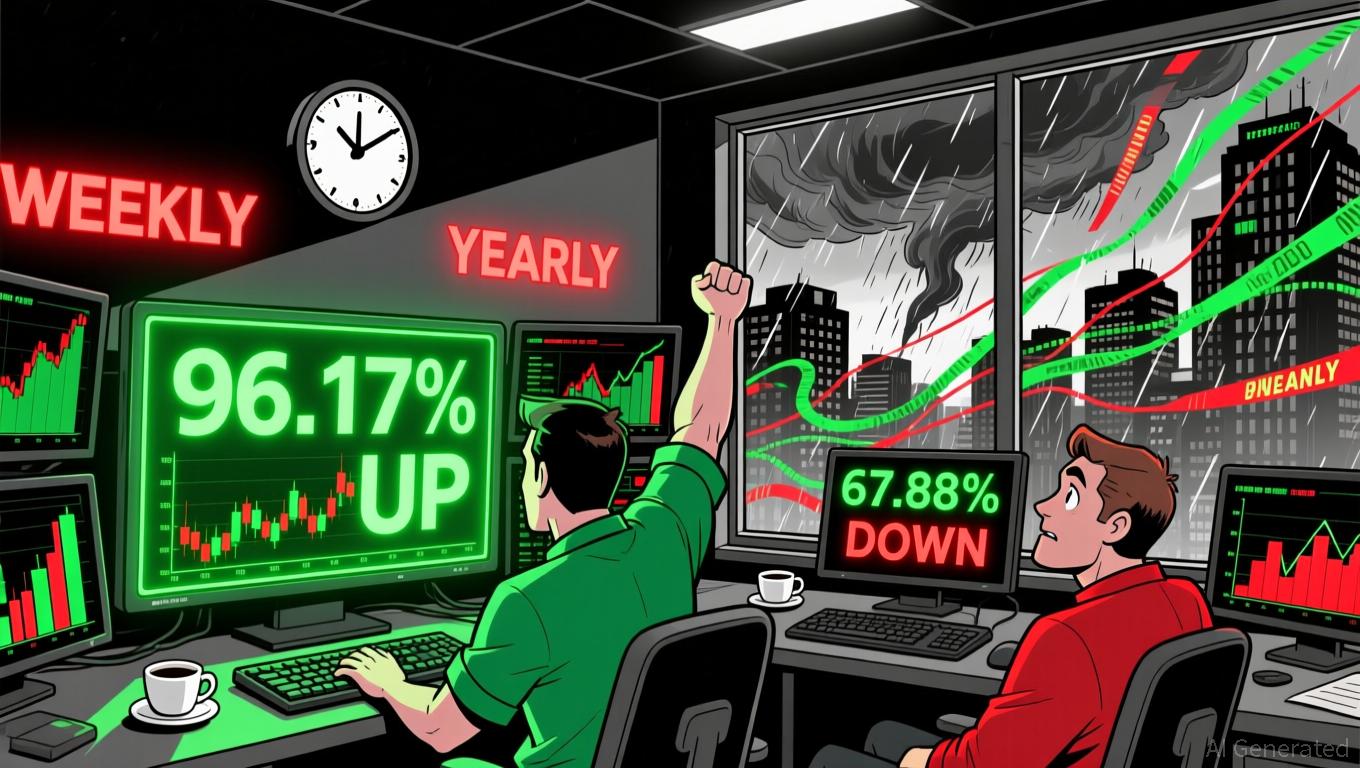

LUNA +96.17% 7D: Surge Attributed to Rumors of SBF Receiving a Pardon

- LUNA surged 96.17% in 7 days amid speculation about Sam Bankman-Fried's potential legal resolution. - The Terra 2.0 token (LUNA) trades at $0.1353, contrasting with LUNC's 70.3% 24-hour gain and $342M market cap. - Market optimism remains cautious as LUNA still faces a 67.88% annual decline and regulatory uncertainties. - SBF's legal developments could influence broader crypto sentiment, though Terra's recovery depends on technical performance.

LUNA Price Movements and Recent Performance

As of December 6, 2025, LUNA experienced a slight decrease of 0.45% over the previous 24 hours, settling at $0.1353. Despite this minor dip, the token has soared by 96.17% in the past week and climbed 84.49% over the last month. However, looking at the bigger picture, LUNA is still down 67.88% compared to its value a year ago.

Weekly Surge Linked to SBF Pardon Speculation

The native asset of the Terra 2.0 blockchain, LUNA, has staged a dramatic comeback, nearly doubling in value over the past seven days. This sharp rally comes after a prolonged period of decline, with the market still recovering from a significant annual loss. The recent price spike appears to be fueled by rumors that Sam Bankman-Fried (SBF), the founder of the now-defunct FTX exchange, could receive a lighter sentence or even a presidential pardon. Although there have been no official announcements, these rumors have sparked renewed optimism among crypto traders, especially those involved in the Terra ecosystem.

This wave of speculation has not only boosted LUNA, but also reignited interest in Luna Classic (LUNC). LUNA’s recent price action, despite a slight daily drop, points to a cautious sense of hope and stabilization following a year of steep losses.

Comparing Terra 2.0 and Terra Classic

LUNA’s recent gains set it apart from LUNC, the token representing the original Terra Classic chain. Over the last 24 hours, LUNC has jumped 70.3%, reaching a market capitalization of $342 million, while LUNA’s market cap stands at $131 million. This contrast highlights the split legacy of the Terra ecosystem: LUNC remains tied to the original blockchain that collapsed in 2022, whereas LUNA is the face of the new Terra 2.0 network.

Following the catastrophic crash in May 2022, which saw the UST stablecoin and LUNA plummet from $80 to nearly worthless—erasing $45 billion in value—the community relaunched LUNA to distinguish the new chain from its predecessor. The downfall was partly attributed to actions by SBF and Alameda Research, who were implicated in the events leading up to the collapse.

Investor Sentiment and Legal Uncertainties

Speculation about a possible pardon for SBF continues to influence market sentiment, though no concrete legal developments have been confirmed. Some analysts believe that a favorable outcome for SBF could help ease market nerves and attract fresh investment into the crypto sector. Nonetheless, the Terra community recognizes that LUNA’s prospects depend more on its technical progress and governance than on external legal news.

Despite the recent rally, LUNA’s value remains far below its previous highs, with investors watching closely to see if the token can maintain its momentum amid ongoing regulatory challenges and uncertain economic conditions.

Outlook

LUNA’s impressive 96.17% weekly gain signals a short-term resurgence, largely driven by speculation around SBF’s legal fate. Although the token is still trading at a fraction of its former value, the recent surge indicates a renewed appetite among investors to support Terra 2.0’s future. The coming weeks will be crucial in determining whether this optimism leads to broader institutional participation or remains limited to speculative trading activity.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Emergence of Tokenized Infrastructure in 2025 and Its Impact on Long-Term Capital Allocation

- Tokenized infrastructure reshapes capital markets via blockchain, enabling fractional ownership and boosting liquidity through real-world asset (RWA) tokenization. - Academic programs (MIT, Notre Dame) and 47% crypto job growth align with industry needs, driven by tokenization education and workforce development. - Institutions tokenize RWAs (real estate, ESG) with $500B–$3T market projections by 2030, supported by EU MiCA and U.S. SEC frameworks. - Strategic asset allocation requires balancing AI-driven

HYPE Token Experiences Rapid Crypto Growth and Attracts Institutional Attention: Immediate Gains and Enduring Value Within Developing Token Ecosystems

- Hyperliquid's HYPE token surged 1,600% in 2025, driven by protocol upgrades, institutional validation, and retail speculation. - Institutional adoption accelerated via VanEck's ETF applications and $420M staking by Nasdaq-listed PURR , boosting token utility and governance confidence. - Ecosystem expansion into traditional finance and emerging markets, plus USDH stablecoin adoption, positions HYPE as a DeFi-mainstream finance bridge. - Risks include November 2025 token unlocks, macroeconomic volatility,

Bitcoin’s Latest Price Fluctuations and Investor Attitudes: Understanding Economic Changes and Market Psychology in 2025

- Bitcoin's 2025 volatility stems from macroeconomic factors (interest rates, inflation) and investor psychology (fear, FOMO), with prices dipping 3.25% amid geopolitical tensions. - Rising rates and inflation drive capital away from crypto, while fixed supply positions Bitcoin as an inflation hedge, though liquidity conditions temper its performance. - Institutional adoption and ETP launches link Bitcoin to traditional markets, yet a Fear & Greed Index at 28 signals caution despite 12.93% annual gains and

LUNA Jumps 39% as Bankruptcy-Related Rally Drives Gains

- LUNA surged 39% in 24 hours amid renewed speculative interest in "bankruptcy concept" tokens tied to Terra/FTX collapses. - USTC (78% rise) and FTT (18% gain) also spiked, driven by SBF's legal developments and social media-driven hype. - Analysts warn these price movements lack fundamental support, with no protocol upgrades or partnerships backing LUNA's surge. - Market volatility highlights risks of trading speculative assets with no intrinsic value, despite short-term gains.