Tom Lee’s BMNR Is a Brilliant Treasury Model or Hidden Time Bomb | US Crypto News

BitMine Immersion Technologies, led by crypto strategist Tom Lee, has amassed over 3.5 million ETH—worth $13.7 billion—using equity financing instead of debt. While the model shields BMNR from bankruptcy, it hinges on investor confidence and ETH’s price. A market downturn or funding freeze could expose its biggest vulnerability yet.

Welcome to the US Crypto News Morning Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab a coffee and lean in. Behind the headlines, a company is quietly stacking billions in Ethereum, turning equity into a high-stakes treasury experiment. Some call it brilliant, while others consider it a ticking time bomb, and everyone is watching to see what happens next.

Can Tom Lee’s Debt-Free Crypto Empire Survive an Ethereum Winter?

BitMine Immersion Technologies (BMNR), led by crypto strategist Tom Lee, uses equity financing to construct a substantial Ethereum (ETH) treasury.

Unlike traditional businesses, BMNR raises capital by issuing shares rather than borrowing, directing each funding round straight into ETH accumulation and staking. This model has delivered dramatic returns but comes with a set of unique risks.

BMNR’s reliance on equity over debt means that classic bankruptcy, triggered by loan defaults, is unlikely.

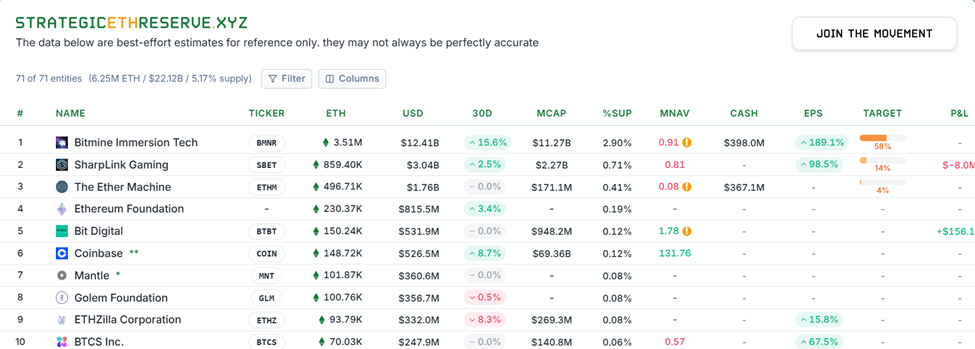

The company’s assets, a combination of ETH holdings and cash reserves, far exceed its liabilities. On-chain data shows BMNR holds over 3.5 million ETH, around 2.8% of the total supply, alongside roughly $389 million in cash.

Ethereum Reserves. Source:

Strategic ETH Reserve

Ethereum Reserves. Source:

Strategic ETH Reserve

Combined, its crypto and cash treasury is valued at approximately $13.7 billion. With minimal debt obligations, BMNR avoids the conventional pathways to financial failure. Yet the company’s stability hinges on two critical “switches”:

- The market’s willingness to invest in new shares, and

- The performance of the ETH price.

If ETH prices fall sharply or investors stop providing capital, BMNR could face a liquidity crunch.

“Because the company has no large debts and mainly relies on equity financing, the path of debt crushing bankruptcy basically doesn’t exist…Can’t raise money, coin price crashes, company expansion stops, valuation drops with a bang,” said analyst Unicorn in a post.

The pseudonymous analyst noted that while such an outcome would not cause a typical debt-driven collapse, it would lead to asset shrinkage and disrupt the financing chain.

The model is highly reflexive as both the treasury’s growth and the stock’s performance are intertwined with market sentiment and Ethereum’s valuation.

BMNR’s High-Stakes ETH Treasury Faces Market Sentiment and Dilution Risks

BMNR shares have surged up to 10 times since the Ethereum treasury strategy was implemented, outpacing the growth of ETH itself. Arkham Intelligence recently flagged an $82.8 million withdrawal of ETH from Galaxy Digital.

TOM LEE IS DCA BUYING $ETH A fresh address has just withdrawn $82.8M of ETH from Galaxy Digital, matching known Bitmine purchase patterns.Tom Lee is DCAing the dip on ETH.

— Arkham (@arkham) November 11, 2025

As this transaction aligned with BMNR’s previous accumulation patterns, it suggests renewed buying activity. Despite these bullish signals, several risks warrant attention:

- Continuous equity issuance can dilute existing shareholders, particularly given BMNR’s aggressive at-the-market offerings.

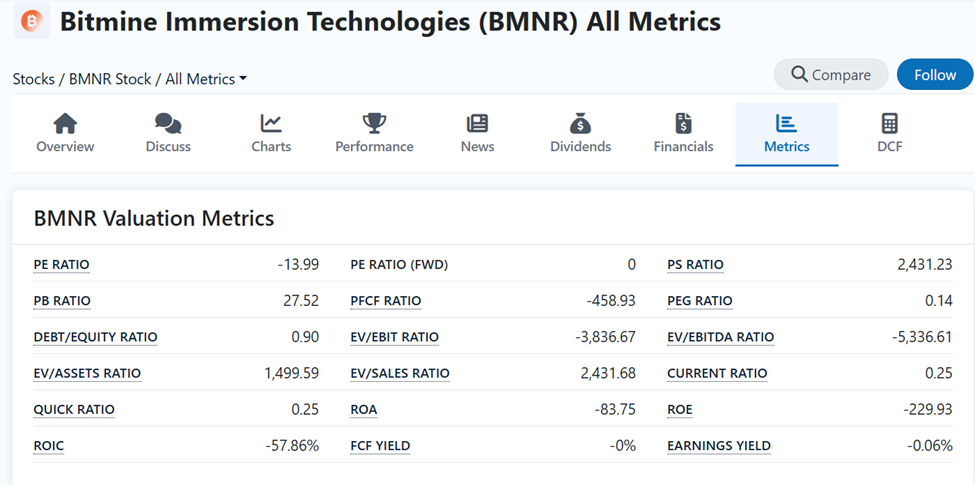

- The company’s valuation is extremely high relative to its operational revenue, which sits around $4.6 million annually with negative net income.

BitMine Immersion Technologies Valuation Metrics. Source:

FinanceCharts

BitMine Immersion Technologies Valuation Metrics. Source:

FinanceCharts

- The Altman Z-Score, a standard measure of financial distress, is currently negative (−0.96), highlighting potential vulnerability if conditions turn unfavorable.

- Moreover, BMNR’s non-traditional structure, functioning more as a treasury vehicle than an operational business, means standard revenue streams are dwarfed by ETH accumulation.

- Operational missteps or regulatory scrutiny could exacerbate risks, particularly if investor appetite slows or Ethereum experiences significant volatility.

- Even with no debt, failure to secure new equity or a sharp ETH decline could erode the company’s asset base really fast.

In summary, BMNR is a high-stakes experiment in equity-financed crypto accumulation. Under normal market conditions, with ETH performing well and investor sentiment positive, the company avoids classic bankruptcy and continues to grow its treasury.

However, the model’s heavy reliance on Ethereum prices and investor participation makes it vulnerable to sudden shocks, dilution, and valuation corrections.

So, what are the takeaways for investors?

BMNR is not a typical company. Its success depends less on operational execution and more on maintaining confidence in its treasury strategy.

If Ethereum falters or market enthusiasm wanes, the seemingly debt-free company could face a sharp contraction, turning a “brilliant treasury model” into a hidden time bomb.

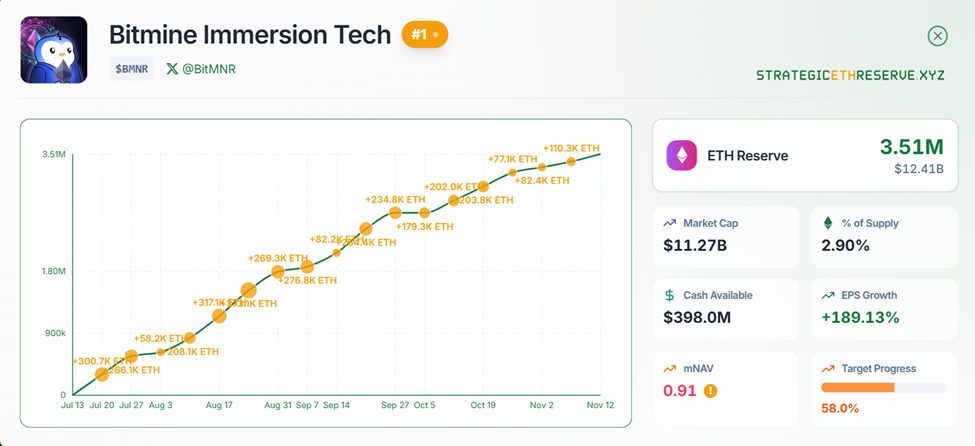

Chart of the Day

BitMine Immersion Tech. Source:

Strategic ETH Reserve

BitMine Immersion Tech. Source:

Strategic ETH Reserve

Byte-Sized Alpha

Here’s a summary of more US crypto news to follow today:

- Why analysts see a $5 target for XRP price in Q4 2025.

- Smart money continues to buy Solana despite a 20% SOL price drop.

- Three signs pointing to mounting selling pressure on Pi Network in November.

- Top 3 price prediction Bitcoin, Gold, Silver: One last buy opportunity before the US shutdown ends?

- JPMorgan achieves the first true bridge between banks and DeFi.

- XRP finds traction among new investors, but $2.50 remains a challenge.

- Pi Coin rebound hope hangs by a thread — and it’s being pulled from both sides.

- Did one whale steal aPriori’s airdrop? 14,000 wallets raise big questions.

Crypto Equities Pre-Market Overview

| Company | At the Close of November 11 | Pre-Market Overview |

| Strategy (MSTR) | $231.35 | $235.09 (+1.62%) |

| Coinbase (COIN) | $304.01 | $308.45 (+1.46%) |

| Galaxy Digital Holdings (GLXY) | $30.74 | $31.21 (+1.53%) |

| MARA Holdings (MARA) | $14.63 | $14.93 (+2.05%) |

| Riot Platforms (RIOT) | $16.14 | $16.40 (+1.61%) |

| Core Scientific (CORZ) | $17.32 | $17.56 (+1.39%) |

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ZK Atlas Enhancement: Accelerating Blockchain Expansion and Driving Institutional Participation in DeFi

- ZK Atlas Upgrade (Oct 2025) boosted blockchain scalability to 15,000+ TPS with $0.0001 per-transaction costs, enabling institutional DeFi adoption. - Modular ZKsync OS and ZK rollups reduced Ethereum gas fees by 90%, driving 30% stablecoin dominance in on-chain transactions. - Institutional TVL in ZK ecosystems hit $3.5B by 2025, with StarkNet tripling TVL and Zcash rising 23% amid U.S./EU regulatory clarity. - ZK token engagement surged 20% post-upgrade, attracting $15B in ETF inflows, as analysts predi

Astar (ASTR) Price Rally: Can Institutional Adoption of Blockchain Interoperability Sustain Long-Term Growth?

- Astar (ASTR) surged 40% in late 2025 as institutional adoption of its cross-chain interoperability infrastructure accelerated. - The integration of Plaza modular infrastructure and EVM compatibility streamlined asset management and bridged Polkadot with external networks. - Strategic partnerships with exchanges like Bitget and Japan-focused Web3 initiatives expanded ASTR's institutional reach and use cases. - Upcoming Startale App aims to simplify cross-chain interactions, positioning ASTR as a foundatio

US-South Korea $350 Billion Agreement Seeks to Bolster Economic Stability and Address China’s Influence

- US and South Korea finalize $350B economic-security pact to counter China, boost resilience. - Includes $150B in US shipbuilding, $200B strategic investments, and 232 tariff cuts on autos, parts, lumber, and pharmaceuticals. - Authorizes Seoul to build nuclear submarines, expands uranium enrichment collaboration, and commits $25B in US military purchases by 2030. - South Korea pledges 3.5% GDP defense spending, US provides $33B troop support; EV subsidies to offset US tariff impacts on automakers .

XRP News Today: XRP ETF Greenlight Signals Major Step Into Mainstream for Crypto

- Canary Capital's XRPC ETF , the first U.S. XRP spot ETF, will launch on November 13, 2025, after SEC and Nasdaq approvals. - XRP gained 4.1% to $2.51 as the ETF's 0.5% fee and direct token exposure attracted institutional and retail demand. - Regulatory approval used expedited Section 8(a) process, with Nasdaq certification finalizing the listing during a government shutdown. - Market shifts included 216M XRP withdrawals and declining futures activity, signaling trust in regulated ETF structures. - Analy