Why has the sentiment in the crypto market suddenly turned so pessimistic?

It's still unclear who's "swimming naked," but it's certain that someone in the crypto casino has already lost their swim trunks.

Original Title: Why Did Crypto Sentiment Get So Bearish?

Original Author: Jack Inabinet, Bankless

Translated by: Peggy, BlockBeats

Editor's Note: Just four days after bitcoin hit a new all-time high, the crypto market experienced an unprecedented "10/10 flash crash." Not only did major coins plummet, but multiple altcoins went to zero, and even exchanges faced liquidation crises. Meanwhile, high-leverage yield funds like Stream Finance imploded one after another, exposing the fragile nature of "trust me" style bubbles. Optimism on social platforms quickly turned to panic, and market confidence was severely shaken.

This article reviews the sequence of these events, attempting to answer a key question: Why did crypto market sentiment suddenly turn so bearish? Amidst the intertwining of bubble bursts and trust crises, we may be standing at a new cyclical inflection point.

The following is the original text:

On Monday, October 6, 2025, bitcoin hit a new all-time high, breaking through the $126,000 mark for the first time. Whether in the trenches of Crypto Twitter or the newsrooms of CNBC, holders were immersed in an omnipresent "fog of hope."

Although fundamentals changed little in the following month, just four days later on October 10 (UTC+8), the crypto market was hit by a crisis—the "10/10 flash crash," now regarded as the largest liquidation event in crypto history.

During this catastrophic drop, major coins plunged by double digits, many altcoins went straight to zero, and several exchanges were on the brink of bankruptcy (almost all major perpetual contract platforms triggered auto-deleveraging mechanisms due to an inability to pay short-side yields).

Although Trump's election as president was seen as a positive for the crypto industry—from establishing a strategic bitcoin reserve to appointing seemingly crypto-friendly regulators—crypto asset prices remained sluggish.

Except for a brief rally after Trump's election last November, the ratio of total crypto market capitalization (TOTAL) to the S&P 500 Index has remained stable for nearly a year. In fact, since Trump's official inauguration on January 20 (UTC+8), this ratio has even seen a startling negative growth.

As the market continues to digest the aftermath of the 10/10 liquidations, more and more questions are surfacing.

Just this Monday, Stream Finance declared bankruptcy. This was a "trust me" type crypto yield fund managing $200 million, providing depositors with above-market returns through leverage. Its "external fund manager" lost about $93 million in assets during operations.

Although details have not yet been disclosed, Stream is likely the first "Delta neutral" strategy fund to publicly implode due to the 10/10 auto-deleveraging mechanism. Despite longstanding doubts about its structure, the collapse still caught many lenders off guard—they chose to sacrifice safety for higher yields without clear risk signals.

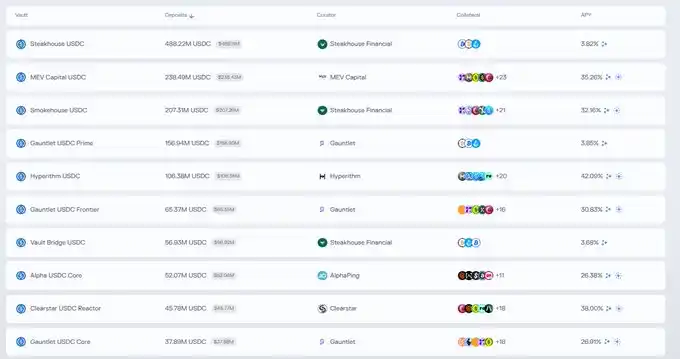

After Stream's blowup, panic quickly spread throughout the DeFi ecosystem, with investors collectively withdrawing from similar high-risk yield strategies.

Although for now, the chain reaction from Stream has not fully spread, this incident exposed the risks of the increasingly popular "circular stablecoin farming" strategies in DeFi—using deposit certificates from existing high-risk strategies to leverage up for even higher yields.

Stream's self-disclosed losses also revealed the huge losses Delta neutral funds might face during 10/10 auto-deleveraging: short hedges are forcibly canceled by the system, while spot longs go to zero instantly.

Although headlines have shifted, it is certain that the losses on October 10 (UTC+8) were catastrophic.

Whether through public DeFi operations or covert CeFi maneuvers, there are billions of dollars in leverage within crypto yield funds. Whether the market has enough liquidity to withstand future waves of liquidations remains unknown.

It is still unclear who is "swimming naked," but it is certain that someone in the crypto casino has already lost their trunks. If the market drops again, especially after lawsuits emerge accusing centralized exchanges of insolvency during the 10/10 liquidations, the question will no longer be "if something will go wrong," but "whether the entire industry can withstand it."

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Behind the x402 Craze: How ERC-8004 Builds the Trust Foundation for AI Agents

If x402 is the “currency” of the machine economy, then what ERC-8004 provides is the “passport” and “credit report.”

JP Morgan Forecasts BTC At $170K Amid Market Doubts

Bitcoin Loses Ground To Stablecoins, Says Cathie Wood

Japanese Regulators Back Major Banks’ Push to Issue Yen-Backed Stablecoins