Silver’s Breakout Sparks New Crypto Trend: Tokenized Metals Surge

Silver (XAG) is outperforming Bitcoin in terms of retail interest, breaking multi-decade records and prompting investors to explore a new frontier: tokenized silver. With precious-metal liquidity rising, analysts say digital silver may be the next major on-chain asset class. Silver’s 46-Year High Changes Market Psychology Silver closed the month at $58, its highest monthly close

Silver (XAG) is outperforming Bitcoin in terms of retail interest, breaking multi-decade records and prompting investors to explore a new frontier: tokenized silver.

With precious-metal liquidity rising, analysts say digital silver may be the next major on-chain asset class.

Silver’s 46-Year High Changes Market Psychology

Silver closed the month at $58, its highest monthly close in 46 years, with retail interest in silver surpassing Bitcoin in global Google Trends.

“Silver just hit $58 and gave its highest monthly close after 46 years. We can see a massive amount of liquidity in US stocks, gold, and now silver. Sooner or later, this will likely flow into riskier assets, such as Bitcoin and cryptocurrencies. The bull market is not over, it’s delayed,” commented analyst Ash Crypto.

Gold, silver, and Bitcoin interest over time. Source:

Google Trends

Gold, silver, and Bitcoin interest over time. Source:

Google Trends

The surge reflects a broad shift in capital toward hard assets as global inflation, industrial demand, and supply constraints intensify. At the same time, the Silver-to-Bitcoin Ratio has broken a decade-long downtrend.

Silver – Bitcoin RatioBreaking out of a decade long downtrend.

— Florian Kössler (@studentofcycles) December 1, 2025

This signals a notable shift in how retail and institutional investors evaluate store-of-value assets, setting the stage for the rise of tokenized silver.

The Tokenized Silver Market: Early, Small, and Growing

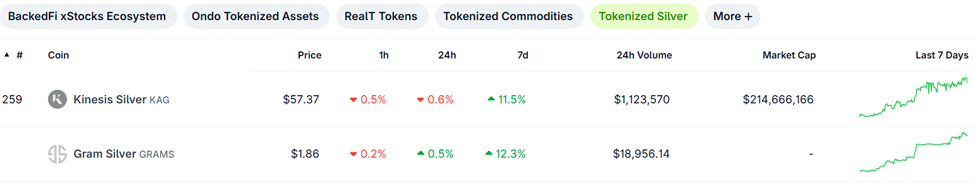

Despite XAG price’s momentum, the tokenized silver sector remains underdeveloped. Only a handful of projects, Kinesis Silver (KAG) and Gram Silver (GRAMS) appear on CoinGecko.

Tokenized Silver. Source:

CoinGecko

Tokenized Silver. Source:

CoinGecko

Yet fundamentals are strengthening. According to Commodity Block research, tokenized silver is “quickly redefining how investors access and interact with the precious metals market, offering:

- Fractional ownership of silver

- 24/7 global trading

- Immutable provenance and traceability

- Use as collateral in DeFi

The report highlights that the tokenized silver market has reached an estimated capitalization of $200 million, while gold-backed tokens dominate at $2.57 billion.

Silver’s accelerating demand suggests a widening appetite for digital commodities, especially as the iShares Silver Trust (SLV) trades at $52.52, reflecting rising global interest. It is up by almost 3% in pre-market trading.

iShares Silver Trust Pre-Market Trading. Source:

Google Finance

iShares Silver Trust Pre-Market Trading. Source:

Google Finance

“Tokenized commodities are shattering traditional ownership models by making physical assets accessible to anyone with an internet connection,” read an excerpt in the report.

Why Investors Care Now

The appeal of tokenized silver aligns with a broader trend: the migration of real-world assets (RWAs) onto blockchain.

Silver’s dual role as both an industrial metal (used in electronics, solar, and medical devices) and an investment hedge makes it uniquely positioned for digital adoption.

Key drivers include:

- Growing demand for fractional investing

- DeFi protocols increasingly accepting silver-backed collateral

- Rising scrutiny over ethical sourcing, which blockchain transparency supports

- Global interest in alternative stores of value during economic uncertainty

Regulatory clarity remains essential. Jurisdictions such as the UAE, Singapore, and parts of the EU are developing frameworks for digital commodities, while global inconsistencies continue to limit cross-border scalability.

On the other side of the fence, the tokenized gold market now exceeds $3 billion, led by Pax Gold (PAXG), Tether Gold (XAUT), and new institutional products like MKS PAMP’s DGLD.

Silver may follow a similar path if infrastructure, custody standards, and exchange listings continue improving.

With silver prices surging, ratios breaking out, and retail interest climbing, tokenized silver may be poised to become crypto’s next major RWA category.

As liquidity rotates across metals and into digital assets, the question for 2025 is no longer if tokenized silver will grow, but how fast.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Chainlink ETF Set to Debut as LINK Slips Amid Market Weakness

Striking baristas win $38.9 million in compensation, yet contract disputes continue

- Starbucks settles NYC Fair Workweek Law violations for $38.9M, including $35.5M restitution to 15,000+ workers. - Striking baristas demand collective bargaining amid ongoing labor disputes and unionization efforts at 550 stores. - Mayor-elect Mamdani and Sen. Sanders join protests, framing demands as moral issues against corporate resistance. - Settlement addresses 500,000 scheduling violations since 2021, with workers receiving $50/week compensation. - Starbucks defends labor law complexity but faces cr

Alphabet's AI-driven ecosystem accelerates flywheel momentum, driving shares up by 68% in 2025

- Alphabet's stock surged 68% in 2025, outperforming peers like Microsoft and Nvidia , driven by strong AI monetization and cloud growth. - Analysts raised price targets to $375-$335, citing Google Cloud's $15.2B Q3 revenue (34% YoY) and $155B cloud backlog growth. - The company's AI ecosystem spans Search, YouTube, and Workspace, generating premium subscriptions and ad yield through Gemini's 650M MAUs. - Projected cloud revenue could exceed estimates by $40B, but risks include regulatory scrutiny and comp

XRP News Today: Vanguard Changes Position on Crypto ETFs, Pointing to Market Maturity and Increased Demand

- Vanguard Group will enable crypto ETF trading on its platform from December 2, 2025, reversing years of opposition to digital assets. - The firm supports Bitcoin , Ethereum , XRP , and Solana ETFs but excludes memecoins, treating crypto as non-core assets like gold . - Market maturation, $25B+ ETF inflows, and regulatory compliance drive the shift, positioning Vanguard as the last major U.S. broker to adopt crypto ETFs. - The move reflects growing institutional confidence in regulated crypto structures a