Crypto coalition calls on Trump to direct federal agencies to expedite stalled tax and regulatory guidance

Quick Take Federal agencies can take “immediate steps,” said the Solana Policy Institute in a letter sent to President Donald Trump on Thursday The groups asked Trump to direct the IRS through guidance to apply de minimis tax rules to crypto, such as creating a $600 threshold.

More than 65 cryptocurrency organizations are calling on President Donald Trump to direct the Treasury Department and the IRS to issue long-overdue digital asset tax guidance, emphasizing that regulatory clarity has become a top priority in the absence of legislative progress.

Federal agencies can take "immediate steps," said the Solana Policy Institute, alongside crypto firms such as Exodus, Mysten Labs and Uniswap Labs, sent a letter to Trump on Thursday.

Recommendations in the letter stem from recommendations made in the President's Working Group Report on Digital Assets, the institute said. In July, the White House released a long report outlining recommendations for how crypto should be regulated, including language around banking, stablecoins and taxes.

"The roadmap exists," the institute said in a post on X. "Now agencies must act to cement American leadership in crypto."

The groups asked Trump to direct the IRS through guidance to apply de minimis tax rules to crypto, such as creating a $600 threshold and direct the Treasury to issue guidance that staking and mining rewards are "self-created property taxed upon disposition and sourced to the residence of the taxpayer."

On Capitol Hill, Sen. Cynthia Lummis, R-Wyo., has been working on legislation to define how digital assets should be taxed. She introduced a bill in July that would end the double taxing of miners and stakers and set forth a $300 transaction threshold to be exempt from taxes, among other changes.

Other asks

The groups also asked Trump to protect decentralized finance, in part through urging the Securities and Exchange Commission and the Commodity Futures Trading Commission to issue exemptive relief.

As for the Department of Justice, the groups asked Trump to urge the DOJ to dismiss charges against Tornado Cash developer Roman Storm. Storm was charged in 2023 with money laundering, conspiracy to operate an unlicensed money transmitting business, and sanctions violations. In August, a jury was unable to reach a verdict on money laundering and sanctions charges, but found Storm guilty on the money transmitting charge.

Soon after in August, Matthew J. Galeotti, acting assistant attorney general of the Justice Department's Criminal Division, said that "writing code" is not a crime

"Dropping the case would reaffirm the Administration’s commitment to protecting developers," they said in the letter. "Doing so will further support that code is speech under the First Amendment and signals that the U.S. will protect innovation."

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Morning Brief | Bitcoin Sharpe Ratio Drops Below 0; Google Plans to Sell TPUs Directly to Meta; Paxos Announces Acquisition of New York Crypto Wallet Startup Fordefi

Overview of major market events on November 25.

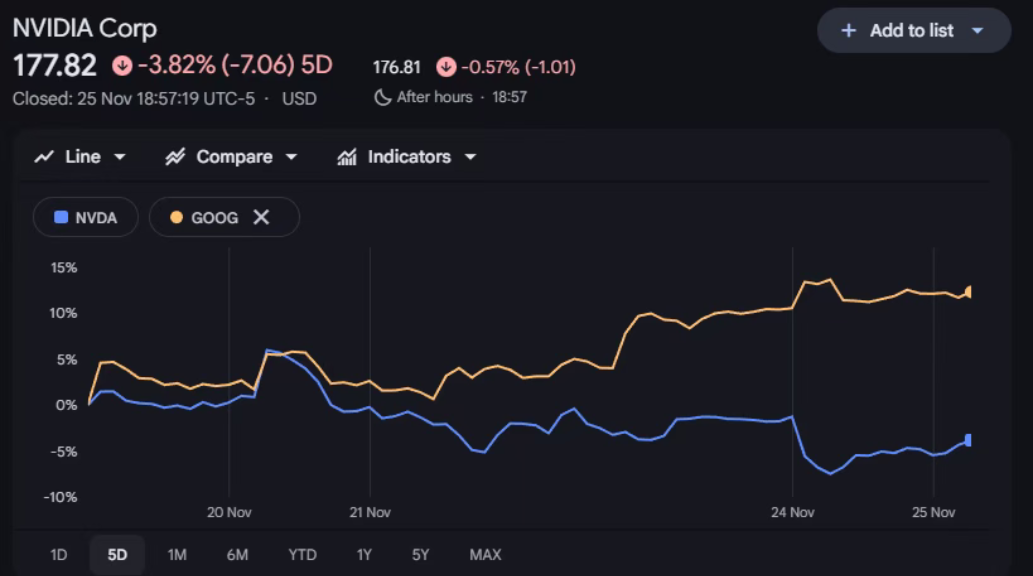

Is Nvidia getting anxious?

Bitcoin wavers under $88K as traders brace for $14B BTC options expiry

The likelihood of a bitcoin short squeeze to $90,000 increases as funding rates turn negative

After dropping from $106,000 to $80,600, Bitcoin has stabilized and started to rebound, sparking discussions in the market about whether a local bottom has been reached. While whales and retail investors continue to sell, mid-sized holders are accumulating. Negative funding rates suggest a potential short squeeze. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively improved by the Mars AI model.