Hyperliquid’s Push Into Lending Meets Rising Security Risks From Fake App

The fake Hyperliquid app has already stolen more than $281,000, underscoring the vulnerability of traders as official mobile support remains absent.

Hyperliquid is experimenting with a borrowing and lending module on its Hypercore testnet, signaling a potential expansion of the platform’s core offering.

The development surfaced after on-chain researcher MLM noted that the team has begun running tests for a feature labeled BLP, which he believes stands for BorrowLendingProtocol.

Is Hyperliquid Exploring a Native Lending Market?

His finding suggests that Hyperliquid may be preparing to introduce a native money-market layer on Hypercore. This layer would support borrowing, supplying, and withdrawing assets.

MLM said the testnet version of BLP currently lists only USDC and PURR, but he noted that even limited asset support creates a foundation for something larger.

The Hyperliquid team is currently testing something called BLP on the Hypercore testnet – which I assume stands for BorrowLendingProtocol. It appears to be a native borrowing and lending market on Hypercore, with functions like borrowing, supplying, and withdrawing.Currently,…

— MLM (@mlmabc) November 8, 2025

He argued that integrating a lending layer could help Hyperliquid introduce multi-margin trading more safely. In his view, margin positions would sit on top of verifiable lending pools rather than isolated balance sheets.

That architecture would mirror systems already used across established DeFi money markets and could make leverage more transparent for traders.

If rolled out, this feature would expand Hyperliquid’s footprint beyond perpetuals and provide users with access to DeFi functions currently missing from the ecosystem.

The move could also consolidate activity on a single platform, creating a more integrated trading environment for users who now rely on external lending markets.

Fake Hyperliquid App Sparks Security Concerns

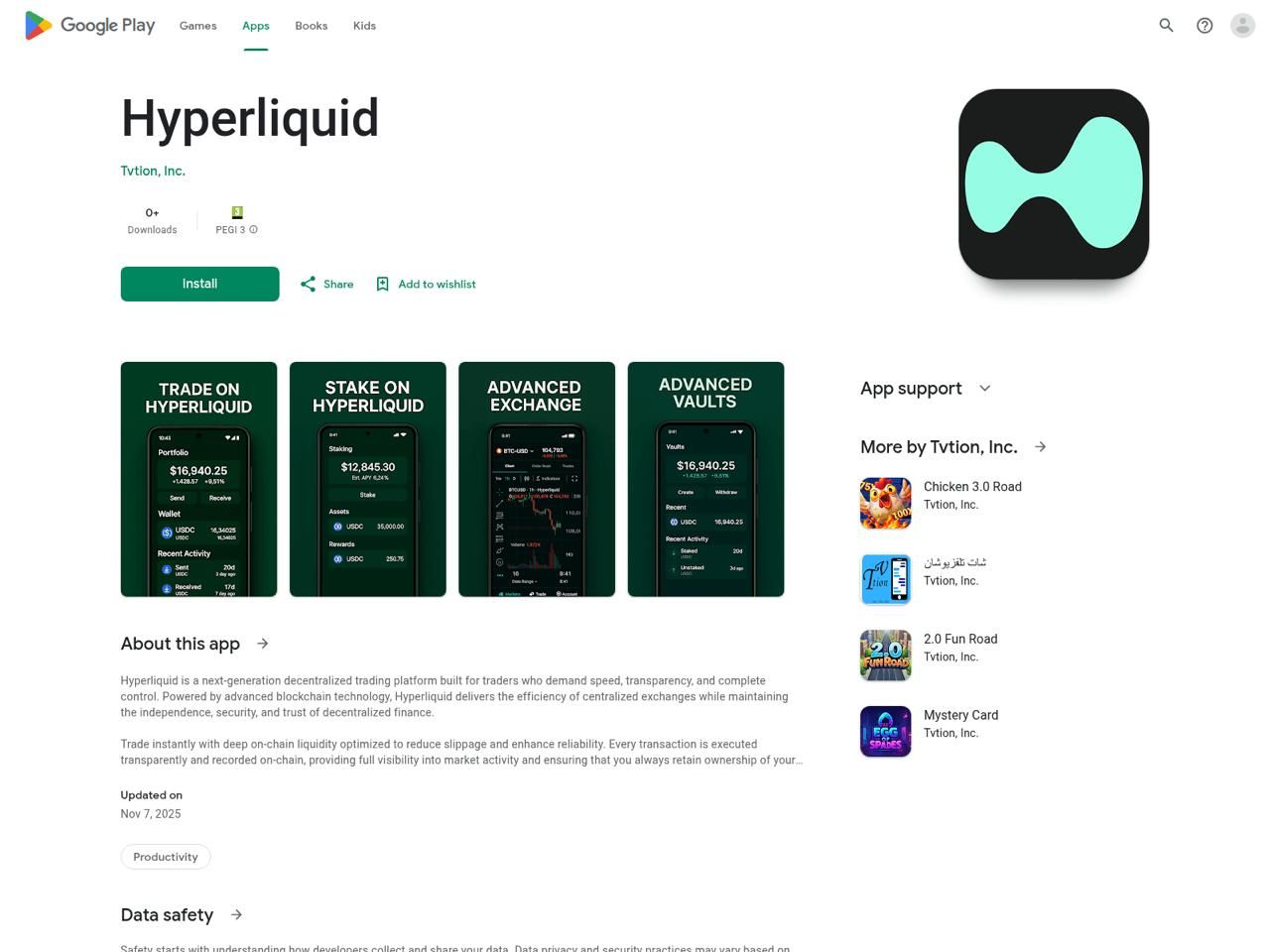

While the team experiments with new functionality, Hyperliquid users are battling a separate threat: a fraudulent mobile application that has appeared on the Google Play Store.

The app mimics Hyperliquid’s branding despite the exchange not offering an official Android or iOS product. Its presence has raised questions about app-store screening standards, especially as users increasingly rely on mobile platforms for financial activity.

Crypto investigator ZachXBT warned that the fake app is designed to steal funds by phishing wallet credentials and private keys.

He identified an Ethereum address linked to the operation that has already collected more than $281,000 in stolen assets. His alert prompted users to check recent downloads and revoke permissions to avoid further losses.

Fake Hyperliquid App On Google Play Store

Fake Hyperliquid App On Google Play Store

The fake listing fits into a broader pattern. Several malicious developers have created look-alike applications for projects such as SushiSwap and PancakeSwap, exploiting the convenience of mobile access to mislead users.

Scammers often combine these apps with sponsored ads on Google, ensuring that fraudulent links appear above legitimate search results. This increases the likelihood that unsuspecting users click through.

As Hyperliquid experiments with new infrastructure and users search for easier access points, the coordinated wave of impersonation attempts highlights a persistent risk.

Attackers continue to target platforms as they grow, and users remain vulnerable when official mobile apps do not exist.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Today: The Major Transition: Bitcoin Mining Companies Evolve into Leading AI Infrastructure Providers

- Bitcoin miners shift to AI infrastructure as margins shrink due to rising energy costs and post-halving challenges, with companies like Core Scientific and Cipher Mining repurposing data centers for AI workloads. - Major contracts, including a $5.5B, 15-year AWS deal and a $9.7B Microsoft agreement, highlight AI’s 25x higher revenue per megawatt compared to Bitcoin mining, driven by stable demand from tech giants. - The pivot reshapes market dynamics, with AI-focused miners outperforming Bitcoin peers as

Fed's Decision to Hold Rates Puts Spotlight on Balancing Trump’s Growth Plans and Inflation Concerns

- The Fed may pause rate cuts in 2025, balancing Trump's policy risks against inflation and economic resilience. - JPMorgan's Karen Ward highlights uncertainty over Trump-era growth vs. inflation, contrasting Wall Street's rate-cut expectations. - Powell emphasizes "strong" economic performance as a reason to delay cuts, with CME FedWatch showing 58% chance of December 25-basis-point cut. - Regional Fed leaders like Bostic and Williams stress inflation risks and cautious reserve management amid leadership

SEC's Token Classification Seeks to Harmonize Innovation with Safeguarding Investors

- The SEC proposes a token taxonomy under the Howey Test to classify digital assets as securities or non-securities, reshaping crypto regulation. - The framework categorizes tokens into four tiers, including securities, digital commodities, collectibles, and tools, with exemptions for non-SEC-regulated platforms. - It aligns with the Digital Asset Market Structure Bill, which assigns major cryptocurrencies to CFTC oversight and mandates exchange function separation. - The SEC emphasizes strict enforcement

Bitcoin News Update: Altcoins at a Turning Point—Innovation Meets Uncertainty as AI, DeFi, and Global Politics Influence 2026

- AI-driven DeepSnitch AI (DSNT) and Bitcoin Hyper (HYPER) lead crypto innovation, combining blockchain analytics with real-time risk detection and Layer-2 scalability solutions. - DeFi projects like RentStac (RNS) and Digitap ($TAP) anchor digital assets to real-world utilities, with RNS targeting $27.45M via tokenized real estate and TAP expanding financial access for unbanked populations. - Geopolitical tensions escalate as China-US clash over a $13B Bitcoin hack, while institutional moves like Metaplan