CZ-Linked YZi Labs Moves to Take Control of BNB Treasury Firm CEA Industries

Quick Breakdown

- CZ’s YZi Labs moves to seize control of CEA Industries, citing “destruction” of shareholder value.

- CEA’s stock has crashed nearly 90% from its July peak despite its ambitions to build a BNB treasury.

- YZi accuses current leadership of weak communication, poor marketing, and divided loyalty.

YZi Labs pushes for board overhaul

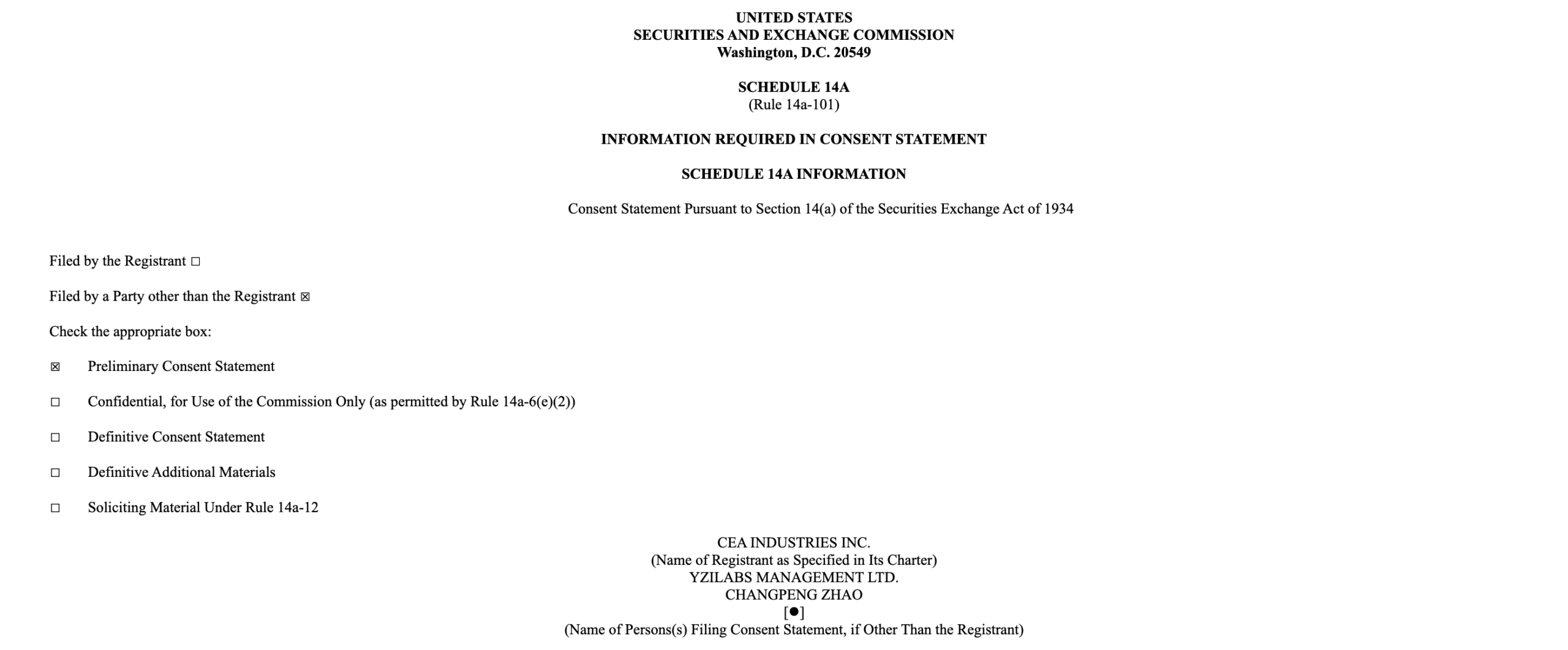

YZi Labs, an investment vehicle formerly known as the family office of Binance founder Changpeng Zhao, has launched an aggressive campaign to take control of CEA Industries, the publicly traded firm attempting to build the world’s most extensive BNB treasury.

Source:

SEC

Source:

SEC

In a regulatory filing on Monday, the firm said it is seeking to cancel all bylaw changes made since July, expand the size of the board, and install its own slate of director nominees. YZi argued that the steps are needed to stop what it called the “ongoing destruction of stockholder value” and ensure the company is aligned with investors’ best interests.

If approved by a majority of shareholders, the move would give Zhao-linked YZi significant influence over the company’s direction and its massive BNB acquisition strategy.

CEA shares collapse despite BNB treasury pivot

CEA’s stock has seen a dramatic reversal since its explosive pivot into crypto. Shares surged 550% on July 28 when the Canadian vape manufacturer announced plans to transform into a major BNB treasury vehicle, reaching a peak of $57.59.

Since then, the momentum has evaporated. The stock has plunged roughly 89%, ending Monday at $6.47, wiping out more than 20% so far this year, well below its pre-pivot price.

The company had touted a $500 million PIPE investment, backed in part by YZi Labs, to accelerate its BNB strategy. That pivot also brought in 10X Capital’s David Namdar as CEO and added several 10X executives to the board. In October, YZi Labs announced its support for 10X Capital’s establishment of the BNB Treasury Company.

YZi criticizes leadership, suggests CEO change

In its filing, YZi faulted CEA’s management for slow investor communications and minimal marketing efforts, arguing that stakeholders have been left in the dark despite the high-stakes treasury strategy. It further accused CEO David Namdar of lacking “devotion and loyalty” to the company, claiming he had publicly promoted other crypto-focused treasury ventures.

YZi suggested that a newly reconstituted board should evaluate whether CEA needs fresh leadership at the top.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Staking Weekly Report December 1, 2025

🌟🌟Core Data on ETH Staking🌟🌟 1️⃣ Ebunker ETH staking yield: 3.27% 2️⃣ stETH...

The Blood and Tears Files of Crypto Veterans: Collapses, Hacks, and Insider Schemes—No One Can Escape

The article describes the loss experiences of several cryptocurrency investors, including exchange exits, failed insider information, hacker attacks, contract liquidations, and scams by acquaintances. It shares their lessons learned and investment strategies. Summary generated by Mars AI This summary was produced by the Mars AI model, and the accuracy and completeness of its generated content are still in the process of iterative improvement.

Mars Morning News | Federal Reserve officials to advance stablecoin regulatory framework; US SEC Chairman to deliver a speech at the New York Stock Exchange tonight

Federal Reserve officials plan to advance the formulation of stablecoin regulatory rules. The SEC Chair will deliver a speech on the future vision of capital markets. Grayscale will launch the first Chainlink spot ETF. A Coinbase executive has been sued by shareholders for alleged insider trading. The cryptocurrency market fear index has dropped to 23. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still in the process of iterative updates.

OECD's latest forecast: The global interest rate cut cycle will end in 2026!

According to the latest forecast from the OECD, major central banks such as the Federal Reserve and the European Central Bank may have few "bullets" left under the dual pressures of high debt and inflation.