Google executive makes millions of dollars overnight through insider trading

Insider addresses manipulated Google algorithms by referring to prediction market odds.

Author: Liu Kaiwen

The hottest Polymarket event this week was undoubtedly yesterday's sensational market: "Who will be the most searched person on Google in 2025?" Since the market opened, Pope Leo XIV has consistently held the top spot, with his probability remaining stable at around 50%. Meanwhile, globally renowned figures such as Trump, Taylor Swift, and Musk have dominated the market narrative—this was supposed to be a list of "celebrity contenders."

The vast majority of traders never seriously looked at the options at the bottom of the market, those with almost zero weight: Mikey Madison, Andy Byron, d4vd... Their presence seemed only to make the odds table look richer, and no one really considered them possible winners.

The "Foolish Whale" No One Cared About Goes Against the Trend

A week ago, while everyone was focused on the fluctuations of these celebrity options, one address (0xafEe) bought a large amount of "d4vd = Yes" positions at extremely low prices. In prediction markets, price equals probability—and at that time, d4vd's probability was not only extremely low, it was almost negligible.

To outsiders, this was just an insignificant "lottery position": for such long-shot options with near-zero probability, as long as the probability rises to 10%, it can bring dozens of times the return. The trader invested only $20,000 in this position, while his historical trading volume was nearly $10 millions, which made the "lottery position" theory even more convincing.

The truly bizarre move happened a week later.

With no one knowing when Google would announce the trending search list, this trader suddenly started building massive positions the day before yesterday. Instead of buying "Yes" on popular figures, he frantically swept up "No" on them.

Pope Leo XIV, Trump, Taylor Swift, the new mayor of New York... all the options the market considered "possible winners" were denied by him with millions of dollars in real money.

This kind of operation, with no hedging logic and ignoring price impact, completely defies whale trading logic and doesn't even resemble normal investment behavior. Some in the market began to notice this contrarian whale, but more people just saw him as a "fool with too much money" joke.

A Jaw-Dropping Market Reversal

However, just a few hours after he finished sweeping the orders, Google suddenly released the annual trending search list. The moment the rankings were announced, the entire market was collectively stunned—the top spot was neither the Pope, nor Trump, nor any of the popular options, but that name with a long-term near-zero probability, one that traders couldn't even be bothered to research: d4vd.

The market exploded instantly. In just a few seconds, d4vd's probability shot vertically from the bottom of the chart to 99.9%, and all other options were instantly wiped out. While the market was still trying to figure out whether this was a Google system bug, some had already noticed: that "reckless" whale had made over $1 million in profit in a single day.

His "d4vd = Yes" bet won, with a return of nearly 20 times. All his "popular figure = No" bets also won.

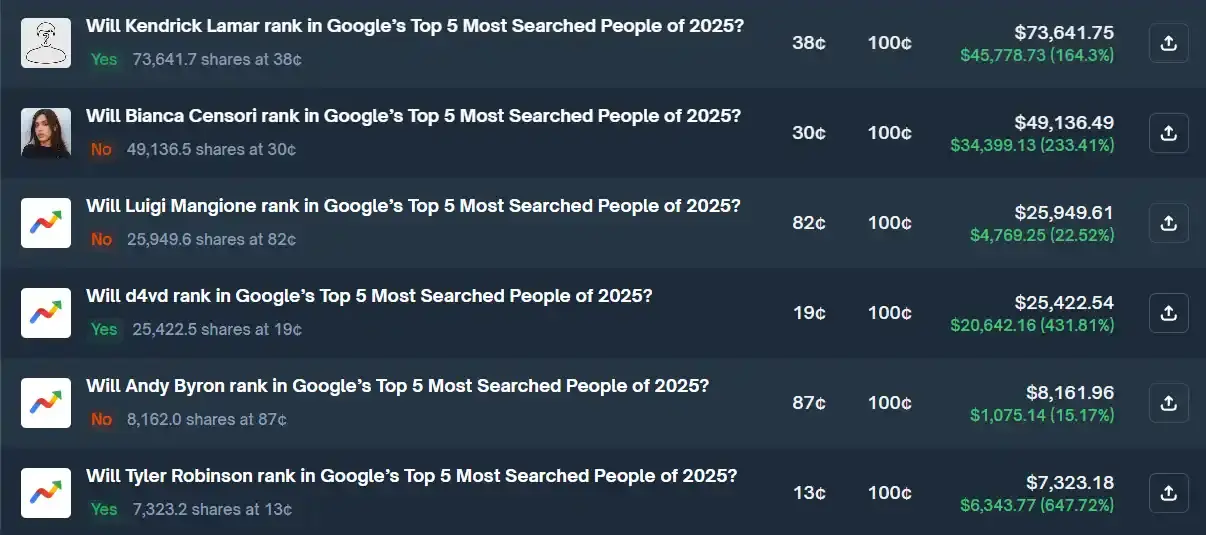

As people continued to scroll through his positions, they found: he also won across the board in another almost identical market, "Top 5 Most Searched People on Google in 2025," investing nearly $500,000 in ten positions and making an unrealized profit of $292,000. He also participated in seven markets about the release time of the new Gemini version, investing over $1 million and still profiting on all.

In other words, as long as it was related to Google, he seemed to never bet wrong.

More Terrifying Than Insider Trading: The "Rewriter"

When people began to characterize this as a Google insider profiting from information asymmetry, deeper on-chain tracking pushed the event in an even more unsettling direction. Analysis showed that the trader's address was adorableraccoon.eth, and according to on-chain records, he had staked over $15 millions worth of ETH on Aave before November 4.

With on-chain assets alone exceeding $15 millions, this is clearly not the wealth level of an ordinary Google employee. More and more signs indicate that this person is likely not just an engineer, but someone deeply embedded in Google's core system, perhaps even with decision-making power—a Google executive.

This brings an even more dangerous question to the surface: what if he not only knew the results in advance, but could even manipulate them?

Google's annual trending search list is not determined solely by total search volume, but relies on an internal algorithm highly sensitive to sudden search spikes. In theory, as long as you know the algorithm's parameters, weights, and thresholds, you can easily push a name to "soar" up the rankings. For a Google executive with real authority, making a name skyrocket to the top is not an impossible task. In this framework, the prediction market is not a tool for forecasting the future, but an instrument for some to directly manufacture arbitrage opportunities through a hidden decision chain.

If this wealthy Google executive truly has the ability to tweak the algorithm, then all Google-related prediction markets are not just channels for him to profit from information asymmetry; if he wishes, he can even "fine-tune" the world line like tweaking an algorithm, pushing it toward the direction most favorable to himself.

Conclusion

For the first time, someone with core decision-making power has demonstrated in the open market that he can turn prediction markets from "platforms for discounting information asymmetry" into "tools for altering reality."

Prediction markets have always been seen as a price mechanism driven by collective wisdom to reverse-engineer the truth; but in this event, it was proven for the first time that those with system privileges can use them to rewrite the world line.

He is not just betting on the future, but on the future he can create.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin profit metric eyes 2-year lows in 'complete reset:' BTC analysis

Mars Morning News | After the Ethereum Fusaka upgrade, the blob base fee surged by 15 million times

Multiple blockchain industry updates: a Bitcoin OG wallet transferred 2,000 BTC; Cloudflare outage was not caused by a cyberattack; the DAT bubble has burst; Ethereum Fusaka upgrade fees have surged; LUNC has risen over 80% intraday. Summary generated by Mars AI. This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still under iterative improvement.

Drones, Fake Birdsong, and Broken Glass Traps: Malaysia is Undergoing an Unprecedented "Bitcoin Crackdown"

The Malaysian government is intensifying its crackdown on illegal bitcoin mining, utilizing technologies such as drones and sensors to uncover numerous operations, with electricity theft causing significant losses. Summary generated by Mars AI. The accuracy and completeness of the content generated by the Mars AI model are still in the process of iterative improvement.

Bitwise CIO: Stop Worrying, MicroStrategy Won't Sell Bitcoin

There are indeed many concerns in the crypto industry, but MicroStrategy selling bitcoin is definitely not one of them.