The new Federal Reserve chairman's dovish policy may ignite the market

Author: Cookie

Original Title: The Possibility of a Wild Bull Market Brought by the New Federal Reserve Chairman

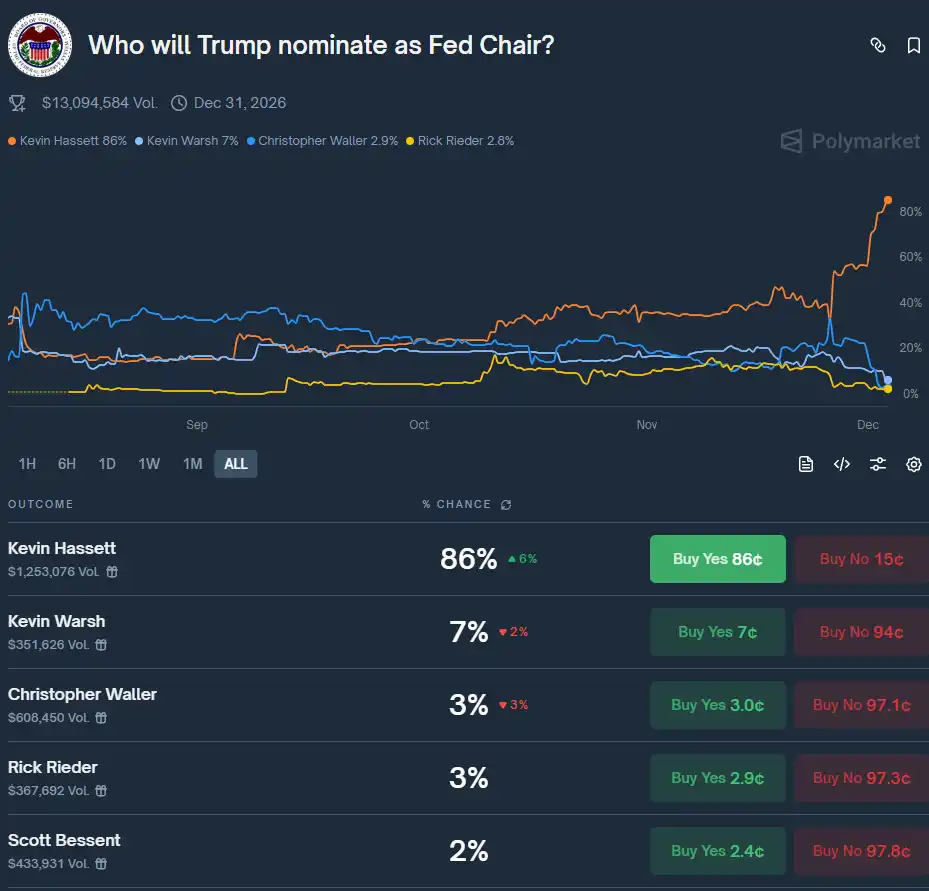

On the prediction market Polymarket, the probability of Hassett being elected as the new Federal Reserve Chairman has risen to 86%, far ahead of other possible candidates for the position.

Barring any surprises, Kevin Hassett is expected to be the next Federal Reserve Chairman, Trump’s favorite.

The actions of the Federal Reserve have always been a significant factor influencing the cryptocurrency market. So, if Hassett ultimately becomes the new Federal Reserve Chairman as the market expects, what impact is anticipated on the market?

Accelerated Rate Cuts

At the end of November, Hassett stated that pausing rate cuts at this time would be "a very bad time," as the government shutdown had already dragged down economic growth in the fourth quarter. He predicted that the government shutdown would cause the fourth quarter’s Gross Domestic Product (GDP) to drop by 1.5 percentage points. Meanwhile, he pointed out that the September Consumer Price Index (CPI) showed inflation performing better than expected.

Earlier, on November 13, Hassett said he expected fourth quarter GDP to fall by 1.5% due to the government shutdown. He saw little reason not to cut rates.

Therefore, if Hassett becomes the new Federal Reserve Chairman, it is expected that he will push for faster rate cuts, possibly lowering the federal funds rate below 3%, or even close to 1%, to stimulate economic growth and employment.

This is also what Trump wants to see.

Resuming QE

On December 1, the Federal Reserve officially ended its quantitative tightening (QT) policy, marking the conclusion of the balance sheet reduction process that began in 2022. Although some believe that the effects may not be seen until early next year, expectations for looser liquidity have gradually materialized.

Hassett may be more tolerant of inflation, viewing the 2% inflation target as a flexible ceiling rather than a strict anchor. He focuses on employment and GDP growth, reducing the "gradual" data-dependent decision-making in favor of more proactive, pro-growth interventions.

In September this year, Hassett said in an interview with Fox Business that the United States is in a period of supply-side prosperity, and in an economy without real inflation, current interest rates are hindering economic growth and job creation. He also stated that the U.S. is expected to achieve 4% GDP growth.

The view of prioritizing economic development over inflation control makes it reasonable to expect that the Federal Reserve under Hassett’s leadership could restart QE.

Impact on Bitcoin

Every Federal Reserve Chairman candidate, whether or not they directly discuss crypto topics, will have a structural impact on the cryptocurrency industry. Hassett, in particular, has an undeniable connection with the crypto industry: he has publicly held Coinbase stock worth millions of dollars and has served as a member of Coinbase’s advisory board.

In addition, he has participated in White House internal working groups on digital asset policy, promoted the preservation of space for innovation within regulatory frameworks, and believes that crypto technology is an important variable affecting the future economic structure. He has stated that bitcoin will "rewrite the rules of finance."

Hassett’s crypto background may reduce regulatory uncertainty, promote institutional adoption, and encourage the Federal Reserve to explore crypto integration. This could enhance bitcoin’s legitimacy and liquidity, potentially driving its price to new highs.

Many traders are optimistic about the market after Hassett takes office, believing that the bull market will truly begin then, with the expected timing being mid-next year. Therefore, the second half of 2026 will be crucial for the cryptocurrency industry.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

2025 Crypto Prediction Review: 10 Institutions, Who Got It Wrong and Who Became Legends?

We can consider these predictions as indicators of industry sentiment. If you use them as an investment guide, the results could be disastrous.

SEC launches innovative exemption policy—Has U.S. crypto regulation entered a new era?

The door to exploration has just opened.

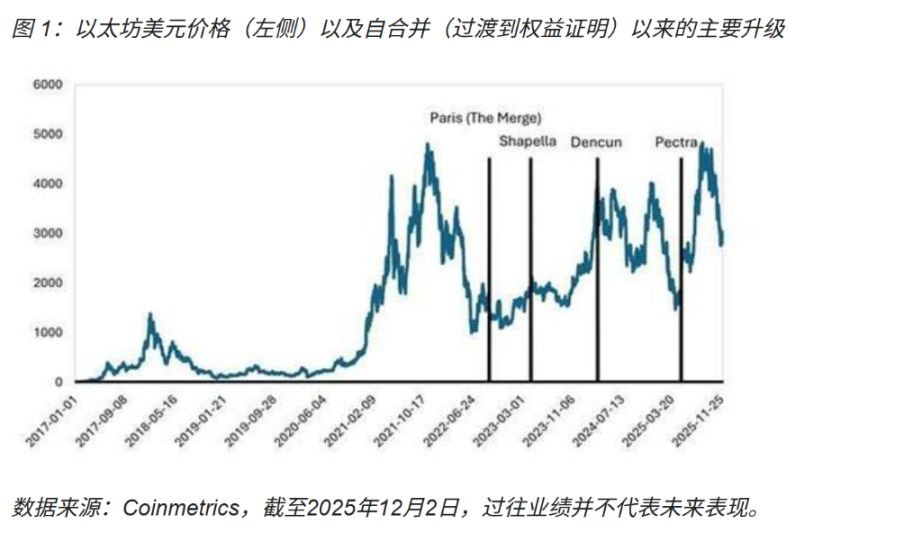

Ethereum undergoes "Fusaka upgrade" to continue "scaling and improving efficiency," strengthening on-chain settlement capabilities

The Fusaka upgrade will consolidate its position as a settlement layer and drive Layer-2 competition towards improvements in user experience and ecosystem depth.

Space Review|Inflation Rebounds vs Market Bets on Rate Cuts: How to Maintain a Prudent Crypto Asset Allocation Amid Macroeconomic Volatility?

In the face of macro volatility, the TRON ecosystem offers a balanced asset allocation model through stablecoin settlements, yield-generating assets, and innovative businesses.