Morning Brief | Ethereum completes Fusaka upgrade; Digital Asset raises $50 million; CZ's latest interview in Dubai

Overview of major market events on December 4.

Compiled by: ChainCatcher

Important News:

- CZ: The debate with Peter Schiff on bitcoin and tokenized gold is about to begin

- He Yi: Customer service rep Xiao He thanks everyone for their support, still Binance's Chief Customer Service Officer

- Yi Lihua: ETH is still significantly undervalued, trend investing should remain firm

- Ethereum completes Fusaka upgrade, officially entering a twice-yearly hard fork schedule

- Putin's economic advisor calls for cryptocurrencies to be included in Russia's national trade ledger

- Digital Asset completes a new $50 million financing round, with participation from BNY Mellon, iCapital, Nasdaq, and S&P Global

- U.S. Commodity Futures Trading Commission: Spot cryptocurrencies can now be traded on CFTC-registered exchanges

What important events happened in the past 24 hours?

CZ: The founder of prediction market predict.fun, incubated and invested by YZi Labs, previously worked at Binance

According to ChainCatcher, Binance founder CZ posted on social media: "Welcome to the new prediction market predict.fun built on BNB Chain. When users make predictions, funds are not idle but generate returns. The founder of predict.fun previously worked at Binance (several years ago). The project is incubated/invested by YZi Labs."

Tom Lee: Bitcoin may rise to $250,000 within months, Ethereum could reach $12,000

ChainCatcher reports that Tom Lee, chairman of Ethereum treasury company BitMine, stated at Binance Blockchain Week that he expects bitcoin to rise to $250,000 within months. He also said that if the price ratio of Ethereum to bitcoin returns to the eight-year average, Ethereum could rise to about $12,000. He noted that Ethereum has begun to break out of its five-year consolidation range, and that the asset tokenization trend in 2025 will enhance Ethereum's utility value.

U.S. Commodity Futures Trading Commission: Spot cryptocurrencies can now be traded on CFTC-registered exchanges

ChainCatcher reports that Caroline D. Pham, Acting Chair of the U.S. Commodity Futures Trading Commission (CFTC), announced today that spot cryptocurrency products will, for the first time, begin trading on federally regulated markets at CFTC-registered futures exchanges. Today's announcement follows recommendations from the President's Working Group on Financial Markets, incorporates stakeholder insights from the CFTC's "Crypto Sprint" initiative, and reflects collaboration with the U.S. Securities and Exchange Commission.

The "Crypto Sprint" initiative has also launched public consultations on all other CFTC-related recommendations in the President's Working Group report. Other aspects of the initiative include: enabling tokenized collateral (including stablecoins) in derivatives markets, and rulemaking for technical revisions to CFTC regulations on collateral, margin, clearing, settlement, reporting, and recordkeeping, to facilitate the use of blockchain technology and market infrastructure, including tokenization, in our markets.

CZ comments on He Yi's new Co-CEO title and reveals future work focus

ChainCatcher reports, at Binance Blockchain Week, during the "KOL and Media Interaction" session, CZ responded to the question "How do you view He Yi's title adjustment and future work focus" by saying: "From my perspective, He Yi becoming Co-CEO is completely normal. She has always acted as a co-founder, working hard to maintain the community and serve users wholeheartedly. She is the most hardworking person I have ever met. She has long been the backbone of the company.

This title change is more of an official business card for external purposes, making her more familiar to the Western community.

He Yi and Richard have very different but complementary skill sets. He Yi is 9 years younger than me, has a strong ability to learn, and can quickly make up for shortcomings. For example, although her English is not as good as Richard's, she is still improving, even though you may still hear some grammatical errors.

Recently, I didn't have much to do in the U.S., so I played some sports; after returning, I found the company running well and the team very strong, which is a good thing.

Life does not go backward. I enjoy my current life, not having to watch binance.com every moment, but giving others room to grow.

My current focus is on BNB Chain ecosystem projects and serving as a crypto advisor to multiple governments."

Digital Asset completes new $50 million financing round, with participation from BNY Mellon, iCapital, Nasdaq, and S&P Global

ChainCatcher reports, according to Bloomberg, blockchain technology company Digital Asset announced it has received a $50 million strategic investment from BNY Mellon, iCapital, Nasdaq, and S&P Global. These investments reflect the accelerating convergence of traditional finance (TradFi) and decentralized finance (DeFi).

Digital Asset is the creator of Canton Network, which currently supports over $6 trillion in on-chain assets, covering bonds, stocks, money market funds, alternative investment funds, commodities, and more, with over 600 institutions participating in its ecosystem. CEO Yuval Rooz stated that the participation of these institutions reinforces the necessity of building blockchain infrastructure for regulated markets. All investors expressed their intention to deepen cooperation with Digital Asset to advance the construction of next-generation financial market infrastructure.

CZ: The debate with Peter Schiff on bitcoin and tokenized gold is about to begin

ChainCatcher reports, CZ posted: "The debate with Peter Schiff is about to begin, preparing backstage."

Previous reports indicated that economist and crypto critic Peter Schiff challenged CZ to a debate on X regarding the pros and cons of bitcoin versus tokenized gold. CZ responded: "Although you oppose bitcoin, you always remain professional and impartial. I appreciate that. We can debate this."

U.S. SEC again delays implementation of controversial short-selling disclosure rules

ChainCatcher reports, the U.S. Securities and Exchange Commission (SEC) has postponed the deadline for compliance with its highly anticipated short-selling and securities lending disclosure rules for the second time. According to SEC guidance, the final deadline for large investment managers (including hedge funds) to comply with short-selling reporting requirements is now extended to January 2, 2028, while the disclosure obligation for securities lending transactions is delayed to September 28, 2028.

The SEC stated: "The Commission believes these temporary exemptions are in the public interest and consistent with investor protection objectives." In October 2023, the SEC introduced new rules requiring qualifying asset managers to report short positions monthly, and pension funds, banks, and institutional investors lending shares must report the next day after the transaction.

In August, the U.S. Fifth Circuit Court of Appeals ruled that the SEC failed to adequately assess the economic impact of the rules and required the agency to reconsider. The SEC's only Democratic commissioner, Crenshaw, commented that the compliance date extension is being used as a pretext to distort the rules until they become ineffective, which is eroding the rule of law. (Golden Ten Data)

Trump’s nominees for CFTC and FDIC chair move forward, potentially reshaping crypto regulatory landscape

ChainCatcher reports, according to CoinDesk, the U.S. Senate is moving forward with confirmation votes for two key financial regulators nominated by President Trump: Mike Selig as CFTC chair and Travis Hill as FDIC chair.

Both are seen as crypto-friendly and will play important roles in U.S. crypto market regulation. Once appointed, Selig will be the sole CFTC commissioner and lead crypto regulatory legislation; Hill emphasizes lifting previous restrictions on banks engaging in crypto business and addressing the issue of "de-banking."

Putin's economic advisor calls for cryptocurrencies to be included in Russia's national trade ledger

ChainCatcher reports, according to Vedomosti and RBC, Russian presidential economic advisor Maxim Oreshkin stated that cryptocurrencies should be included in the national balance of payments and called bitcoin mining an "undervalued export project."

He noted that Russian companies have invested over $1.3 billion in mining infrastructure and are using cryptocurrencies for import and export settlements, which has a real impact on the foreign exchange market. The Russian government is gradually promoting the inclusion of crypto trading in the regulatory framework to meet foreign trade needs under sanctions.

Uniswap founder opposes regulating DeFi developers as centralized institutions

ChainCatcher reports, Uniswap founder Hayden Adams posted that some traditional financial institutions are pushing the U.S. SEC to regulate decentralized protocol software developers as centralized intermediaries. He mentioned that these institutions were controversial during the Constitution DAO auction and now argue that DeFi protocols cannot meet the "fair access" standard.

Adams stated that the so-called "fair access" is being used as a reason to strengthen regulation, while open-source, peer-to-peer technology itself lowers the threshold for liquidity creation and is fundamentally different from the traditional market maker model.

Vitalik: Ethereum will continue to implement multiple "hard rules" to enhance security and protocol efficiency

ChainCatcher reports, Ethereum co-founder Vitalik Buterin posted on X that in recent years, Ethereum has continuously introduced multiple "hard fixed rules," effectively improving protocol security and long-term adaptability. He reviewed: 2021: EIP-2929 and EIP-3529, increasing storage read costs and reducing gas refunds; 2024: with the Dencun upgrade, weakening contract self-destruct instructions; 2025: setting a gas limit of 16,777,216 per transaction.

Vitalik pointed out that these changes set clear upper limits for the maximum processing capacity of a single block and transaction, helping to prevent various denial-of-service attacks, simplify client implementation, and provide more room for improving system efficiency. He also said that more hard limits are expected to be introduced, including: limiting the total byte size of accessible code (short-term increasing the cost of calling large contracts, medium-term using binary tree structures and charging by data block); setting a maximum computation cycle for zero-knowledge EVM verifiers and adjusting costs accordingly; adjusting memory charging methods and setting a clearer upper limit for EVM maximum memory consumption.

He Yi: Customer service rep Xiao He thanks everyone for their support, still Binance's Chief Customer Service Officer

ChainCatcher reports, Binance co-founder and Co-CEO He Yi posted on social media: "I am still Binance's Chief Customer Service Officer, always ready to serve users. Customer service rep Xiao He thanks everyone for their support and will continue to work hard."

According to GMGN market data, possibly affected by the above news, the market cap of the meme coin "Customer Service Xiao He" on BNB Chain briefly exceeded $9 million, currently at $8.47 million, with a 24-hour increase of 128%.

Yi Lihua: ETH is still significantly undervalued, trend investing should remain firm

ChainCatcher reports, Yi Lihua, founder of Liquid Capital (formerly LD Capital), posted on social media: "ETH has broken through $3,200 (UTC+8). I've been firmly buying the dip and am optimistic about the subsequent market. It seems that only Liquid Capital is bullish across the entire network, reminiscent of the last round when we were mocked for buying the dip.

But as an investor, without blind confidence, you must stick to your logic. Be greedy when others are fearful. With ETH upgrades and the continued development of on-chain finance, ETH is still significantly undervalued. The core of trend investing is to believe in the trend and buy on dips."

Ethereum completes Fusaka upgrade, officially entering a twice-yearly hard fork schedule

ChainCatcher reports, Ethereum's 17th major upgrade "Fusaka" has been officially activated on the mainnet at epoch 411392, only about 7 months after the May Pectra upgrade. This upgrade not only brings multiple UX and scalability improvements but also marks Ethereum's official entry into an accelerated development pace of "two hard forks per year." Consensys stated that Ethereum researchers will aim for two upgrades per year in the future.

Since the 2022 Merge, Ethereum has typically only had one major update per year: Shapella (2023), Dencun (2024), and Pectra (2025). Fusaka introduces several key technical changes, including a new sampling technology "PeerDAS" that affects data availability and pricing. The upgrade includes 9 core EIPs and 4 supporting EIPs, making it one of the largest upgrades in Ethereum's history by some metrics.

Bloomberg: Polymarket is recruiting new staff to form an internal market-making team

ChainCatcher reports, according to Bloomberg, Polymarket is hiring new team members to form an internal market-making team, which may trade with clients on the company's trading platform. Similar functions have previously drawn criticism for its main competitors.

Sources revealed that the company has recently held talks with several traders, including sports betting traders, to invite them to join the new department. Polymarket declined to comment.

Meme Hot List

According to meme token tracking and analysis platform GMGN, as of December 5, 09:00 (UTC+8),

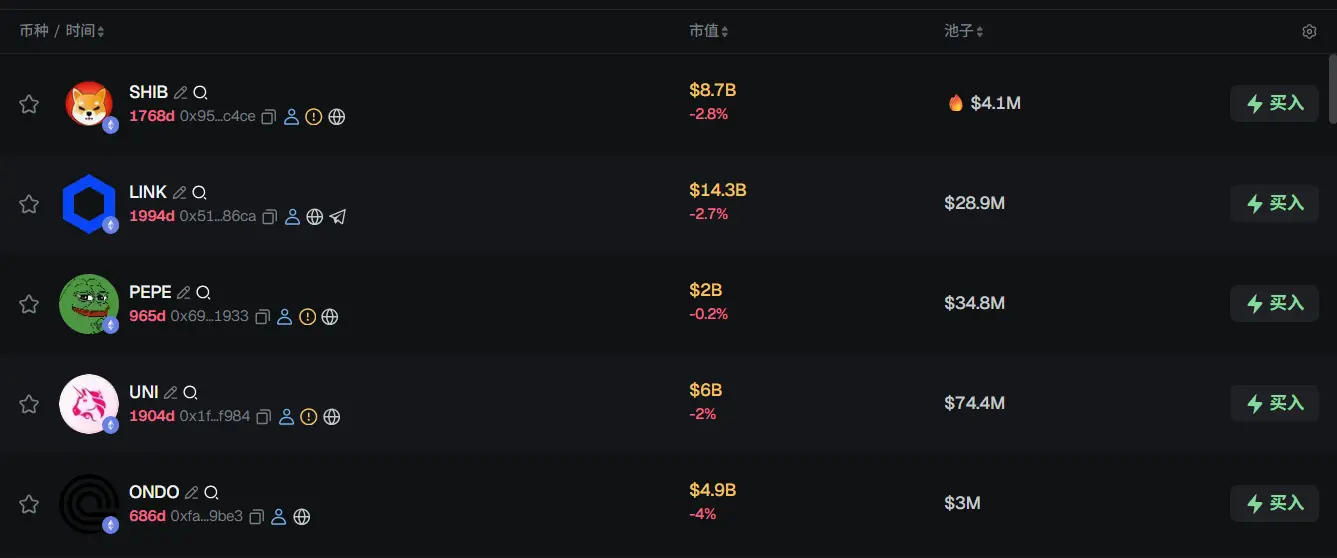

The top five trending ETH tokens in the past 24h are: SHIB, LINK, PEPE, UNI, ONDO

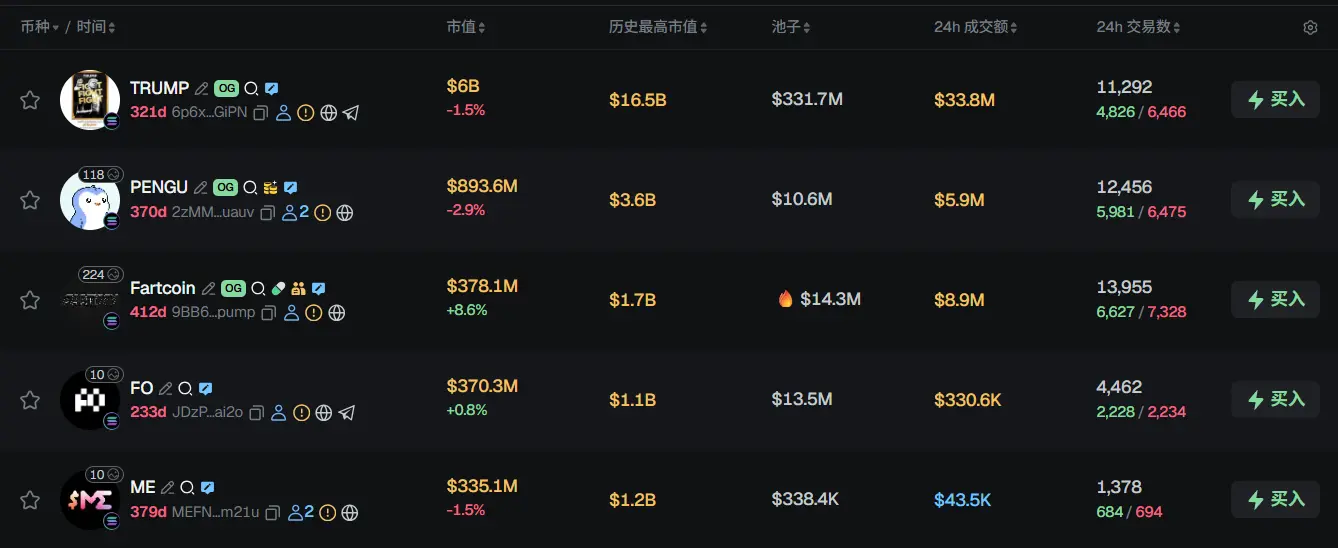

The top five trending Solana tokens in the past 24h are: TRUMP, PENGU, Fartcoin, FO, ME

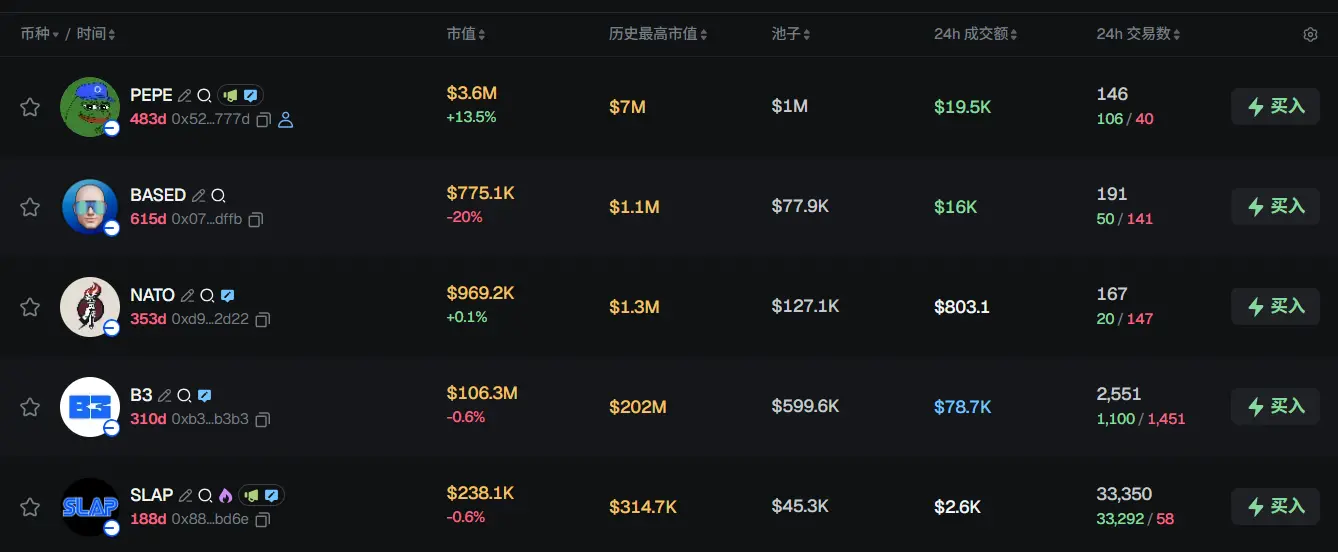

The top five trending Base tokens in the past 24h are: PEPE, BASED, NATO, B3, SLAP

What are some must-read articles from the past 24 hours?

When "intent" becomes the standard: How can OIF end cross-chain fragmentation and bring Web3 back to user intuition?

In the previous article "Ethereum Interop Roadmap," we mentioned that the Ethereum Foundation (EF) has formulated a three-step interoperability strategy to improve user experience (Improve UX): initialization, acceleration, and finalization (see also "Ethereum Interop Roadmap: How to Unlock the 'Last Mile' for Mass Adoption").

If the future Ethereum is a vast highway network, then "acceleration" and "finalization" address the issues of road smoothness and speed limits, but before that, we face a more fundamental pain point: different vehicles (DApps/wallets) and different toll booths (L2/cross-chain bridges) speak completely different languages.

ETFs are being launched in droves, but token prices are falling. Is ETF approval still a positive?

In the past month, DOGE, XRP, Solana (SOL), Litecoin (LTC), Hedera (HBAR), Chainlink (LINK), and other emerging crypto projects have had their spot ETFs approved and listed. Contrary to market expectations, the prices of these assets have not soared due to ETF listings. Instead, despite continuous capital inflows, token prices have seen significant pullbacks, raising the question: Does ETF approval still provide long-term support for token prices?

Greenfield's outlook for crypto in 2026: Ten key questions and opportunities

The digital asset ecosystem is evolving in unexpected ways: new building blocks, new behavioral patterns, and new coordination tools are emerging. What was considered experimental a year ago may now be foundational.

Last year, we shared predictions for the coming year's trends. This year, we take a different approach. We no longer claim to predict the future, but instead wish to share our vision: a wish list of ten ideas, questions, and products we hope founders will tackle by 2026.

Through these reflections, we can better understand where the next batch of significant opportunities may arise in infrastructure, DeFi, and consumer sectors, and how the evolving regulatory environment will shape the foundation of these opportunities.

Ethereum completes Fusaka upgrade, team says it can unlock up to 8x data throughput

Ethereum officially completed the major "Fusaka" upgrade early this morning. This is the second hard fork after the Pectra upgrade in May this year, symbolizing the Ethereum development team's determination to accelerate iteration and officially moving to a twice-yearly upgrade pace. Meanwhile, ETH price has climbed for several days to a high of $3,240 (UTC+8), up about 20% from recent lows, reflecting positive market sentiment.

The Fusaka upgrade (a name combining Fulu and Osaka) not only includes comprehensive optimizations to both the consensus and execution layers, but also introduces up to 12 Ethereum Improvement Proposals, focusing on increasing network throughput, optimizing transaction speed, and revising the economic model to strengthen ETH's deflationary mechanism.

CZ's latest interview in Dubai: What is he focusing on after leaving Binance's daily operations?

After experiencing legal turmoil and a personal identity shift, Binance founder CZ stands at a new starting point. Although he has handed over daily operations to Co-CEOs He Yi and Richard Teng and other new-generation leaders, he remains at the center of the industry.

During Binance Blockchain Week in Dubai, CZ had a dialogue with media and the community. From personal role transformation to industry outlook, he clearly outlined his "post-CEO era" action roadmap.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The "Five Tigers Competition" concludes successfully | JST, SUN, and NFT emerge as champions! SUN.io takes over as the new driving force in the ecosystem

JST, SUN, and NFT are leading the way, sparking increased trading and community activity, which is driving significant capital inflows into the ecosystem. Ultimately, the one-stop platform SUN.io is capturing and converting these flows into long-term growth momentum.

The End of Ethereum's Isolation: How EIL Reconstructs Fragmented L2s into a "Supercomputer"?

EIL is the latest answer provided by the Ethereum account abstraction team and is also the core of the "acceleration" phase in the interoperability roadmap.

Research Report|In-Depth Analysis and Market Cap of Stable (STABL)