Cardano Looks Dormant, But Whales Quietly Scoop Up $200 Million Worth of ADA

Cardano whales are quietly accumulating ADA at the fastest pace since May, echoing patterns that preceded past bull runs. As consolidation continues and the Summit 2025 nears, on-chain data hints at a potential upside for ADA.

Although Cardano (ADA) remains among the top 10 altcoins by market cap, its price is still hovering around 2024 levels. While many holders express disappointment with ADA’s performance, accumulation continues quietly beneath the surface.

What evidence supports this trend, and what impact could it have? The following analysis draws on on-chain data and expert insights.

How Have Cardano (ADA) Whales Been Accumulating in November?

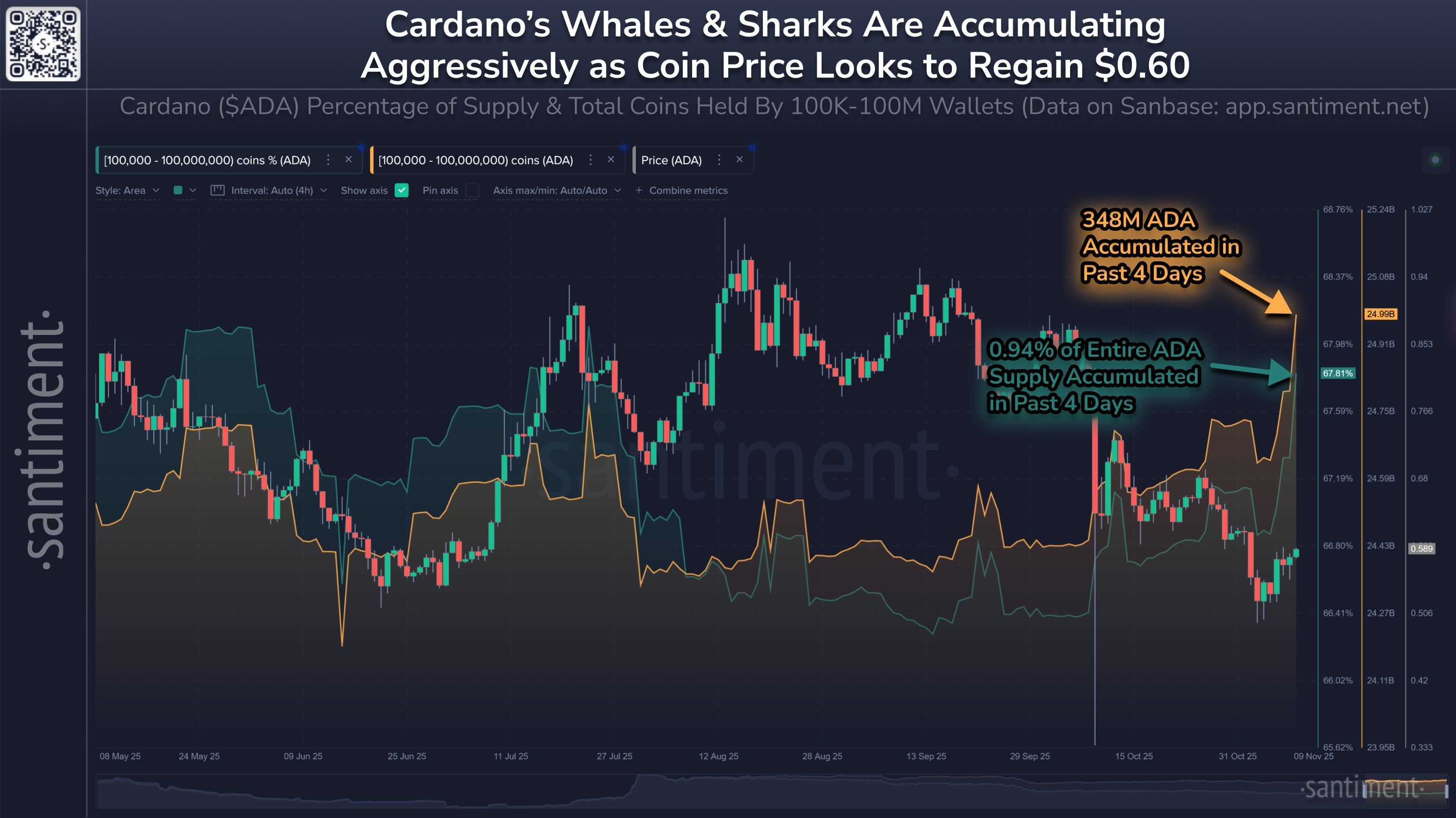

Data from Santiment shows that “whales” and “sharks” — investors holding between 100,000 and 100 million ADA — have been accumulating heavily in a short period.

Over the past four days, these large holders have purchased 348 million ADA, valued at approximately $204.3 million, which represents 0.94% of the total ADA supply.

Cardano Whales Accumulation. Source:

Santiment

Cardano Whales Accumulation. Source:

Santiment

This marks the strongest accumulation since May. Notably, this buying activity comes as ADA’s price has corrected by more than 30% from last month and remains below $ 0.60.

While many retail investors appear to have exited, whales seem to view the pullback as a chance to secure better entry positions. With smaller traders sidelined, smart money is accumulating quietly, creating minimal volatility. Analysts see this as a potential signal for an upcoming bullish phase.

“While many call Cardano (ADA) ‘dormant,’ the charts whisper a different story — millions of ADA are quietly being scooped up by whales and institutions. On-chain data shows this ‘silence’ isn’t weakness — it’s precision accumulation. With retail out of the picture, smart money is loading up without triggering alarms.” — BeLaunch.

Historical Patterns Suggest Possible Rally

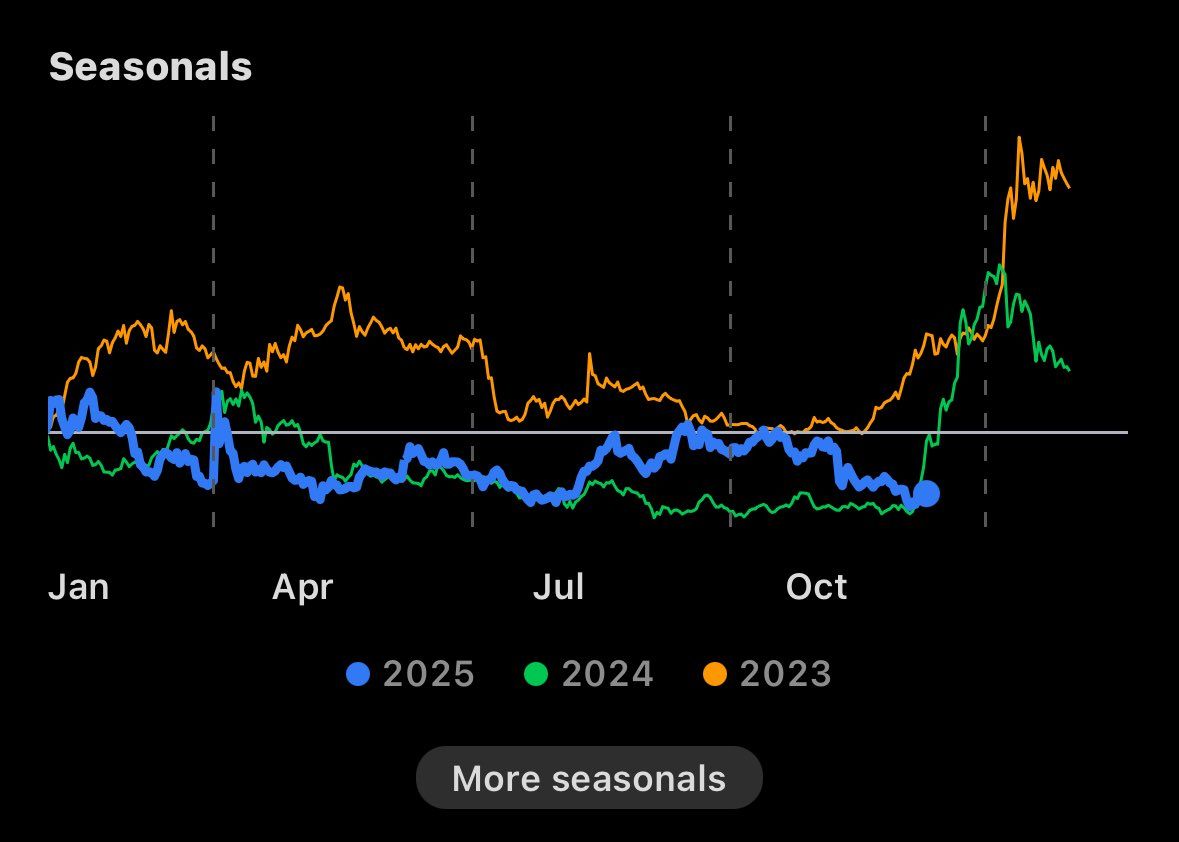

Historical ADA price patterns suggest that strong rallies frequently follow extended consolidation periods of approximately ten months.

The DApp Analyst highlighted this trend, comparing 2025’s behavior with that of the previous two years. In both 2023 and 2024, ADA experienced powerful bull runs following prolonged consolidation phases, delivering gains of 200% to 300%.

Comparing ADA Price Models in 2023, 2024, and 2025. Source:

The DApp Analyst

Comparing ADA Price Models in 2023, 2024, and 2025. Source:

The DApp Analyst

Now, in October 2025, conditions appear similar to those of historical setups — potentially forming a base for another upward move. Combined with current whale accumulation, this alignment strengthens the bullish outlook.

“Will 2025 be like ‘23 & ‘24? $ADA has spent the entire year consolidating between $0.5 and $1.3. Can we finally get a breakout?” — The DApp Analyst.

November also brings the Cardano Summit 2025 in Berlin. Statements from project leaders at the event are expected to renew optimism among ADA investors this month.

However, overall market sentiment remains cautious. The altcoin season index sits at a low 39 points, reflecting lingering fear — a potential headwind for ADA’s recovery despite growing accumulation and bullish setups.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solana News Update: Solana Applications Surpass Ethereum as Meme Coins Lose Momentum

- Solana and BSC meme coin trading volumes dropped, with most tokens fluctuating within 6% ranges as of LookOnChain data. - Solana apps outperformed Ethereum in app revenue ($4.33M vs $1.82M), driven by platforms like Pump.fun despite SOL's 5.4% decline. - The TRUMP (market cap: $7.8B) showed mixed signals, with $1.8B trading volume and key support levels at $7.95/$6.73 per FXStreet analysis. - Market consolidation persists as investors await 2025 catalysts, with Solana ETF inflows and institutional intere

Sonic’s Deflationary Strategy: Will Developer Rewards Surpass Market Fluctuations?

- Sonic Labs, under new CEO Mitchell Demeter, is prioritizing deflationary tokenomics and ecosystem growth through a revised fee monetization system. - The updated FeeM model allocates 15-90% of fees to developers, 10% to validators, and burns remaining funds to reduce S token supply. - S token (S) trades at $0.14 with $546.8M market cap, while Sonic's TVL fell to $126.65M from $1B peak despite 370,000 TPS capacity. - Demeter emphasizes U.S. expansion, Ethereum/Solana competition, and institutional engagem

CZ Refutes Connection to Trump Amidst Political Rumors Following Pardon

- Binance Alpha's TIMI airdrop (960 tokens/$30 value) highlights its ecosystem expansion, following MetaArena project launch. - CZ denies Trump family business ties and political pardon speculation, emphasizing 2023 AML plea as regulatory strategy. - Binance's leverage reset aims to reduce trading risks and stabilize crypto volatility through adjusted margin requirements. - Bitwise's Chainlink ETF gains regulatory traction via DTCC listing, potentially outpacing Grayscale in altcoin ETF race.

Solana News Update: Institutional Investors Pour into Solana ETFs While Bitcoin and Ethereum Trail Behind

- U.S. Solana ETFs recorded 10 consecutive days of inflows, totaling $342M, surpassing Bitcoin and Ethereum in institutional demand. - Bitwise (BSOL) and Grayscale (GSOL) led with $5.92M and $854K net inflows, signaling strong adoption despite crypto market volatility. - Analysts highlight Solana's expanding utility and stable derivatives metrics, but warn of consolidation risks as price dips 2.3% to $163. - Technical indicators show bearish momentum (AO -21, RSI 40), with potential downside to $80 if key