange-traded funds (ETFs) experiencing outflows, while strategy funds are increasing their Bitcoin holdings. Despite the current weak price trend, the improvement in US liquidity conditions may help limit further short-term declines.

Complex Institutional Investor Sentiment

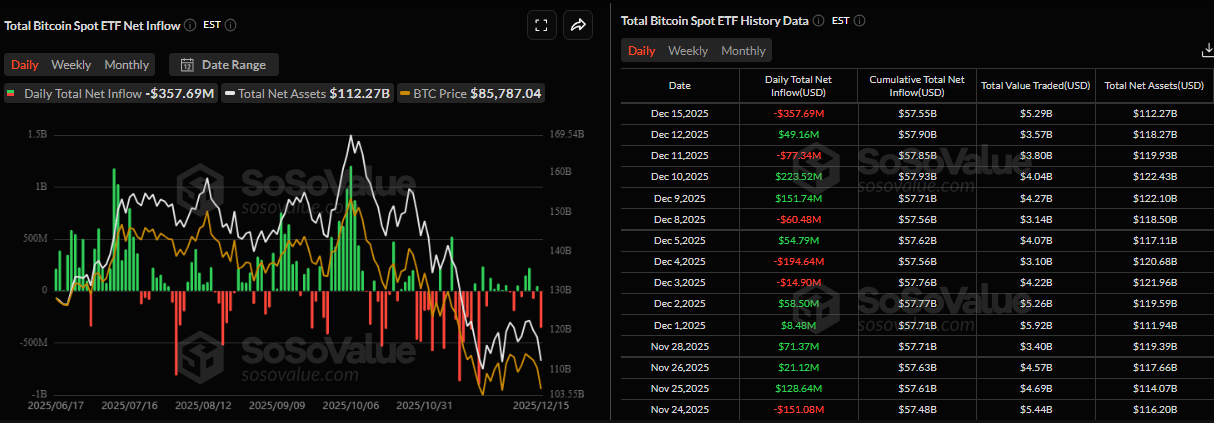

Institutional demand started off weak this week. According to SoSoValue data, spot Bitcoin ETFs recorded an outflow of $357.69 million on Monday, the largest single-day outflow since November 20. If this outflow continues and intensifies, Bitcoin price may see further pullbacks.

However, on the corporate side, Strategy Executive Chairman Michael Saylor announced on Monday that his company, Strategy Inc. (MSTR), spent $980 million to purchase 10,645 Bitcoins. This purchase closely follows the purchase of 10,624 Bitcoins last week, highlighting the company's continued aggressive accumulation strategy and long-term confidence in Bitcoin despite ongoing market weakness.

Extreme Panic Among Bitcoin Traders

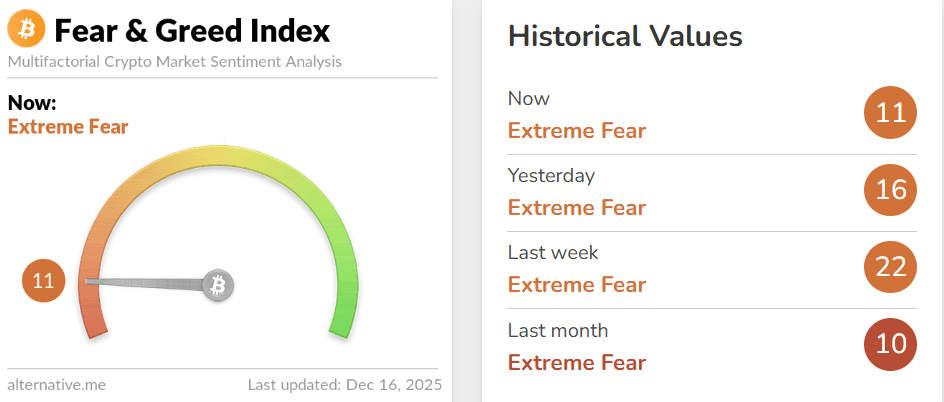

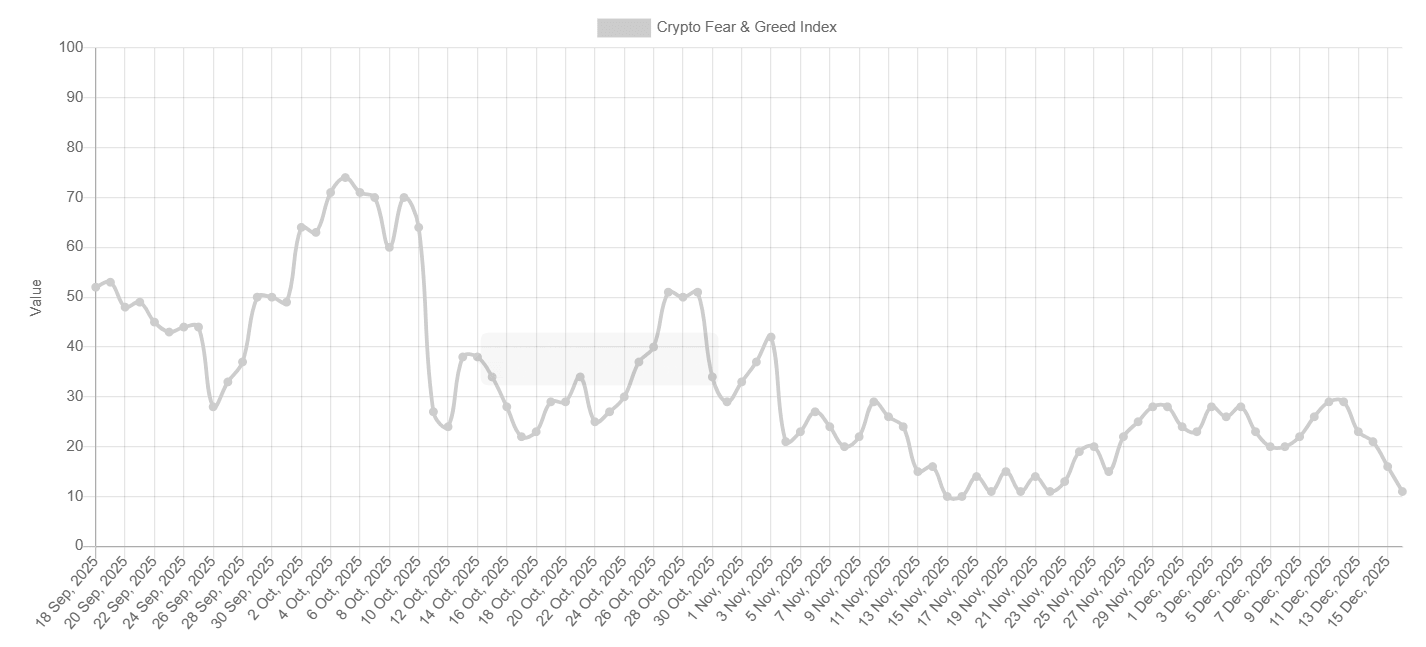

On Tuesday, the Fear and Greed Index dropped to 11, close to the late November low, indicating that market sentiment has sharply shifted to extreme fear, and market participants are preparing for further declines.

Some Optimistic Signs

In addition to the complex institutional investor sentiment and extreme trader panic, a post on Kobeissi Letter X on Tuesday indicated an optimistic outlook for Bitcoin.

The report explained that the Treasury General Account (TGA) fell to $78 billion last week, marking the largest liquidity injection since June, as shown in the chart below. Analysts pointed out that the TGA is the US government's main cash account at the Federal Reserve (Fed), and when it decreases, cash flows directly into the financial system, thereby increasing liquidity.

In addition, the Fed is injecting $40 billion through bond purchases and will reinvest $14.4 billion from principal payments on mortgage-backed securities (MBS) into Treasury purchases during the same period, further enhancing overall liquidity.

This wave of net liquidity injection into financial markets will lower borrowing costs and stimulate risk appetite, especially for assets such as stocks and cryptocurrencies, providing short-term support for Bitcoin.

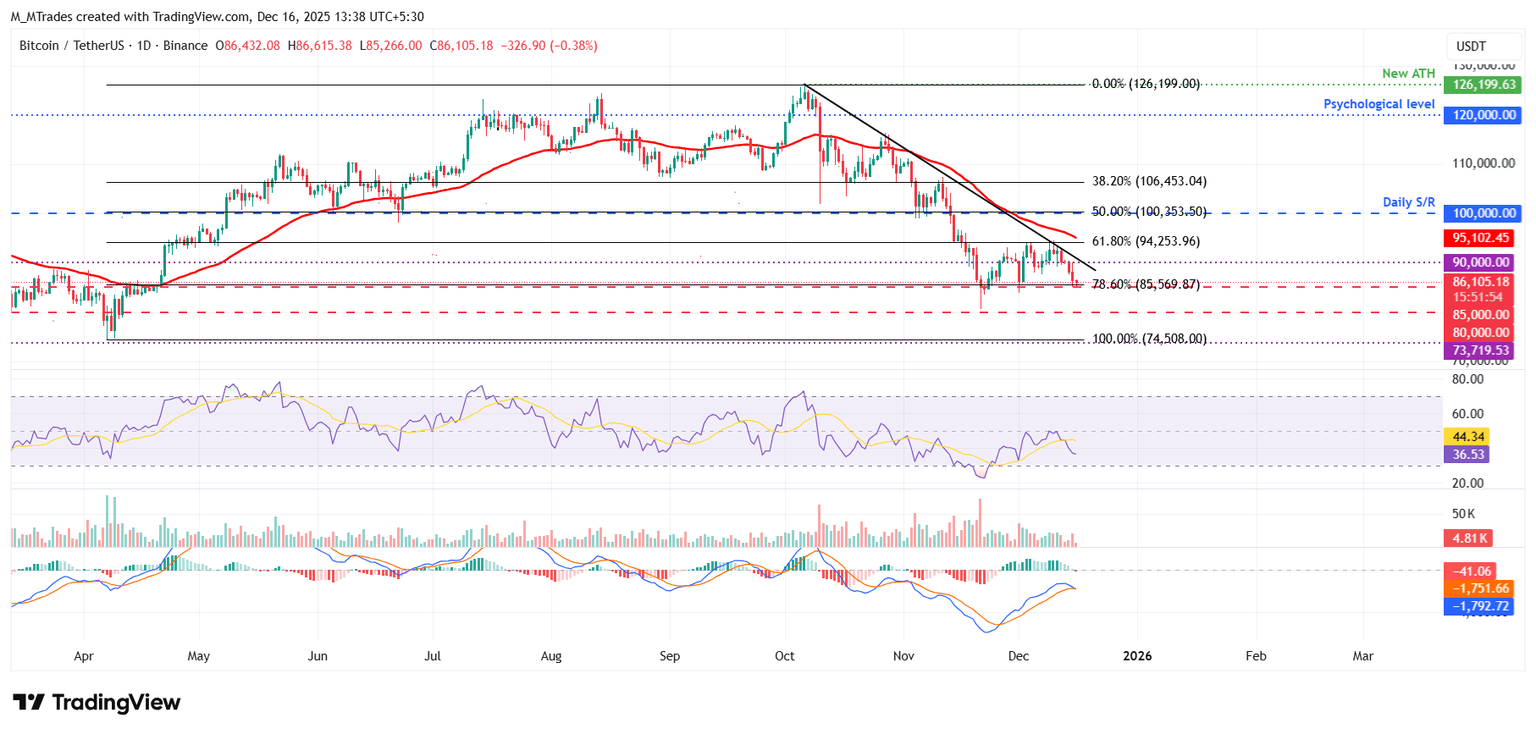

Bitcoin Price Prediction: BTC Momentum Indicators Suggest a Deeper Pullback May Occur

Bitcoin price was blocked by a descending trendline (formed by connecting multiple highs since early October) on Friday, and has since dropped nearly 7%, retesting Monday's support at $85,569. This trendline coincides with the 61.8% Fibonacci retracement level at $94,253 (drawn from the April low of $74,508 to the all-time high of $126,199 in October), making it a key resistance level. As of Tuesday, Bitcoin continues to decline, trading near $86,100.

If Bitcoin continues to pull back and the daily closing price falls below $85,569 (which coincides with the 78.6% Fibonacci retracement level), it may further decline to the psychological threshold of $80,000.

The Relative Strength Index (RSI) on the daily chart is at 36, below the neutral level of 50, indicating that bearish momentum is increasing. In addition, the Moving Average Convergence/Divergence (MACD) indicator formed a death cross on Tuesday, further supporting the bearish outlook.

If Bitcoin price rebounds, it may continue to rise to the 61.8% Fibonacci retracement level at $94,253.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Quantum Computing Bitcoin: Michael Saylor’s Powerful Vision for an Unbreakable Future

1.18 Billion XRP In Four Weeks. Here’s What Whales Are Doing

PancakeSwap, YZi Labs Announce Zero-Fee Prediction Market on BNB Chain