Bitcoin Price Tanks Below $97K as Analyst Warns the Worst Is Yet to Come

Despite the positive developments on a macro front, such as the US government reopening, BTC’s quite unfavorable price actions continued in the past 12 hours or so as the asset plunged to a new multi-month low.

The cryptocurrency stood above $107,000 just three days ago after Trump promised to send tariff checks of at least $2,000 to some Americans and hinted that the government shutdown might end soon. However, bitcoin failed to capitalize on this momentum and quickly dipped back to $103,000.

Nevertheless, it rebounded to $105,000 on Wednesday before the bears took complete control of the market, especially on Thursday. The POTUS signed legislation to reopen the government, which was first followed by an immediate bounce, but the landscape changed for the worse shortly after.

In less than a day, bitcoin dumped by more than eight grand and currently struggles below $97,000, which is the lowest it has been since early May.

Doctor Profit, who has been bearish on the asset for weeks, believes the worst is yet to come by predicting another nosedive to somewhere around $90,000 and $94,000.

#Bitcoin: First promised target of 90-94k region is about to be hit. Important to note that I wont take any profits from the short at 90-94k region! https://t.co/p6qQqxsaor pic.twitter.com/Rhamwixvct

— Doctor Profit 🇨🇭 (@DrProfitCrypto) November 14, 2025

The altcoins have followed suit with multiple double-digit price declines. AAVE, ENA, RENDER, SUI, PEPE, and LINK are also down by more than 12%. Even the largest of the bunch has plunged by over 11% and now struggles well below $3,200.

You may also like:

- Bitcoin’s Price Jumps as Trump Signs Bill to End Record US Govt Shutdown

- Bitcoin Tumbles Below $100K Again, Liquidations Approach $700 Million

- BTC Steadies Over $100K: Sign of Maturity While ‘Moonvember’ Buzz Builds

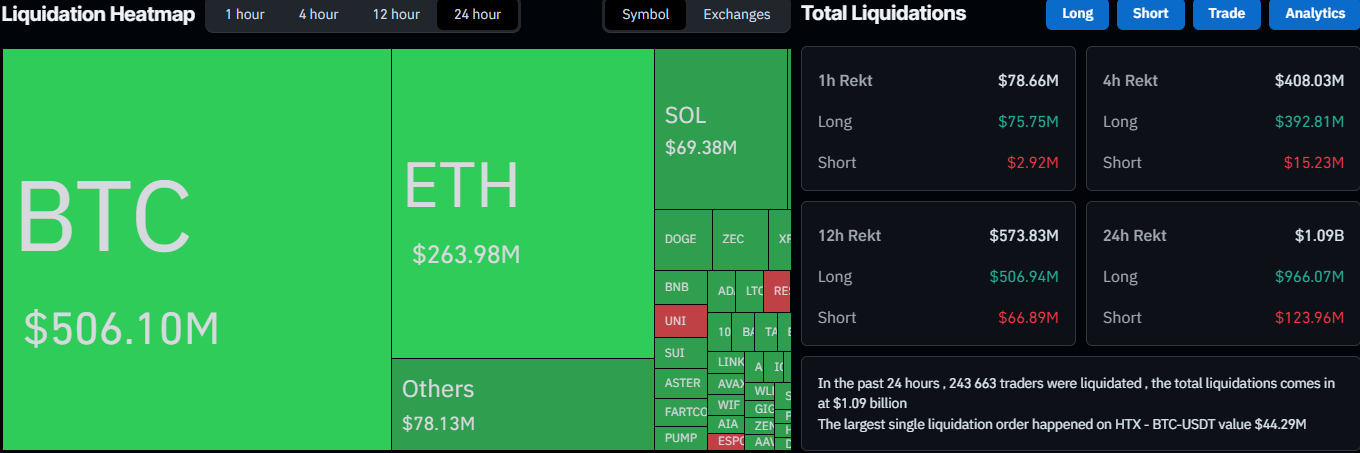

The total value of wrecked positions has skyrocketed to almost $1.1 billion on a daily basis. The single-largest liquidated position, according to CoinGlass, took place on HTX and was worth a whopping $44.29 million. The number of wrecked traders is above 240,000.

Naturally, longs represent the lion’s share, with $966 million. Short liquidations are worth $124 million as of press time.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates: Saylor's Fiery Voyage: MicroStrategy Remains Committed to Bitcoin Amid Growing Market Strain

- MicroStrategy's Michael Saylor denies selling 47,000 BTC amid rumors, reaffirming the company's commitment to aggressive BTC accumulation. - Analysts project 6,720 BTC additions via STRE issuance, targeting 27% BTC yield and a $141k BTC price by year-end. - Market skepticism grows as MicroStrategy's stock drops 35% YTD, trading below NAV amid mNAV ratio concerns and short-seller warnings. - New entrants like BSTR and Reitar Logtech expand BTC treasury strategies, signaling broader institutional adoption

Ethereum Latest Updates: BitMine Invests $12.5 Billion in Ethereum, CEO Predicts a Repeat of the 1990s Internet Surge

- BitMine appoints Chi Tsang as CEO and adds three board members to accelerate Ethereum holdings expansion. - The firm increased ETH purchases by 34% last week, holding 3.5M ETH ($12.5B) despite price drops. - Tsang compares Ethereum's growth to the 1990s internet boom, aiming to bridge traditional and crypto markets. - Regulatory compliance and market skepticism follow the leadership change, with BMNR down 4.7% premarket.

Public's $65 Million CryptoIRA Initiative Reflects Surging Interest in Tax-Beneficial Crypto Retirement Options

- Public acquires Alto's CryptoIRA business for $65M to enable IRA crypto trading by early 2026. - Acquisition expands retirement crypto options amid rising retail demand and evolving regulations. - Existing Alto customers retain platform access until integration, with seamless transition planned. - Alto shifts to custodial role under CaaS model, while Public handles trading functionality. - Move reflects crypto fintech consolidation and growing investor interest in tax-advantaged digital assets.

ZEC Jumps 6.68% Following Winklevoss-Supported Treasury Approach

- Zcash (ZEC) surged 6.68% in 24 hours to $548.91 on Nov. 14, 2025, despite a 9.98% weekly decline. - Winklevoss-backed Cypherpunk Technologies rebranded from a biotech firm to a ZEC-focused treasury strategy, acquiring 1.25% of total ZEC supply. - The firm aims to hold 5% of ZEC supply (800,000 tokens) as a privacy hedge, supported by $58.9M in funding and a $200M equity facility. - ZEC's 37.03% monthly gain and 885.34% annual rise reflect growing demand for privacy-centric assets, with Network Upgrade 6.