Key Market Information Discrepancy on November 14th - A Must-See! | Alpha Morning Report

Editor's Picks

1.Crypto Market Suffers Another Blow as Bitcoin Touches $98,000, US Stock Crypto Concept Stocks Fall Across the Board

2.Musk Announces X Money Will Soon Go Live

3.Aster Launches DEXE Trading Event with Rewards Totaling Over $200,000

4.Boosted by Robinhood Listing, AVNT Surges Over 8%

5.Total Liquidations in the Past 24 Hours Soar to $748 Million, Over 197,000 People Liquidated

Articles & Threads

1. "The New Era of Token Financing, a Milestone in US Regulatory Financing"

The discussion about Monad's ICO on Coinbase with a $25 billion FDV was a hot topic this week. Apart from debating whether the sale at a $25 billion FDV is worth participating in, the "compliance level" as Coinbase's first ICO also sparked widespread discussion and was seen as a landmark event in the industry's compliance. Stablecoin issuer Circle mentioned in its recent quarterly report that it is exploring the possibility of issuing native tokens on the Arc Network. Coinbase also hinted at the launch of the Base token this October, almost two years after the joint founder of Base Chain, Jesse Pollak, said in an interview. All signs indicate that asset issuance in the industry is entering a new era of compliance.

2. "Major Adjustment in U.S. Crypto Regulation, CFTC Could Take Over Spot Market"

The long-standing blurred boundary of crypto regulation in the United States is being redrawn. With Mike Selig nominated as CFTC chairman and Congress advancing new legislation, the division of labor between the SEC and CFTC is emerging for the first time at a policy level, and a rare clear trend in the regulatory structure is appearing: the SEC focuses on securities; the CFTC focuses on the digital commodity spot market.

Market Data

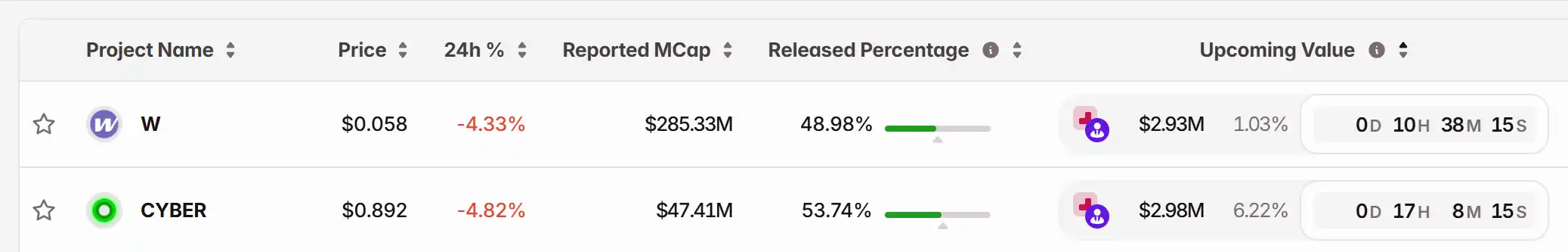

Daily Marketwide Capital Flow Heatmap (reflected by funding rate) and Token Unlocks

Data Source: Coinglass, TokenUnlocks

Funding Rate

Token Unlocks

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ZEC rises 0.69% following the introduction of a privacy-focused treasury

- Cypherpunk Technologies , rebranded from Leap Therapeutics, launched a $50M Zcash (ZEC) treasury, acquiring 1.25% of total supply at $245.37 average cost. - Winklevoss Capital led a $58.88M private placement, supporting ZEC's strategic value as "encrypted bitcoin" with privacy features complementing Bitcoin's transparency. - ZEC surged 829.57% year-to-date but dropped 15.07% in seven days, reflecting crypto market volatility amid growing adoption of privacy-focused assets. - The company plans to accumula

Bitcoin Updates: Ethereum Whale's Unbroken Winning Run—Genius Strategist or Market Influencer?

- A $9.9M Ethereum short by a 100% win-rate trader on Hyperliquid reignites debates over whale influence, with platform data showing $5.377B in whale positions (55.13% short). - The leveraged bet aligns with bearish technical indicators, while a $131M Bitcoin short faces liquidation risks if prices hit $111,770, creating potential upward price pressure from short liquidations. - Whale activity highlights leveraged trading volatility: a 10x ETH short yields $5.7M gains, contrasting with a $64.7M Bitcoin lon

Titan Faces $3 Million Deficit: Calculated Move for Future Expansion?

- Titan Machinery plans to sell its German dealership operations, aligning with CNH Industrial's dual-brand strategy and optimizing its global footprint. - The $3M–$4M pre-tax loss reflects operational challenges in Germany, with CEO Bryan Knutson emphasizing focus on high-performing markets. - Analysts highlight mixed reactions: short-term financial risks versus long-term strategic alignment with CNH, a $12B machinery industry player. - Titan's stock shows 14.7% YTD gains but faces uncertainty amid macroe

Bitcoin News Today: Bitcoin's Surge Brings Whale's $131M Short Position Close to Liquidation Point

- A $131M Bitcoin short faces liquidation if price exceeds $111,770, per Hyperliquid data. - Market rally triggered $343.89M in 24-hour liquidations, with 74.7% from shorts, pushing Bitcoin higher. - Technical indicators and institutional buying signal bullish momentum, risking self-reinforcing price gains. - Whale’s aggressive leverage history contrasts with recent large long positions, highlighting market volatility.