After weeks of weakness and a sharp 22% drop in the last month, the popular meme-coin is now showing early signs of strength again. Traders who follow long-term Dogecoin patterns believe that something bigger may be forming beneath the surface

Over the past week, Dogecoin has slowly climbed back, recovering around 6.5% and trading near $0.136 .

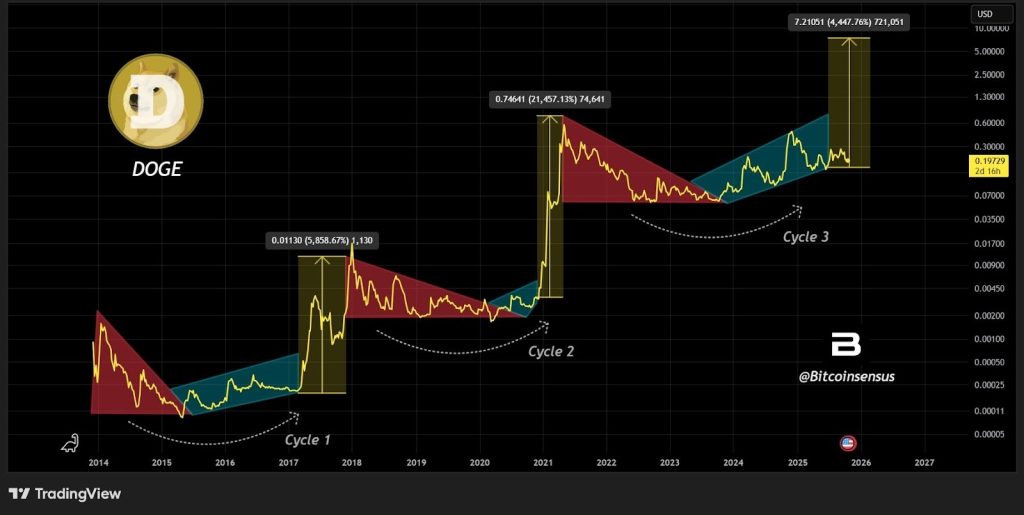

Crypto trader BitcoinSensus shared a long-term chart that DOGE has been moving in the same pattern for many years. In every cycle since 2014, the price first stays quiet for a long time, then slowly breaks out, and finally shoots up in a sudden, powerful rally. This happened in Cycle 1, it repeated almost perfectly in Cycle 2, and now Cycle 3 seems to be forming in the same way.

BitcoinSensus believes that if this pattern continues, analysts believe DOGE could enter its explosive phase next, possibly pushing above $1 and even toward the $1.5 to $1.7 zone.

At the same time, the weekly chart shows another strong signal. Dogecoin has formed a huge Cup and Handle pattern, which is one of the most reliable bullish setups in technical analysis. The cup reflects years of recovery, and the handle is now shaping up, a move that usually comes right before a major breakout.

With trading volume slowly increasing, analysts say traders might already be preparing for the next big rally.

Another crypto analyst Ali Martinez highlights two important levels. First the $0.08 level, which is acting as a strong support and $0.20 as the main breakout level.

However, Martinez hints that Dogecoin is currently moving between these zones while indicators like Bollinger Bands and RSI show tightening conditions, which often happen before a major move.

If DOGE closes a weekly candle above $0.20, analysts believe it could trigger a rally toward $0.80 and possibly even higher if the full cycle repeats

For the first time ever, Dogecoin now has ETF support. Grayscale’s GDOG and Bitwise’s GWOW ETFs have already collected nearly $2 million in early inflows. This number may look small, but it is historic for DOGE because previous cycles never had institutional demand.

If Dogecoin begins a breakout, these ETF inflows could play a major role in pushing the price higher.