Jensen Huang predicts: China will surpass the United States in the AI race

Nvidia CEO Jensen Huang stated bluntly that, thanks to advantages in electricity prices and regulation, China will win the AI race. He added that overly cautious and conservative regulation in Western countries such as the UK and the US will "hold them back."

Nvidia (NVDA.O) CEO Jensen Huang predicts that China will surpass the United States in the AI race, citing lower electricity costs and a more relaxed regulatory environment. This is his most severe assessment of the AI competitive landscape to date.

Since DeepSeek emerged at the beginning of the year, concerns in the United States over China's AI progress have continued to escalate, sparking intense debate in Silicon Valley: Can resource-rich American AI companies, including OpenAI and Anthropic, maintain their technological lead?

As the head of the world's most valuable company, Jensen Huang stated bluntly in an interview with the Financial Times: "China will win the AI race." He noted that Western countries, including the United States and the United Kingdom, are being constrained by "excessive negativity." Speaking at the "Future of AI Summit" hosted by the Financial Times on Wednesday, he said, "We need more optimism."

Jensen Huang specifically criticized new AI regulations in various U.S. states, saying they could result in "50 new regulatory regimes." He contrasted this with China's energy subsidies, pointing out that these subsidies make it easier for local tech companies to afford the costs of running domestic AI chip alternatives. "Over there, electricity is almost free," he said exaggeratedly.

Huang has previously warned that the gap between the latest U.S. AI models and those from China is narrowing, and has urged the U.S. government to reopen the chip market to maintain global reliance on American technology. In his interview on Wednesday, he reiterated:

"As I have always said, China is only a few nanoseconds behind the U.S. in AI. The U.S. must catch up and win the support of global developers to ultimately prevail."

The Financial Times reported this week that several regions in China have increased energy subsidies for large data centers operated by tech giants such as ByteDance, Alibaba, and Tencent. According to sources, after domestic chips from companies like Huawei and Cambricon proved less energy efficient than Nvidia's products—leading to higher electricity costs for tech companies—local governments have increased electricity subsidies. However, this information has not yet been confirmed.

According to the Financial Times, Huang has previously urged Washington to allow broader chip sales. Last week, Trump reiterated that he does not intend to allow Nvidia's most advanced Blackwell chips into the Chinese market. "These are the most advanced technologies, and we will not let anyone outside the United States have them," Trump said in an interview with CBS. "We can let them work with Nvidia, but it will not involve the most cutting-edge products."

Nvidia held a developer conference in Washington, D.C. last week, once again demonstrating the company's active pursuit of government support. Previously, Trump had hinted that Nvidia's Blackwell chips might re-enter the Chinese market in a modified version, "I might make a deal for a 'negatively enhanced' version of Blackwell."

Before these remarks, Nvidia and AMD (AMD.O) had already agreed to pay the U.S. government 15% of their AI chip sales revenue in China as a fee, but the relevant regulations have not yet been implemented.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

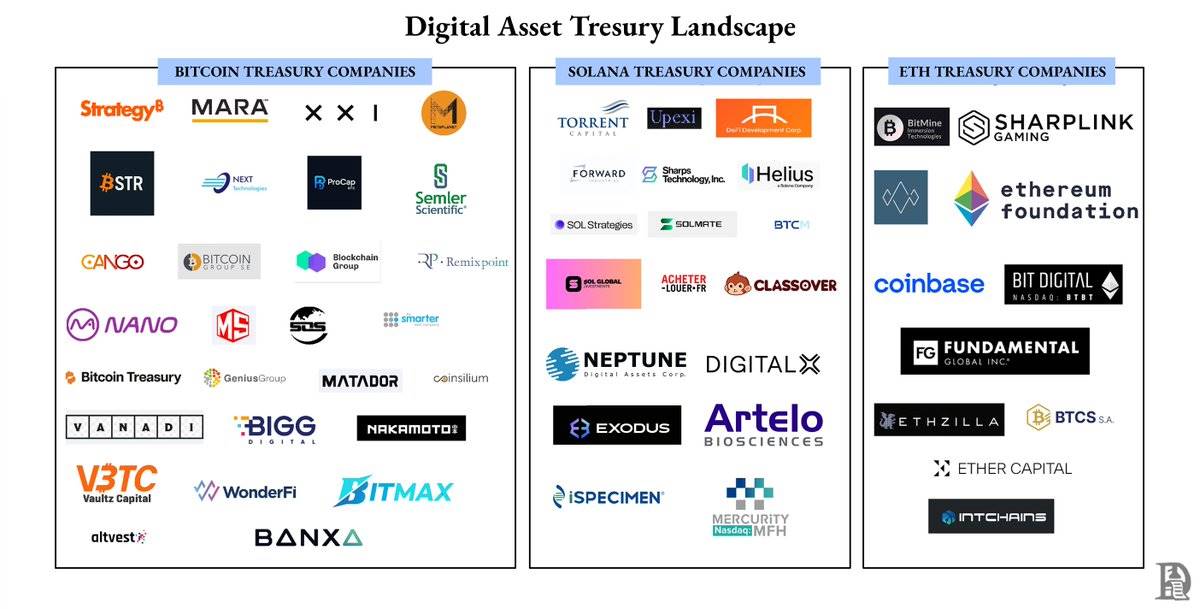

A bucket of cold water: Most Bitcoin treasury companies are facing doomsday

They imitated the asset and liability structure of Strategy, but did not replicate its capital structure.

Dive into Altcoin Strategies that Shape the Market

In Brief Arthur Hayes shares insights on the genuine emergence of an altcoin season. Investors now focus on income-generating and share-distributing projects. This shift reflects the evolving maturity of the crypto market.

Ripple and Mastercard Propel XRP to New Heights

In Brief XRP's price surged by 4.9%, reaching $2.35, driven by institutional trading. The XRP Ledger pilot by Ripple and Mastercard boosts XRP's market demand. Dogecoin maintains its trend with institutional support around $0.1620-$0.1670.

Cryptocurrency Analyst Highlights Recovery Hints in Key Altcoins

In Brief Analyst Ali Martinez identifies potential recovery signs in key altcoins. Martinez highlights critical support re-tests in SEI, PEPE, VET, ALGO, and AVAX. Technical indicators suggest possible trend shifts in these altcoins.