Key Market Information Discrepancy on November 11th - A Must-Read! | Alpha Morning Report

1. Top News: DeFi Sector Tokens Soar, UNI Surges Over 38% in 24 Hours 2. Token Unlocking: $APT, $IO, $LAYER

Featured News

1.DeFi Sector Tokens See Collective Rise, UNI Surges Over 38% in 24 Hours

2.Major U.S. Stock Indexes Open Higher, Crypto Stocks Experience General Uptrend

3.$3.01 Billion Liquidated Across the Board in the Last 24 Hours, Longs and Shorts Both Suffer

4.Fed Governor Milan Calls for Substantial Rate Cut in December Once Again

5.Coinbase Announces Monad Token Public Sale Launching on November 17

Articles & Threads

1.《U.S. Government Set to Reopen, Bitcoin Finally Poised for a Rally》

The historically longest U.S. government shutdown is finally coming to an end. The government collectively shut down due to budget disagreements, a phenomenon almost unique to the U.S. political system. The 40-day government shutdown had a significant impact on the global financial markets. Nasdaq, Bitcoin, tech stocks, Nikkei Index, and even safe-haven assets like U.S. Treasuries and gold were not spared.

2.《Will Trump's Announced $2000 "Tariff Windfall" Truly Bring a Liquidity Feast?》

Every Christmas, children receive a gift from a mysterious old man, and they never question the cost of the gift. Today, Donald Trump is trying to play Santa Claus to the adult world, promising to distribute a sky-fallen $2000 "tariff windfall," claiming the gift is paid for by distant "foreign factories." The crypto market is as excited as a group of children eager to unwrap their gifts. However, there's an overlooked detail in this grand magical performance: before applauding the rabbit that appeared out of thin air, no one asks, who paid for its dinner. And who will go hungry tonight?

Market Data

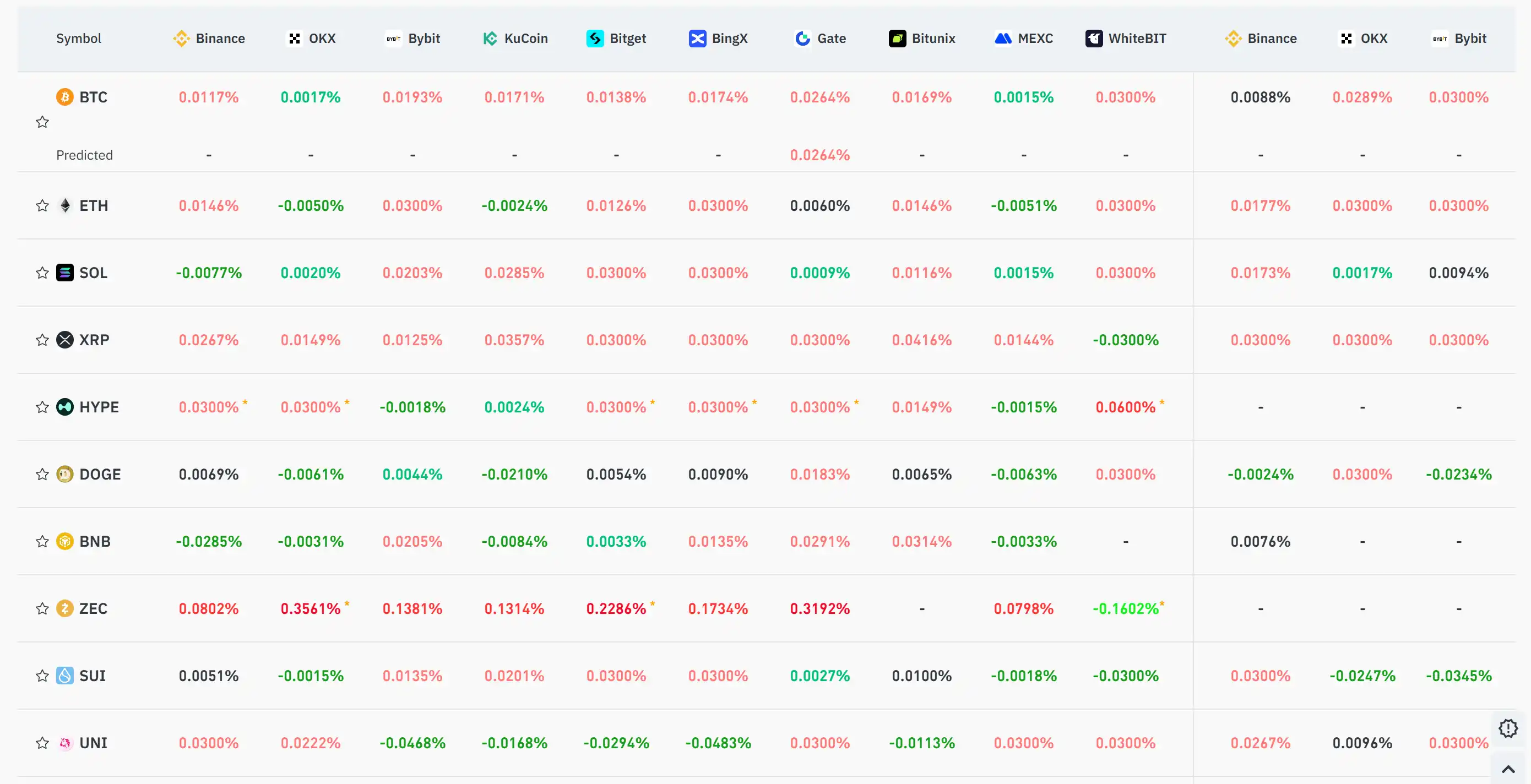

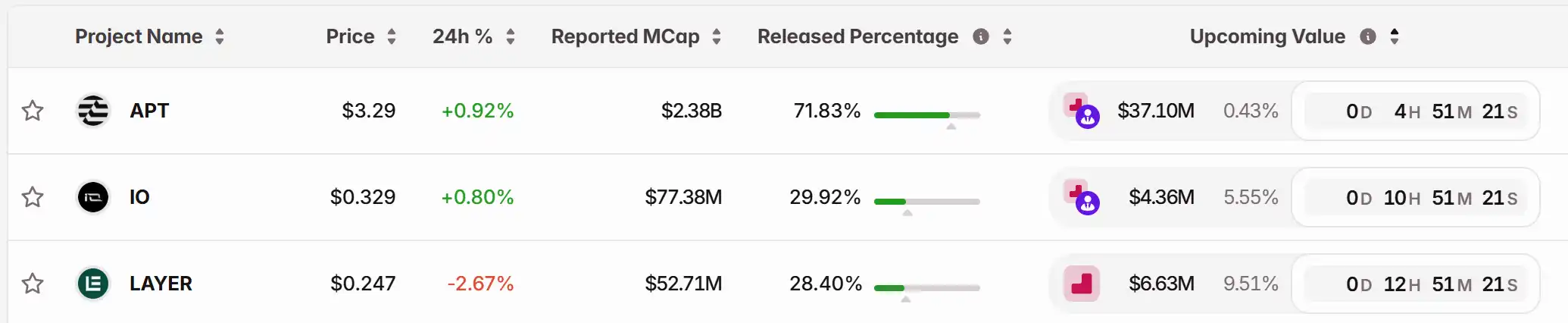

Daily Market Overall Funding Heatmap (as reflected by Funding Rate) and Token Unlocks

Data Source: Coinglass, TokenUnlocks

Funding Rate

Token Unlocks

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP News Update: Altcoin ETFs Move Closer to U.S. Approval After DTCC Surpasses Major Obstacle

- DTCC's approval of Bitwise's CLNK ETF marks a key step toward U.S. altcoin ETFs, with XRP-focused funds from 5 firms now listed. - XRP ETFs like Canary's XRPC and Grayscale's proposed offering highlight growing institutional demand for crypto exposure. - SEC resumes reviews post-government shutdown, accelerating approvals for pending applications including XRP Trust conversion. - Historical ETF inflows and CME's crypto derivatives success suggest regulatory clarity could drive significant capital into al

Bitcoin News Today: Whale Faces $190M Short Liquidation Risk as Bitcoin Approaches $104K

- Bitcoin nears $104K as a whale's $190M short position risks liquidation, potentially boosting prices to $105K. - Market volatility grows from $240M institutional selling and leveraged trading risks highlighted by Arkham Intelligence. - CME Group expands crypto products (XRP futures) amid regulatory scrutiny and record October trading volumes. - Whale liquidation could trigger cascading effects, testing Fibonacci resistance and accelerating BTC's bullish momentum. - CME's $7.3B 2028 revenue forecast contr

ZEC rises by 5.95% as whales reduce holdings and accumulation becomes evident

- ZEC surged 5.95% in 24 hours amid whale liquidation reducing its stake from $37M to $10.37M, triggering $960K realized losses. - Binance saw $33M ZEC accumulation via 2,200 coins/second trades, suggesting coordinated large-scale buying. - Grayscale’s Zcash Trust hit $151.6M AUM, reflecting institutional interest in ZEC’s hybrid privacy model aligned with U.S. regulatory clarity. - Whale position reversals and accumulation signals highlight ongoing bear-bull dynamics, with technical indicators like RSI di

DASH rises by 6.6% as quarterly results and recent strategic actions fuel near-term positive sentiment

- DASH surged 6.6% in 24 hours ahead of its Nov 12 earnings report, driven by strategic investments in autonomous delivery and a $5.1B acquisition. - The company’s 35.22% monthly gain and 88.68% annual rise reflect expanded partnerships with McDonald’s , Waymo, and Kroger , boosting order growth and market reach. - Analysts remain cautious due to high valuation risks and competition from Uber Eats and Instacart, despite DoorDash’s aggressive expansion into AI-driven commerce.