Macroeconomic Interpretation: Powell's "Driving in the Fog" and the Financial "Hunger Games"

The new policy framework exhibits three characteristics: limited visibility, fragile confidence, and liquidity-driven distortions.

Original Title: "Driving in Fog” and the Financial Hunger Games

Original Author: @arndxt_xo

Translated by: Dingdang, Odaily

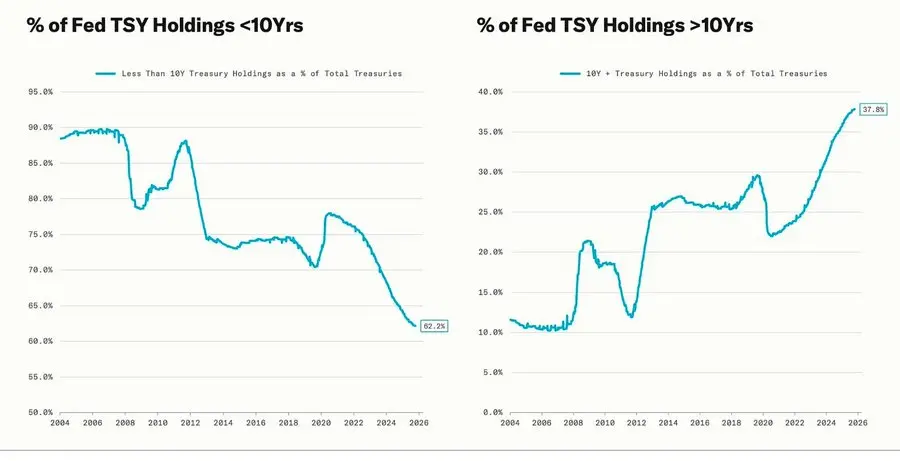

The sharp correction coincided with the quantitative easing (QE) cycle—when the Federal Reserve intentionally extended the maturity of its asset holdings to suppress long-term yields (an operation known as “Operation Twist” as well as QE2/QE3).

Powell’s “driving in fog” metaphor is no longer limited to the Federal Reserve itself, but has become a portrayal of today’s global economy. Whether policymakers, corporations, or investors, all are groping forward in an environment lacking clear visibility, relying only on liquidity reflexes and short-term incentive mechanisms.

The new policy regime exhibits three characteristics: limited visibility, fragile confidence, and liquidity-driven distortions.

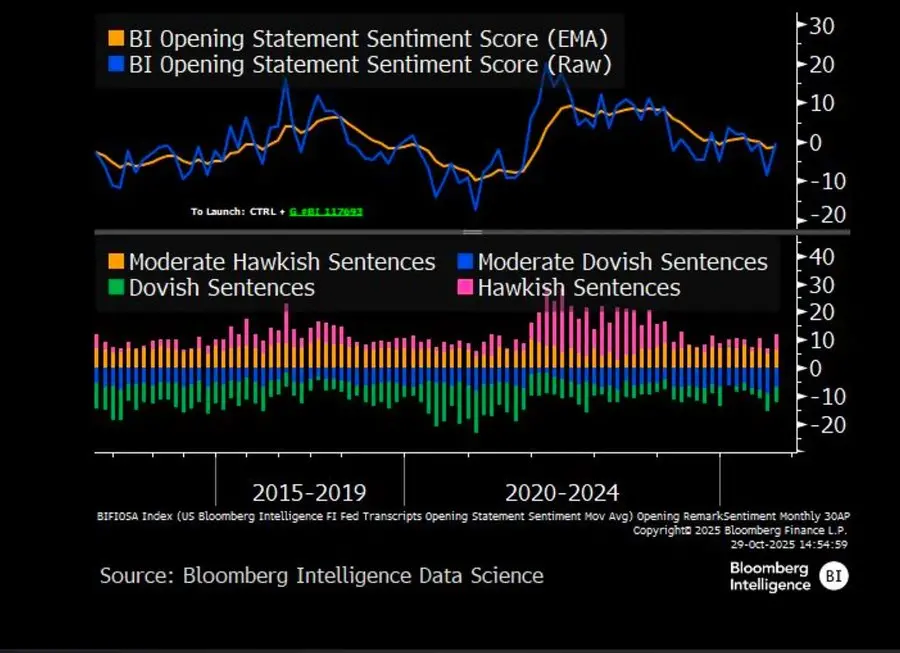

The Fed’s “Hawkish Rate Cut”

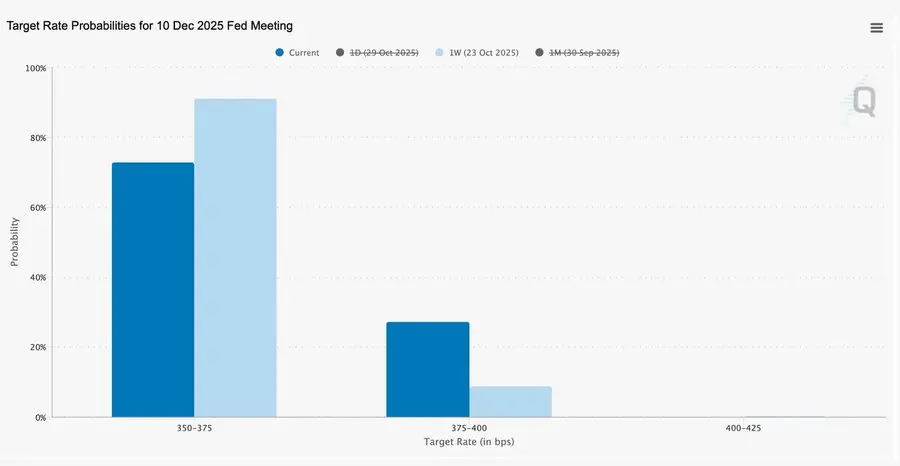

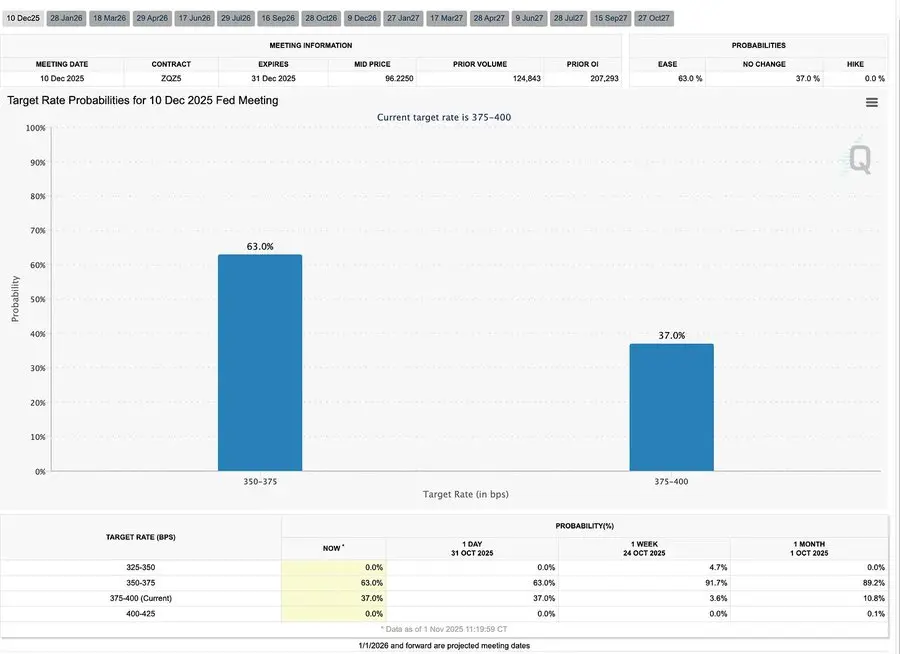

This 25 basis point “risk management” rate cut, lowering the rate range to 3.75%–4.00%, is less about easing and more about “preserving optionality.”

Due to two sharply opposing views, Powell sent a clear signal to the market: “Slow down—the visibility is gone.”

Due to a data blackout caused by the government shutdown, the Fed is almost “driving blind.” Powell’s hint to traders was very clear: There is no certainty about whether rates will be announced in December. Rate cut expectations quickly receded, the short end of the yield curve flattened, and the market is digesting a shift from “data-driven” to “data-missing” caution.

2025: The Liquidity “Hunger Games”

Repeated central bank interventions have institutionalized speculation. Now, it is not productivity but liquidity itself that determines asset performance—this structure leads to ever-expanding valuations while credit to the real economy weakens.

The discussion further extends to a sober examination of the current financial system: passive concentration, algorithmic reflexivity, retail options frenzy—

- Passive funds and quantitative strategies dominate liquidity, volatility is determined by positioning, not fundamentals.

- Retail call option buying and Gamma squeezes create synthetic price momentum in the “Meme sector,” while institutional funds crowd into an increasingly narrow set of market leaders.

- The host calls this phenomenon the “financial version of the Hunger Games”—a system shaped by structural inequality and policy reflexivity, forcing small investors toward speculative survivalism.

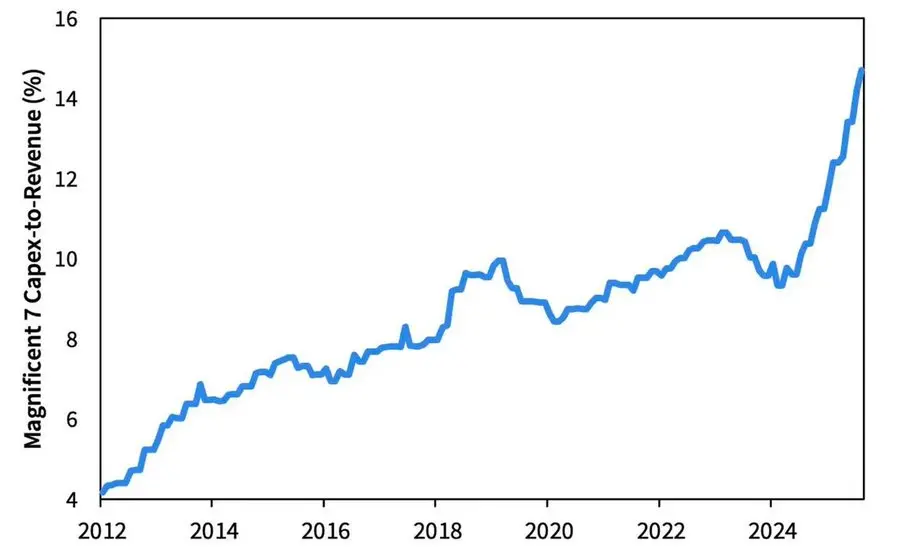

2026 Outlook: The Boom and Worries of Capital Expenditure

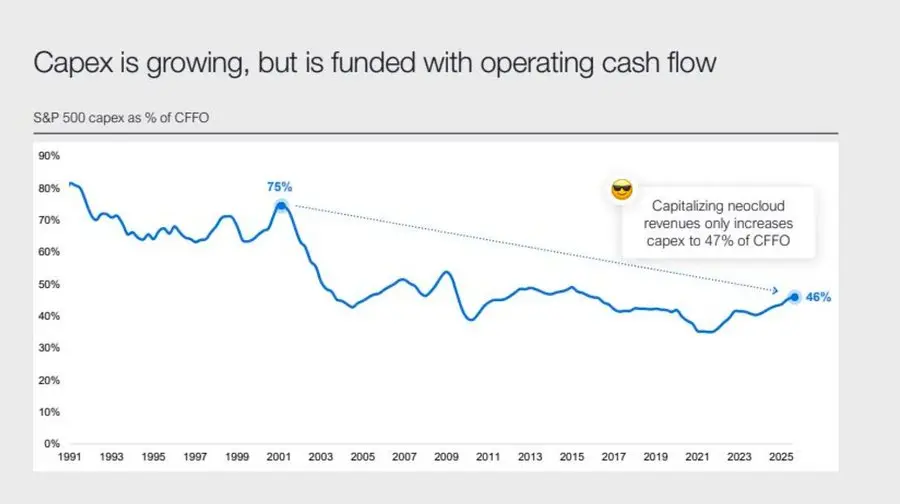

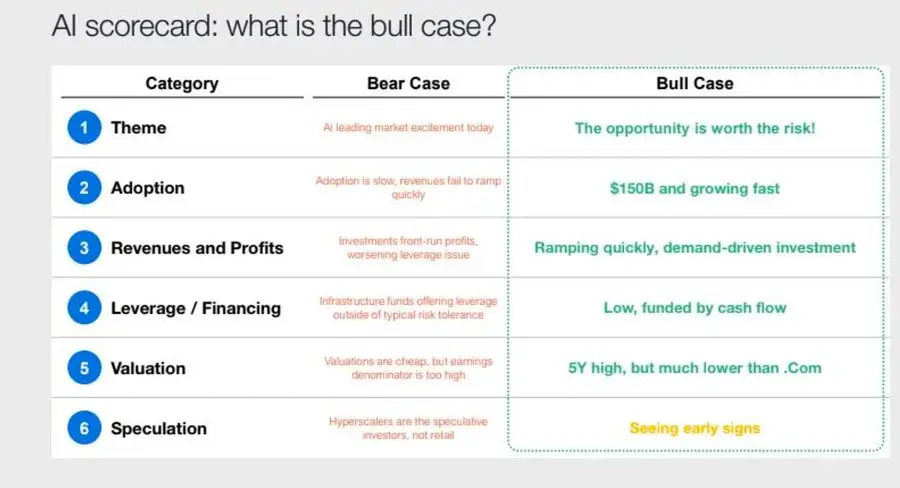

The AI investment wave is pushing “Big Tech” into a post-cycle industrialization phase—currently driven by liquidity, but facing leverage sensitivity risks in the future.

Corporate profits remain strong, but the underlying logic is changing: the former “light-asset cash machines” are transforming into heavy capital infrastructure players.

- The expansion of AI and data centers initially relied on cash flow, but now shifts to record-breaking debt financing—for example, Meta’s oversubscribed $25 billions bond issuance.

- This shift means margin compression, rising depreciation, and increased refinancing risk—setting the stage for the next credit cycle reversal.

Structural Commentary: Trust, Distribution, and Policy Cycles

From Powell’s cautious tone to the final reflection, a clear thread runs throughout: concentration of power and loss of trust.

Every policy bailout almost always strengthens the largest market participants, further concentrating wealth and continuously undermining market integrity. The coordinated operations of the Fed and Treasury—from quantitative tightening (QT) to short-term Treasury (Bill) purchases—have exacerbated this trend: liquidity is abundant at the top of the pyramid, while ordinary households are suffocated by stagnant wages and rising debt.

Today, the core macro risk is no longer inflation, but institutional fatigue. The market surface remains prosperous, but trust in “fairness and transparency” is eroding—this is the real systemic fragility of the 2020s.

Macro Weekly | Update for November 2, 2025

This issue covers the following:

- This week’s macro events

- Bitcoin heat indicators

- Market overview

- Key economic indicators

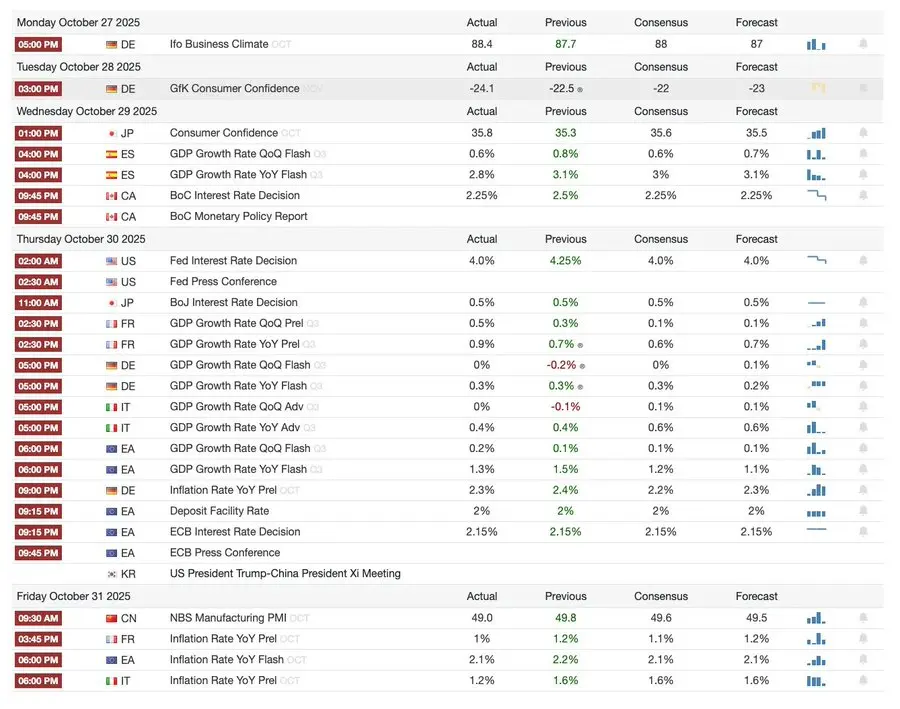

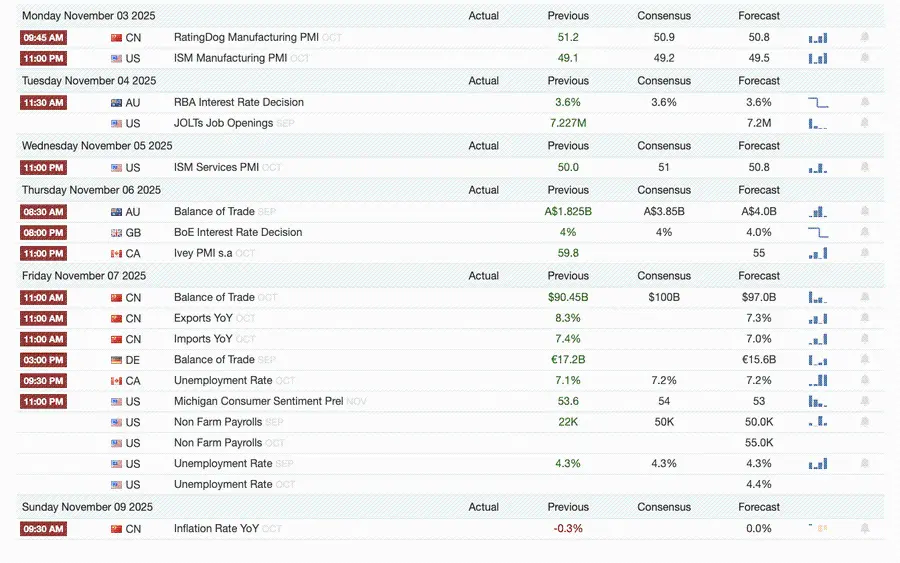

This Week’s Macro Events

Last week

Next week

Bitcoin Heat Indicators

Market Events and Institutional Developments

- Mt. Gox has extended its repayment deadline to 2026, with approximately $4 billions in bitcoin still frozen.

- Bitwise Solana ETF reached $338.9 millions in AUM in its first week, setting a new record, even as the SEC remains at an approval impasse.

- ConsenSys plans to IPO in 2026, with underwriters including JPMorgan and Goldman Sachs, targeting a $7 billions valuation.

- Trump Media Group launches Truth Predict—the first prediction market co-developed by a social media platform and Crypto.com.

Financial and Payment Infrastructure Upgrades

- Mastercard acquires crypto infrastructure startup Zerohash for up to $2 billions.

- Western Union plans to launch the stablecoin USDPT on Solana in 2026 and has registered the WUUSD trademark.

- Citi and Coinbase jointly launch an institutional-grade 24/7 stablecoin payment network.

- Circle launches Arc public testnet, attracting participation from over 100 institutions including BlackRock and Visa.

Ecosystem and Platform Expansion

- MetaMask launches multi-chain accounts, supporting EVM, Solana, and soon to add bitcoin support.

Global and Regional Developments

- Kyrgyzstan launches a stablecoin collateralized by BNB; meanwhile, Trump pardons CZ, paving the way for Binance’s return to the US market.

- US SOL spot ETF (excluding seed capital) saw $199.2 millions in inflows.

- Japan launches the fully compliant yen stablecoin JPYC, targeting an issuance scale of $65–70 billions by 2028.

- Ant Group registers the “ANTCOIN” trademark, quietly returning to the Hong Kong stablecoin race.

- AWS and Microsoft cloud service outages cause market chaos, with conflicting statements from both sides.

- JPMorgan Kinexys blockchain completes its first tokenized private equity fund transaction, further advancing institutional adoption.

- Tether becomes one of the largest holders of US Treasuries, with holdings reaching $135 billions and annualized returns exceeding $10 billions.

- Metaplanet launches a stock buyback program to address declining net assets.

- Privacy asset trading heats up, with ZEC prices breaking 2021 highs, though this week’s gains still lag behind DASH.

- Sharplink deploys $200 millions in ETH on Linea to capture DeFi yields.

- As sports betting becomes a hot sector, Polymarket plans to officially launch its product in the US by the end of November (UTC+8).

- Securitize announces a $1.25 billions SPAC merger to go public.

- Visa adds payment support for four stablecoins and four blockchains.

- 21Shares files for a Hyperliquid ETF, with more crypto funds entering the market.

- KRWQ becomes the first Korean won stablecoin issued on the Base chain.

Market Overview

The global economy is transitioning from inflation risk to confidence risk—future stability will depend on policy clarity, not liquidity.

Global monetary policy is entering a stage of limited visibility. In the US, the FOMC cut rates by 25 basis points to 3.75%–4.00%, exposing widening internal divisions. Powell hinted that further easing in the future is “not a given.” The ongoing government shutdown prevents policymakers from accessing key data, increasing the risk of policy misjudgment. Weakening consumer confidence and a slowing real estate market mean that market sentiment, rather than stimulus measures, is now steering the path of economic “soft landing.”

Among G10 countries: the Bank of Canada completed its final rate cut, the European Central Bank held rates steady at 2.00%, and the Bank of Japan paused cautiously. The common challenge is how to curb economic growth amid persistent services inflation. Meanwhile, China’s PMI has slipped back into contraction, indicating weak recovery, sluggish private demand, and policy fatigue.

Compounded by political risk, the US government shutdown threatens the normal operation of welfare programs and may delay the release of key data, undermining confidence in fiscal governance. The bond market has already begun to price in lower yields and slower economic growth, but the real risk lies in the breakdown of institutional feedback mechanisms—data delays, policy indecision, and declining public trust intertwine, ultimately brewing a crisis.

Key Economic Indicators

US Inflation: Moderate Rebound, Clearer Path

The inflation rebound is mainly supply-driven, not demand-pulled. Core pressures remain under control, and weakening employment momentum gives the Fed room to continue cutting rates without triggering an inflation rebound.

- September inflation was up 3.0% year-on-year and 0.3% month-on-month, the fastest since January this year, but still below expectations, reinforcing the “soft landing” narrative.

- Core CPI excluding food and energy rose 3.0% year-on-year and 0.2% month-on-month, showing price stability at the base level.

- Food prices rose 2.7%, with meat up 8.5%, affected by agricultural labor shortages due to immigration restrictions.

- Utility costs rose significantly: electricity +5.1%, natural gas +11.7%, mainly driven by energy consumption from AI data centers—a new driver of inflation.

- Services inflation fell to 3.6%, the lowest since 2021, indicating that a cooling labor market is easing wage pressures.

- Market reaction was positive: stocks rose, rate futures reinforced rate cut expectations, and bond yields remained stable overall.

US Demographics: A Critical Turning Point

Net immigration turns negative, posing challenges for economic growth, labor supply, and innovation capacity.

The US may face its first population decline in a century. Although births still outnumber deaths, net immigration is negative, offsetting the 3 million population increase in 2024. The US is facing a demographic reversal, not due to falling birth rates, but due to policy-driven declines in immigration. Short-term impacts include labor shortages and rising wages; long-term risks focus on fiscal pressure and slowing innovation. Unless this trend is reversed, the US may repeat Japan’s aging experience—slower economic growth, rising costs, and structural productivity challenges.

According to AEI forecasts, net migration in 2025 will be –525,000, the first negative value in modern history.

- Pew Research Center data shows that in the first half of 2025, the foreign-born population fell by 1.5 million, mainly due to deportations and voluntary departures.

- Labor force growth has stalled, with significant shortages and wage pressures in agriculture, construction, and healthcare.

- 28% of American youth are immigrants or children of immigrants; if immigration drops to zero, the under-18 population could fall by 14% by 2035, intensifying pension and healthcare burdens.

- 27% of doctors and 22% of nursing assistants are immigrants; if supply declines, automation and robotics in healthcare may accelerate.

- Innovation risk: immigrants have contributed 38% of Nobel Prizes and about 50% of billion-dollar startups; if the trend reverses, America’s innovation engine will be damaged.

Japan’s Export Rebound: Recovery Amid Tariff Shadows

Despite being dragged down by US tariffs, Japan’s exports have rebounded. September exports rose 4.2% year-on-year, the first positive growth since April, mainly driven by reviving demand in Asia and Europe.

After months of contraction, Japan’s exports returned to growth, up 4.2% year-on-year in September, the largest increase since March. This rebound highlights that despite new trade frictions with the US, regional demand remains strong and supply chains have adjusted accordingly.

Japan’s trade performance shows that, despite US tariffs on automobiles (its core export category), external demand from Asia and Europe has initially stabilized. The recovery in imports indicates a mild rebound in domestic demand, driven by a weaker yen and restocking cycles.

Outlook:

- Exports are expected to gradually recover, driven by normalization of intra-Asia supply chains and energy prices

- Persistent US protectionism remains the main obstacle to maintaining export momentum in 2026.

Recommended Reading:

$1 billions stablecoin evaporates, what’s the truth behind the DeFi domino collapse?

MMT short squeeze review: a carefully orchestrated money grab

Under brutal harvesting, who is looking forward to the next COAI?

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

MEET48: From Star-Making Factory to On-Chain Netflix — How AIUGC and Web3 Are Reshaping the Entertainment Economy

Web3 entertainment is moving from the retreat of the bubble to a moment of restart. Projects represented by MEET48 are reshaping content production and value distribution paradigms through the integration of AI, Web3, and UGC technologies. They are building sustainable token economies, evolving from applications to infrastructure, aiming to become the "Netflix on-chain" and driving large-scale adoption of Web3 entertainment.

Digital Euro: Italy Advocates for a Gradual Implementation

Ethereum Validator Queues Surge as 2.45M ETH Sits in Exit Line

21Shares And Canary Ignite XRP ETF Approval Process