BitMine Ramps Up Ether Holdings Amid Price Dip, Eyes 5% of Total ETH Supply

Quick Breakdown

- BitMine increased its weekly Ether purchase by 34%, now holding over 3.5 million ETH.

- The company is working toward owning 5% of Ethereum’s total supply, currently holding 2.9%.

- Chairman Tom Lee remains strongly bullish, citing institutional adoption and long-term blockchain value creation.

BitMine Immersion Technologies has intensified its Ether accumulation efforts, purchasing 110,288 ETH in the past week alone. The latest purchase marks a 34% increase from the previous week, underscoring the company’s ongoing push to expand its position in the Ethereum ecosystem.

🧵

BitMine provided its latest holdings update for Nov 10th, 2025:$13.2 billion in total crypto + “moonshots”:

-3,505,723 ETH at $3,639 per ETH (Bloomberg)

– 192 Bitcoin (BTC)

– $61 million stake in Eightco Holdings (NASDAQ: ORBS) (“moonshots”) and

– unencumbered…— Bitmine (NYSE-BMNR) $ETH (@BitMNR) November 10, 2025

Growing treasury and strategic outlook

With the most recent acquisition , BitMine now holds approximately 3,505,723 ETH at an average purchase price of $3,639 per token. This positions the company as the largest Ethereum treasury holder globally, with its holdings currently valued at about $12.5 billion.

The firm has set a long-term objective of securing 5% of Ethereum’s circulating supply of roughly 120.7 million tokens. Its current holdings represent 2.9%, moving it closer to that strategic benchmark.

Chairman highlights institutional adoption

BitMine’s chairman Tom Lee emphasized that the recent price pullback offered a favorable entry opportunity. He pointed to increasing institutional interest in blockchain-based asset tokenization as a long-term catalyst for Ethereum’s value trajectory.

Lee maintained a bullish outlook, reiterating his belief that Ethereum is positioned for what he described as a “super cycle” that could unfold over the next decade. In October, he projected ETH could trade between $10,000 and $12,000 by the end of 2025. At present, ETH is trading at $3,561, meaning the asset would need a substantial rally to meet his forecast.

Market Reaction

Despite ETH’s recent pullback—down 13.4% over two weeks and 4.7% in the past month—BitMine’s confidence has been mirrored in its share performance. The company’s stock, BMNR, has surged more than 400% this year to reach $41.15, reflecting strong investor interest in its treasury-focused strategy.

Meanwhile, BitMine issued a statement clarifying its regulatory standing following reports that NASDAQ is tightening oversight of companies building crypto treasuries. The firm stressed that the new requirements do not apply to its operations, as it is already fully compliant with NYSE American standards.

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

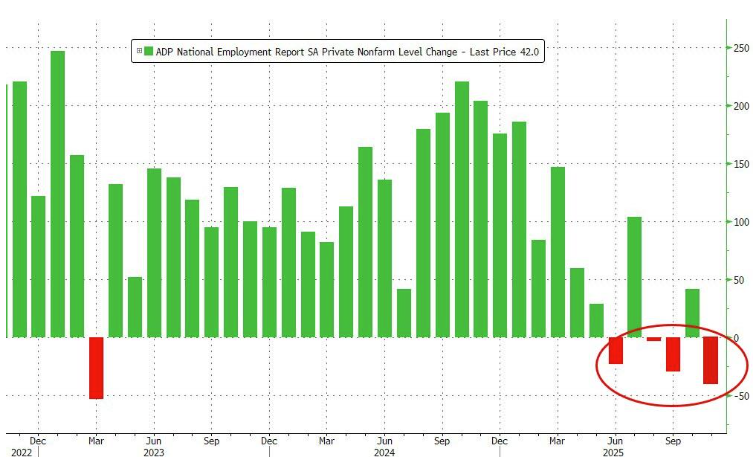

ADP data sounds the alarm again: US companies cut 11,000 jobs per week

The government shutdown has delayed official employment data, so ADP data has stepped in to reveal the truth: in the second half of October, the labor market slowed down, and the private sector lost a total of 45,000 jobs for the entire month, marking the largest decline in two and a half years.

The US SEC and CFTC may accelerate the development of crypto regulations and products.

The Most Understandable Fusaka Guide on the Internet: A Comprehensive Analysis of Ethereum Upgrade Implementation and Its Impact on the Ecosystem

The upcoming Fusaka upgrade on December 3 will have a broader scope and deeper impact.

Established projects defy the market trend with an average monthly increase of 62%—what are the emerging narratives behind this "new growth"?

Although these projects are still generally down about 90% from their historical peaks, their recent surge has been driven by multiple factors.