This Week's Preview: BTC Returns to 86,000, Trump’s Epic Showdown with Major Shorts, Macro Turmoil Just Settled

After last week's global market panic and subsequent recovery, bitcoin rebounded to $86,861. This week, the market will focus on new AI policies, the standoff between bears and bulls, PCE data, and geopolitical events, with intensified competition. Summary generated by Mars AI. The accuracy and completeness of this summary, produced by the Mars AI model, are still being iteratively improved.

(November 24, 2025 - November 30, 2025)

Last week, global markets underwent a stress test dominated by macro panic. The lagging impact of September’s non-farm payroll data, combined with hawkish statements from the Federal Reserve, once led investors to mistakenly believe that the AI bubble was about to burst. However, as institutions such as CITIC Securities pointed out that the decline was actually profit-taking rather than a deterioration of fundamentals, and with New York Fed President Williams providing timely dovish reassurance over the weekend, market sentiment quickly rebounded in early trading on Monday.

Bitcoin (BTC) rebounded strongly this morning, once breaking through $88,000 and is now reported at $86,861 (UTC+8). This marks a shift in the market from pure fear to a new round of strategic positioning.

Although this week’s trading days are shortened due to the US Thanksgiving holiday, the narrative density is extremely high. We will witness a top-tier showdown between bulls and bears: on one side, Trump launches the national-level AI Genesis Mission, and on the other, the legendary short seller Michael Burry vows to expose the profit black holes of tech giants. Coupled with the last PCE inflation data before the Federal Reserve enters its blackout period, this week is destined to be a direct confrontation between policy-driven bullishness and valuation-driven bearishness.

Key Focus 1: The Ice and Fire of the AI Narrative—Trump’s New Policy vs. The Big Short’s Attack

This week, the AI and tech sectors will no longer be calm, as two opposing forces will clash fiercely at the start of the week.

- Bullish Nuclear Bomb (Monday): Trump Signs the Genesis Mission Trump plans to sign this AI policy, likened to the Manhattan Project, at the White House. This is not just an executive order, but a signal that the US is elevating computing power to the level of national strategic security.

- Core Logic: Mobilizing national power to remove bottlenecks in AI development related to computing power and regulatory constraints.

- Market Impact: This is a long-term and significant positive for AI infrastructure, chip manufacturing, and the DePIN (decentralized physical infrastructure) sector in crypto. It implies a substantial increase in electricity and computing resources, providing a strong boost for investors worried about computing power bottlenecks.

- Bearish Sniper (Tuesday): The Big Short Michael Burry Exposes Depreciation Scandal Michael Burry, who famously shorted subprime mortgages in 2008, is once again standing on the opposite side of the market. He accuses tech giants of inflating profits by underestimating depreciation (extending server lifespans), with the amount reaching $176 billions, specifically naming Meta and Oracle.

- In-depth Analysis: This is not a simple financial query, but a challenge to the sustainability of the AI business model. If the market accepts Burry’s logic—that rapid hardware iteration renders existing assets worthless—then the high valuation logic of tech stocks will face a reassessment.

- Crypto Perspective: If the Nasdaq pulls back due to Burry’s short report, Bitcoin, as a high-beta asset, will inevitably be affected. But if the market ignores this news (believing cash flow remains strong), the rebound will be even more intense.

Key Focus 2: The Final Macro Hurdle—PCE Data and Geopolitical Ultimatum

- November 26 (Wednesday, UTC+8): US October Core PCE Price Index, Q3 GDP Revision

- November 27 (Thursday, UTC+8): Trump’s Ultimatum Day for Russia-Ukraine

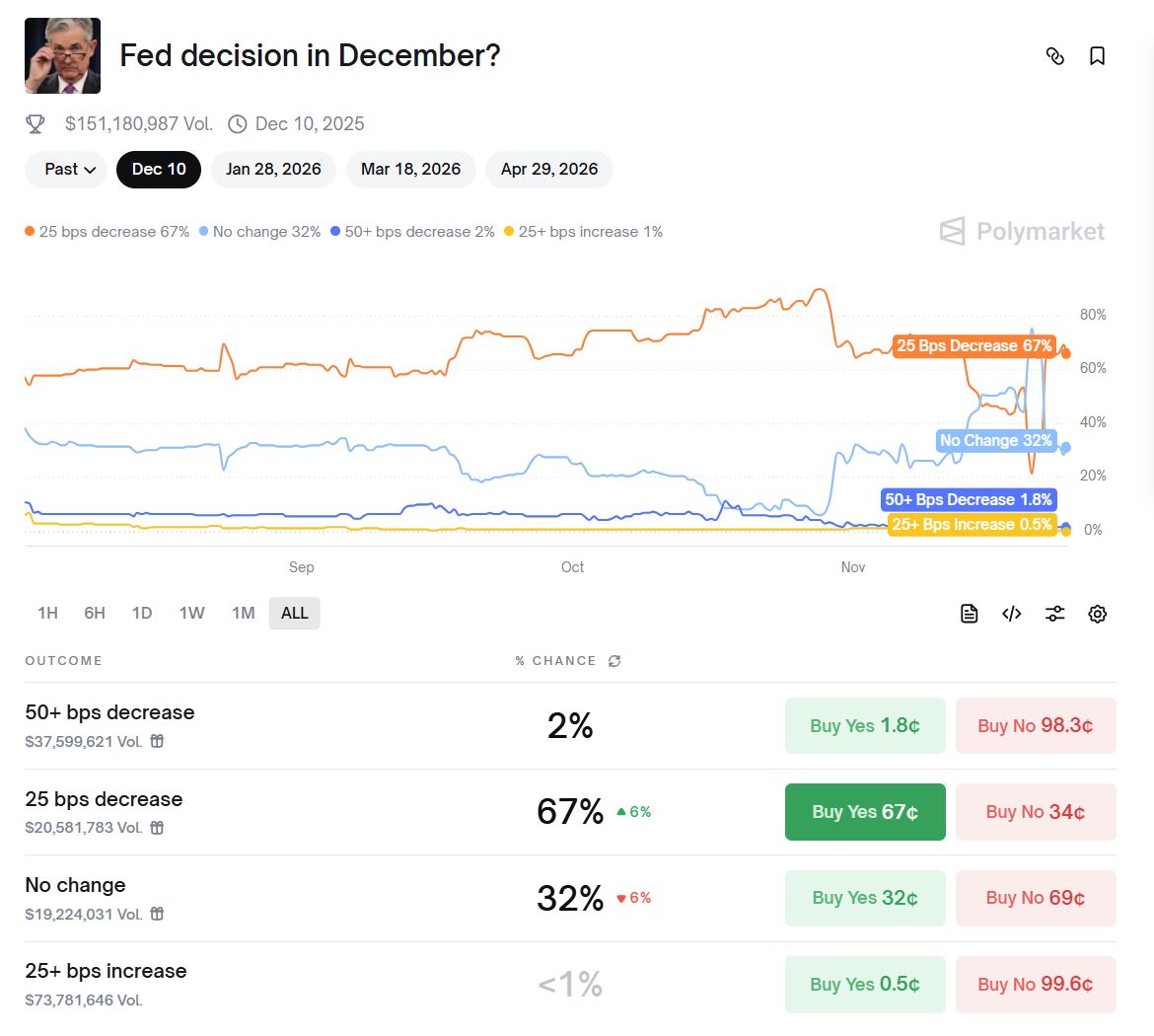

1. Final Confirmation for a December Rate Cut New York Fed President Williams hinted over the weekend that a December rate cut is appropriate, directly pulling the market’s rate cut expectations back to 70%. As the Federal Reserve will enter its blackout period this Friday (29th), Wednesday’s PCE data will be the final verdict in this round of positioning.

- Scenario Analysis:

- In Line with Expectations (Moderate): As long as PCE does not accelerate significantly, Williams’ dovish remarks will be seen as the official stance. The market will confirm a 25bps rate cut in December, the dollar index will fall, and this will be bullish for BTC to challenge $90,000.

- Above Expectations (Overheating): This will sharply contradict Williams and trigger intense expectation swings. Considering the deterioration of liquidity before Thanksgiving, this could lead to preemptive selling before the holiday.

2. Separating Fact from Fiction in Geopolitics Trump has declared November 27 as the final deadline for Ukraine to accept the 28-point peace plan.

- Potential Risks: If a peace agreement is reached, it will be seen as a major release of global geopolitical risk, benefiting risk assets; if negotiations break down or the situation escalates, the safe-haven attributes of gold and Bitcoin may be reactivated, but this will also come with a surge in market volatility.

Other Events Worth Watching

- Tuesday: Alibaba Earnings Report. As a bellwether for Chinese concept stocks, its performance will test the resilience of Chinese e-commerce under macro headwinds.

- Thursday: US Thanksgiving Market Holiday. Be alert to liquidity drying up on Wednesday night (during US trading hours) due to the approaching holiday, which often amplifies price volatility in the crypto market.

This Week’s Summary and Outlook

In summary, the main theme of the market this week is recovery and strategic positioning.

Williams’ speech has already put an end to last week’s macro panic, and BTC returning above $86,000 is the best proof. The focus now shifts to a deeper logical debate: Should we believe in the AI “sea of stars” brought by Trump’s Genesis Mission, or worry about the earnings bubble seen by the big short?

For crypto investors, the most dangerous macro moment seems to have passed (unless PCE data delivers a major shock). The trading rhythm this week should be: focus on policy dividends from the AI narrative at the start of the week, closely watch the PCE data midweek, and be cautious of flash crashes due to low liquidity around Thanksgiving at the end of the week.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Latest Global On-Chain Wealth Rankings: Who Are the Top Players in the Crypto World?

The latest on-chain rich list shows that crypto assets are highly concentrated in the hands of a few whales, making the wealth distribution pattern increasingly clear.

Monad mainnet launches tonight: key information you must know

Based on the pre-market price of around $0.032-0.034 at the time of publication, the public offering participants' notional returns are between 28% and 36%.

The Federal Reserve is deeply embroiled in an "internal war," making a December rate cut a "coin toss" bet.

Significant policy divisions have emerged within the Federal Reserve, making the question of whether to cut interest rates in December a key focus. Powell’s silence has increased market uncertainty, while political pressure and the lack of economic data have further complicated decision-making.

Filecoin Onchain Cloud: Application Case Analysis and Launch of Limited Edition NFT Program for Early CloudPaws Contributors

Filecoin is a protocol-based decentralized data storage network designed to provide long-term, secure, and verifiable data storage capabilities.