The four-year bitcoin cycle is invalidated—who will lead the new two-year cycle?

Author: Jeff Park

Translation: AididiaoJP, Foresight News

Original Title: Bitcoin's Four-Year Cycle Has Ended, Replaced by a More Predictable Two-Year Cycle

Bitcoin has historically followed a four-year cycle, which can be described as a combination of mining economics and behavioral psychology.

Let’s first review what this cycle means: each halving mechanically reduces new supply and tightens miners’ profit margins, forcing weaker participants out of the market and thus reducing selling pressure. This, in turn, reflexively pushes up the marginal cost of new BTC, resulting in a slow but structural supply squeeze. As this process unfolds, fervent investors anchor themselves to the predictable halving narrative, creating a psychological feedback loop. The cycle is: early positioning, price appreciation, viral media-driven attention, retail FOMO, ultimately leading to leveraged frenzy and ending in a crash. This cycle worked because it was a combination of programmatic supply shocks and the seemingly reliable reflexive herd behavior it triggered.

But that was the Bitcoin market of the past.

Because we now know that the supply side of the equation is less effective than ever before.

Bitcoin’s circulating supply and diminishing marginal inflation impact

So what should we expect for the future?

I propose that in the future, Bitcoin will follow a “two-year cycle,” which can be described as a combination of fund manager economics and behavioral psychology dominated by ETF footprints. Of course, I am making three arbitrary and controversial assumptions here:

-

Investors are evaluating their Bitcoin investments on a one- to two-year time frame (rather than longer, because this is how most asset management companies operate in the context of liquid fund management. These are not private/VC closed-end structures holding Bitcoin. It also bluntly assumes that financial advisors and registered investment advisors operate on a similar framework);

-

In terms of “new sources of liquidity injection,” professional investor capital flows via ETFs will dominate Bitcoin’s liquidity, and ETFs become the proxy indicator to track;

-

The selling behavior of veteran whales remains unchanged / is not considered as part of the analysis, even though they are now the largest supply determiners in the market.

In asset management, there are several key factors that determine capital flows. The first is co-holder risk and year-to-date P&L.

Regarding co-holder risk, this refers to the concern that “everyone holds the same thing,” so when liquidity is one-way, everyone needs to make the same trade, thereby amplifying potential moves. We typically see this in sector rotation (theme concentration), short squeezes, pair trades (relative value), and failed merger arbitrage/event-driven situations. But we also see this in multi-asset fields, such as CTA models, risk parity strategies, and, of course, in fiscal-dominated trades where equities represent asset inflation. These dynamic factors are hard to model and require a lot of proprietary information about positions, so ordinary investors find them difficult to access or understand.

But what is easy to observe is point 2: year-to-date P&L.

This is a phenomenon in the asset management industry that operates on a calendar year cycle, because fund fees are standardized annually based on December 31 performance. This is especially evident for hedge funds, which need to standardize their carried interest before year-end. In other words, as year-end volatility increases, and fund managers do not have enough “locked-in” P&L as a buffer from earlier in the year, they become more sensitive to selling their riskiest positions. This relates to whether they get another chance in 2026, or get fired.

In “Flows, Price Pressure, and Hedge Fund Returns,” Ahoniemi & Jylhä documented that capital inflows mechanically push up returns, these higher returns attract additional inflows, and eventually the cycle reverses, with the full return reversal process taking nearly two years. They also estimate that about one-third of hedge fund reporting can actually be attributed to these flow-driven effects, rather than manager skill. This creates a clear understanding of the underlying cyclical dynamics, namely that returns are largely shaped by investor behavior and liquidity pressure, not just by the performance of underlying strategies—factors that determine the latest capital flows into the Bitcoin asset class.

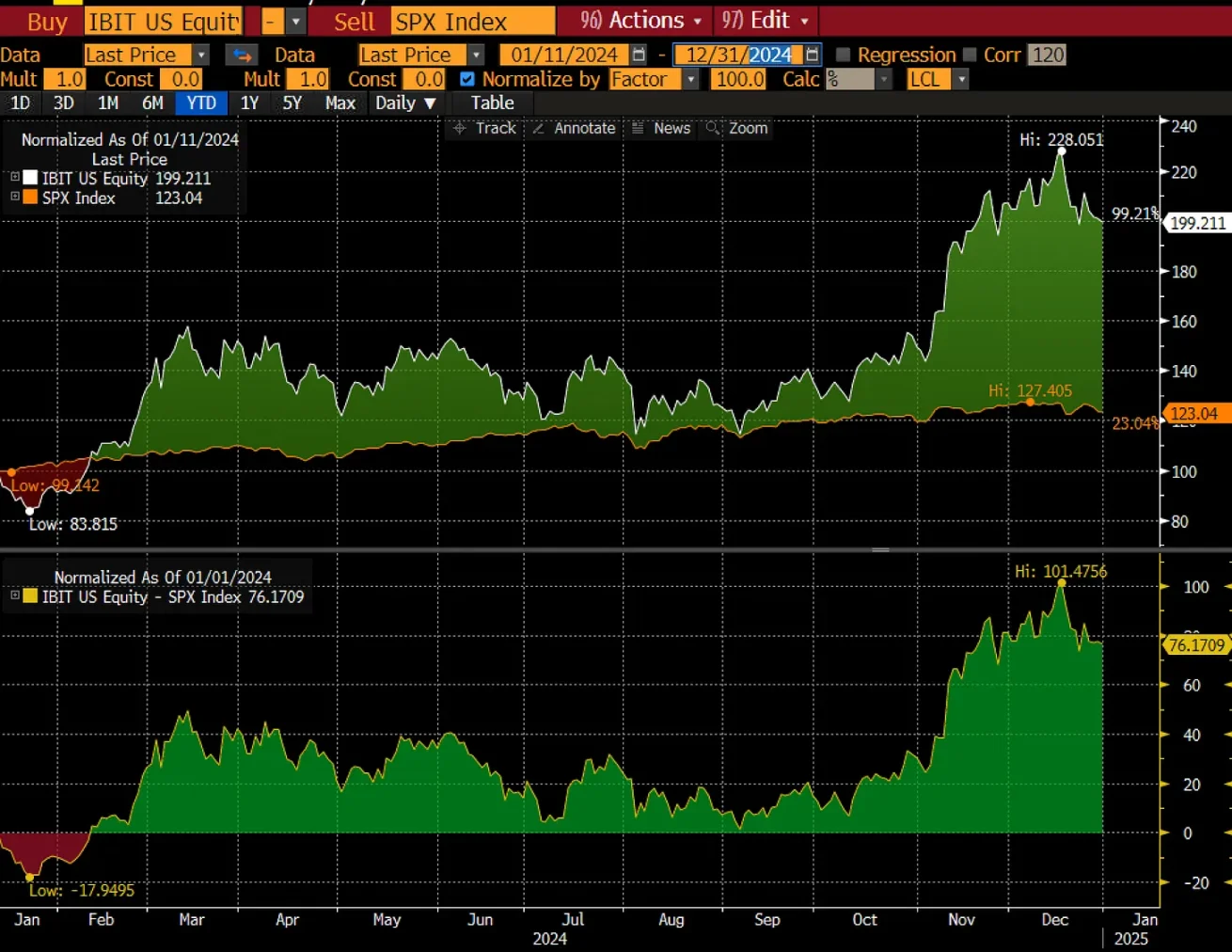

So with this in mind, imagine how a fund manager would evaluate a position like Bitcoin. Facing their investment committee, they are likely to argue that Bitcoin’s annualized growth rate is about 25%, so they need to achieve over 50% compounded growth within that time frame.

In Scenario 1 (from inception to the end of 2024), Bitcoin rose 100% in one year, so that’s great. Assuming Saylor’s proposed 30% annualized growth rate over the next 20 years is the “institutional threshold,” then a year like this achieves 2.6 years of performance in advance.

But in Scenario 2 (from the beginning of 2025 to now), Bitcoin is down 7%, which is not so good. These are investors who entered on January 1, 2025, and are now in a loss position. These investors now need to achieve more than 80% returns in the next year, or 50% returns in the next two years to reach their threshold.

In Scenario 3, those who have held Bitcoin from inception to now / the end of 2025 have seen returns rise about 85% in roughly two years. These investors are slightly above the 70% return required for a 30% annualized growth rate over that time frame, but not as much as they would have observed at this point on December 31, 2025, which presents them with an important question: Should I sell now to lock in profits, secure my performance, and claim victory, or let it run longer?

At this point, rational investors in the fund management business would consider selling. This is because of the reasons I mentioned above, namely

-

Fee standardization

-

Reputation protection

-

Combining “risk management” as a premium service with a continuous flywheel effect

So what does this mean?

Bitcoin is now approaching an increasingly important price of $84,000, which is the total cost basis of ETF inflows since inception.

But just looking at this picture is not complete. Take a look at this chart from CoinMarketCap, which shows the net monthly capital flows since inception.

You can see here that most of the positive P&L comes from 2024, while almost all ETF capital flows in 2025 are in a loss position (except for March). Considering the fact that the largest monthly inflow occurred in October 2024, when Bitcoin was already priced at $70,000.

This can be interpreted as a bearish pattern, because those who invested the most at the end of 2024 but have not yet reached their return threshold will face decision points as their two-year period approaches over the next year, while those who invested in 2025 will need to perform well in 2026 to catch up, which may lead them to preemptively stop out, especially if they believe higher investment returns can be found elsewhere. In other words, if we enter a bear market, it’s not because of the four-year cycle, but because the two-year cycle never allowed new capital from fund managers to enter at a suitable entry point relative to exiting investors taking profits.

In October 2024, the closing price was $70,000. In November 2024, the closing price was $96,000. This means that when the one-year period arrives, their thresholds are set at $91,000 and $125,000, respectively (I admit this is a bit rough, as it doesn’t account for intra-month prices and needs to be adjusted more appropriately). If you take a similar approach for June 2025 (the month with the largest year-to-date inflow), then a price of $107,000 means that by June 2026, $140,000 becomes a threshold. By then, you either succeed or fail again. By now, you can probably intuitively understand that the comprehensive analysis is to combine all these capital flows with a time-weighted average.

As shown below, we are at a turning point: if we drop 10% from here, the assets under management of Bitcoin ETFs could return to the level we started the year with ($103.5 billions).

All of this shows that not only is it important to monitor the average cost basis of ETF holders, but also to monitor the moving average of P&L by entry period. I believe these will become more important sources of liquidity supply and circuit breaker pressure in future Bitcoin price action than the historical four-year cycle. This will lead to a “dynamic two-year cycle.”

The second most important conclusion here is that if Bitcoin’s price does not fluctuate but time moves forward (whether you like it or not, it will!), this is ultimately unfavorable for Bitcoin in the institutional era, because fund managers’ investment returns are declining. Asset management is a business about “cost of capital” and relative opportunity. So if Bitcoin’s investment return declines, it’s not because it rises or falls, but because it consolidates sideways, which is still unfavorable for Bitcoin and will lead investors to sell when their returns are compressed below 30%.

In summary, the four-year cycle has definitely ended, but the end of old tricks does not mean there are no new tricks to play. Those who understand this specific behavioral psychology will find a new cycle to operate in. This is more difficult because it requires more dynamism in understanding capital flows in the context of cost basis, but ultimately, it will reaffirm the truth about Bitcoin: it will always fluctuate based on marginal demand, marginal supply, and profit-taking behavior.

It’s just that the buyers have changed, and supply itself has become less important. The good news is: these buyers, as agents of other people’s money, are more predictable, and the fact that supply constraints are less important means that more predictable factors will become more dominant.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Forbes 2026 Crypto Trend Forecast: Where Will the Market Go After Volatility Decreases?

The stablecoin frenzy, the financialization of bitcoin, and cross-border capital flows are accelerating the restructuring of the industry.

Once the most lucrative application, is it now completely abandoned?

You may have misunderstood JESSE; this is an attempt to bring revenue to the Base chain.