Bitcoin News Update: Senate Divided Over Crypto Regulation: CFTC Authority or SEC Supervision

- U.S. Congress proposes competing crypto frameworks: Senate Agriculture Committee expands CFTC's digital commodity oversight, while Banking Committee grants SEC control over "ancillary assets" via decentralization thresholds. - CFTC's expanded authority would regulate Bitcoin/Ethereum spot markets, requiring custodial safeguards, while SEC's framework creates conditional pathways for tokens to transition from securities to commodities. - Post-shutdown resumption enables SEC/CFTC to restart ETF reviews, wi

As Congress moves forward with rival legislative plans to address the regulatory split over digital assets, the U.S. Securities and Exchange Commission (SEC) and Commodity Futures Trading Commission (CFTC) are set to fully resume their activities.

The Agriculture Committee’s proposal, led by Senators John Boozman and Cory Booker, would broaden the CFTC’s jurisdiction to include “digital commodities” and their spot markets,

The regulatory limbo was

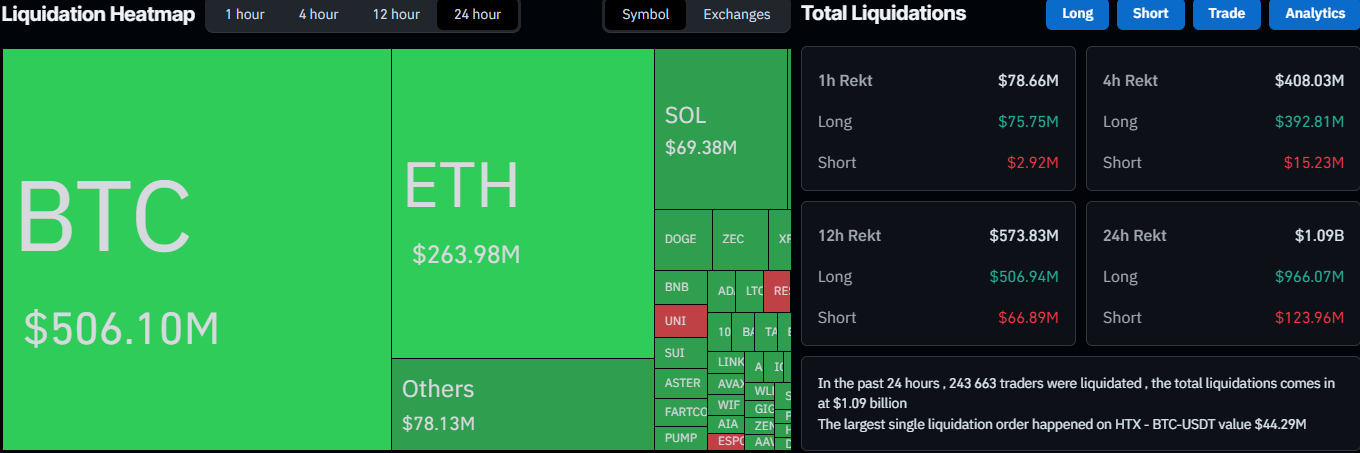

Market response to the end of the shutdown has been mixed. Bitcoin climbed back above $102,000 after dropping to weekly lows near $100,800, and Ethereum jumped 2.36% to $3,533,

The Senate’s rival proposals underscore the ongoing debate over how to distinguish securities from commodities in the crypto space.

As lawmakers continue their work, the industry’s attention will turn to enforcement details and implementation schedules. While neither proposal fully settles the SEC-CFTC jurisdictional dispute, both lay out a regulatory path that could help stabilize market expectations.

---

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Price Tanks Below $97K as Analyst Warns the Worst Is Yet to Come

Stablecoin Charter Dispute Highlights Oversight Shortcomings in Digital Banking

- ICBA opposes Sony Bank's U.S. trust charter bid, warning its stablecoin venture could bypass traditional banking safeguards and regulatory frameworks. - Critics argue Connectia's dollar-pegged stablecoins mimic deposits without CRA/FDIC compliance, creating an uneven playing field for insured banks. - Over 30 crypto firms including Coinbase seek similar charters, sparking regulatory debates about innovation risks versus financial stability. - JPMorgan upgrades stablecoin stocks while ICBA highlights OCC'

Hyperliquid News Today: How DeFi's Growth and Bridgewater's New Direction Indicate a Changing Market

- DeFi platforms Lighter, Hyperliquid, and Aster dominated Perp DEX trading volumes in November 2025, with Lighter leading at $73.77B 7-day volume. - Lighter's 650,000 TPS throughput and planned token generation event (TGE) with 25-30% community airdrop drive speculation about its valuation. - Bridgewater Associates reshaped its Q3 2025 portfolio, boosting stakes in Netflix (+896.6%), Verizon (+860%), and digital assets while exiting "Magnificent 7" tech stocks. - Ray Dalio warned of an "AI bubble" amid Br