One top layer 1 altcoin that has been down as much as 40% in this corrective phase is Solana (SOL). Whenever a rally begins the price is slammed down hard. Is a full-on recovery going to take place any time soon?

Is the $SOL price being suppressed?

Each time it looks like $SOL is going to break out, it seems that cartloads of $SOL are sent from Binance to Wintermute and heavy selling begins, forcing the price back down. Could this be a ploy on behalf of certain institutions to keep the price low before the SOL spot ETFs are approved?

$SOL price follows descending channel

Source: TradingView

The short-term time frame shows that the $SOL price is still descending within a channel and has been doing so since mid-September. In addition, the price has fallen below supports, turning them into resistance, and is now below a major ascending trendline which started to form in April this year.

The current price action suggests that the price is likely to come back down to the $156 horizontal support which has been a strong level so far. If this level fails, the next support is either the bottom of the channel or the major $127 horizontal level.

A base forming for $SOL big rally?

Source: TradingView

The main takeaway in the daily chart is that it does rather look like the $SOL price is now setting in a bottom. $156 is a strong horizontal support line and testament to this are the candle wicks that have shot below, with one of them tagging the bottom of the descending channel.

This is all good news for a recovery, so the bulls just need to make sure that this current corrective impulse does not fall and confirm below the horizontal support.

Getting back above the 200-day SMA and the major trendline are two major targets. The top of the channel could also coincide with the major trendline and horizontal resistance, making this a very difficult barrier for the bulls to overcome.

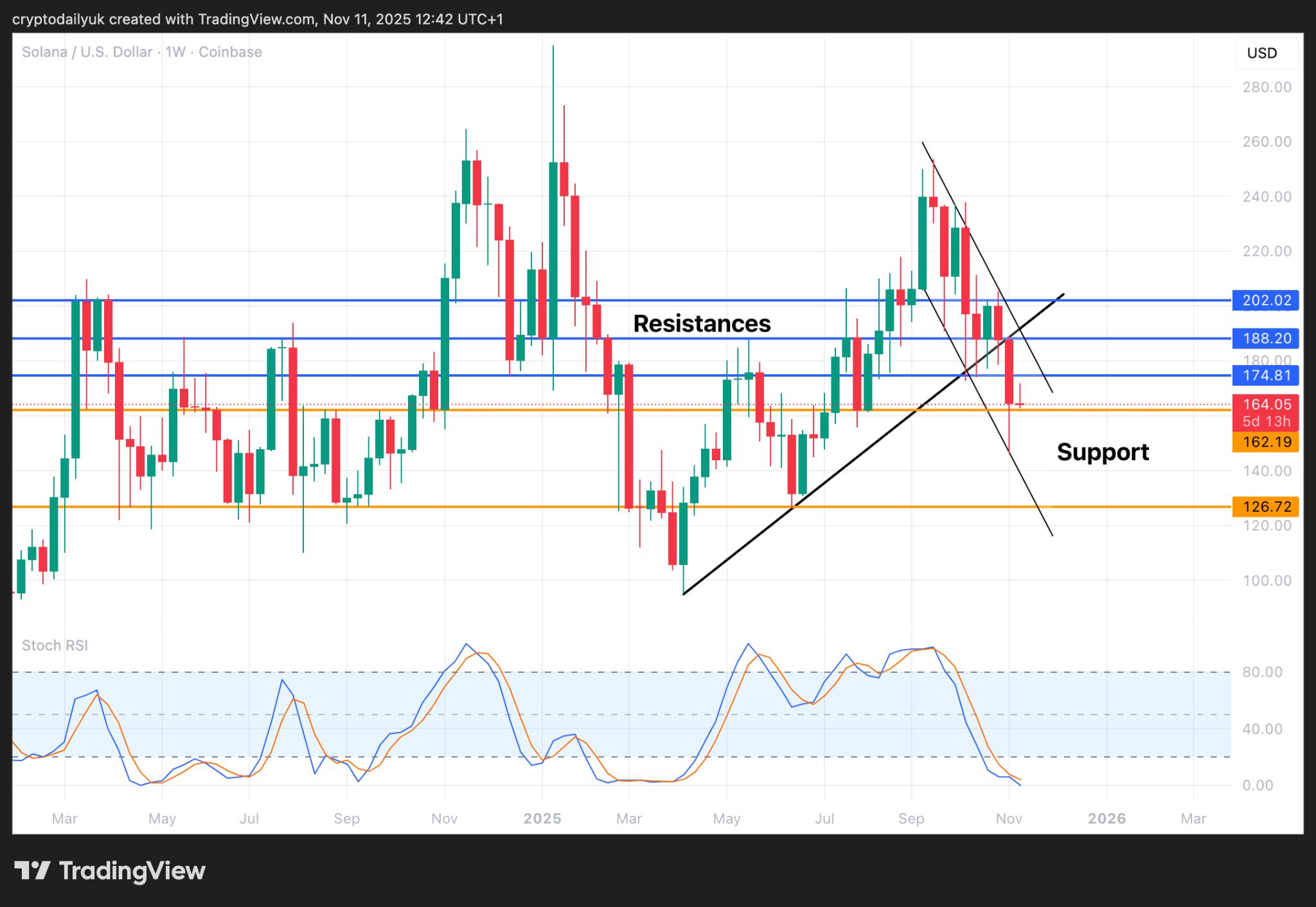

3 stand-out elements in weekly time frame

Source: TradingView

In the weekly time frame there are three stand-out elements. The first, and a bearish one, is that a full and long candle body opened below the ascending trendline and another one has also opened below. The second element, this time bullish, is that the long bearish candle retested the bottom of the channel, providing a third confirmation of the lower trendline of this pattern. Finally, the fourth element, also bullish, and perhaps the most important of all, is that the Stochastic RSI indicator lines are touching the bottom. When they cross back up, there is the possibility of a rally of similar proportions as the last time they crossed up. This resulted in a 167% rally. Yes, a recovery is very much on the horizon.