Wall Street interprets the Federal Reserve decision as more dovish than expected

The market originally expected a "hawkish rate cut" from the Federal Reserve, but in reality, there were no additional dissenters, no higher dot plot, and the anticipated tough stance from Powell did not materialize.

The market originally expected a "hawkish rate cut" from the Federal Reserve, but the actual result showed no additional dissenters, no higher dot plot, and the anticipated tough stance from Powell did not materialize.

Written by: Bao Yilong

Source: Wallstreetcn

The Federal Reserve cut rates by 25 basis points as expected, but it was not as hawkish as the market had anticipated.

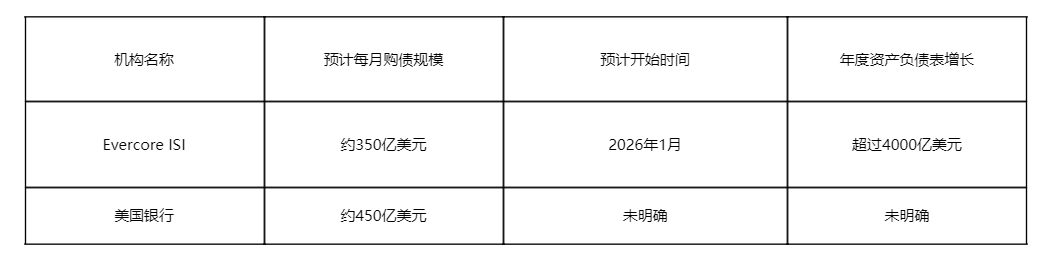

In the early hours of Thursday, East 8th District time, the Federal Reserve announced a 25 basis point rate cut and, in its policy statement, declared it would launch a $40 billion Treasury purchase plan within two days. The New York Fed subsequently released the specific implementation plan.

This is the first time since the liquidity crunch during the early 2020 COVID-19 pandemic that such a measure has been directly written into the policy statement. Some analysts see this move as a clear dovish signal.

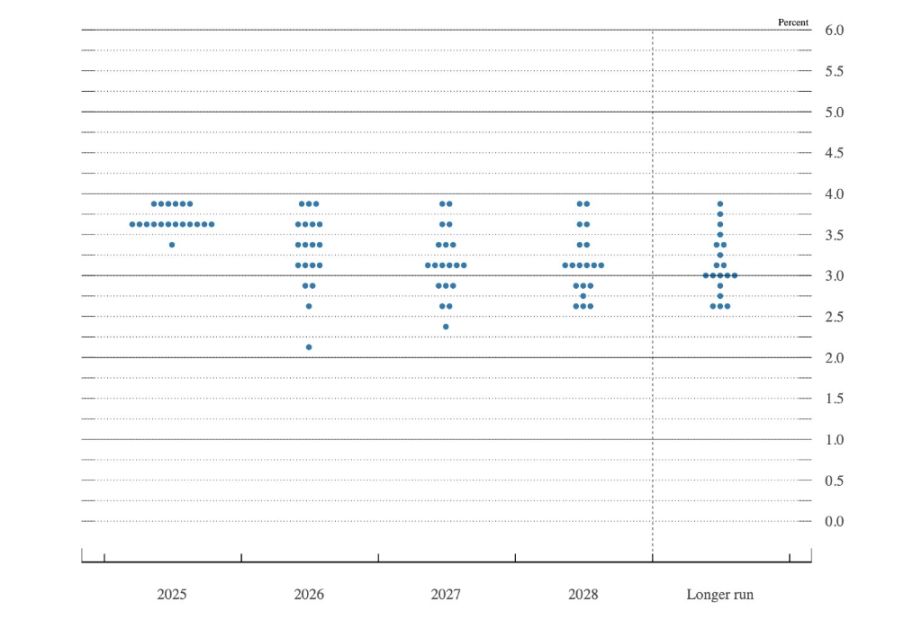

Additionally, the dot plot shows that although six committee members support keeping rates unchanged next year, only two voting members expressed dissent, fewer than the market's expected hawkish lineup.

(Among the FOMC, 6 members opposed the rate cut, of which 4 do not have voting rights)

Although the market originally expected a "hawkish rate cut," the actual result showed no additional dissenters, no higher dot plot, and the anticipated tough stance from Powell did not materialize. Wall Street analysts interpreted the Fed's decision as more dovish than expected.

Dovish Signals Go Beyond the Rate Cut Itself

Bloomberg Chief Economist Anna Wong pointed out that the overall tone was dovish, despite some underlying hawkish elements. The committee significantly raised its growth forecast while lowering its inflation outlook and kept the dot plot unchanged.

She expects the Fed to cut rates by 100 basis points next year, rather than the 25 basis points indicated by the dot plot, citing expectations of weak wage growth and almost no sign of an inflation rebound in the first half of 2026.

Goldman Sachs Head of US Economic Research David Mericle stated:

The decision contains many subtle hawkish elements, but overall it is in line with expectations.

He pointed out:

There are six committee members in the dot plot who hold hawkish dissent for next year, more than we expected. However, the Fed announced the resumption of bond purchases to maintain balance sheet stability and wrote this directly into the statement, which is unusual.

Goldman Sachs Macro FX Researcher Mike Cahill focused on the labor market forecast, noting that the committee kept the fourth-quarter unemployment rate forecast at 4.5%, implying a slowdown from recent growth rates.

He pointed out that the current US unemployment rate is 4.44%. To reach the median forecast, less than 5 basis points would need to be added each month, while seven committee members expect it to rise to 4.6%-4.7%, more in line with recent averages.

Treasury Purchase Plan Draws Attention

Bloomberg Rate Strategist Ira Jersey questioned the Fed's reserve management strategy. He pointed out:

Reserve balances are either sufficient or insufficient. If the Fed wants to maintain an adequate supply of reserves, it should consider using temporary open market operations during periods of declining reserve balances, rather than permanent operations.

Jersey noted that while he understands the need for slow asset growth on the asset side, using traditional repo operations to calibrate reserve demand is a more reasonable way to adjust the scale of asset purchases.

Deutsche Bank Chief US Economist Matthew Luzzetti said he hopes Powell will confirm whether the committee has factored in the expected weakness in employment data, which will be released with a delay next week.

Raphael Thuin of Tikehau Capital believes that due to limited visibility on the data path, policymakers are forced to balance weak labor signals with demand-driven disinflation. The result is greater policy uncertainty, which could be a key driver of market volatility in 2026.

Personnel Changes Add Policy Uncertainty

Jim Bianco of Bianco Research pointed out that the US will have a new Fed Chair next year, which is a major issue. The new chair may be seen as having a political agenda. He said:

Originally, I hoped to see more dissenters to show that the committee is ready to act as a political counterbalance. But perhaps FOMC members will do so after the new chair takes office, though that would appear political since they did not act before the newcomer arrived.

Seema Shah of Principal Asset Management stated:

Given the recent lack of economic data and the significant divergence in expectations for the neutral rate, it is hard to imagine the Fed having any confidence in the economy, let alone voting unanimously.

Seema Shah expects the Fed to pause and assess the lagged effects of previous tightening policies. She said:

While there may be some additional easing in 2026, the extent may be limited and will depend on greater confidence and evidence of the health of the US economy.

Richard Flynn of Charles Schwab UK pointed out that by acting early, the Fed is sending a cautious signal about increasing downside risks amid slowing global growth and ongoing policy uncertainty. He said:

For investors, this is a mild adjustment rather than a sharp turn. While rate cuts may provide near-term support for risk assets and could drive a seasonal "Santa rally," volatility may remain elevated as the market assesses the impact on future policy and the broader economic outlook.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Undercurrents Surge: Crypto Whales Spark Another Wave of Accumulation

Fed Decision Preview: Balance Sheet Expansion Signals Are More Important Than Rate Cuts

The Federal Reserve cuts interest rates as expected, what happens next?

![[Bitpush Daily News Selection] The Federal Reserve cut interest rates by 25 basis points as expected; the Federal Reserve will purchase $40 billions in Treasury securities within 30 days; Gemini received CFTC approval to enter the prediction market; State Street Bank and Galaxy will launch the tokenized liquidity fund SWEEP on Solana in 2026.](https://img.bgstatic.com/multiLang/image/social/87a413b57fb2c702755e8bc5b4385a781765441081405.png)