Creator Talk | Where Are the Opportunities in the Second Half of the Prediction Market?

"Creator Talk" is a dialogue column for content creators launched by Foresight News. Each month, we pose questions on trending market topics to outstanding creators selected for that month, gathering and organizing their responses into articles to capture diverse opinions and uncover deeper insights.

"Creator Speaks" is a dialogue column launched by Foresight News, where we pose questions on hot market topics to outstanding creators selected each month, and compile the collected responses into an article. By gathering diverse opinions, we aim to uncover deeper insights.

Written by: Foresight News Outstanding Content Creators, October 2025

Compiled by: Foresight News

In a world swept by uncertainty, decentralized prediction markets have emerged from the niche Web3 sector. Leveraging blockchain’s transparent settlement and open participation, they cover diverse scenarios from elections to sports events. The explosive growth of platforms like Polymarket demonstrates the market’s potential. As compliance exploration and technological innovation advance in tandem and new users continue to pour in, this revolution in "probability pricing" is brewing a new trend that could reshape the industry landscape.

This edition of "Creator Speaks" focuses on "decentralized prediction markets." We invited October 2025 Foresight News Outstanding Creators List members, including Web3 Jianghu by Tian Daxia, Crypto Market Watch, K1 Research, On-chain Revelation, and Jinke Yulu to join this discussion.

We raised four questions: "Key factors in choosing a prediction platform," "Memorable experiences operating in prediction markets," "Criteria for judging hot events," and "Outlook on prediction market regulation." Below are the answers we collected.

1. When playing prediction markets, do you value liquidity, settlement speed, or the variety of markets most? Among the platforms you use, which do you favor and why?

Web3 Jianghu by Tian Daxia: What I value most is definitely liquidity. Because prediction markets are essentially "consensus games," poor liquidity means high slippage and greater risk of manipulation—you might spend a lot of effort analyzing a hot topic, only to find the odds have collapsed when you place your bet. Settlement speed and market variety are also important, but liquidity is fundamental; it determines whether you can enter and exit quickly and avoid being "stuck." For example, slow settlement can be tolerated, but if liquidity dries up, you’re likely to get "rekt."

Currently, I’m most optimistic about Polymarket. First, it’s based on Polygon L2, so transaction costs are negligible; second, its liquidity is king in the space, especially for political and crypto events, often with million-dollar depth.

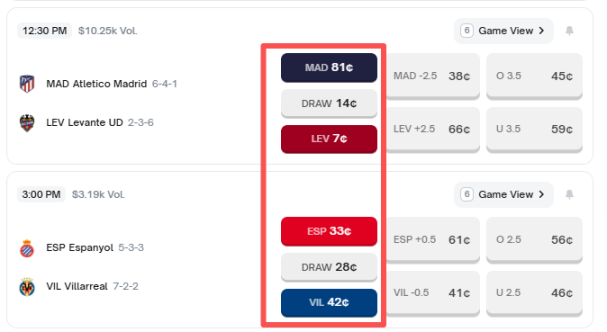

Crypto Market Watch: The main thing I look at is the odds. For these betting algorithms, here’s a little trick: for example, in this event:

The sum of win/draw/lose odds for the first match is 102; for the second match, it’s 103.

In this case, the first match has a 2% rake, the second match a 3% rake.

K1 Research: Liquidity is the top priority. Core focus: liquidity.

- Without depth and matching volume, even the best odds are just "paper prices"—slippage eats up every entry and exit.

- Polymarket maintains tight spreads and thick order books over the long term by combining CLOB and market-making bots, so even trades of tens of thousands of dollars can be executed near the mid-price.

- Institutional funds also prefer highly liquid platforms, as their data can be used directly for risk hedging and probability pricing.

Platform preference: For short-term/high-frequency or deep research trading, Polymarket is preferred: stable liquidity, user-friendly UX, on-chain non-custodial support, and low fees.

On-chain Revelation: In professional practice with prediction markets, I personally use a "dual-platform strategy," leveraging the complementarity of Polymarket and Kalshi.

They represent two paths for prediction markets:

- Polymarket represents decentralization and thematic innovation (wild flexibility);

- Kalshi represents compliance and capital efficiency (diversified assets).

In practice, I rely more on Polymarket for "market sentiment" and price signals—it updates topics extremely quickly, mapping network consensus in real time from the US election to crypto airdrops.

Kalshi, on the other hand, provides a more stable capital environment, with USD settlement and a regulatory framework making mid-term positions more controllable in terms of risk.

For me, the combination is like "capturing signals on-chain, locking in profits off-chain." They are currently independent, but if in the future they can interoperate via on-chain USD, data bridges, or mutual settlement recognition, prediction markets will truly become global and structured.

In the long run, I’m very bullish on Polymarket, especially after Donald Trump Jr. became an advisor to Polymarket.

Next, I also suggest everyone pay attention to the upcoming Truth Predict platform to be launched by President Trump—there should be plenty of opportunities (currently in Beta testing); as the year ends, keep a close eye on this family’s moves.

Jinke Yulu: Among liquidity, settlement speed, and market variety, I value liquidity the most. A "zombie" market lacking liquidity is like a deserted commercial street—you can’t buy when you want, can’t sell when you want, or have to accept huge slippage and high transaction costs. Such an experience is a big turnoff for users.

I think Polymarket performs exceptionally well in terms of liquidity, and its leading position in prediction markets is unquestionable. If we set aside Web3 ideals, Kalshi is also worth watching—it’s a CFTC-approved exchange, legitimate, compliant, mainstream, and has overcome regulatory barriers, giving it innate advantages in attracting liquidity, institutional participation, and building market trust.

2. Do you have any particularly memorable experiences in prediction markets? For example, winning by accurately judging a hot event, or falling into a pit due to result disputes or oracle issues?

Web3 Jianghu by Tian Daxia: Actually, I haven’t participated much in this aspect, but looking back over the past few years, from Polymarket’s election boom to Augur’s early explorations, prediction markets have moved from fringe experiments to mainstream entry points. The next trend should be AI-driven personalized prediction and integration with on-chain derivatives. Pure prediction markets can get stuck on "information asymmetry" and "single events," but AI can inject real-time data analysis (such as integrating on-chain sentiment, social signals, and macro models), allowing users to shift from passive betting to actively building "prediction strategy portfolios." Prediction is hard—winning or losing by accurately judging hot events can both happen.

Crypto Market Watch: I’ve always done well with football match predictions, for example, prioritizing draws in big tournaments like the World Cup or European Championship.

Because national teams play fewer matches and their players don’t cooperate as well as in club matches, the strength gap between strong and weak teams is smaller than it appears, so betting on a draw may offer arbitrage opportunities.

K1 Research: Winning with information advantage in traditional markets:

For LOL WORLDS2025, I bet based on my own and friends’ knowledge of the teams.

Oracle dispute pitfall:

Once, in a niche market involving internal Vatican affairs, due to scarce public information, the UMA oracle was challenged by a few large holders and triggered arbitration.

On-chain Revelation: What impressed me most was betting on Trump’s victory in the 2024 US election on Polymarket.

At that time, the market odds fell to 18%, and almost all mainstream polls were bearish on him. But I kept an eye on two types of data:

- First, structural bias in poll samples and the flow of on-chain donations—especially in key swing states, small on-chain donations clearly favored the Republican Party;

- Second, the July 13 incident—that bullet grazing his ear almost "mythologized" him in public opinion. At that moment, I realized that such major election events are not just political games but also the destination of public sentiment. You could say this event changed many people’s minds—he became the "hero" people wanted.

More importantly, he is one of the few "crypto-friendly" politicians. For insiders, this is not just a political stance but also about survival.

So that bet was not pure speculation, but a judgment based on data, narrative, and conviction. This is the real charm of prediction markets.

Jinke Yulu: I heard a particularly memorable case: The question was, "Will a post containing the phrase 'The Runny Babbit' reach the top of r/wallstreetbets on or before 2023-12-31?" When the market was created, "The Runny Babbit" was a completely non-existent phrase, a pure hypothetical, and the market probability was very low. Some traders realized they didn’t need to wait for such a post to appear naturally—they could create this future themselves. So, they started frantically posting on Reddit’s r/wallstreetbets with "The Runny Babbit" and tried to upvote and comment each other’s posts to push them to the top. As these posts began to appear, the "No" side argued that since these posts were artificially pushed up and not naturally popular, they didn’t meet the spirit of "reach the top," and started looking for loopholes in the rules. They discovered that r/wallstreetbets’ homepage has a pinned post, usually by the moderators, which is always at the very top. They argued that only this pinned post is truly "top," and no regular post, even if it’s the hottest, can surpass it, so technically, it can never "reach the top." In the end, this market was not force-settled by a centralized authority but entered a long discussion period as the community tried to agree on what counts as a result.

This case shows that prediction markets are not just a cold probability game, but a micro-battlefield where people not only bet but also actively participate. Self-fulfilling prophecies, rule-interpretation games, and the dilemmas of decentralized governance are all vividly displayed here. Of course, this may also be the most fascinating and vibrant aspect of Web3 prediction markets.

3. For high-frequency crypto hot topics like Fed policy or x402 protocol progress, odds change quickly in prediction markets. Do you trust your own analysis more, or do you refer to on-chain data or market sentiment?

Web3 Jianghu by Tian Daxia: 60% trust my own analysis, 40% refer to on-chain data and market sentiment. Relying solely on sentiment leads to chasing highs and lows, while my own analysis is the anchor; but on-chain data is a "real-time calibrator" that can catch blind spots. In short, trusting myself is the baseline (to avoid herd mentality), but data is an amplifier. Last year, by mixing these approaches, I made a small profit in the Fed’s "unexpected dovish" market.

Crypto Market Watch: Without an information edge, it’s hard to make money gambling—you have to play to your strengths; all profits come from going against sentiment.

K1 Research:

- Establish priors: Combine your own judgment with historical precedents, analyze key stakeholders in macro policy paths, and make a basic judgment;

- Data/sentiment check (Polymarket high-win-rate account positions/options implied probability/CEX/DEX large trades/social media buzz, news sentiment);

- Dynamic adjustment (quickly adjust when large on-chain positions or odds swings occur).

On-chain Revelation:

1) Trust your own analysis, but use on-chain data and market sentiment as a "validator"; here’s a useful tool

Because personal analysis is like the "anchor" of a ship—in such a fast-changing market, having your own judgment is important. Many clues are hidden in public information, so pay attention to news and prepare in advance, such as by following Foresight News.

2) Being right doesn’t mean you have to enter the market. To quote Polymarket top winner @0xashensoul, choose markets where the odds are between 50% and 80%, because in these markets, group hesitation creates the greatest competitive advantage.

3) Do your research. Beginners can start by choosing 1-2 fields you’re familiar with, and it’s recommended to keep the trading cycle within a month.

Jinke Yulu: I believe that pure self-analysis and pure external reference are both dangerous. Market sentiment can be used to time trades or as a contrarian indicator—it’s a thermometer for the market’s "temperature." On-chain data is relatively objective and can verify or falsify market narratives. Self-analysis is the core, allowing us to stay calm amid market fluctuations and earn within our cognitive range; otherwise, if you’re led by market sentiment and messy data, you’ll just be a pure gambler.

4. Blockchain prediction markets have always been on the edge of "compliance." Polymarket was once forced out of the US due to regulation and is now about to return; Trump Media Group recently launched a prediction feature on Truth Social. How do you view the future direction of prediction market regulation?

Web3 Jianghu by Tian Daxia: The regulatory dilemma of prediction markets is essentially a tug-of-war between "gambling vs. information tool." The future direction is layered compliance, with crypto platforms needing to embed KYC/AML; then cross-sector integration, with regulators pushing for "prediction + AI" sandbox testing to avoid a pure gambling label. The risk is that Europe’s MiCA is stricter and may force platforms to migrate.

Crypto Market Watch: Prediction markets will be regulated similarly to gambling management—online lotteries or betting have already gone through this process. If you really care about prediction markets, pay attention to betting companies transitioning to support on-chain payments and settlements; once that’s implemented, it could quickly create application scenarios and maybe even spark a hype wave.

P.S. Before entering crypto, I was a product manager for a leading domestic internet betting company.

K1 Research: Regulation will drive two parallel paths—regulated fiat/contract markets and open on-chain markets:

- Regulated fiat (legitimate for institutions and fiat users, strong legal protection, but limited assets, high fees and compliance costs)

- Open on-chain layer (more innovation, globally accessible, low barriers, but must bear KYC/AML risks and is easily blocked by states or countries)

The future of prediction markets is no longer a simple binary of "gambling or not," but a collaborative competition of "licensed track + decentralized sandbox." Liquidity determines market vitality, oracles and regulation determine credibility and scalability; both paths will jointly shape the next generation of information value discovery networks.

On-chain Revelation: As I mentioned in related articles: prediction markets are both DeFi’s "unexpected holy grail" and democracy’s "secret weapon"—they are both.

For prediction markets to move from the "fringe" to the "mainstream," the path is clear: embed business into licensed, regulated exchanges and clearing structures, and accept their compliance and risk control rules. Polymarket’s acquisition of a CFTC-licensed derivatives exchange/clearinghouse (QCEX) and gaining regulatory recognition is a typical approach. This "license acquisition + compliance" can turn products previously seen as "unregistered gambling/binary options" into regulated event contracts.

Regulators (especially the CFTC) have recently signaled that they are not outright rejecting prediction contracts, but are willing to bring them into the existing derivatives regulatory framework, as long as platforms meet requirements for trading, settlement, AML, customer suitability, etc.

Kalshi’s legal path and Polymarket’s compliance acquisition both show that the regulatory direction is "integration and management," not simple prohibition. This means future regulation will focus on: exchange licenses, reporting/disclosure obligations, product design (avoiding binary gambling structures), and transparency/manipulation prevention for political contracts.

Therefore, my personal prediction: competition in this sector will give rise to two types of players: one taking the compliance license route, serving institutional investors; the other focusing on social traffic, offering lightweight contracts but facing higher legal risks.

Message to readers: Watch for who can secure both "traffic + compliance"—that’s the key to winning. In the short term, players entering via acquisition or compliant partners (exchange/clearing) are more likely to land steadily.

Jinke Yulu: We can see that prediction markets are splitting into two distinct development paths: "compliant" and "native," which directly determines how they interact with regulation. Platforms like Kalshi choose the narrow path of compliance, designing products as "event contracts" and emphasizing their risk-hedging function, but at the cost of more restrictions on product scope and innovation speed; Polymarket, on the other hand, leans more toward a crypto-native model, pursuing global liquidity, diverse assets, and product experience, but must always dynamically contend with regulation.

Overall, prediction markets will not return to the completely unregulated wild era, nor will they be fully assimilated by the traditional financial system and lose their uniqueness.

Given this market structure, regulators may also adopt diversified, classified governance strategies, such as bringing compliant markets into the traditional financial regulatory framework, while for crypto-native markets, controlling fiat on-ramps and user access channels to limit their impact, thereby achieving risk isolation and investor protection.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Looking at the Latest Short Interest Trends for Regeneron Pharmaceuticals Inc

Delta, United Expected to Drive Airline Growth in 2026 as Capacity Remains Controlled, Analyst Says

Disney Highlights Robust Orlando Visitor Numbers Over Holiday Season

Billionaire Andreas Halvorsen Increases Stake In Chewy — Are Savvy Investors Signaling A Bottom For CHWY?