Key Market Information Gap on November 12th - A Must-Read! | Alpha Morning Report

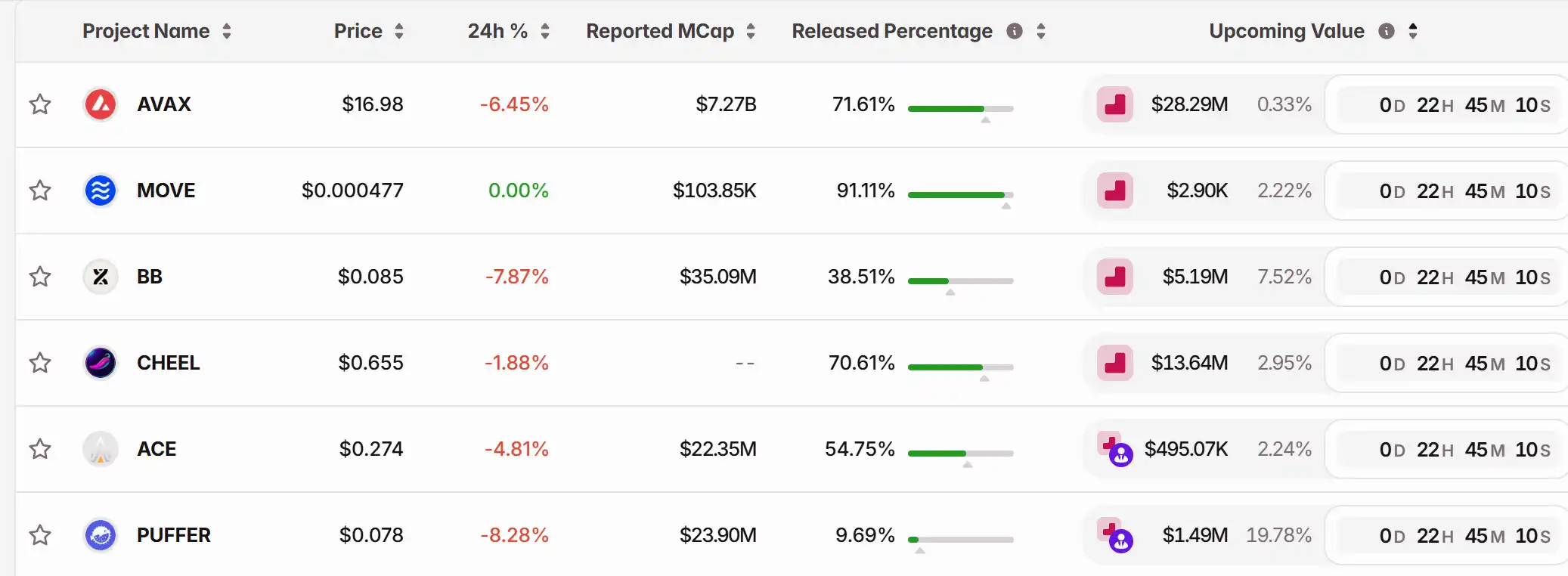

1. Top News: CFX Surpasses $0.14, Up Over 45% in 24 Hours 2. Token Unlock: $AVAX, $MOVE, $BB, $CHEEL, $ACE, $PUFFER

Featured News

1.CFX Breaks $0.14, Surges Over 45% in 24 Hours

2.US Stock Market Closing with Mixed Moves, Crypto Stocks Generally Down

3.$4.11 Billion Liquidated Across the Board in the Past 24 Hours, Mainly Longs

4.Coinbase Cancels $2 Billion Acquisition of Stablecoin Startup BVNK

5.SOL Reserves Strategy Firm Upexi Reveals "Record-Breaking" Quarterly Performance, Staking Rewards Reach $6.1 Million

Articles & Threads

1.《Destruction, Uniswap's Last Ace》

Waking up, UNI surged nearly 40%, leading the entire DeFi sector in a general uptrend. The reason for the rise is that Uniswap revealed its last ace. Uniswap founder Hayden proposed a new proposal focusing on the age-old "fee switch" topic. In fact, this proposal has been raised 7 times in the past two years, not new to the Uniswap community. However, this time is different, as the proposal is personally initiated by Hayden and covers a series of measures including fee switch, token burning, Labs and Foundation merger.

2.《Winning the Championship Thanks to Faker, He Earned Nearly $3 Million》

The League of Legends S15 Global Finals has come to an end, and Faker once again stood on the highest award podium, securing his 6th championship title, continuing to write his legend. In the crypto world, with the rise of prediction markets, players are enjoying esports events while participating in the prediction markets. Among the many crypto players participating in prediction markets, an ID named "fengdubiying (Sure Bet Sure Win)" has become a new legend. In the final prediction of T1 versus KT, he boldly wagered around $1.58 million on T1's victory, ultimately earning approximately $820,000 in profit.

Market Data

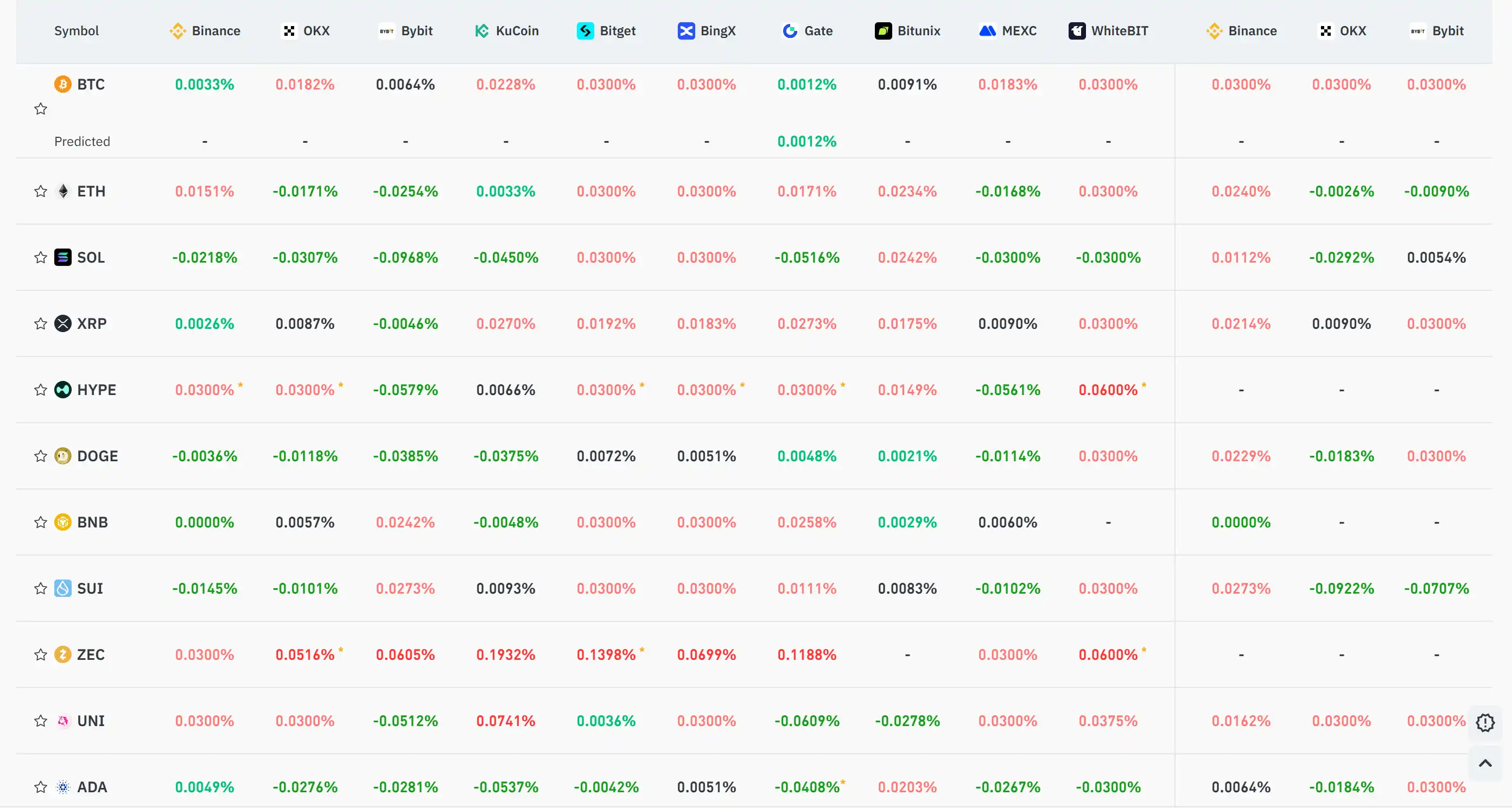

Daily Market Overall Fund Heat (Reflected by Funding Rate) and Token Unlocks

Data Source: Coinglass, TokenUnlocks

Funding Rate

Token Unlocks

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: Bitcoin Faces $103k Impasse as Bearish Signals Clash with Bullish Expectations

- Bitcoin fell near $103,000 on Nov. 8, 2025, amid Fed rate-cut uncertainty, trading in a $99,376–$103,956 range as technical indicators showed bearish consolidation. - Analysts highlighted key support at $98,900 and resistance at $104,000, with bullish sentiment driven by Cathie Wood’s $1M price target and Eric Trump’s “world-class asset” endorsement. - Strategy expanded its STRE offering to €620M to fund BTC purchases, holding 3.05% of circulating supply despite Bitcoin’s dip below $100,000. - Market cau

Ethereum Update: Validator Departures Point to a Streamlined and More Effective Network Ahead

- Ethereum's validator count fell below 1 million in November 2024, signaling structural shifts in staking dynamics and raising network security concerns. - Exit queues now take 37 days for withdrawals, driven by large-scale exits from Lido, Kiln, and leveraged staking unprofitability due to 2.9% annualized yields. - Experts predict consolidation toward professional operators, accelerated by Ethereum's Pectra upgrade allowing 2,048 ETH per validator. - Despite validator declines, Ethereum hosts $201B in to

ZEC Value Jumps 4.8% on NOV 12 2025 as Institutions Embrace and Privacy Advances Emerge

- Zcash (ZEC) surged 4.8% on Nov 12, 2025, to $464.06, with a 725.75% annual gain despite recent volatility. - Institutional adoption, including Grayscale's $137M ZCSH investment, and U.S. regulatory clarity via the Clarity and Genius Acts boosted ZEC's legitimacy. - DeFi integration via zenZEC and 30% shielded pool adoption highlight Zcash's privacy-driven appeal, supported by Electric Coin Company's ecosystem upgrades. - Whale activity and $500 support level analysis suggest potential for a $1,500 price

BCH Shares Rise 0.55% Today Following Governance and Earnings Announcements

- BCH stock rose 0.55% in 24 hours amid governance reforms approved at an Extraordinary Shareholders’ Meeting on Nov 10, 2025. - The bank reported slower growth due to reduced inflation-adjusted income and subdued loan expansion, with over 60% revenue from net interest income. - Governance amendments aim to enhance oversight, but technical analysis highlights risks from interest income reliance and macroeconomic exposure. - A backtest error occurred due to zero-price data, with three recovery options propo