How a Weak U.S. Labor Market Puts Pressure on Bitcoin and Cryptocurrency Prices

Author: Bradley Peak, Source: Cointelegraph, Translation: Shaw Jinse Finance

1. The Job Market Is "Weak, Not Collapsing," and Crypto Markets Show Signs of Fatigue

After hitting new highs in 2025, bitcoin has struggled to maintain its momentum in the weeks since late November. Meanwhile, U.S. labor market data has started to send another warning signal—not a sudden drop in jobs, but a clear cooling off.

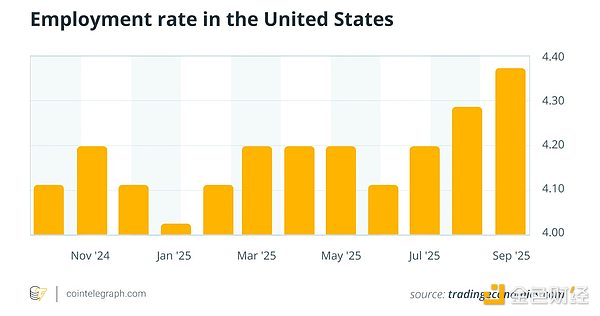

The U.S. unemployment rate has climbed from 3% in 2022-2023 to around 4%, reaching its highest level in recent years. Data from the U.S. Bureau of Labor Statistics (BLS) and the Federal Reserve Economic Data (FRED) series show that monthly nonfarm payroll growth has slowed from post-pandemic levels to a more moderate six-figure increase. Job openings and quits have also declined from their 2021-2022 peaks.

U.S. Employment Rate

This is already a familiar scenario for the stock, bond, and forex markets. Weak labor market data often quickly adjusts expectations for economic growth and influences central bank policy.

Now, cryptocurrencies are also part of the same macroeconomic network. Rather than simply explaining the relationship as causal, it’s better understood this way: changes in the labor market affect risk appetite and liquidity conditions, and these changes are often reflected in the price trends of bitcoin and the broader crypto market.

2. Why Is Labor Data So Critical for Risk Assets?

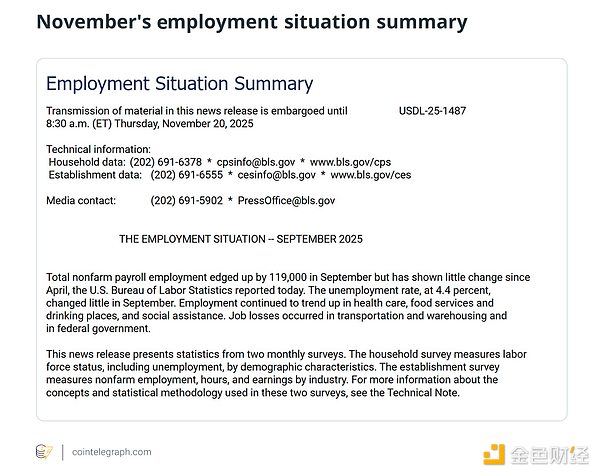

Every month, traders around the world pause their work to await the U.S. Bureau of Labor Statistics (BLS) nonfarm payrolls report. The main data in this report is straightforward: the number of new jobs added, the unemployment rate, wage growth, and labor force participation rate.

November Employment Situation Summary

Behind these numbers lie deeper issues: the health of U.S. consumers and the likelihood of a recession. Strong job growth and low unemployment indicate that households have sufficient income to spend, supporting corporate profits and credit quality. Weak data suggests the opposite.

For macro markets, employment data also directly influences expectations for the Federal Reserve. If labor market data remains stable while inflation stays high, investors infer that interest rates may remain elevated for longer. If unemployment rises and nonfarm payroll growth slows, the case for rate cuts strengthens.

Now, cryptocurrencies are traded within the same ecosystem. Bitcoin and major altcoins are widely held by macro funds, exchange-traded funds (ETFs), and retail investors who also focus on stocks and bonds. Therefore, a weakening labor market can have two opposite effects:

It raises concerns about an economic slowdown or hard landing, which usually prompts investors to sell high-beta assets.

It also increases the likelihood of future policy easing, ultimately supporting risk assets by lowering yields and loosening financial conditions.

The key is that labor data influences expectations and probabilities, but it does not "mechanically" determine bitcoin's next trading direction.

3. Two Main Channels Through Which a Weak Job Market Impacts Crypto

When strategists discuss the pressure the labor market puts on bitcoin and crypto, they usually describe two overlapping channels.

The first is the growth channel. Rising unemployment, slower hiring, and weak wage growth make markets more cautious about future earnings and default risk. In this environment, investors typically reduce the riskiest parts of their portfolios, such as small-cap stocks, high-yield bonds, and volatile assets like bitcoin and altcoins. Cryptocurrencies, especially those other than bitcoin and ethereum, are still seen as high-beta corners of the risk spectrum.

The second is the liquidity and interest rate channel. Similarly weak economic data can trigger investor panic and prompt central banks to adopt looser monetary policy. If the market starts to expect multiple rate cuts, real yields may fall, the dollar may weaken, and global liquidity may expand. Some macroeconomic and digital asset research institutions have noted that periods of rising global liquidity and falling real yields often coincide with strong bitcoin performance, though this relationship is far from perfect.

Macro strategists are increasingly inclined to describe bitcoin as an asset whose role changes with the market environment. Sometimes, it performs like a high-growth tech stock; at other times, it acts as a macro hedge. Around labor market data releases, a common pattern emerges: after poor data, there is a short-term risk-off sentiment; then, as rate cut expectations and ETF inflows recover, the market partially rebounds.

4. What Do Current U.S. Labor Market Trends Really Mean?

To understand the pressure currently facing cryptocurrencies, you can't just look at a single unemployment rate number.

Recent reports from the U.S. Bureau of Labor Statistics (BLS) show that the economy is still adding jobs, but at a slower pace than during the post-pandemic boom. Job growth is slowing, the unemployment rate continues to rise, and surveys show fewer Americans believe jobs are plentiful, while more believe jobs are hard to find.

Industry breakdowns also matter. Recent job gains have mainly come from relatively resilient sectors like healthcare, government, and service industries such as leisure and hospitality. In contrast, manufacturing, some construction, and interest-rate-sensitive business sectors—those more cyclical or involved in goods production—have performed weaker across various indicators.

Forward-looking indicators also confirm this cooling trend. Job openings and quits tracked in the Job Openings and Labor Turnover Survey (JOLTS) are well below peak levels. The frequency of job switching has declined, indicating that the labor market's strong position has faded from the red-hot state of 2021-2022.

A series of mixed labor market signals has sparked debate over whether the U.S. economy will achieve a smooth soft landing or face more turbulence. This uncertainty alone may prompt investors to take a more conservative approach to risk assets, including being reluctant to chase bitcoin after a strong rally.

5. How Cryptocurrencies Are Affected by Recent Changes in Employment Trends

Recent trading activity around monthly employment data releases, while not perfect, provides a useful window into these dynamics.

In recent years, it has become common for nonfarm payroll data to fall short of expectations or for the unemployment rate to unexpectedly rise, showing a familiar pattern. One study found that when nonfarm payrolls beat expectations, bitcoin's average gain is about 0.7%, while when payrolls miss expectations, bitcoin's average loss is about 0.7%. This suggests that when employment data disappoints, traders do indeed reduce exposure to high-beta assets.

In the minutes and hours after data releases, algorithmic and short-term traders driven by headlines about economic slowdown often sell stocks and cryptocurrencies. For example, around the delayed September 2025 report, bitcoin prices briefly soared to around $90,000 before falling back to the mid-$80,000s, with over $2 billion in crypto positions liquidated, including nearly $1 billion in bitcoin long positions.

Once the dust settles, the market's focus shifts to the rates market. If weak economic data triggers expectations for larger Fed rate cuts in futures and swaps, long-term yields will fall. In some cases, as investors rotate back into longer-duration, higher-beta assets, bitcoin stabilizes or partially rebounds in the following trading days. In other cases—especially when a weak labor market is accompanied by banking sector stress or geopolitical shocks—risk-off sentiment dominates, and crypto volatility persists for longer.

Analysts at traditional macro research firms and crypto-native companies alike emphasize that ETF flows, stablecoin liquidity, on-chain activity, and special news such as protocol upgrades or exchange issues can easily overshadow any single data release. In other words, while employment data is important, it is just one of many crypto-specific drivers.

6. Key Labor Data Cycle Points Crypto Investors Should Watch

For investors who want to understand these correlations but don't want to treat them as trading rules, a simple macro dashboard can be very helpful.

Main points include:

New jobs added and unemployment rate: These two form the core of the monthly employment report. A sustained rise in unemployment and slowing job growth usually signal a cooling economy.

Wage growth and hours worked: These reflect household income and purchasing power, which in turn affect economic growth expectations and the Fed's inflation outlook.

JOLTS data such as job openings, quits, and hires: High job openings and quit rates indicate a tight labor market; declines suggest slowing labor demand and weak confidence.

Weekly initial jobless claims: Many macro and quant funds use this high-frequency series as an early warning signal for labor market changes.

Different combinations send different signals. A steady, moderate employment situation and slowing inflation give the Fed room to gradually ease monetary policy, which is usually more favorable for risk assets. A rapid rise in unemployment and a drop in job openings increase the risk of a sharp economic downturn, in which case investors may prefer to hold cash, Treasuries, and defensive assets.

For bitcoin and cryptocurrencies, the key is that a weak labor market means lower prices, and labor data helps predict macroeconomic conditions. These data influence growth expectations, interest rate trends, and liquidity, which in turn affect the level of risk investors are willing to take.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin battles $50K price target as Fed adds $13.5B overnight liquidity

Bitcoin valuation metric projects 96% chance of BTC price recovery in 2026

Bitcoin's ‘more reliable’ RSI variant hits bear market bottom zone at $87K

XRP ETF inflows exceed $756M as bullish divergence hints at trend reversal