A Guide to Profiting in the Crypto Market During a Sentiment Shift

Project visibility, transaction speed, and early conviction are more important than patience.

Original Title: How to Make Money in Crypto This November

Original Author: @MercyDeGreat

Translation: Peggy, BlockBeats

Editor's Note: The key to investing in November is not to guess the next coin to skyrocket, but to strategically allocate funds in advance and focus on sectors where attention and algorithmic rotation are happening. The biggest winners this month will be those who deeply understand market narratives, timing, and distribution mechanisms. This article analyzes five core sectors: Meme brings liquidity, InfoFi rewards attention, and x402/AI enables automation.

The following is the original text:

Market Sentiment: "Rotation Season" Arrives

The cryptocurrency market is entering a new phase, driven by sector rotation rather than blind speculation. As bitcoin prices stabilize, new capital is flowing into Layer-2, AI, and InfoFi ecosystems—targets with higher beta (greater elasticity).

On the X (formerly Twitter) platform, the information flow is clear: developers are rapidly delivering products, arbitrageurs are racing up the leaderboards, and the speed of market narrative shifts is faster than ever. This month’s profits will not come from passive holding, but from timely participation in the right ecosystems.

Liquidity is rotating from large-cap assets like BTC and ETH to emerging L2s (such as Base), AI+InfoFi concept tokens (such as Xeet, Wallchain, MindoAi), and even to revived Meme coins on Solana and Base. Early entrants are gaining an edge by accumulating leaderboard points and deploying yield strategies on platforms like Pendle.

This is a market where "attention equals alpha." In this market, a project's visibility, trading speed, and early conviction are more important than patience. Focus on projects that are early-stage but already showing potential: those gaining social attention, with developer momentum, and about to launch incentive programs.

Because in "rotation season," the winners are not those who stand still, but those who act first.

Here are the areas where I believe capital and attention will be focused:

Meme

Meme is the fastest path to 2x to 10x returns, but only if you strike precisely. Their boom depends on attention, liquidity, and timing, not fundamentals.

Currently, Solana and Base are leading the Meme cycle. Low gas fees, fast transaction speeds, and active communities make them ideal places for rapid capital rotation.

We have witnessed many successful BNB Chain Meme coins, but I believe activity in this sector is currently low.

Meme is an attention-driven trade, not a long-term investment. Treat it as a short-term event: enter quickly, exit even faster.

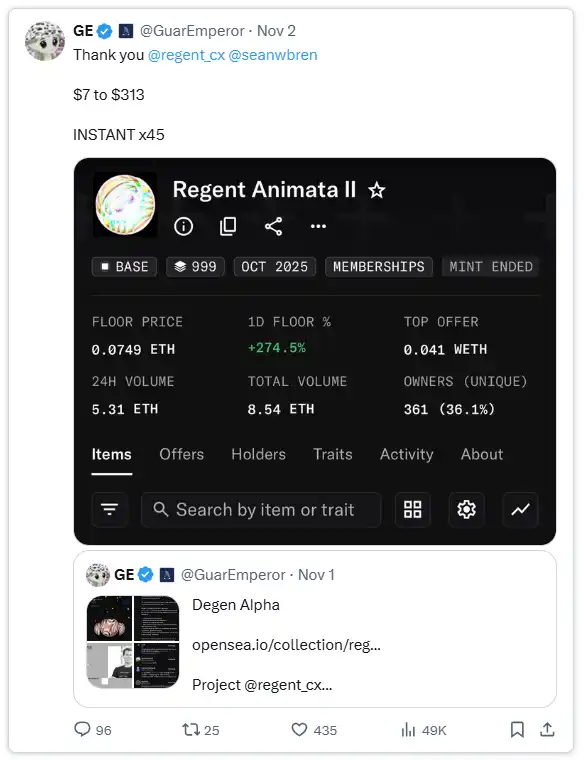

NFT

NFTs are not dead—they have simply evolved. The market, once driven by hype and profile pictures (PFPs), is now transforming into a space powered by utility, incentive mechanisms, and financial integration.

October marked a small but noteworthy rebound in the NFT market. Now, protocols that combine DeFi with digital collectibles are driving what was once a hype- and PFP-fueled market.

This is one of his suggestions.

Here are some upcoming NFT projects you should keep an eye on:

AI & Robotics

AI tokens and decentralized physical infrastructure network (DePIN) projects related to robotics are quietly building a new class of crypto assets. In this category, machines can autonomously earn yield, trade, and provide services. This is not mere speculation, but the early foundation of a machine-to-machine (M2M) economy.

The market’s focus is shifting to agent ecosystem networks, where AI robots can independently make payments, trade, or execute on-chain tasks. Pay close attention to x402—it is the Web-native upgrade of HTTP 402 "Payment Required," designed to enable machines to pay each other directly over the internet.

Here are some AI, robotics, and x402-related project tokens you should know about:

If you’re not familiar with x402, here’s a guide for your reference:

InfoFi (Information Financialization)

InfoFi is a brand-new on-chain model that allows you to profit from knowledge rather than trading. It is the intersection of the creator economy and decentralized finance (DeFi), rewarding users for sharing insights, research, or predictions that add value to the ecosystem.

The core operating mechanism of InfoFi is "Proof-of-Knowledge." You don’t need to mine or stake; just provide valuable, verifiable information—whether it’s accurate predictions, in-depth analytical articles, or educational thread series—and you’ll be rewarded. The more value your information creates, the more tokens, points, or reputation rewards you receive.

Ways to profit:

1. Prediction Markets: Platforms allow you to earn profits by making correct predictions about real-world or crypto-related events.

2. Research Leaderboards: Protocols reward authors who publish deep insights or data-supported content with points, experience (XP), or token allocations.

3. Curation Markets: Some systems pay users who like or recommend high-quality posts, rewarding good judgment and community curation ability.

InfoFi projects worth watching:

Projects on these platforms often also include airdrop opportunities. To profit in November this year, your portfolio must cover the above categories.

Meme coins bring liquidity, InfoFi rewards signals, and x402/AI automates it all. Those who can see these connections will dominate the next cycle.

If you read this guide early, you’re already ahead of 99% of crypto Twitter users.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Nasdaq Reprimands TON Strategy Over Toncoin Deal Rule Breach

Crypto: 80% of Bitget's Volume Now Comes from Institutions

Fear & Greed Index Shows Deep Investor Fear

Sui (SUI) Dips to Test Key Support — Could This Pattern Trigger a Bounce Back?