- Analysts say Bitcoin may be approaching a local bottom, citing key support at the 61.8% Fibonacci retracement at $94,253, and reversal could lead to an overall crypto market rally.

- Altcoins show early signs of stabilizing, with ETH and XRP attempting to hold key support levels after sharp weekly declines.

Even as US equities and Gold continue to deliver strong gains, Bitcoin (BTC) and the broader crypto market have delivered a subpar performance. With BTc extending its weekly losses to 10%, market analysts question where the bottom lies.

On the other hand, altcoins like Ethereum (ETH), XRP, and Solana (SOL) have also extended double-digit losses over the past week, triggering massive crypto market liquidations.

Will Crypto Market Recover As Bitcoin Tests Local Bottom?

Crypto market liquidations have hit another $500 million today as the BTC price took a dive under $93,000 earlier today. The long liquidations dominate at $378 million, as top altcoins like ETF, XRP, and SOL face volatility.

However, market experts have started believing that the Bitcoin bottom could soon be in, while projecting a reversal to the upside. BTC pulled back nearly 10% last week after being rejected at the 38.20% Fibonacci retracement level at $106,453, measured from the April 7 low of $74,508 to the October 6 all-time high of $126,299. As of Monday, the asset is trading near $95,300.

If BTC price holds support around the 61.8% Fibonacci retracement level at $94,253, it could resume its rebound and retest the $106,453 level.

Source: TradingView

Source: TradingView

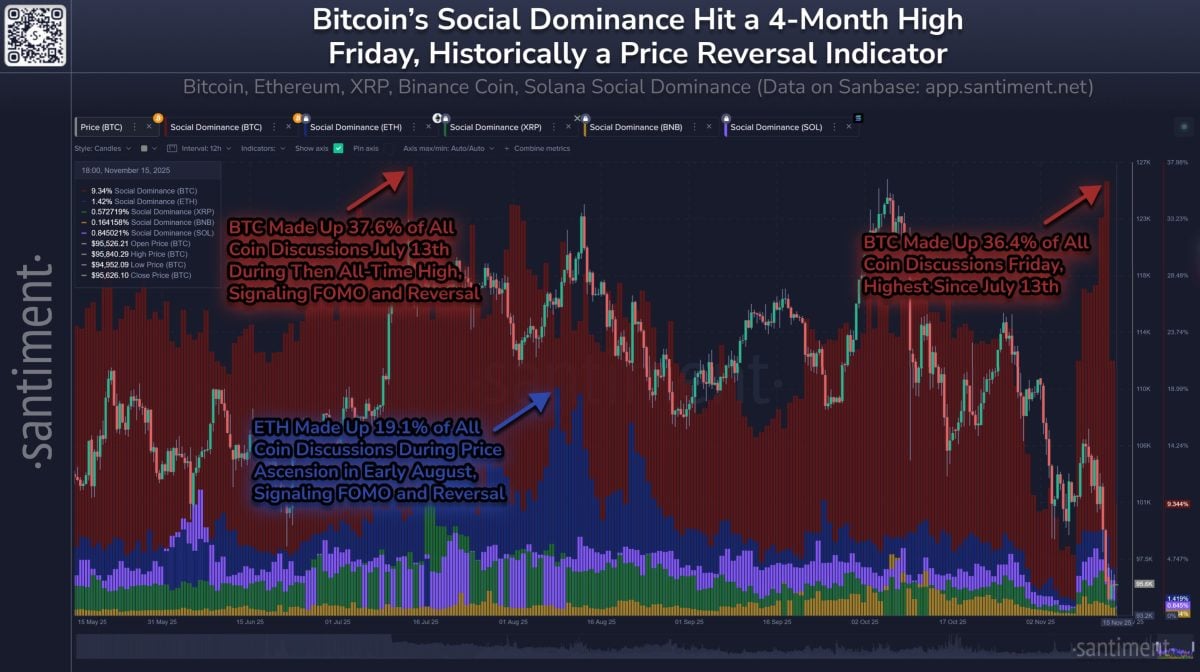

Additionally, blockchain analytics firm Santiment reported that while it is not a definitive market-bottom indicator, the likelihood of a reversal increases when Bitcoin’s social dominance spikes.

During Friday’s drop below $95,000, discussion levels reached a four-month high. They highlighted that BTC could soon find its footing as retail panic and fear increase.

Source: Santiment

Source: Santiment

At the same time, analyst Ted Pillows said the ongoing price action suggests Bitcoin remains in a Wyckoff distribution phase. He noted that the $88,000–$90,000 range may provide a key support zone and potentially serve as a local bottom. He also questioned where the crypto market might establish its next definitive bottom.

Source: Ted Pillows

Source: Ted Pillows

A Look At ETH, XRP Recovery Chances

Amid the broader crypto market sell-off, top altcoins like ETH, XRP, and others have also extended losses. Ethereum fell nearly 14% after being rejected at the previously broken trendline near $3,592 last week, with the token trading around $3,100 on Monday.

Source: TradingView

Source: TradingView

A hold above support at $3,017 could set the stage for a move back toward the $3,592 resistance zone. Similar to Bitcoin, Ethereum’s RSI has bounced from oversold territory, indicating weakening bearish momentum.

Similarly, XRP encountered resistance at the 50-day EMA near $2.49 last week, leading to a decline of almost 7%. As of Monday, the token is trading around $2.25.

A continued recovery could open the path for a move back toward the 50-day EMA at $2.49. The daily RSI sits at 42, close to the neutral 50 mark, indicating weakening bearish momentum.

Source: TradingView

Source: TradingView