Tether helps authorities seize $12m in Southeast Asia scam

Tether provided blockchain intelligence to Thai and U.S. agents, enabling the seizure of $12 million in USDT and the arrest of 73 individuals connected to a sprawling transnational scam network operating across Southeast Asia.

- Tether helped Thai and U.S. authorities seize $12M in USDT from a transnational scam.

- Seventy-three individuals were arrested, and additional assets worth over 522 million baht were recovered.

According to a press release dated Nov. 13, the operation was spearheaded by Thailand’s Technology Crime Suppression Division, which worked in concert with the U.S. Secret Service.

The coordinated effort led to the arrest of 73 individuals, including 51 Thai nationals and 22 foreigners, and the seizure of additional assets valued at over 522 million baht. Tether said its involvement provided key blockchain analysis that enabled authorities to trace the movement of the stolen USDT across the digital ledger.

“This operation highlights how blockchain transparency can empower law enforcement to act quickly and effectively against criminal activity,” Tether CEO Paolo Ardoino noted. “We are committed to supporting law enforcement around the world in freezing illicit assets, protecting victims, and ensuring that USDT continues to serve as a transparent tool for global commerce.”

Tether’s ongoing role

Tether’s involvement in the Southeast Asia seizure builds on a broader pattern of collaboration with law enforcement worldwide. Over the past year, the company has supported multiple high-profile operations aimed at halting illicit flows of digital assets.

In June, the U.S. Department of Justice publicly acknowledged Tether’s assistance in a landmark case that led to the seizure of approximately $225 million in USDT . The cooperation deepened this past March, with Tether acting on requests from the U.S. Secret Service to immobilize $23 million in illicit funds connected to transactions on the sanctioned crypto exchange Garantex.

In that same month, the company also moved to freeze an additional $9 million linked directly to the sophisticated attack on the Bybit exchange. The scale of this behind-the-scenes work is further illustrated by Tether’s disclosure that it has now blocked over 3,660 wallets at the request of law enforcement, with 2,100 cases conducted in direct coordination with various U.S. agencies.

According to the release, Tether has provided support to more than 290 law enforcement agencies across 59 different jurisdictions.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

VIPBitget VIP Weekly Research Insights

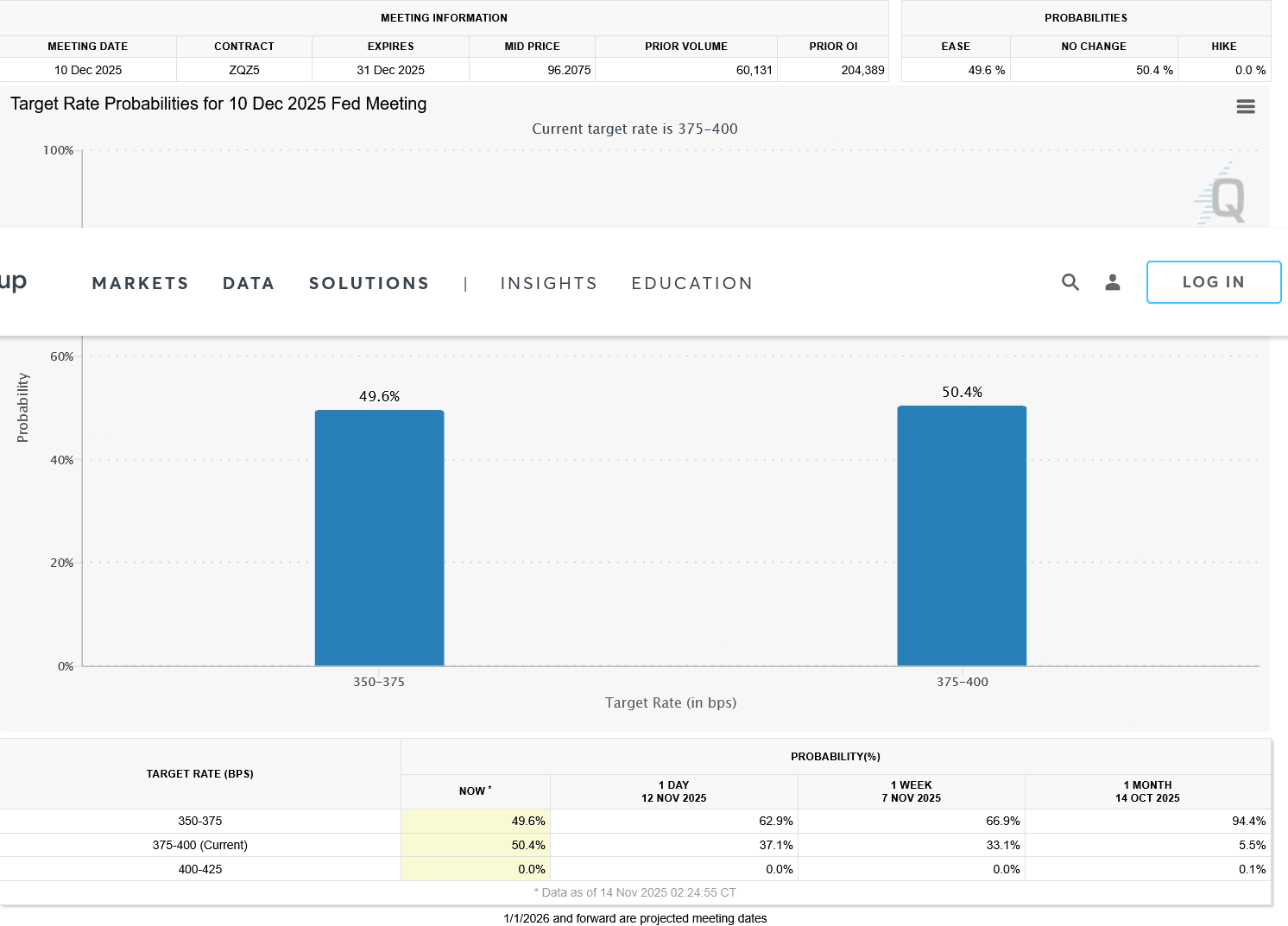

Global markets are experiencing multiple transformative catalysts supporting the recovery of risk assets. For instance, Trump has revived his proposal to distribute $2000 "tariff dividend" checks to every American using tariff revenues. While the plan faces hurdles such as congressional approval and inflationary concerns, it has already boosted consumer confidence and is expected to inject trillions of dollars in liquidity, benefitting high-growth technology sectors. Meanwhile, the U.S. government shutdown has reached a record 41 days. With the Senate having reached an agreement, it's expected to end on November 11—potentially triggering a renewed fiscal injection of tens of billions of dollars and a V-shaped rebound similar to past shutdown recoveries. Market expectations for a rate cut at the Federal Reserve's December FOMC meeting are also rising, with a 62.6% probability priced in for a 25-basis-point cut. Some Trump-backed officials even advocate for a 50-basis-point reduction, which would extend the easing cycle and further stimulate investment in crypto and AI infrastructure. Together, these factors may drive a 5–10% rebound in total crypto market capitalization, creating a window of opportunity for allocation to high-quality projects.

Massive $869M Outflow Slams Bitcoin. Is a Crash Coming?

Ethereum Latest Updates: BitMine Commits $12 Billion to ETH—Chairman Predicts $12,000 Despite 13% Market Drop

- BitMine Immersion Technologies (BMNR) surged ETH purchases by 34% to 110,288 tokens weekly, now holding 3.5M ETH (2.9% supply) valued at $12.76B. - Leadership overhaul appoints Chi Tsang as CEO, aligning with chairman Tom Lee's "supercycle" vision and $12K ETH price target by 2025. - Market reacts mixed as ETH dips 13.4% in two weeks, with treasury buys currently underwater and regulatory shifts like CFTC oversight emerging. - Shareholders demand transparency amid unstaked ETH holdings and evolving crypt

Vitalik Buterin's Breakthrough in ZK Technology: Ushering in a New Age of Privacy and Blockchain Scalability

- Vitalik Buterin drives Ethereum's ZK innovations to solve scalability and privacy challenges, positioning ZK as crypto's next growth pillar. - Modexp precompile updates and GKR protocol reduce proof costs 50x-15x, enabling ZK-rollups to process 43,000 TPS with near-zero fees. - ZK integration with MPC/FHE/TEE expands use cases beyond DeFi, with ZK-FHE hybrids targeting enterprise adoption in healthcare and finance . - ZK Layer 2 market projected to grow at 60.7% CAGR to $90B by 2031, driven by institutio