The Lone Warrior of Crypto Compliance: How Circle CEO Breaks Through the Double Squeeze of Tether Encirclement and Declining Interest Rates?

Circle's upcoming financial report will be a new opportunity for it to prove the effectiveness of its strategy.

Translated by: Saoirse, Foresight News

On June 5, Circle CEO Jeremy Allaire (center) attended the company's IPO ceremony at the New York Stock Exchange. Photographer: Michael Nagle / Bloomberg

Key Points:

- Although Circle is one of the most established companies in the stablecoin sector and CEO Jeremy Allaire has become a billionaire, he still has much to prove.

- Circle is facing multiple challenges: fierce market competition, core revenue sources at risk due to falling interest rates, and its main competitor Tether is returning to the U.S. market.

- Allaire firmly believes in his strategy and that Circle will ultimately prevail. The company will release its financial report on Wednesday, providing a new opportunity to prove the effectiveness of his strategy.

Jeremy Allaire still has much to prove.

As CEO of Circle Internet Financial, he leads one of the top companies in the latest crypto craze—the stablecoin sector. The business model he has promoted for years has now been officially incorporated into the legal framework by a bill signed by President Trump. Thanks to Circle’s IPO in June this year (which also sparked a wave of crypto industry listings in 2025), Allaire has now become a billionaire.

However, the 54-year-old CEO still struggles to gain broad recognition within the industry, and Circle is facing multiple challenges. The market in which the company operates is fiercely competitive, and its core revenue sources are at risk of shrinking due to falling interest rates. Meanwhile, its main competitor—Tether, which far surpasses Circle in both profitability and valuation—is returning to the U.S. market, a dangerous signal for Circle’s home turf.

Traditional bankers see Allaire as a threat, fearing that stablecoins will siphon off bank deposits. Even peers in the crypto sector keep their distance. At industry conferences full of hoodie-wearers, he is always the “outlier” in a suit. More importantly, he insists on compliant operations and actively pushes for legislative bodies to establish industry rules.

In an industry that prides itself on anonymity, unique personalities, and disrupting the traditional financial system, such an approach clearly does not win Allaire any “popularity contests.”

“Jeremy Allaire’s strategic path has always run counter to the bitcoin ecosystem,” said Cory Klippsten, head of bitcoin investment platform Swan Bitcoin. “Bitcoin’s goal is to separate money from the state, while his core work is to integrate crypto technology into the existing fiat currency system.”

Despite ongoing skepticism, Allaire remains convinced that his strategy and Circle will ultimately win. The company will release its financial report on Wednesday, providing a new opportunity to prove the effectiveness of his strategy.

“To persevere, you must have a strong belief in the importance of what you’re doing and a deep moral foundation,” Allaire said in an interview. “You will encounter setbacks, and everyone will tell you ‘you’re wrong’ or ‘you’ll fail.’ But for me, this is not just a business plan—I do this because I truly believe it can make the world a better place.”

Allaire’s tenure at Circle has been full of ups and downs; the company was founded in 2013.

Circle was originally a payments platform based on the bitcoin network, but after several strategic pivots, it nearly went bankrupt and was caught in a funding crisis due to the collapse of Silicon Valley Bank. To maintain the operational structure of its core stablecoin USDC, Allaire ultimately had to sell assets and lay off hundreds of employees to keep the company afloat.

“During Circle’s crisis, no one believed I could pull through,” Allaire recalled. “But I gave it everything I had.”

Growth Challenges

Now, the challenge Allaire faces has shifted from “survival” to “proving growth capability.”

Stablecoin issuers like Circle mainly earn revenue by investing reserves in short-term cash-like assets such as U.S. Treasuries. As interest rates fall, even if Circle’s revenue grows, the return per unit invested will almost certainly decrease.

In addition, the revenue-sharing agreement Allaire reached with Coinbase Global Inc. has significantly squeezed Circle’s profit margins. In the second quarter of 2025, the distribution fees paid to Coinbase were more than three times Circle’s adjusted profit of $126 million. In contrast, Tether, which is not subject to the same rules and audit requirements, reported a profit of $4.9 billion for the same period.

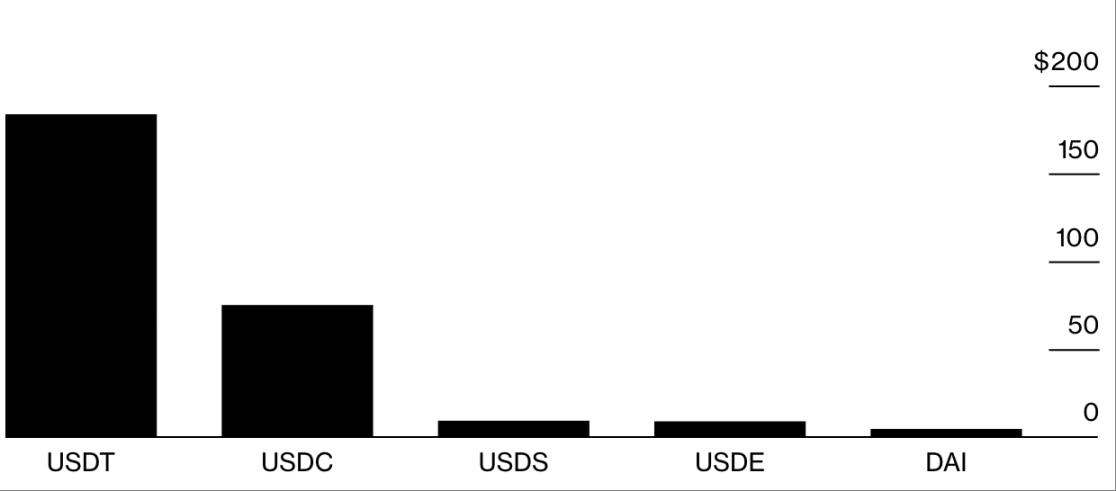

Top 5 Stablecoins by Market Cap

Unit: billions of dollars

Data source: CoinGecko

Tether’s USDT was launched several years before Circle’s USDC and is much larger in scale—USDT’s market cap is $183 billion, while USDC’s is only $76 billion—so its earning power is much stronger. In addition, Tether is associated with Cantor Fitzgerald, where U.S. Commerce Secretary Howard Lutnick once worked.

Another new stablecoin competitor, World Liberty Financial Inc., is linked to the Trump family. As stablecoin usage surges, hundreds of companies, including Tether and World Liberty, are vying for Circle’s market share. Allaire admitted in a recent earnings call that this is a “winner-takes-all market.”

Currently, Allaire is trying to open up new revenue streams for Circle through other businesses, but Wall Street analysts are generally skeptical about the effectiveness of these moves. His recent attempts include launching a blockchain, a payment network, and a tokenized money market fund.

Nevertheless, Mizuho Securities analyst Dan Dolev bluntly stated: “USDC is just another stablecoin, nothing special. Circle’s stock is overvalued, it’s that simple.” Among analysts tracking Circle, four have a “sell” rating, eleven have a “buy” rating, and ten have a “hold” rating.

Currently, Circle’s stock price is about $104, far above the IPO price of $31, but less than half its post-listing peak. Its $24 billion market cap pales in comparison to the $500 billion valuation implied by Tether’s current fundraising activities.

Tech Entrepreneur Background

Although Allaire has previously led two companies to go public—software company Allaire Corp. and video platform Brightcove Inc.—Circle will almost certainly be the core legacy of his career.

Allaire’s interest in technology began in childhood: at age 11, his family moved to the small town of Winona, Minnesota, and he and his brother JJ were seen as “a bit nerdy”—they would take printouts of machine language and type them into the computer, creating games. “If you made a single typo, the program wouldn’t run, so you had to be extremely focused,” he recalled.

As an adult, Allaire fully immersed himself in the internet sector. He even helped political activist Noam Chomsky digitize his works. After that, he founded several startups. Not long after leaving Brightcove, he co-founded Circle with his friend Sean Neville.

“I used to hang out at his house a lot,” Neville recalled. “Our ultimate goal was to build a whole new financial system.”

On July 18, 2025, U.S. President Trump held the signing ceremony for the GENIUS Act at the White House, and Circle CEO Jeremy Allaire (top right) attended the event. Photographer: Francis Chung / Politico Magazine / Bloomberg

According to the Bloomberg Billionaires Index, Allaire’s current personal wealth is $2.1 billion, mainly from his stake in Circle. While this is far less than Tether CEO Paolo Ardoino’s $5.6 billion, it is on par with well-known American business figures such as Apple CEO Tim Cook and BlackRock CEO Larry Fink.

Allaire said he grew up in a family with “progressive values”—both parents worked in social services and activism—but he spoke highly of his experience attending the GENIUS Act signing ceremony at the White House and shaking hands with Trump. The act established a federal regulatory framework for stablecoins.

“I felt incredibly honored and excited to be part of it,” Allaire said. “The bill was signed into law, and I was able to play an important role in the process—this was one of the most meaningful moments of my life.”

Public records show that Allaire has long mainly supported the Democratic Party, but Circle once donated $1 million to Trump’s inauguration committee.

Fitness Lifestyle

A few years ago, Allaire started a fitness regimen: he quit drinking, began eating healthier, and according to health app data, now averages seven hours of sleep per night.

On June 5, Jeremy Allaire attended Circle’s IPO ceremony at the New York Stock Exchange. Photographer: Michael Nagle / Bloomberg

Both current and former employees describe Allaire as a “gentle but strict” boss—he doesn’t yell or slam tables, doesn’t work late at the office, but almost always responds to messages quickly. Someone recalled having a strategy meeting with him while walking in the woods.

Now, Allaire is already planning his next steps.

“Building the monetary layer on the internet was the goal of phase 1.0,” Allaire said. “We’ve achieved that, and now we’re advancing the plans for phases 2.0 and 3.0.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Hit to Earn? A Look at 8 Popular Recent Token Launch Projects

The crypto industry is experiencing a wave of mergers and acquisitions: giants are bottom-fishing, and the Web3 ecosystem is being restructured.

While small projects are still struggling for their next round of funding and token launches, industry giants are already using cash to buy time and acquisitions to secure their future.