3 Altcoins Facing Major Liquidation Risk in the Second Week of November

XRP, Zcash, and Starknet are showing strong momentum but carry high liquidation risks for leveraged traders this week. Analysts warn that overleveraged longs could face steep losses if market sentiment turns.

While the altcoin season has yet to return, a few altcoins are showing stronger performance than the rest of the market in the second week of November. However, these same tokens also face the risk of triggering massive liquidations for short-term traders.

Which altcoins are they, and what risks are involved in trading their derivatives?

1. XRP

Short-term trader sentiment for XRP remains highly optimistic as Canary Capital prepares to launch its Spot XRP ETF on November 13.

Additionally, five XRP spot ETFs from Franklin Templeton, Bitwise, Canary Capital, 21Shares, and CoinShares have appeared on the DTCC list. This development strengthens investor confidence that multiple XRP ETFs could soon receive approval.

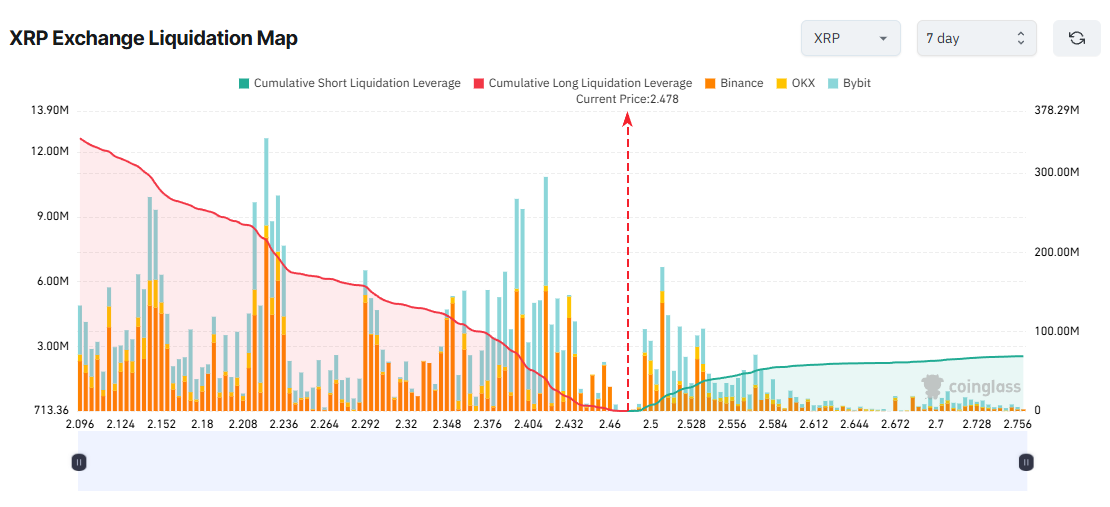

XRP Exchange Liquidation Map. Source:

Coinglass

XRP Exchange Liquidation Map. Source:

Coinglass

The 7-day liquidation map indicates a significant concentration of potential long liquidations, suggesting that many traders are anticipating an XRP price rally this week.

However, BeInCrypto’s latest analysis reveals a sharp decline in new XRP addresses over the past week, indicating a weakening of interest from new investors. Moreover, the MVRV Long/Short Difference has dropped, increasing the likelihood of a price correction.

If XRP falls toward $2.10 this week, long positions could face more than $340 million in liquidations. Conversely, if XRP rises to $2.75, short positions may be liquidated for around $69 million.

2. Zcash (ZEC)

The rally in Zcash (ZEC) shows no sign of slowing down in the second week of November. Although ZEC reached $750 before correcting to around $658, many traders still expect the price to climb toward $1,000.

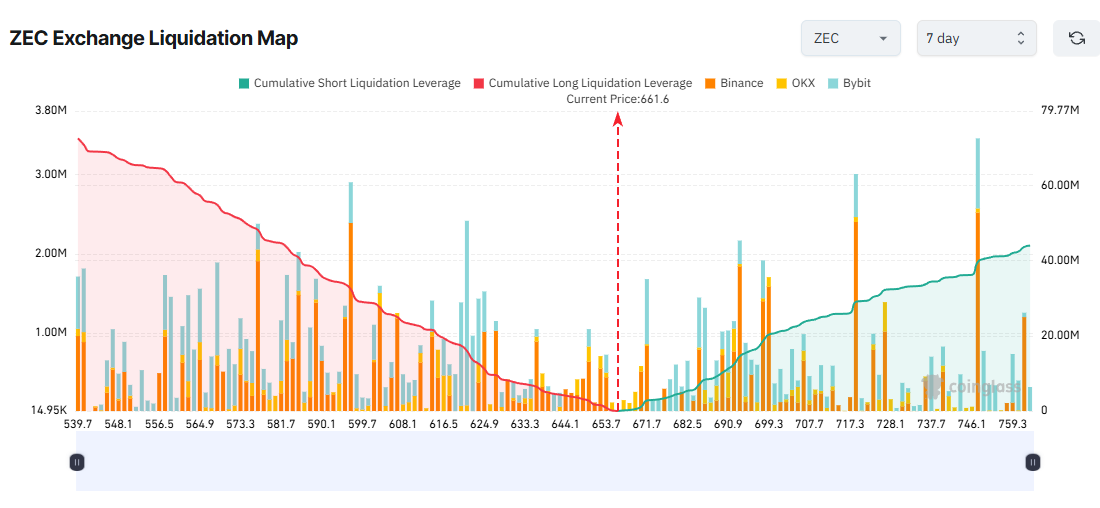

The 7-day liquidation map reveals that short-term derivatives traders are allocating more capital and leverage toward long positions. This means they could face larger losses if ZEC experiences a correction this week.

ZEC Exchange Liquidation Map. Source:

Coinglass

ZEC Exchange Liquidation Map. Source:

Coinglass

If ZEC drops to $540, over $72 million in long positions could be liquidated. Conversely, if ZEC surges to $760, roughly $44 million in shorts could be wiped out.

Analysts warn that ZEC may be forming a classic parabolic uptrend after a 10x rally, possibly nearing the final stage of the pattern.

“Just sold 90% of my ZEC. I’m bullish on the privacy thesis, but parabolic charts rarely sustain in the short run without a meaningful retrace. Too much short-term FOMO imo,” investor Gunn said.

3. Starknet (STRK)

Starknet (STRK) surprised the market in the second week of November with a 30% daily surge, recovering losses from last month’s sharp decline.

Several analysts suggest STRK may be breaking out of a long-term resistance line, potentially kicking off a strong new bull run.

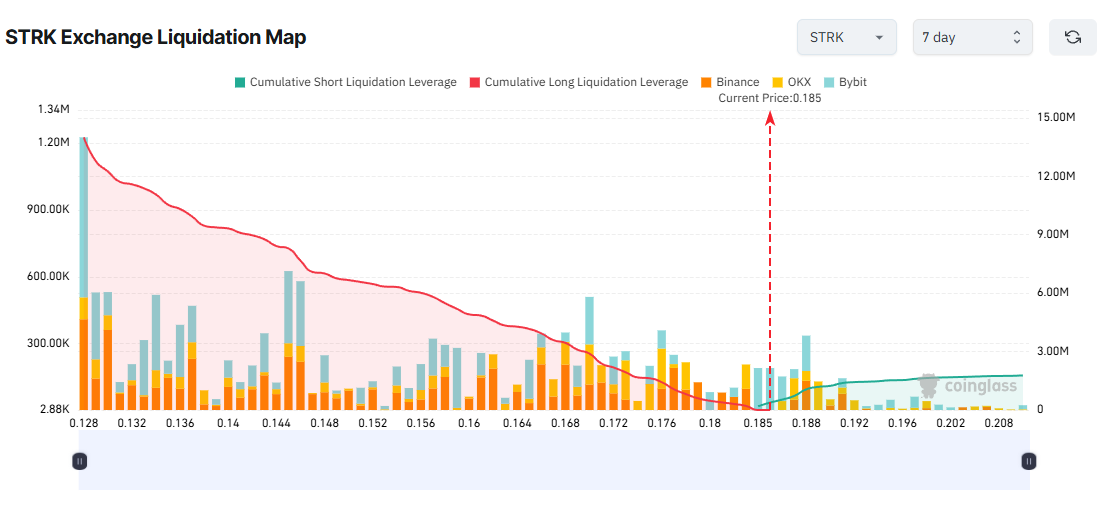

Liquidation map data reflects this short-term bullish sentiment, showing a dominance of potential long liquidations over shorts.

STRK Exchange Liquidation Map. Source:

Coinglass

STRK Exchange Liquidation Map. Source:

Coinglass

However, CryptoRank reports that STRK is among the top 7 altcoins with major token unlocks this week. More than 127 million STRK tokens will be unlocked, potentially adding significant selling pressure and disrupting the plans of leveraged long traders.

If STRK falls to $0.128, approximately $14 million in long positions could be liquidated. Conversely, if it breaks above $0.20, about $1.78 million in shorts could be wiped out.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

AI-Blockchain Leaders Falter While Presale Pioneers Transform the Investment Scene

- AI-blockchain convergence drives high-return investments via AI analytics, tokenized assets, and scalable infrastructure, attracting retail/institutional capital. - C3.ai faces 50%+ stock decline and $116M losses, exploring strategic options after founder's departure, with potential buyers including defense/enterprise giants. - SoundHound AI reports 68% YoY revenue growth to $42M, leveraging voice-first tech and enterprise automation to narrow losses and target 2026 breakeven. - Presale projects like IPO

U.S.-India Trade Agreement Strikes a Balance Between Strategic Interests and Energy Relations

- U.S. and India near trade deal to cut tariffs (15-16%) and reduce India's Russian oil imports, easing tensions. - Agreement aims to boost bilateral trade to $500B by 2030 while addressing U.S. concerns over India's Russian energy ties. - India seeks WTO-compliant steel/aluminum export terms, balancing U.S. strategic goals with its energy security priorities. - Deal could inject $250-350B liquidity globally, weakening the dollar and boosting crypto markets like Bitcoin .

Is the Lightning Network Losing Steam? The Numbers Raise Questions

Luxren Capital Review 2025: Is This Broker Worth Your Trust, Time, and Money?