BlackRock Bitcoin ETF sees five consecutive weeks of outflows, totaling over $2.7 billion

Jinse Finance reported that BlackRock's iShares Bitcoin Trust (IBIT) has experienced its longest weekly outflow since its launch in January 2024. In the five weeks ending November 28, investors withdrew over 2.7 billion USD from the ETF. As of Thursday, the ETF saw another 113 million USD in redemptions, putting it on track for a sixth consecutive week of net outflows. IBIT currently manages assets exceeding 71 billion USD. Blockchain analytics firm Glassnode stated that this trend marks a significant reversal of the sustained inflow mechanism that previously supported prices, reflecting a cooling of new capital allocation to the asset. Currently, Bitcoin is trading at around 92,000 USD, down 27% from its October peak.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

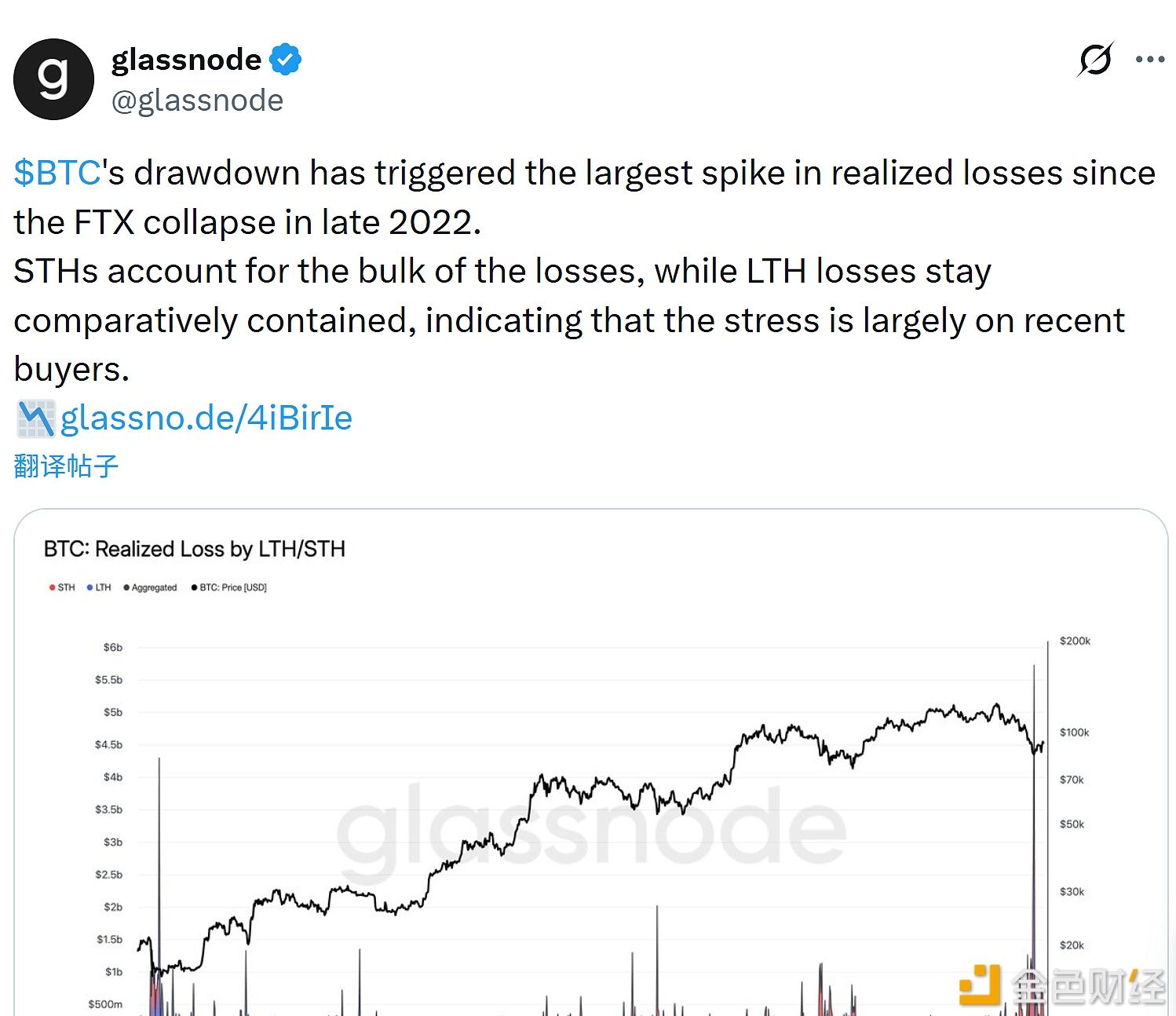

Glassnode: Short-term holders bore most of the losses during this BTC correction

Matrixport: Bitcoin's current rebound is more reflected in position structure rather than price itself

Ethereum Prysm client bug causes validator participation to drop by 25%, nearly resulting in loss of finality