Bitcoin News Today: Bitcoin’s Recent Decline Ignites Discussion: Is This a Temporary Correction or the Start of a Larger Downtrend?

- Bitcoin long-term holders offloaded 815,000 BTC in 30 days, pushing price below $100,000 and triggering $683M liquidations. - Analysts link the selling to profit-taking after prolonged rallies, with open interest dropping 27% to $68.37B as demand remains subdued. - Market debates whether this marks a mid-cycle correction (22% average drawdowns historically) or a broader bearish shift. - Despite volatility, 72% of BTC supply remains in profit, and DeFi TVL exceeding $1T signals potential long-term resilie

Bitcoin Long-Term Holders Unload 815K BTC in a Month, Stirring Market Turbulence

On Thursday, Bitcoin slipped below $100,000 for the second time in a week, heightening worries about market steadiness as long-term investors

The recent price drop resulted in

Market experts warn that increased selling by long-term holders heightens liquidity concerns. "

The downturn has sparked debate about whether the market is undergoing a mid-cycle pullback or entering a more prolonged bearish phase. Bitfinex analysts suggest the current environment

The broader cryptocurrency market reflected Bitcoin’s challenges.

The future trajectory depends on a revival in demand. "

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

VIPBitget VIP Weekly Research Insights

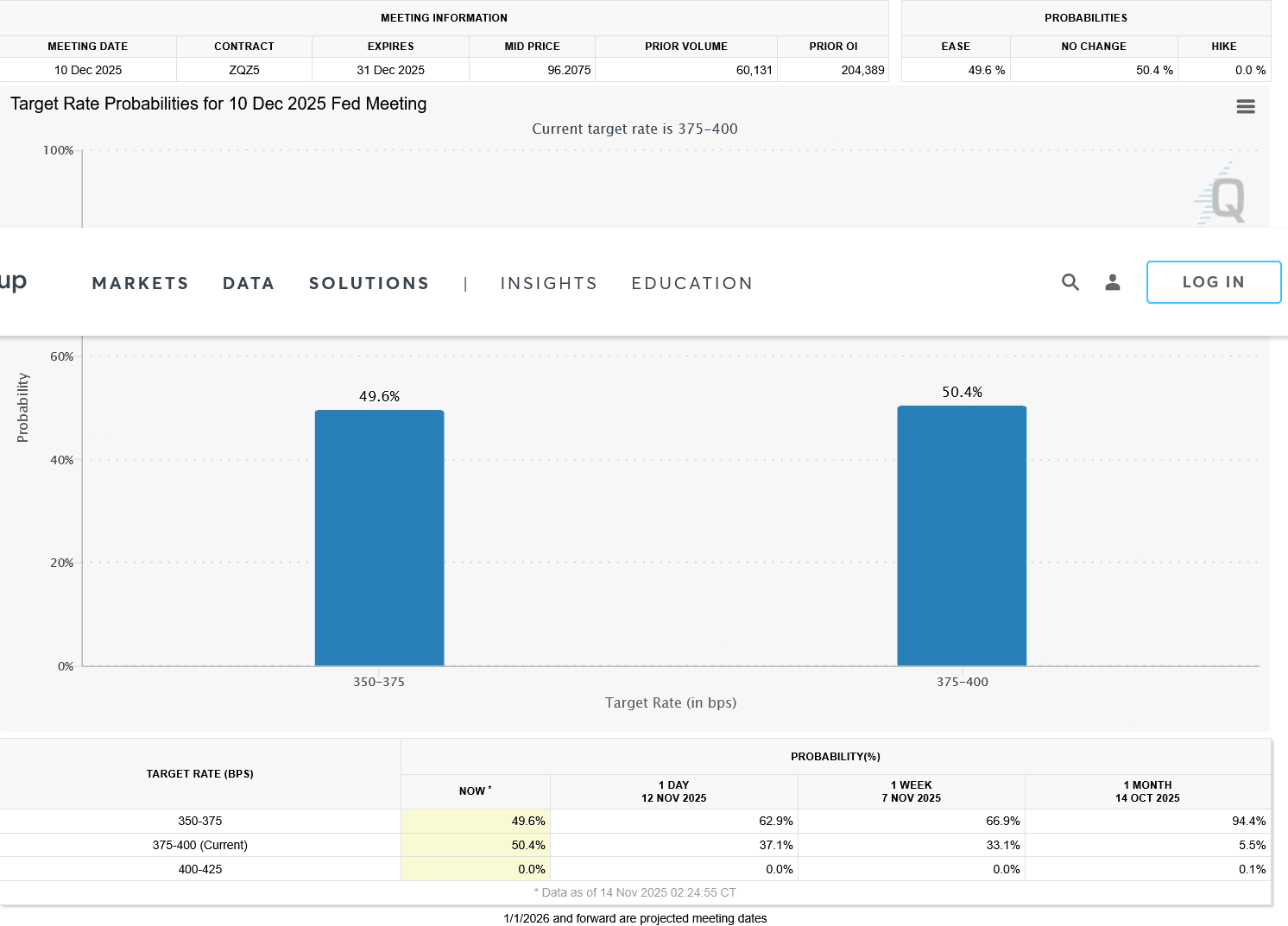

Global markets are experiencing multiple transformative catalysts supporting the recovery of risk assets. For instance, Trump has revived his proposal to distribute $2000 "tariff dividend" checks to every American using tariff revenues. While the plan faces hurdles such as congressional approval and inflationary concerns, it has already boosted consumer confidence and is expected to inject trillions of dollars in liquidity, benefitting high-growth technology sectors. Meanwhile, the U.S. government shutdown has reached a record 41 days. With the Senate having reached an agreement, it's expected to end on November 11—potentially triggering a renewed fiscal injection of tens of billions of dollars and a V-shaped rebound similar to past shutdown recoveries. Market expectations for a rate cut at the Federal Reserve's December FOMC meeting are also rising, with a 62.6% probability priced in for a 25-basis-point cut. Some Trump-backed officials even advocate for a 50-basis-point reduction, which would extend the easing cycle and further stimulate investment in crypto and AI infrastructure. Together, these factors may drive a 5–10% rebound in total crypto market capitalization, creating a window of opportunity for allocation to high-quality projects.

Massive $869M Outflow Slams Bitcoin. Is a Crash Coming?

Ethereum Latest Updates: BitMine Commits $12 Billion to ETH—Chairman Predicts $12,000 Despite 13% Market Drop

- BitMine Immersion Technologies (BMNR) surged ETH purchases by 34% to 110,288 tokens weekly, now holding 3.5M ETH (2.9% supply) valued at $12.76B. - Leadership overhaul appoints Chi Tsang as CEO, aligning with chairman Tom Lee's "supercycle" vision and $12K ETH price target by 2025. - Market reacts mixed as ETH dips 13.4% in two weeks, with treasury buys currently underwater and regulatory shifts like CFTC oversight emerging. - Shareholders demand transparency amid unstaked ETH holdings and evolving crypt

Vitalik Buterin's Breakthrough in ZK Technology: Ushering in a New Age of Privacy and Blockchain Scalability

- Vitalik Buterin drives Ethereum's ZK innovations to solve scalability and privacy challenges, positioning ZK as crypto's next growth pillar. - Modexp precompile updates and GKR protocol reduce proof costs 50x-15x, enabling ZK-rollups to process 43,000 TPS with near-zero fees. - ZK integration with MPC/FHE/TEE expands use cases beyond DeFi, with ZK-FHE hybrids targeting enterprise adoption in healthcare and finance . - ZK Layer 2 market projected to grow at 60.7% CAGR to $90B by 2031, driven by institutio