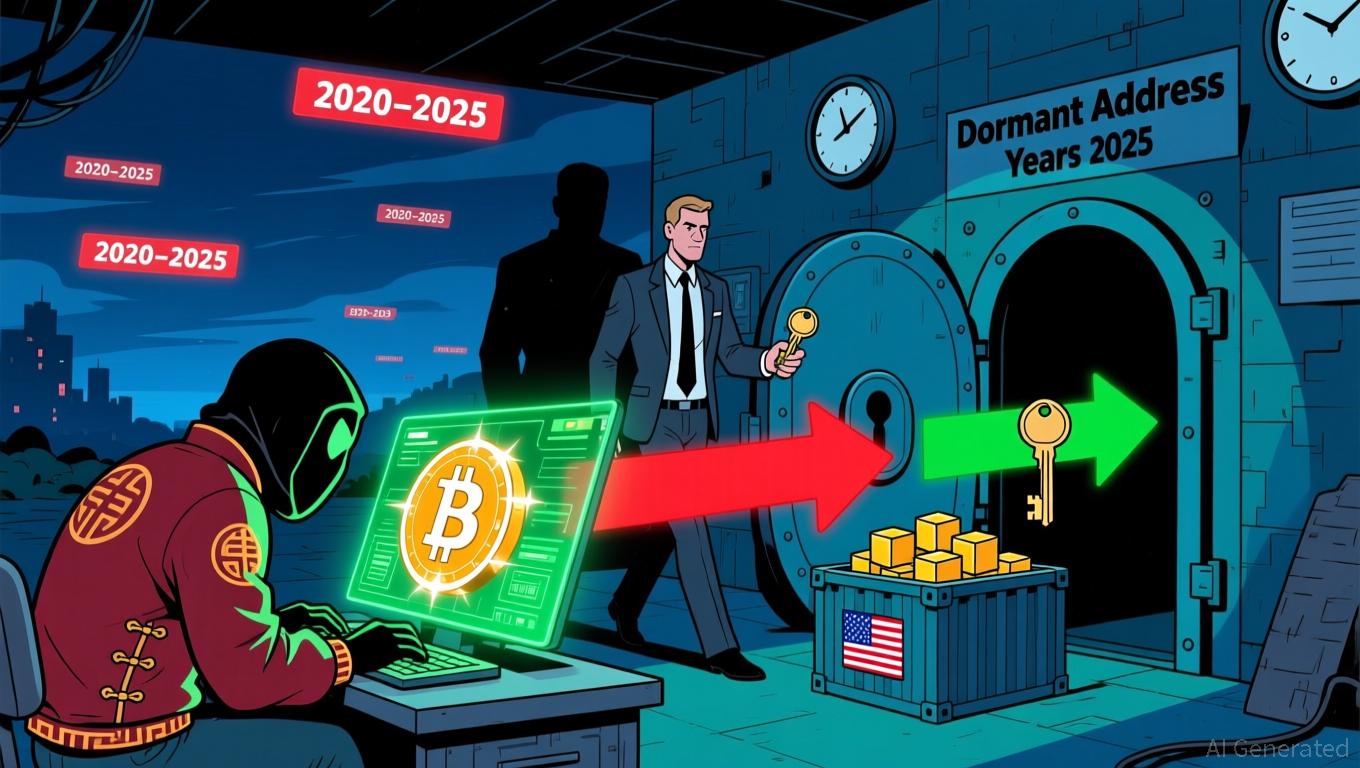

Bitcoin News Today: Digital Sovereignty Clash: US-China Tensions Escalate Over $13B Bitcoin Seizure

- China's CVERC accuses U.S. government of orchestrating a $13B Bitcoin theft from 2020 LuBian mining pool hack. - U.S. denies claims, asserting 2025 seizure targeted criminal proceeds from Cambodian fraudster Chen Zhi's $2B scheme. - Dispute highlights geopolitical tensions over digital sovereignty, with 127,426 BTC (0.65% of total supply) now central to U.S.-China crypto rivalry. - CVERC demands enhanced blockchain security measures as seized assets represent largest U.S. crypto forfeiture in history. -

China’s cybersecurity authorities have accused the United States of carrying out a $13 billion

The controversy revolves around a cyberattack on LuBian in December 2020, which led to the theft of 127,426 BTC—worth $3.5 billion at the time, according to a

The U.S. Department of Justice (DOJ) has justified the seizure, stating the bitcoins were tied to Chen Zhi’s alleged $2 billion cryptocurrency fraud and were confiscated through a civil forfeiture action in October 2025, according to a

This dispute has reverberated throughout the cryptocurrency market, with Bitcoin hovering around $105,000 as investors assess the broader geopolitical fallout. Experts point out that about 0.65% of Bitcoin’s total supply—roughly 127,000 coins—is now entangled in the controversy, which could restrict liquidity and impact long-term price trends, according to an

CVERC has urged the adoption of stronger blockchain security protocols, such as layered defenses and real-time surveillance, to guard against future government-sponsored cyberattacks, according to a

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ZK Atlas Enhancement: Accelerating Blockchain Expansion and Driving Institutional Participation in DeFi

- ZK Atlas Upgrade (Oct 2025) boosted blockchain scalability to 15,000+ TPS with $0.0001 per-transaction costs, enabling institutional DeFi adoption. - Modular ZKsync OS and ZK rollups reduced Ethereum gas fees by 90%, driving 30% stablecoin dominance in on-chain transactions. - Institutional TVL in ZK ecosystems hit $3.5B by 2025, with StarkNet tripling TVL and Zcash rising 23% amid U.S./EU regulatory clarity. - ZK token engagement surged 20% post-upgrade, attracting $15B in ETF inflows, as analysts predi

Astar (ASTR) Price Rally: Can Institutional Adoption of Blockchain Interoperability Sustain Long-Term Growth?

- Astar (ASTR) surged 40% in late 2025 as institutional adoption of its cross-chain interoperability infrastructure accelerated. - The integration of Plaza modular infrastructure and EVM compatibility streamlined asset management and bridged Polkadot with external networks. - Strategic partnerships with exchanges like Bitget and Japan-focused Web3 initiatives expanded ASTR's institutional reach and use cases. - Upcoming Startale App aims to simplify cross-chain interactions, positioning ASTR as a foundatio

US-South Korea $350 Billion Agreement Seeks to Bolster Economic Stability and Address China’s Influence

- US and South Korea finalize $350B economic-security pact to counter China, boost resilience. - Includes $150B in US shipbuilding, $200B strategic investments, and 232 tariff cuts on autos, parts, lumber, and pharmaceuticals. - Authorizes Seoul to build nuclear submarines, expands uranium enrichment collaboration, and commits $25B in US military purchases by 2030. - South Korea pledges 3.5% GDP defense spending, US provides $33B troop support; EV subsidies to offset US tariff impacts on automakers .

XRP News Today: XRP ETF Greenlight Signals Major Step Into Mainstream for Crypto

- Canary Capital's XRPC ETF , the first U.S. XRP spot ETF, will launch on November 13, 2025, after SEC and Nasdaq approvals. - XRP gained 4.1% to $2.51 as the ETF's 0.5% fee and direct token exposure attracted institutional and retail demand. - Regulatory approval used expedited Section 8(a) process, with Nasdaq certification finalizing the listing during a government shutdown. - Market shifts included 216M XRP withdrawals and declining futures activity, signaling trust in regulated ETF structures. - Analy