DeAgentAI (AIA) Explodes 862% in 24 Hours after Piverse Partnership

DeAgentAI’s explosive 862% rally showcases its breakout from Bitcoin’s influence, but thin inflows and speculative trading suggest that volatility—and a possible correction—may follow.

DeAgentAI (AIA) has seen a remarkable rally, soaring 862% in the past 24 hours to become one of the fastest-rising altcoins in the market. The surge follows its recent partnership with Piverse, enabling invoice payments via Binance Wallet.

This development boosted AIA’s adoption potential and triggered a wave of investor enthusiasm. The altcoin’s momentum also stems from its divergence from Bitcoin’s performance, allowing it to rally independently amid broader market uncertainty.

DeAgentAI Investors Are Still Behind

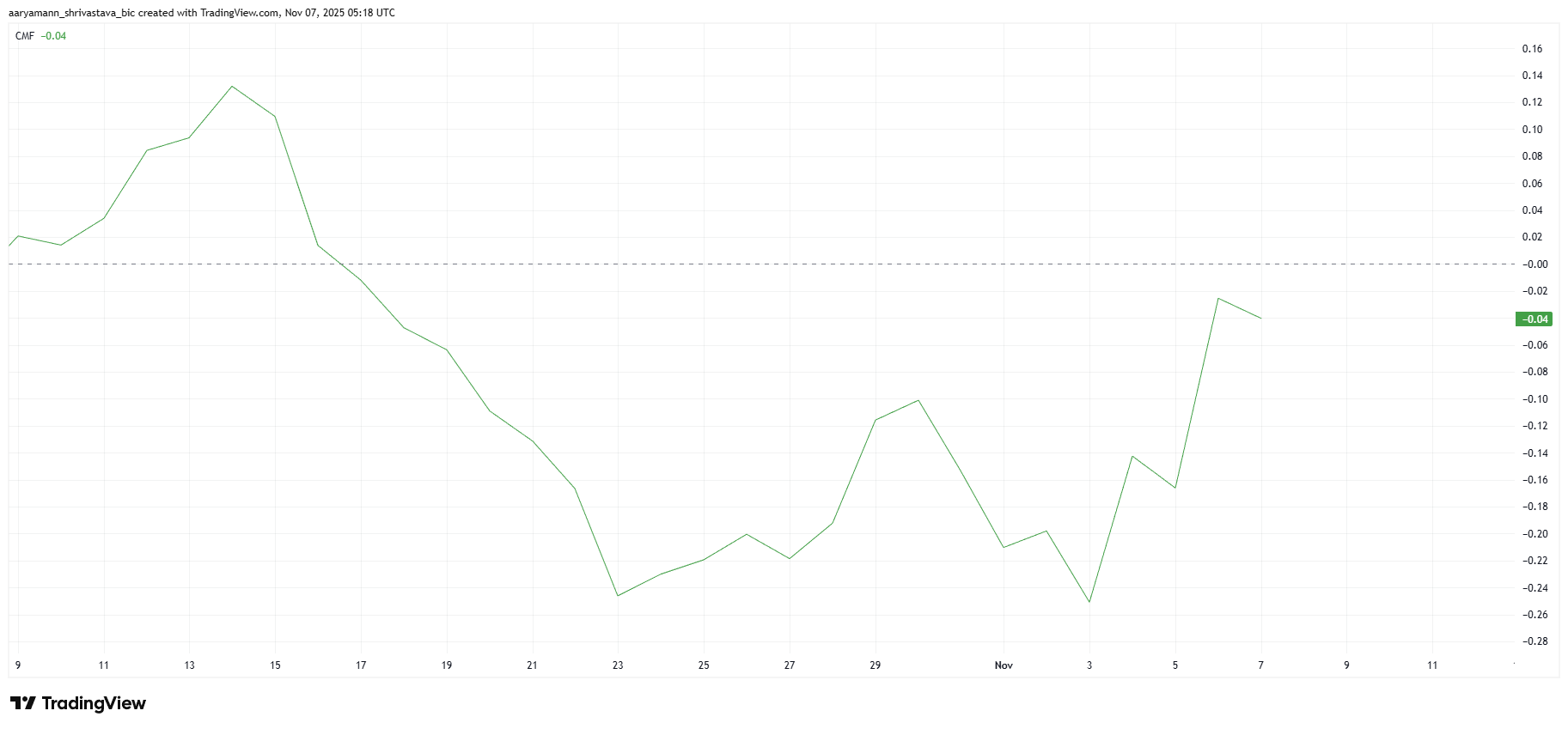

The Chaikin Money Flow (CMF) indicator highlights growing optimism among traders as outflows have slowed in recent sessions. Although capital movement into AIA is improving, strong inflows have yet to materialize. This signals that the rally is not entirely supported by trading volume, suggesting speculative participation may be driving current price levels.

Such conditions often precede overheated markets. Without consistent on-chain activity or liquidity depth, AIA’s sharp price gains could face correction risks.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

AIA CMF. Source:

TradingView

AIA CMF. Source:

TradingView

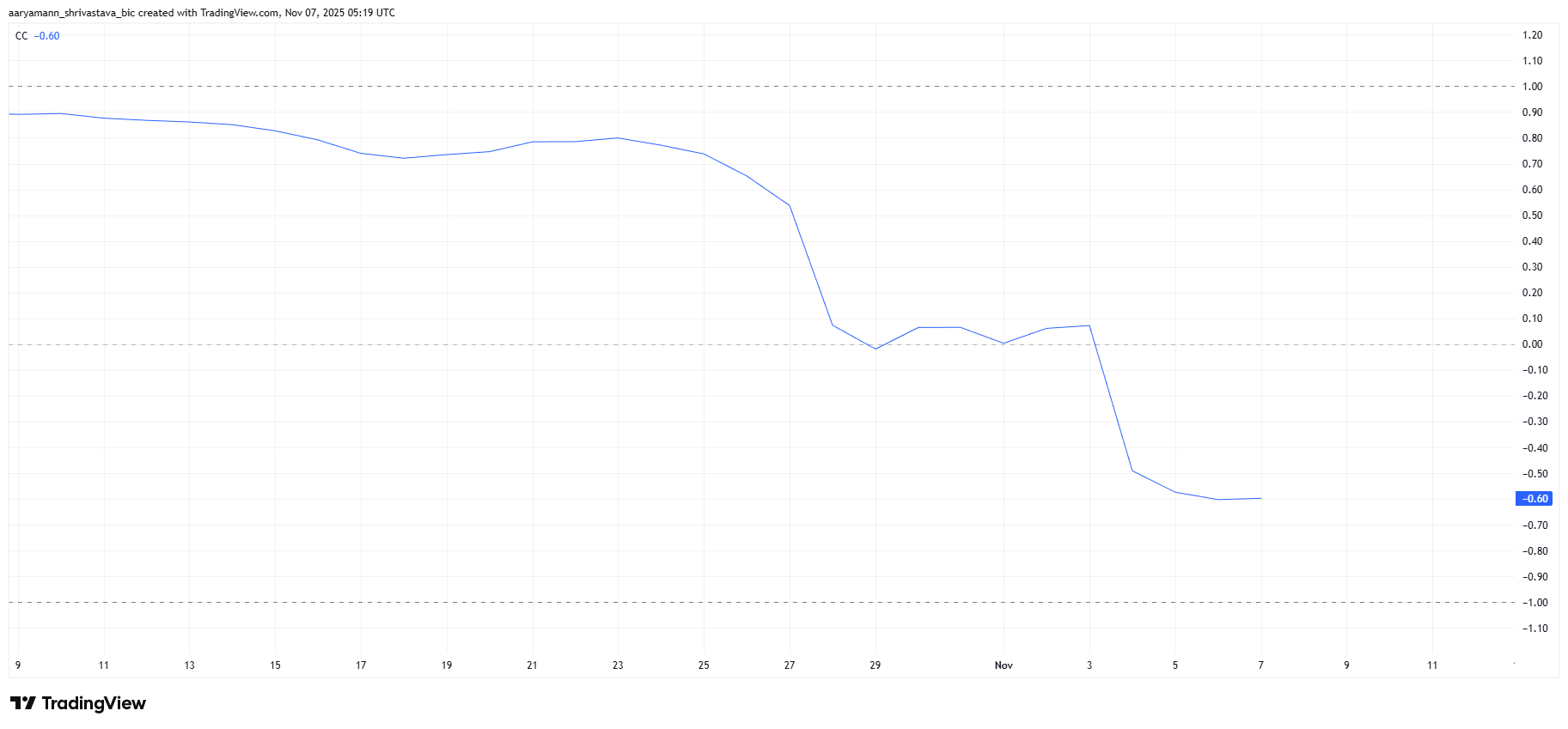

AIA’s correlation with Bitcoin currently sits at -0.60, showing that the token’s rally is largely uncorrelated with broader crypto market trends. This negative correlation benefits AIA in the short term, as Bitcoin’s recent price decline has not hindered its growth trajectory.

However, this detachment also introduces volatility risks. Without the stabilizing influence of Bitcoin’s broader liquidity cycles, AIA’s price movement may remain highly speculative and reactive. In other words, AIA needs an anchor.

AIA Correlation To Bitcoin. Source:

TradingView

AIA Correlation To Bitcoin. Source:

TradingView

AIA Price Faces Reversal/

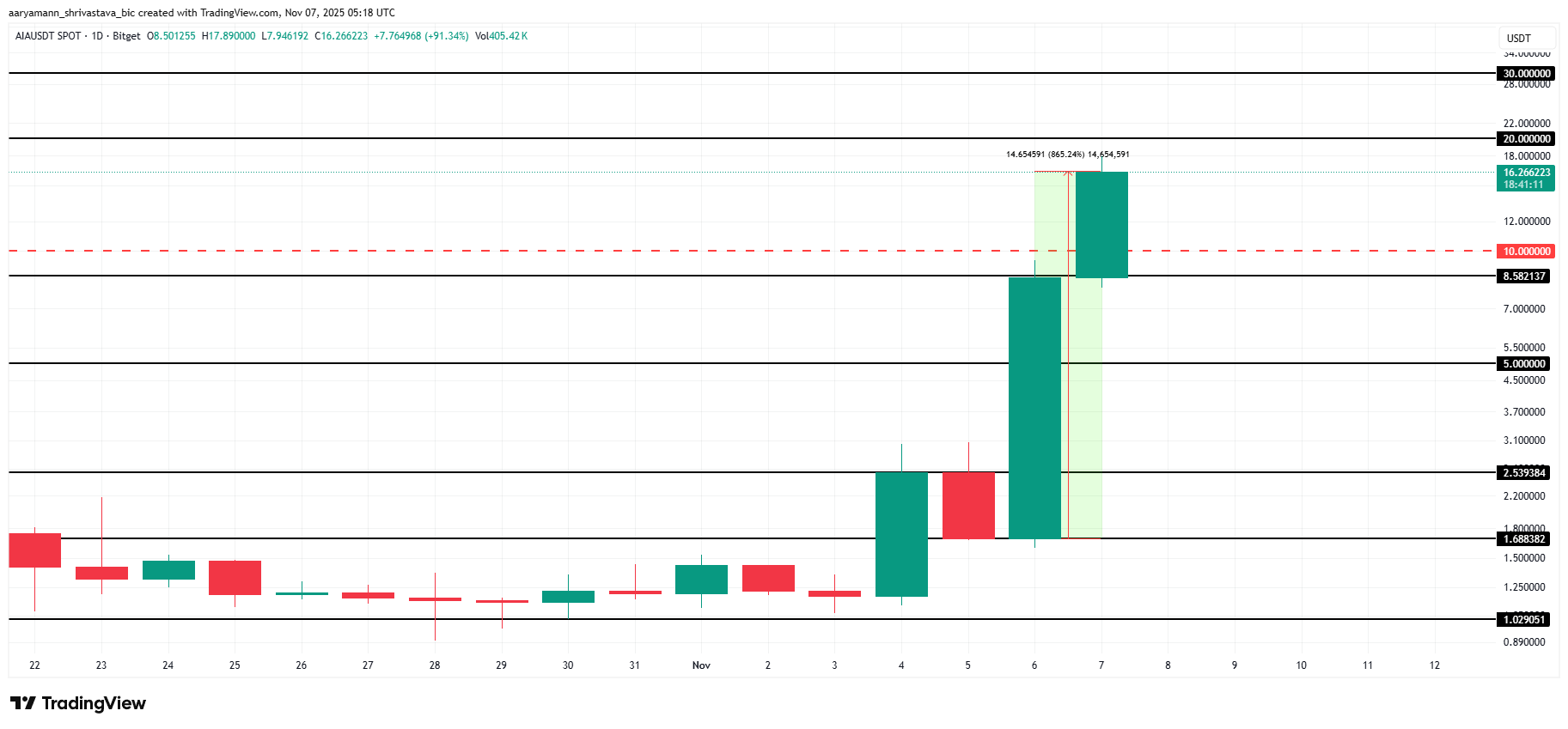

AIA’s price has skyrocketed by 865% in a single day, now trading around $16.26. The altcoin is testing resistance near the $20.00 mark, a key psychological level for traders eyeing short-term profits.

If bullish momentum fades, AIA could face a steep correction. Selling pressure may drive the price below $10.00, potentially testing $8.58 and even $5.00 as support. Profit-taking behavior typically intensifies after rapid rallies of this magnitude.

AIA Price Analysis. Source:

TradingView

AIA Price Analysis. Source:

TradingView

Conversely, if investor confidence strengthens and inflows increase, AIA could extend its rally toward $20.00 and even $30.00. Sustained volume and network activity will be essential to maintain upward momentum and invalidate any near-term bearish thesis.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Universal Exchange

This article will explore how Coinbase's diversified businesses work together to achieve its vision.

DeFi faces a potential $8 billion risk, but only $100 million has exploded so far

Interview with RaveDAO Head of Operations: Breaking Barriers with Music, Enabling Real Users to Onboard to Blockchain Seamlessly

RaveDAO is not just about organizing events; it is creating a Web3-native cultural ecosystem by integrating entertainment, technology, and community.

Behind the x402 Craze: How ERC-8004 Builds the Trust Foundation for AI Agents

If x402 is the “currency” of the machine economy, then what ERC-8004 provides is the “passport” and “credit report.”